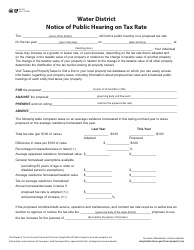

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-858

for the current year.

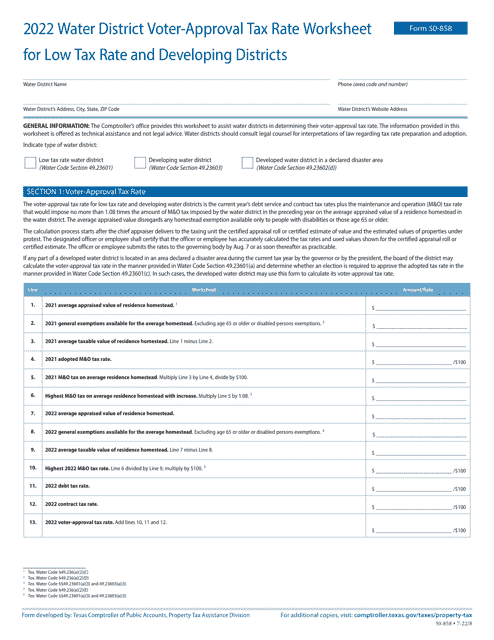

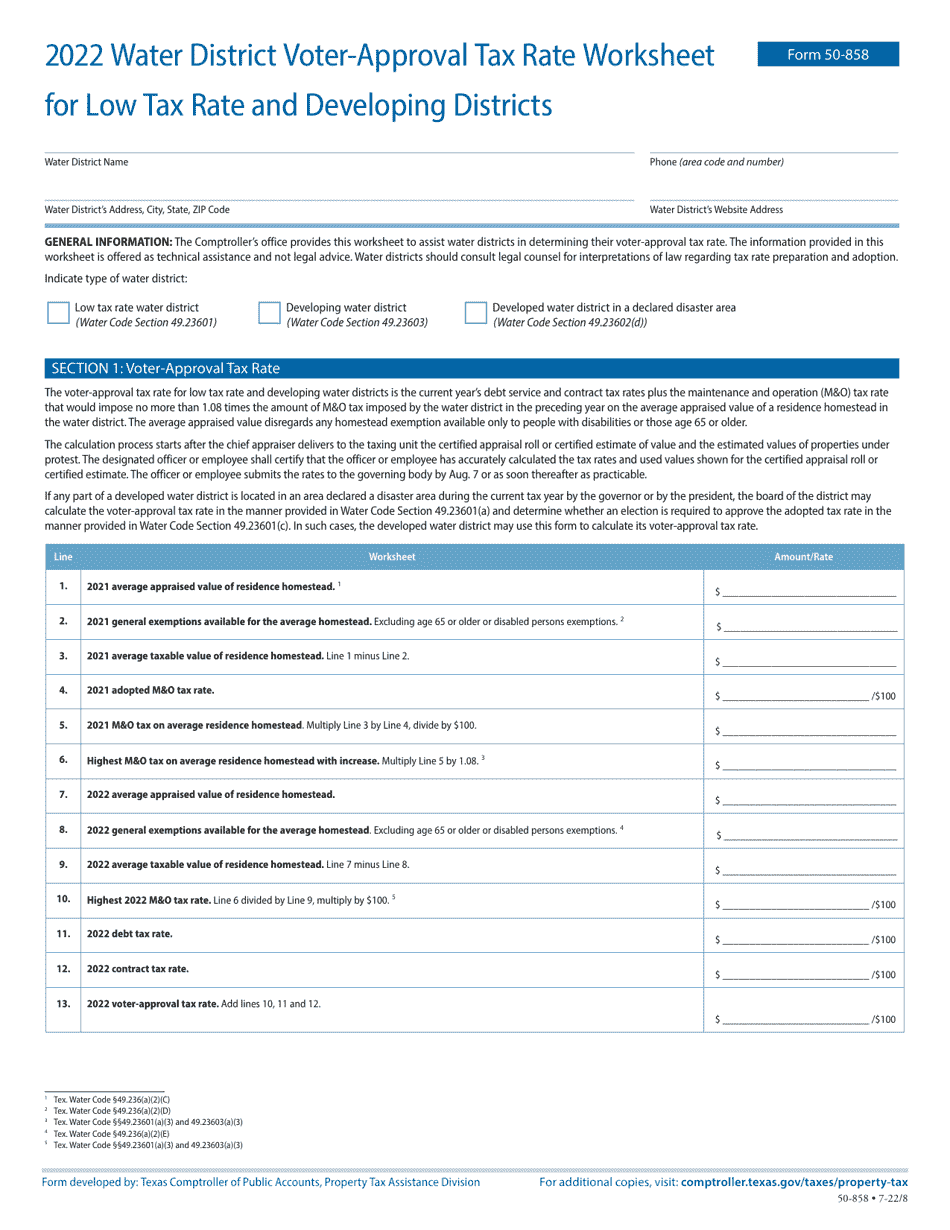

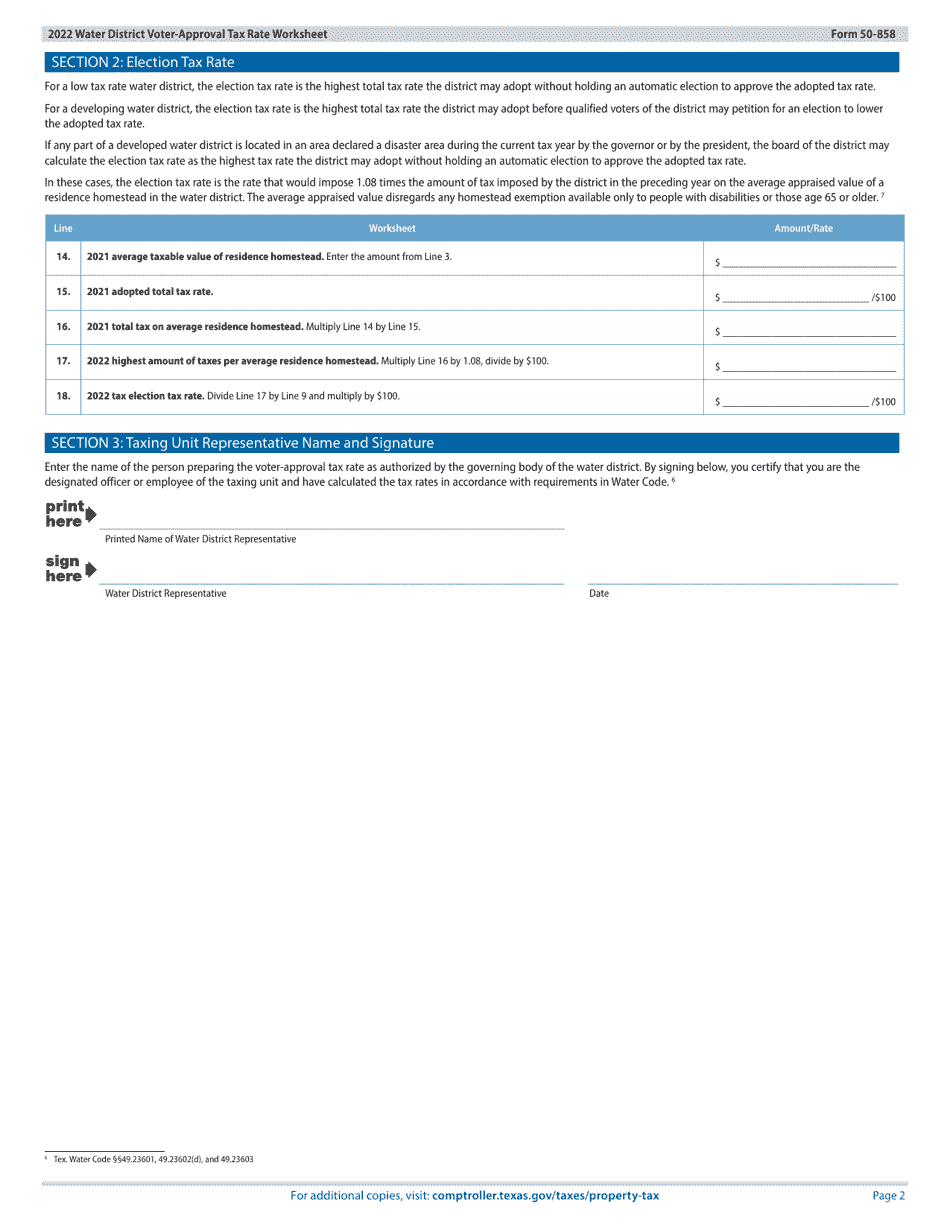

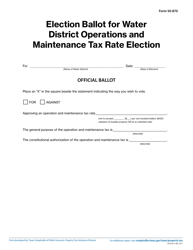

Form 50-858 Water District Voter-Approval Tax Rate Worksheet for Low Tax Rate and Developing Districts - Texas

What Is Form 50-858?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form 50-858?

A: The purpose of Form 50-858 is to calculate the voter-approval tax rate for water districts in Texas.

Q: Who is Form 50-858 for?

A: Form 50-858 is for water districts in Texas with low tax rates or those in the developing stage.

Q: What does the voter-approval tax rate mean?

A: The voter-approval tax rate is the maximum tax rate that a water district can adopt without voter approval.

Q: What information is needed to complete Form 50-858?

A: To complete Form 50-858, you will need information on the water district's property tax levy, debt service requirements, and other sources of revenue.

Q: Is Form 50-858 applicable only to water districts in Texas?

A: Yes, Form 50-858 is specific to water districts in Texas.

Q: Is Form 50-858 mandatory for water districts in Texas?

A: Yes, water districts in Texas with low tax rates or those in the developing stage are required to complete and submit Form 50-858.

Q: Are there any penalties for not filing Form 50-858?

A: Failure to file Form 50-858 can result in penalties imposed by the Texas Comptroller of Public Accounts.

Q: Can I get assistance in completing Form 50-858?

A: Yes, you can seek assistance from the Texas Comptroller of Public Accounts or consult a tax professional for help with completing Form 50-858.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-858 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.