This version of the form is not currently in use and is provided for reference only. Download this version of

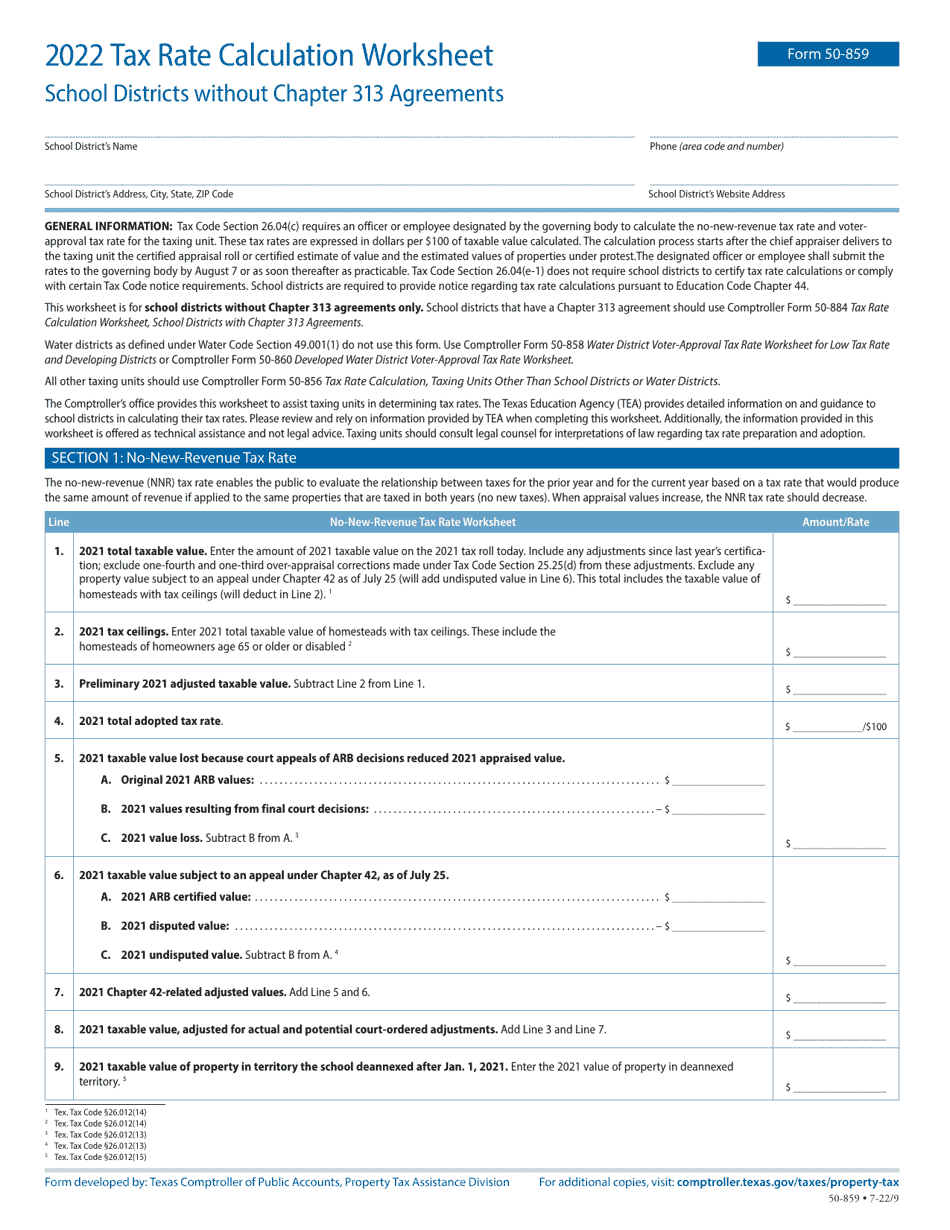

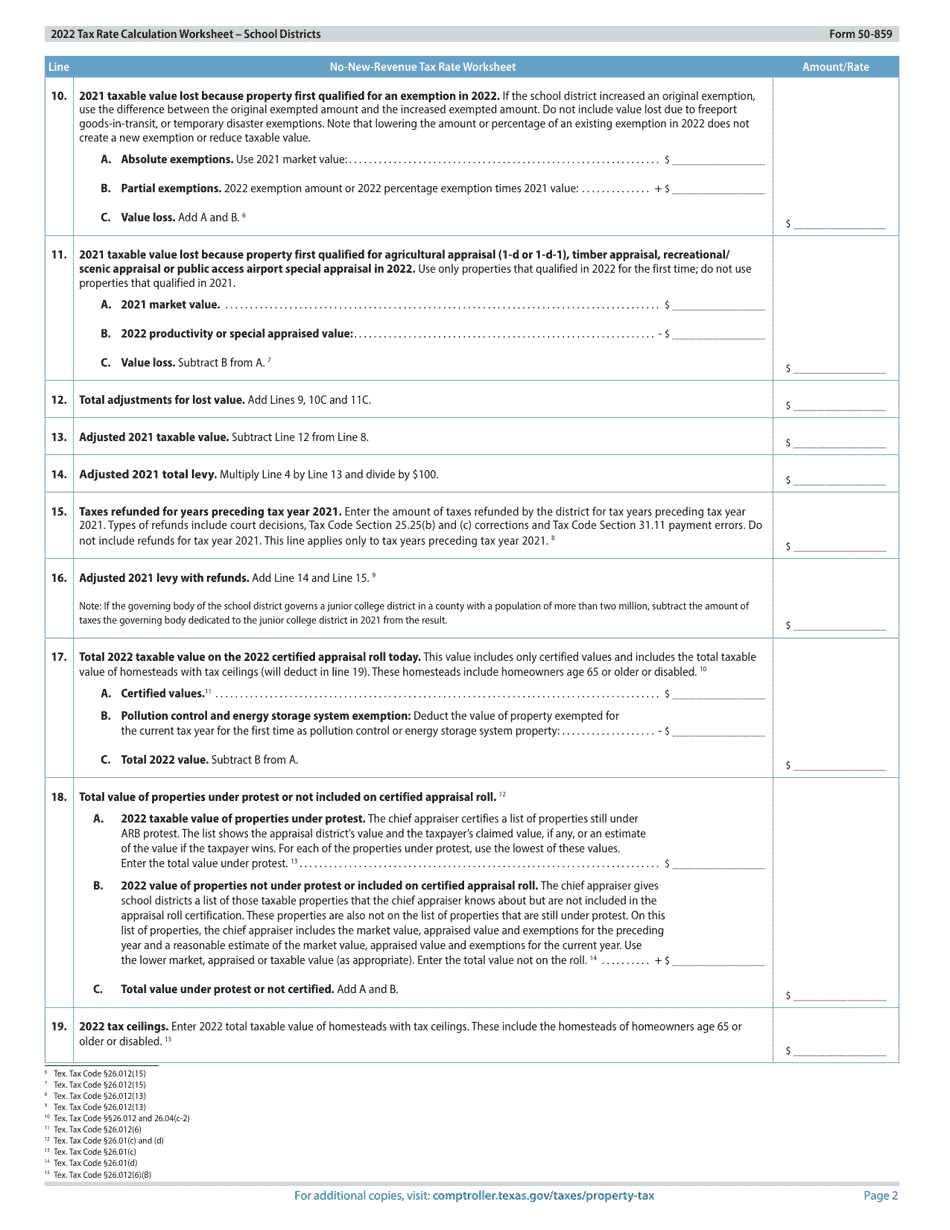

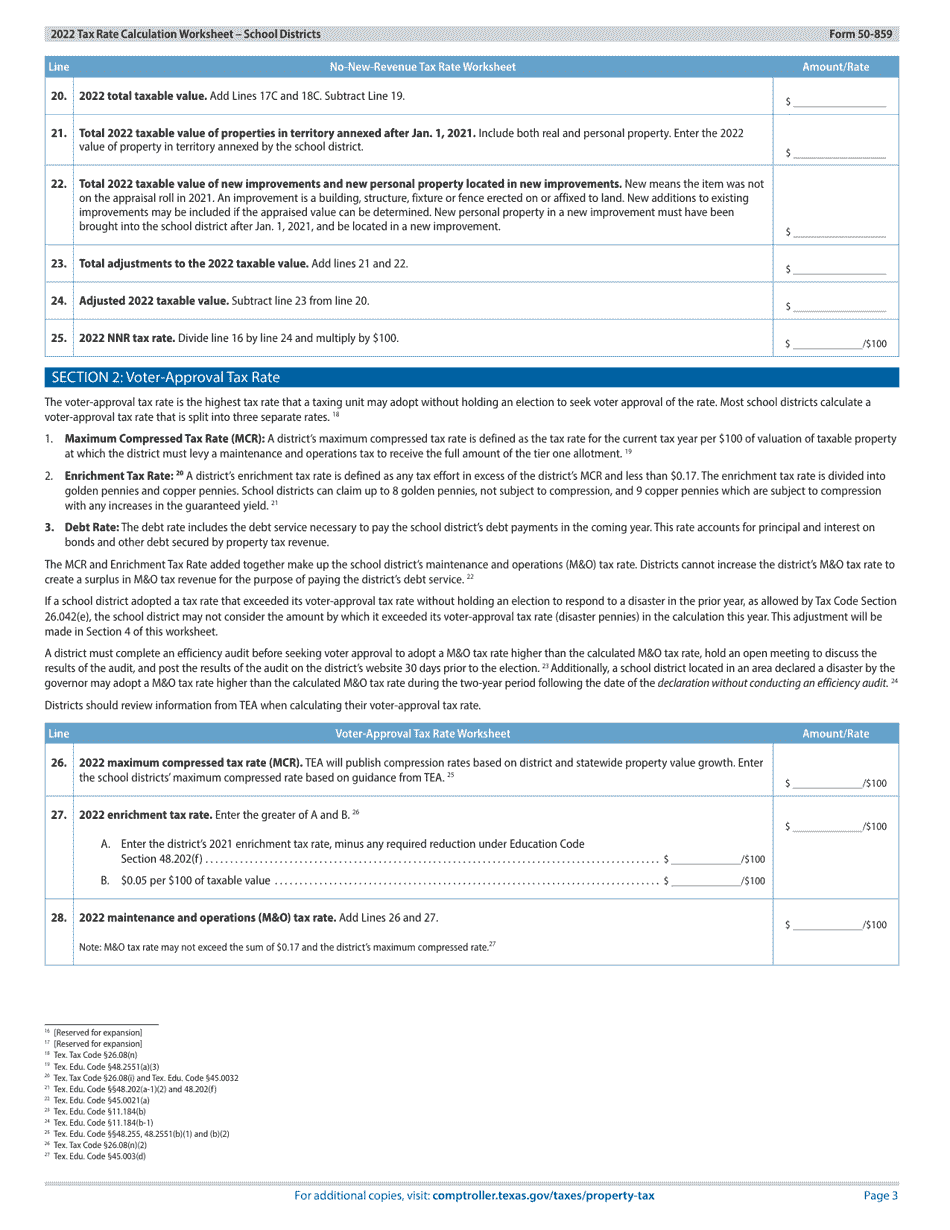

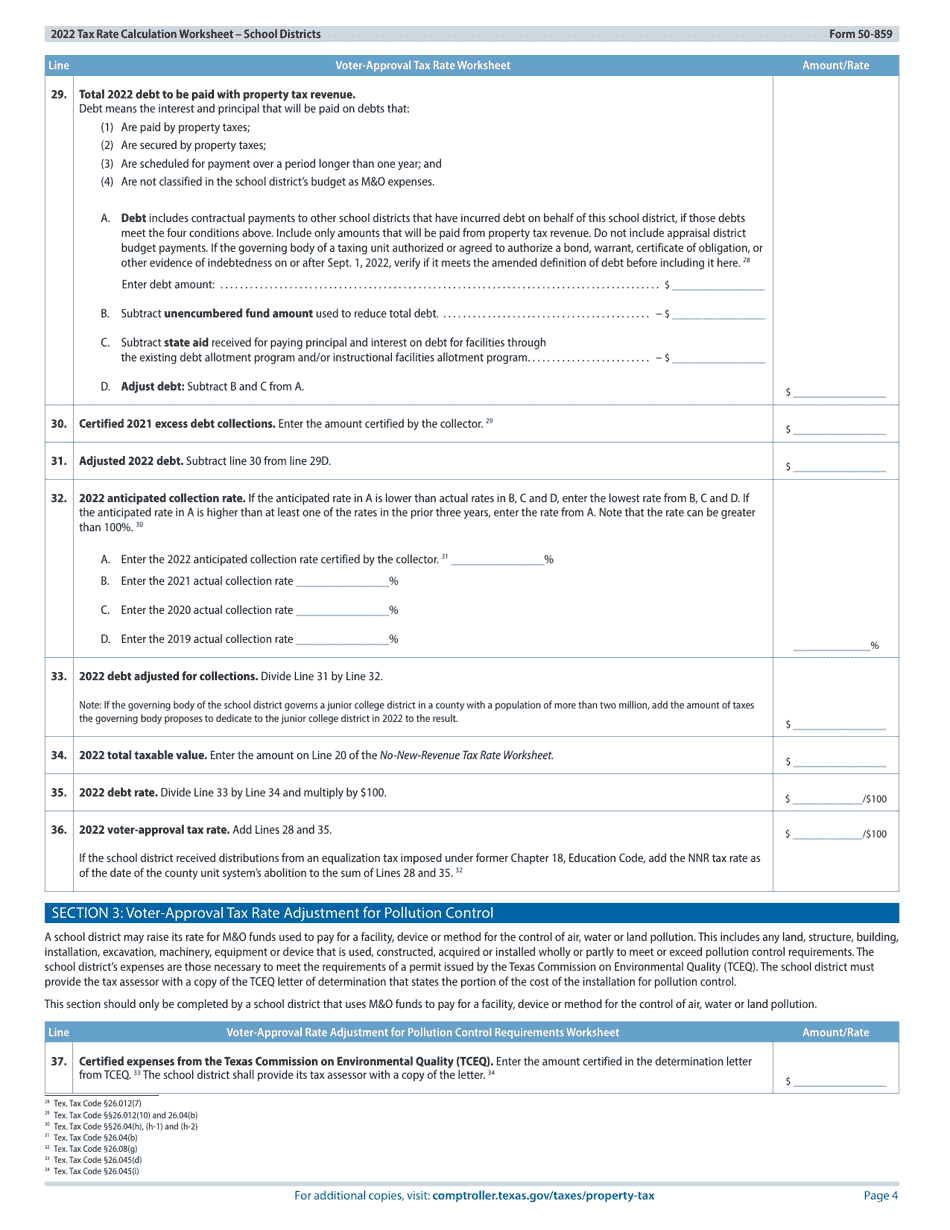

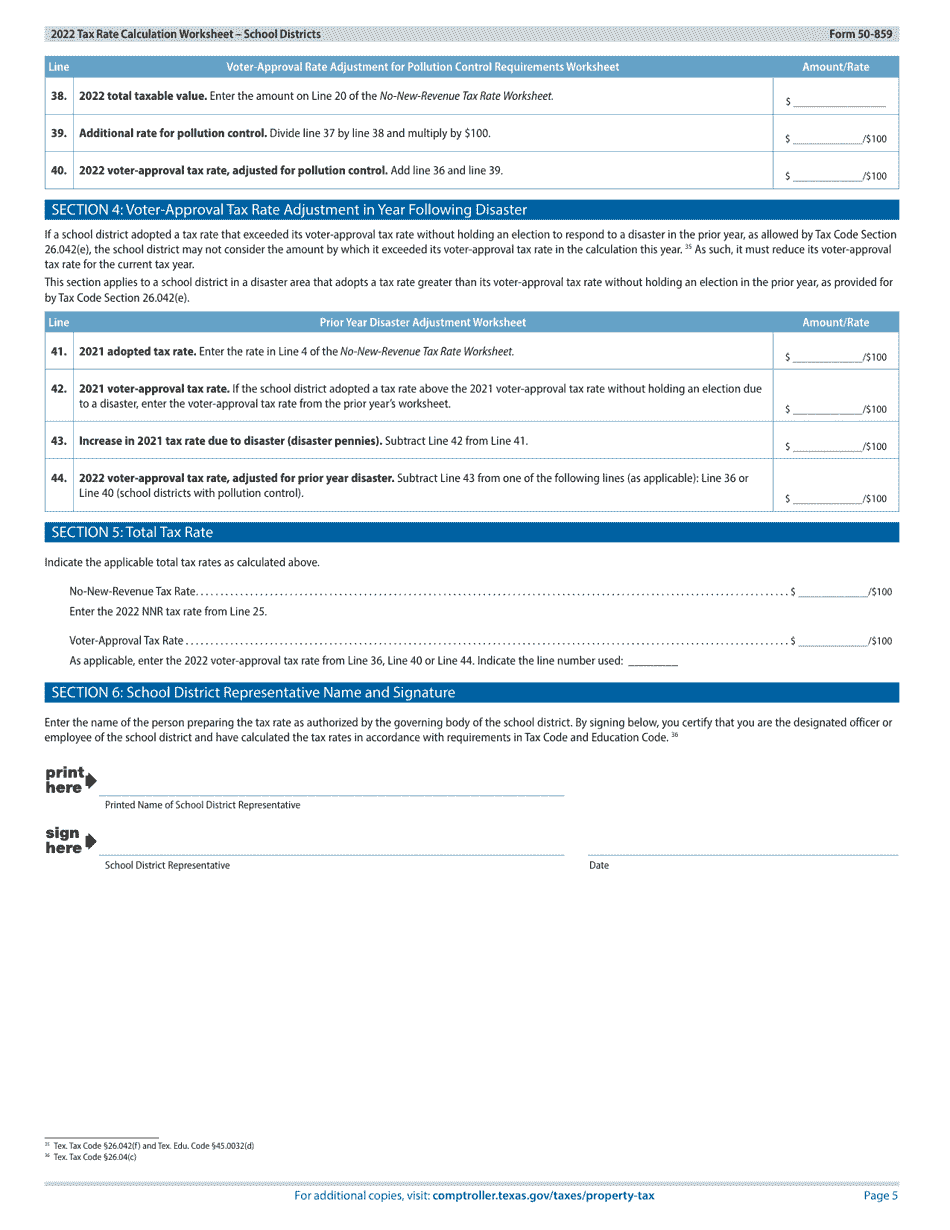

Form 50-859

for the current year.

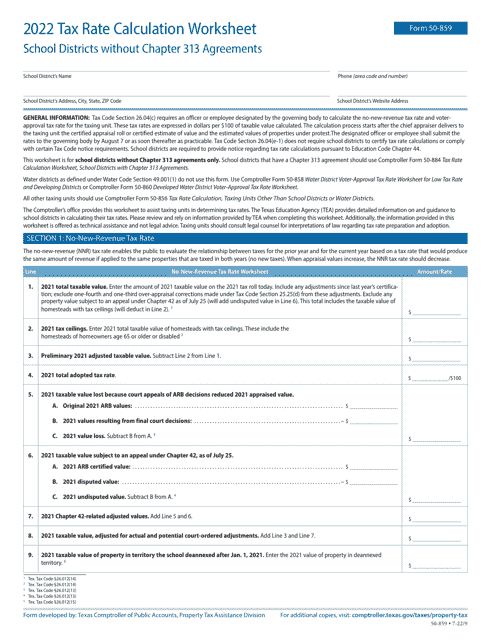

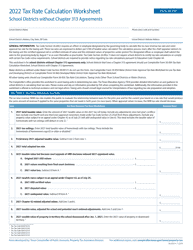

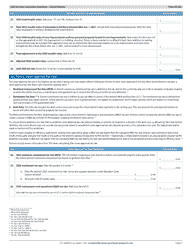

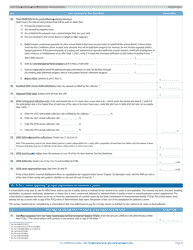

Form 50-859 Tax Rate Calculation Worksheet - School Districts Without Chapter 313 Agreements - Texas

What Is Form 50-859?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-859?

A: Form 50-859 is a tax rate calculation worksheet.

Q: What is the purpose of Form 50-859?

A: The purpose of Form 50-859 is to calculate tax rates for school districts without Chapter 313 agreements in Texas.

Q: What are school districts without Chapter 313 agreements?

A: School districts without Chapter 313 agreements are those that haven't entered into agreements with businesses for property tax limitations.

Q: Is Form 50-859 specific to Texas?

A: Yes, Form 50-859 is specific to Texas.

Q: Who is required to fill out Form 50-859?

A: School districts without Chapter 313 agreements in Texas are required to fill out Form 50-859.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-859 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.