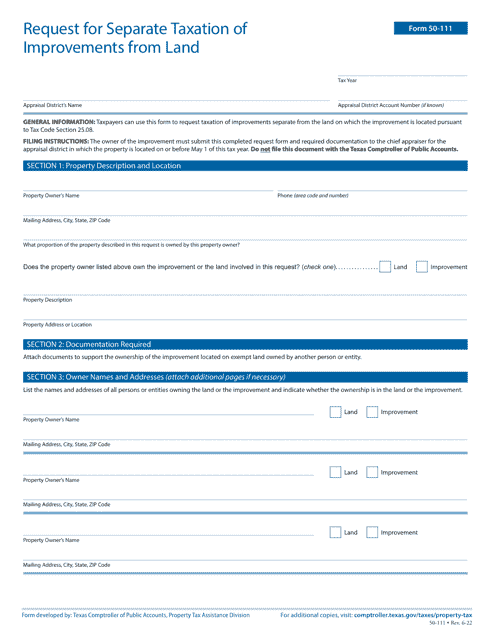

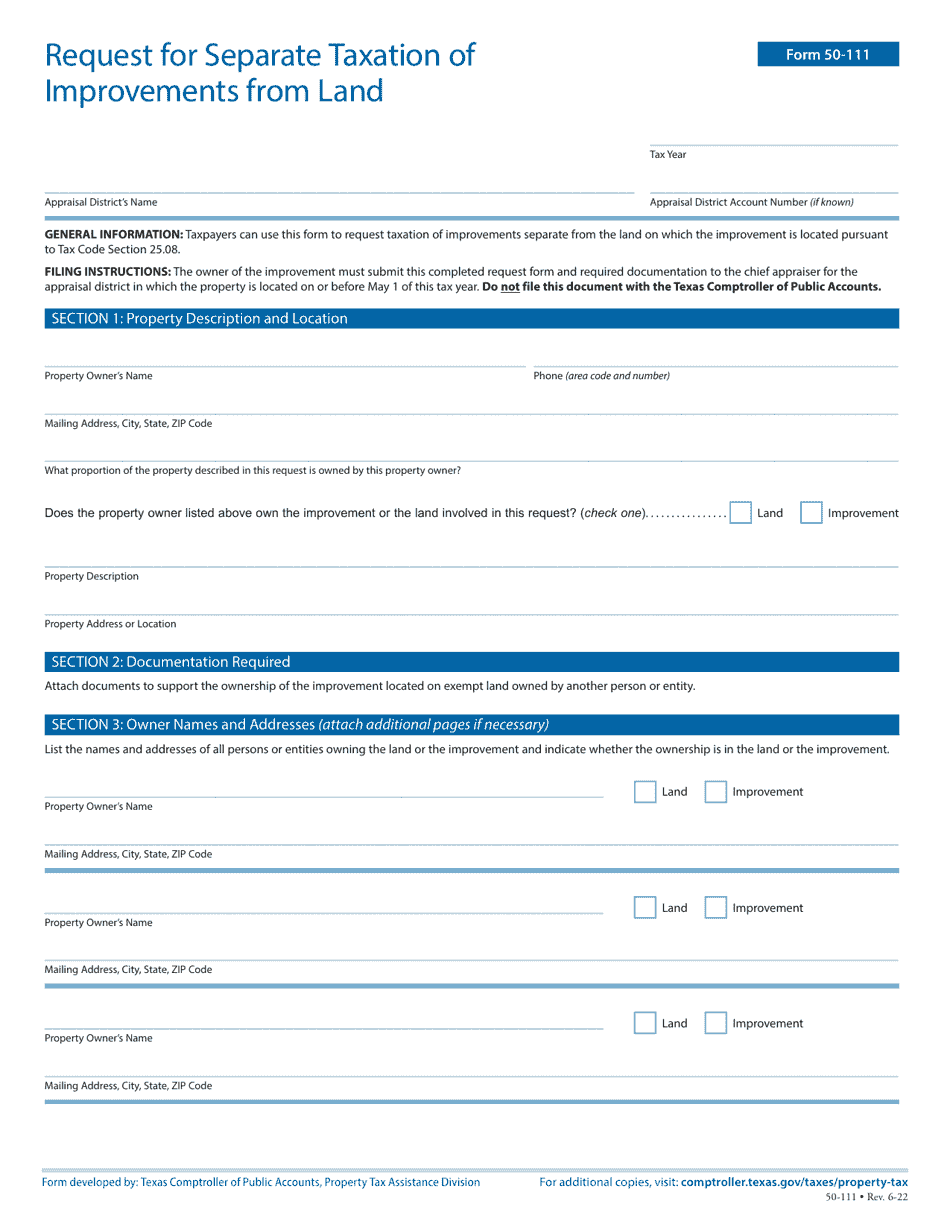

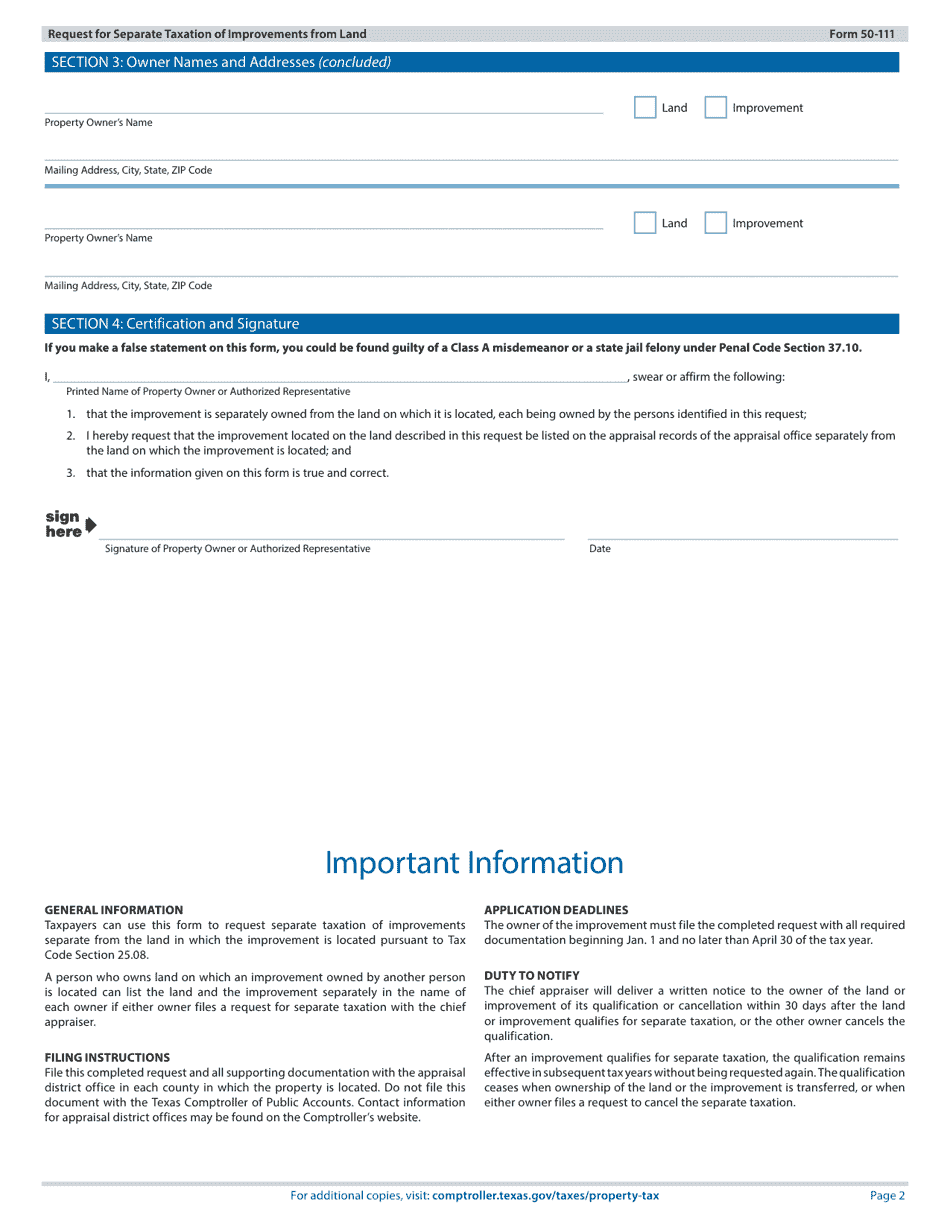

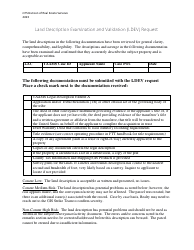

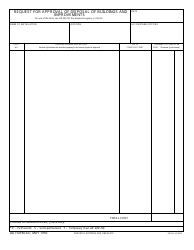

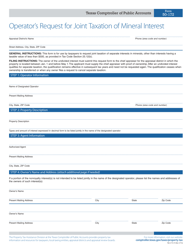

Form 50-111 Request for Separate Taxation of Improvements From Land - Texas

What Is Form 50-111?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

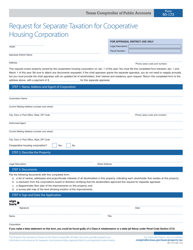

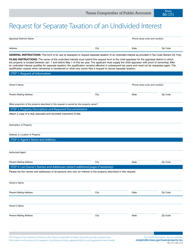

Q: What is Form 50-111?

A: Form 50-111 is the Request for Separate Taxation of Improvements From Land form in Texas.

Q: What is the purpose of Form 50-111?

A: The purpose of Form 50-111 is to request separate taxation of improvements from land.

Q: Who needs to fill out Form 50-111?

A: Property owners in Texas who want to have their improvements on land taxed separately need to fill out Form 50-111.

Q: Is there a deadline to submit Form 50-111?

A: Yes, Form 50-111 must be submitted to the local appraisal district by April 30th of the tax year in which the improvements were made.

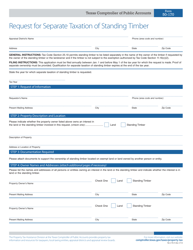

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-111 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.