This version of the form is not currently in use and is provided for reference only. Download this version of

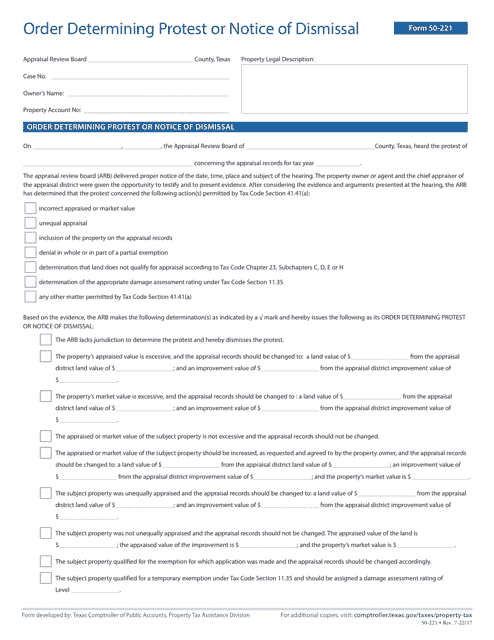

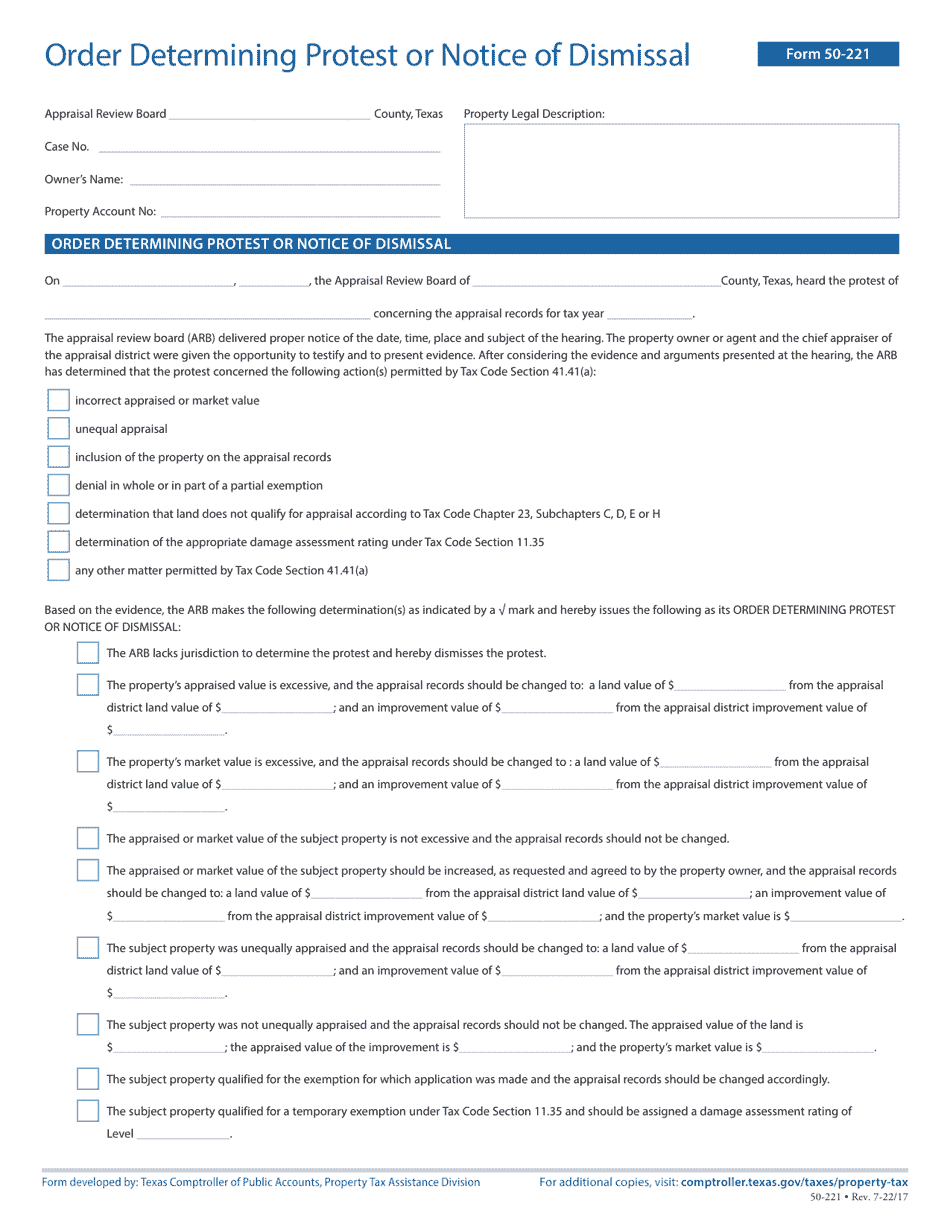

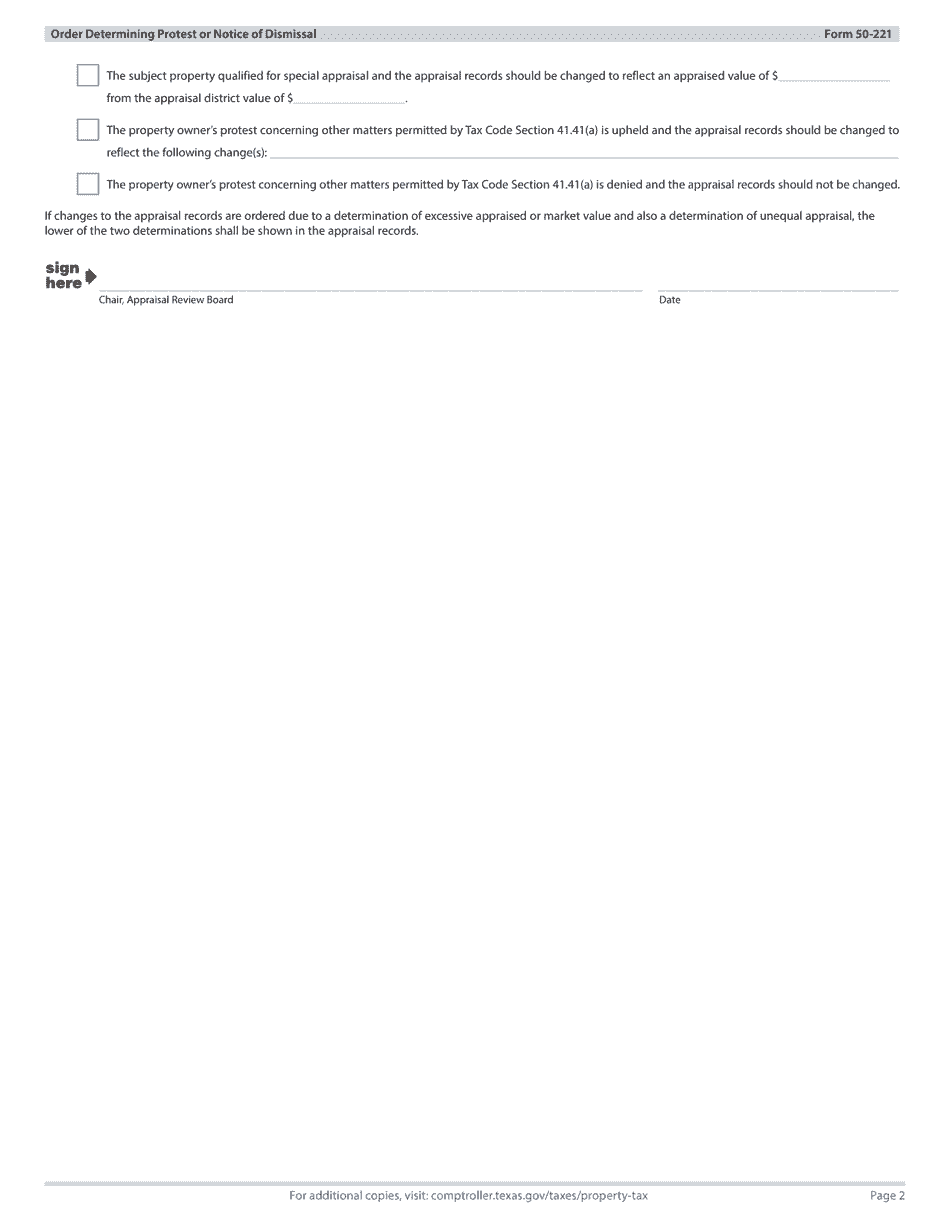

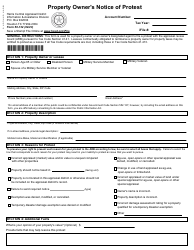

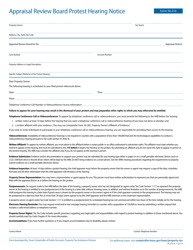

Form 50-221

for the current year.

Form 50-221 Order Determining Protest or Notice of Dismissal - Texas

What Is Form 50-221?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-221?

A: Form 50-221 is a document used in Texas to determine a protest or notice of dismissal.

Q: What is the purpose of Form 50-221?

A: The purpose of Form 50-221 is to determine whether a protest should be upheld or dismissed.

Q: Who uses Form 50-221?

A: Form 50-221 is used by individuals or businesses who have filed a protest with the Texas Comptroller's Office.

Q: What is a protest in this context?

A: A protest is a formal complaint filed by a taxpayer who disagrees with an assessment or decision made by the Texas Comptroller's Office.

Q: What happens after Form 50-221 is filed?

A: After Form 50-221 is filed, the Texas Comptroller's Office will review the protest and make a determination.

Q: What are the possible outcomes of a protest?

A: The possible outcomes of a protest are either a decision in favor of the taxpayer or a dismissal of the protest.

Q: Are there any filing fees for Form 50-221?

A: No, there are no filing fees for Form 50-221.

Q: Is legal representation required to file Form 50-221?

A: Legal representation is not required to file Form 50-221, but it is recommended for complex cases.

Q: What should be included in Form 50-221?

A: Form 50-221 should include all relevant information and supporting documentation for the protest.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-221 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.