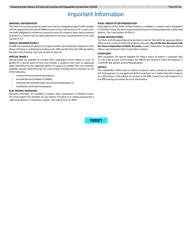

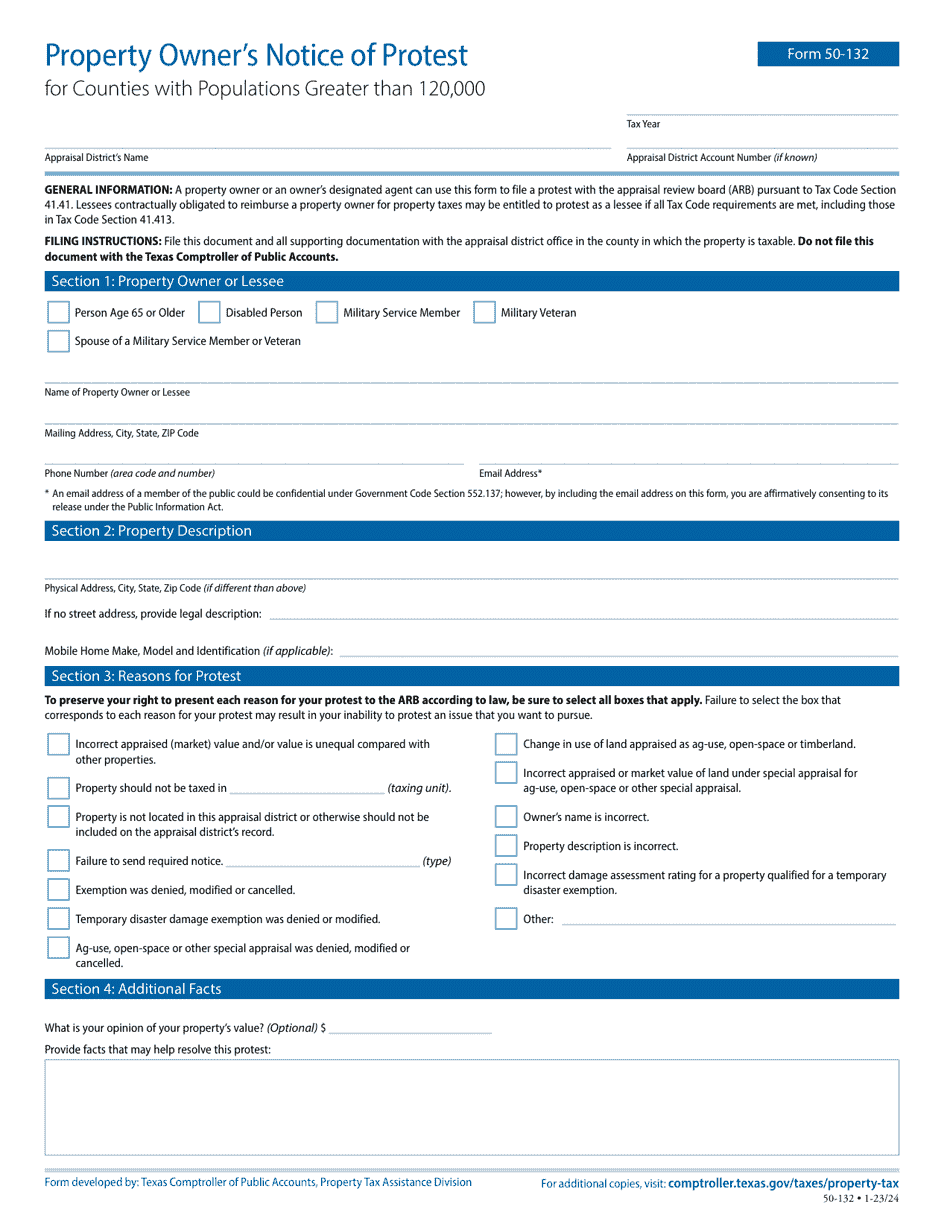

This version of the form is not currently in use and is provided for reference only. Download this version of

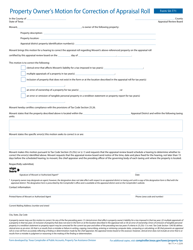

Form 50-132

for the current year.

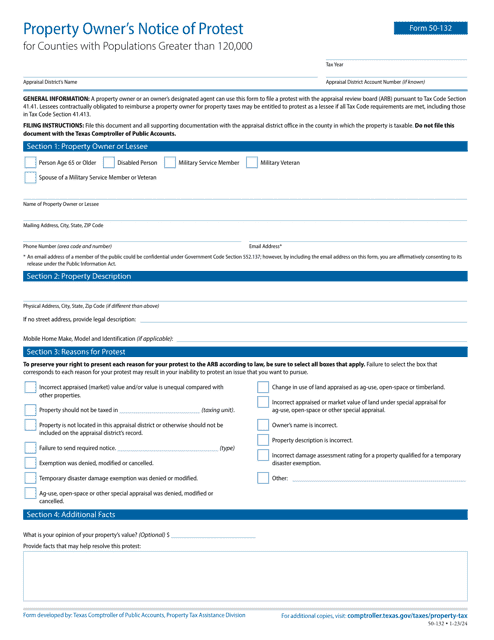

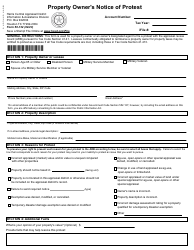

Form 50-132 Property Owner's Notice of Protest for Counties With Populations Greater Than 120,000 - Texas

What Is Form 50-132?

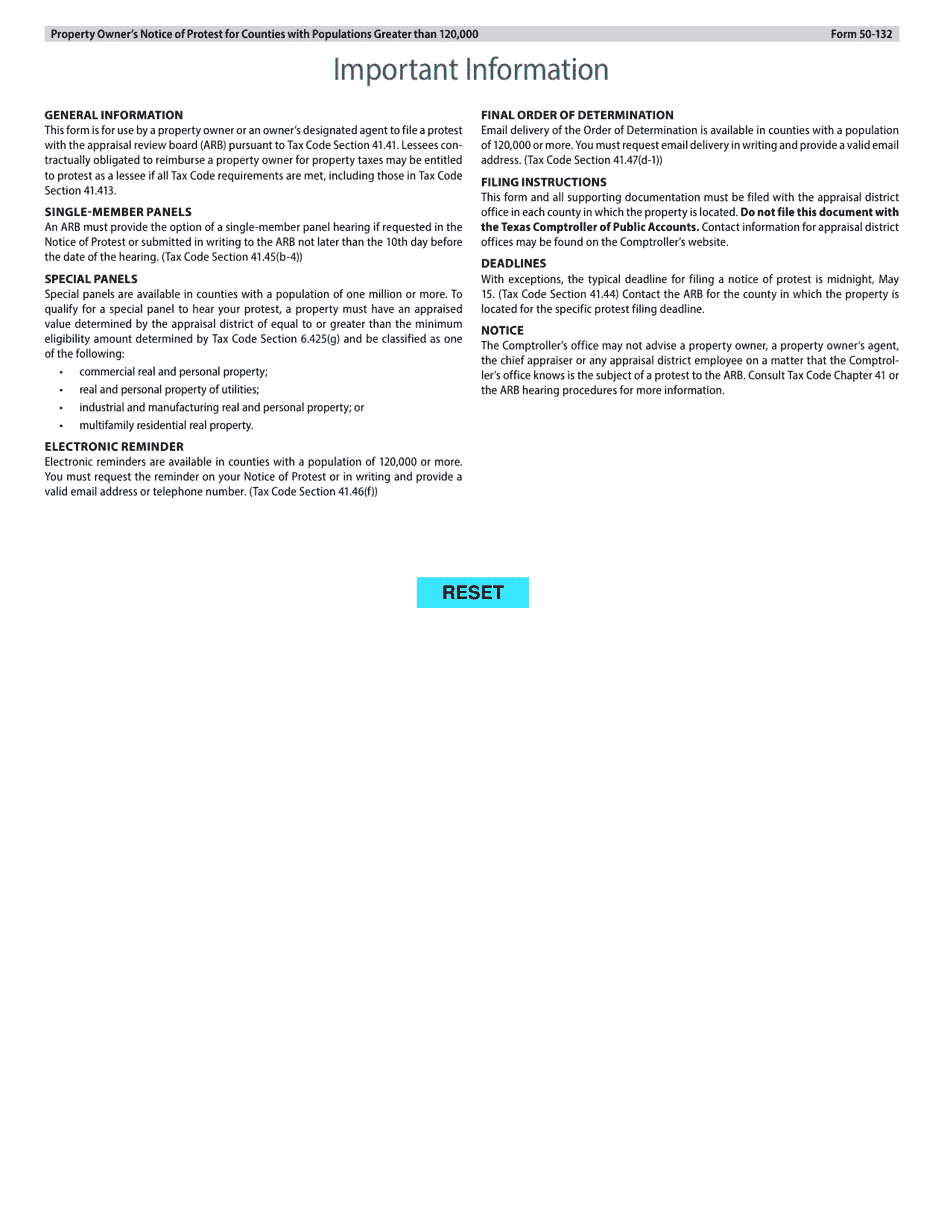

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-132?

A: Form 50-132 is the Property Owner's Notice of Protest for counties in Texas with populations greater than 120,000.

Q: What is the purpose of Form 50-132?

A: The purpose of Form 50-132 is to allow property owners to file a notice of protest if they disagree with the appraised value of their property.

Q: Who can use Form 50-132?

A: Form 50-132 can be used by property owners in Texas counties with populations greater than 120,000.

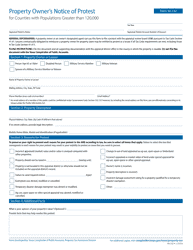

Q: What is a notice of protest?

A: A notice of protest is a written statement filed by a property owner to indicate their disagreement with the appraised value of their property.

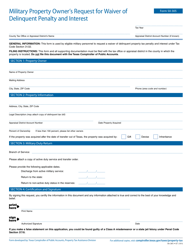

Q: When should Form 50-132 be filed?

A: Form 50-132 should be filed on or before May 15th (or the next business day if May 15th falls on a weekend or holiday) of the tax year for which the protest is being made.

Q: Is there a fee to file Form 50-132?

A: No, there is no fee to file Form 50-132.

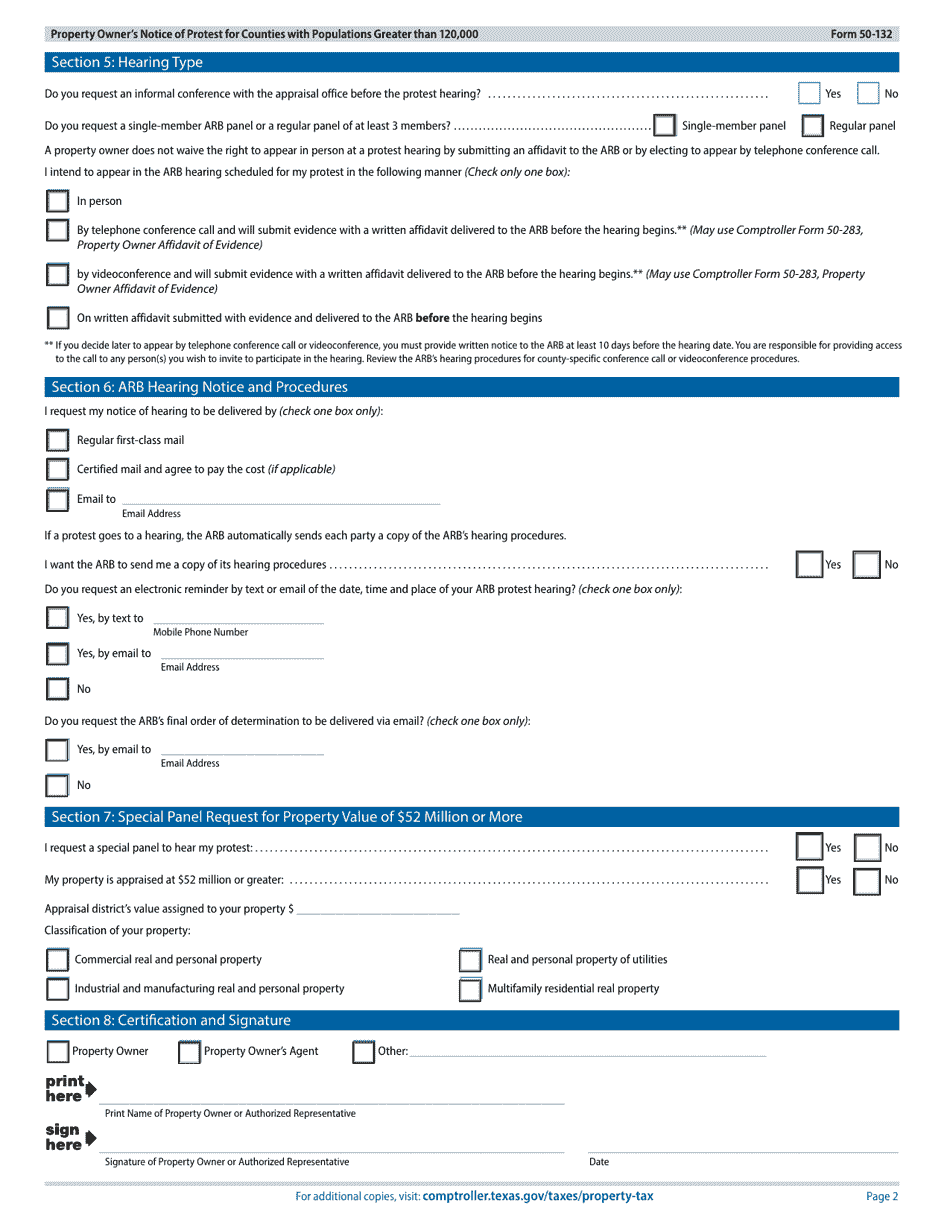

Q: What happens after filing Form 50-132?

A: After filing Form 50-132, the property owner may be contacted by the chief appraiser's office to attempt to resolve the protest. If an agreement cannot be reached, a formal hearing may be scheduled.

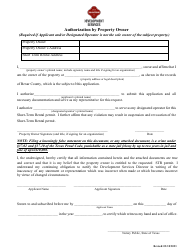

Q: Can an attorney or agent file Form 50-132 on behalf of the property owner?

A: Yes, an attorney or agent can file Form 50-132 on behalf of the property owner, as long as they have written authorization.

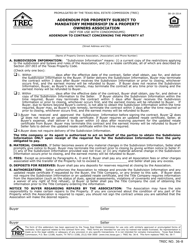

Q: What should property owners include in their notice of protest?

A: Property owners should include their name, address, property description, reason for protest, and the value they believe the property should be appraised at in their notice of protest.

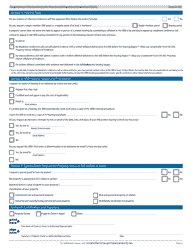

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-132 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.