This version of the form is not currently in use and is provided for reference only. Download this version of

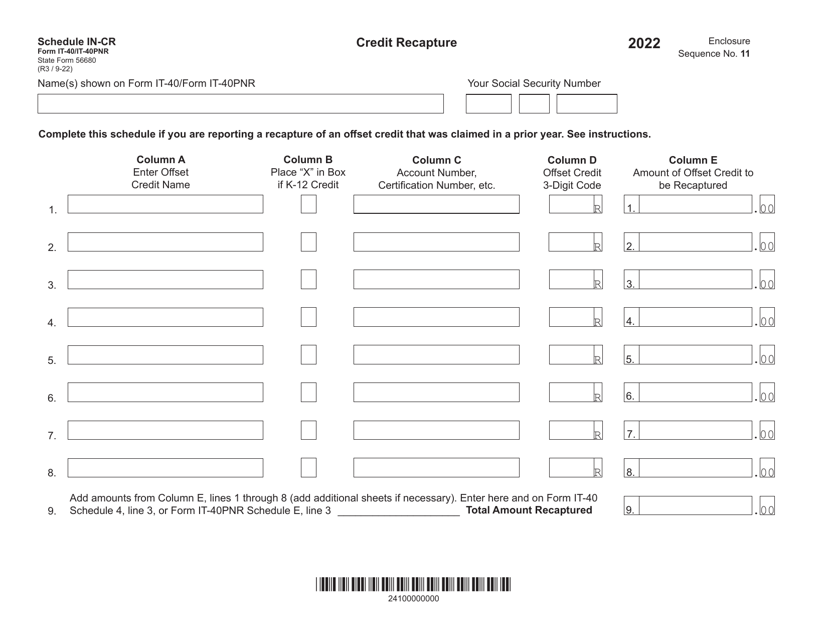

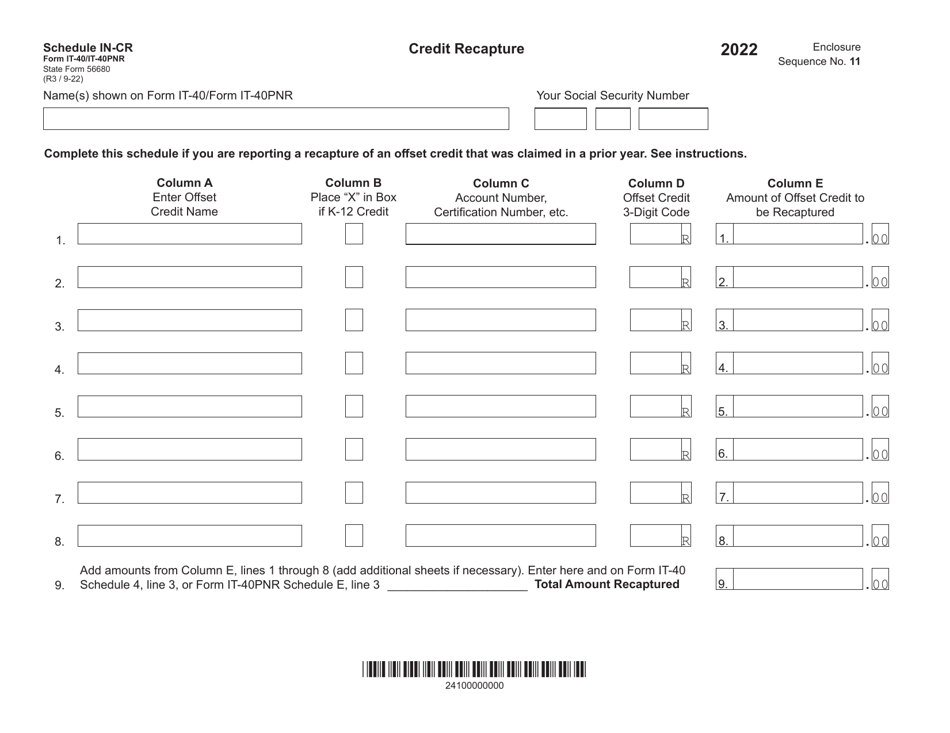

Form IT-40 (IT-40PNR; State Form 56680) Schedule IN-CR

for the current year.

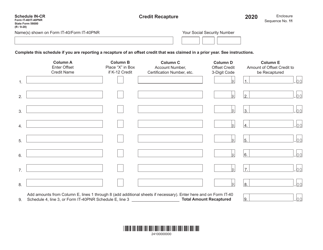

Form IT-40 (IT-40PNR; State Form 56680) Schedule IN-CR Credit Recapture - Indiana

What Is Form IT-40 (IT-40PNR; State Form 56680) Schedule IN-CR?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is the individual income tax return form for the state of Indiana.

Q: What does IT-40PNR stand for?

A: IT-40PNR stands for Indiana Part-Year/Nonresident Individual Income Tax Return.

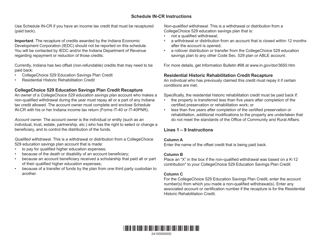

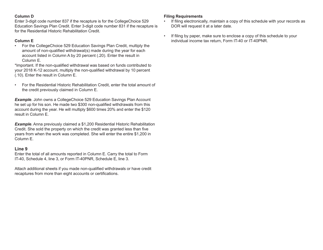

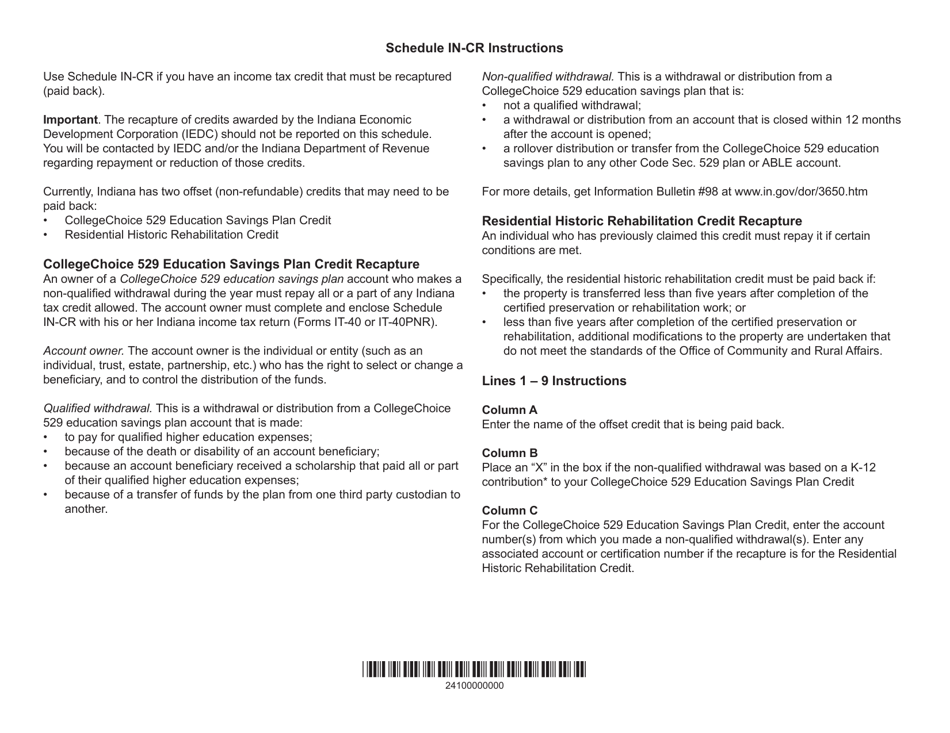

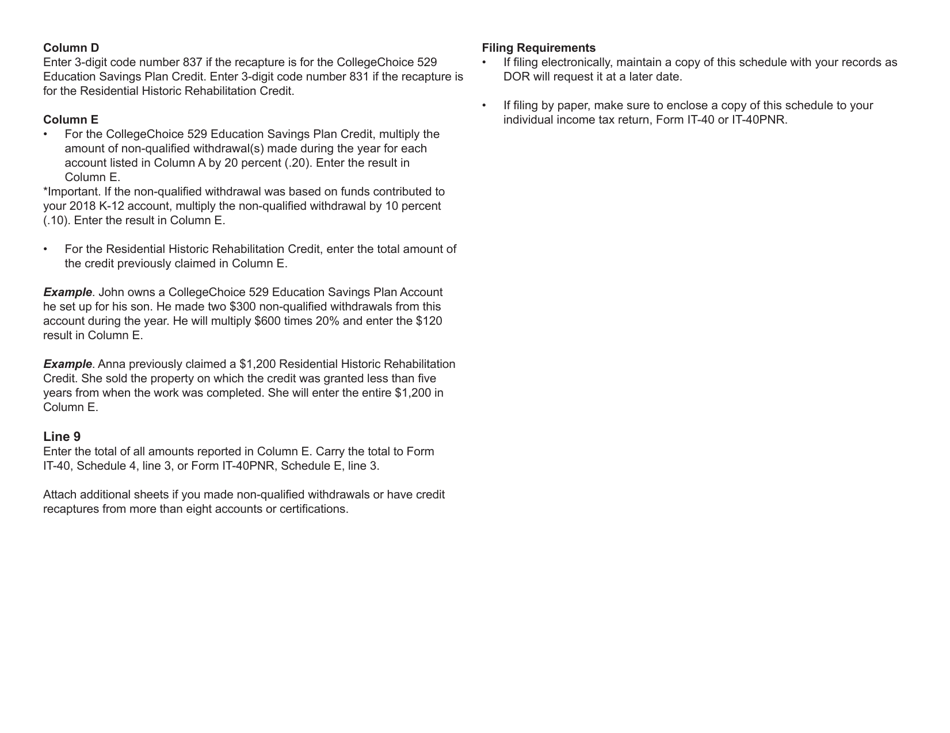

Q: What is Schedule IN-CR?

A: Schedule IN-CR is the form used to calculate and report the credit recapture for Indiana individual income tax.

Q: What is credit recapture?

A: Credit recapture is the process of taking back or reducing a previously claimed tax credit.

Q: Who needs to file Schedule IN-CR?

A: Individuals who need to recapture or repay a tax credit claimed in a previous year in Indiana.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (IT-40PNR; State Form 56680) Schedule IN-CR by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.