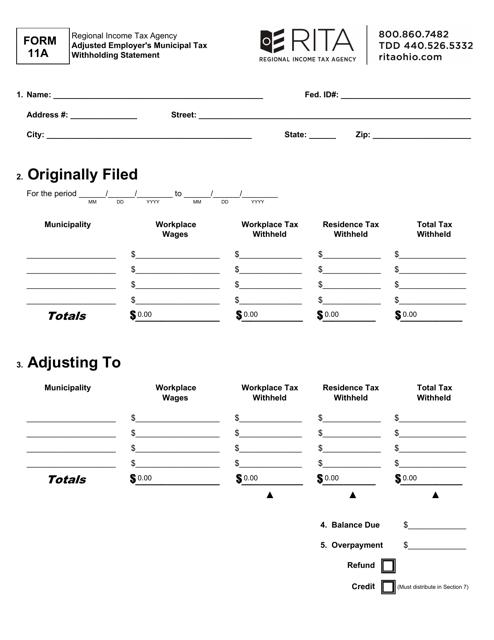

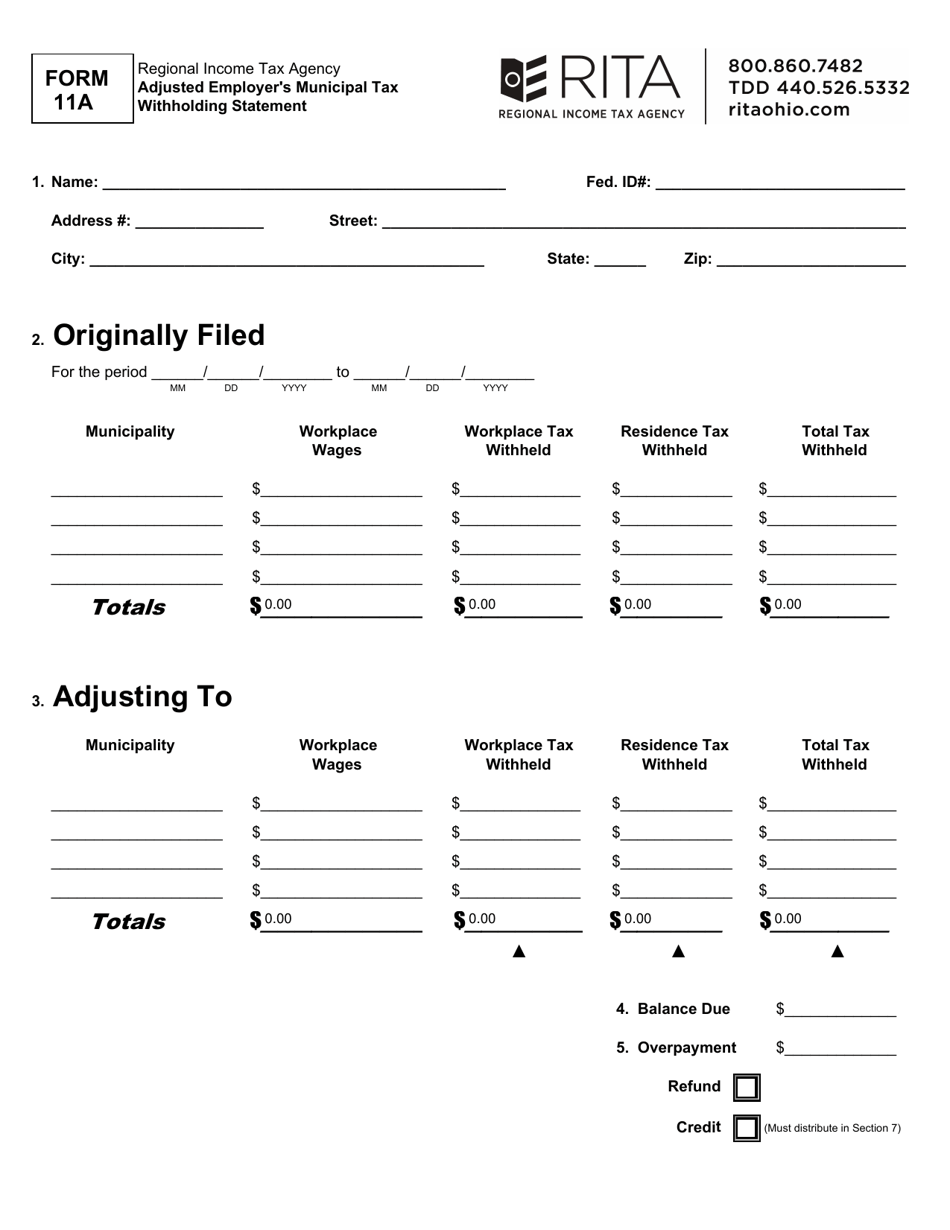

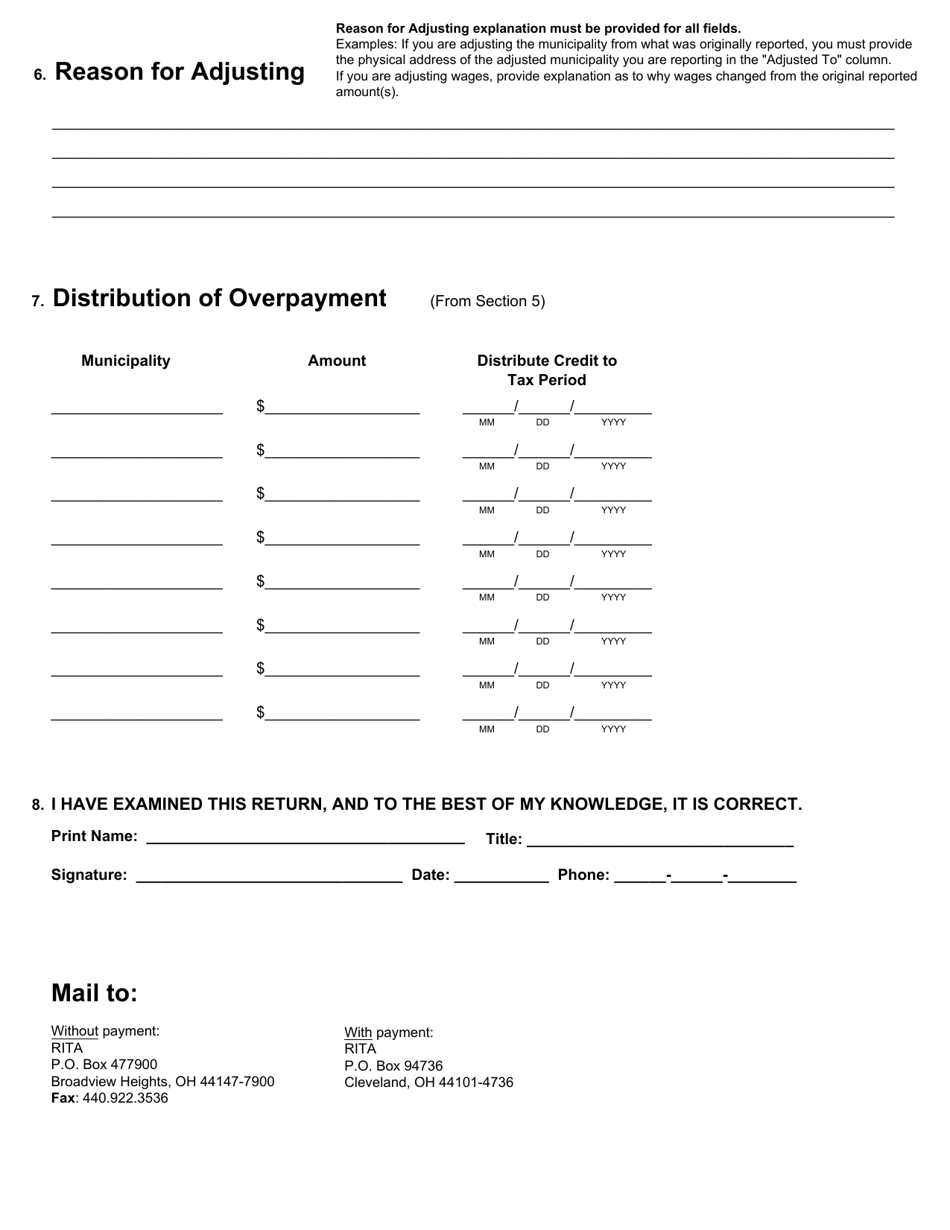

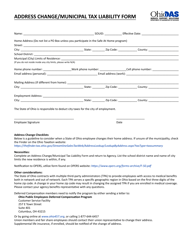

Form 11A Adjusted Employer's Municipal Tax Withholding Statement - Ohio

What Is Form 11A?

This is a legal form that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

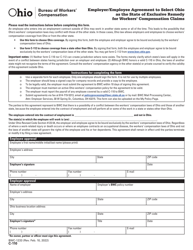

Q: What is Form 11A?

A: Form 11A is the Adjusted Employer's Municipal Tax Withholding Statement for Ohio.

Q: What is the purpose of Form 11A?

A: The purpose of Form 11A is to report and adjust municipal tax withholding for employees in Ohio.

Q: Who needs to file Form 11A?

A: Employers in Ohio need to file Form 11A if they have employees subject to municipal tax withholding.

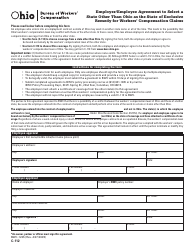

Q: When is Form 11A due?

A: Form 11A is due annually on February 28th for the previous calendar year.

Q: What information is required on Form 11A?

A: Form 11A requires the employer's name, address, and federal employer identification number (FEIN), as well as detailed information about each employee's municipal tax withholding.

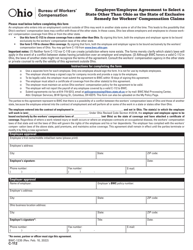

Q: Are there any penalties for late or incorrect filing of Form 11A?

A: Yes, there may be penalties for late or incorrect filing of Form 11A, so it is important to file on time and ensure accurate information.

Q: Can Form 11A be filed electronically?

A: Yes, Form 11A can be filed electronically through the Ohio Business Gateway.

Q: Is Form 11A the only form required for municipal tax withholding in Ohio?

A: No, in addition to Form 11A, employers may also be required to file other forms or reports depending on the specific municipality's requirements.

Form Details:

- The latest edition provided by the Ohio Regional Income Tax Agency (RITA);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 11A by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (RITA).