This version of the form is not currently in use and is provided for reference only. Download this version of

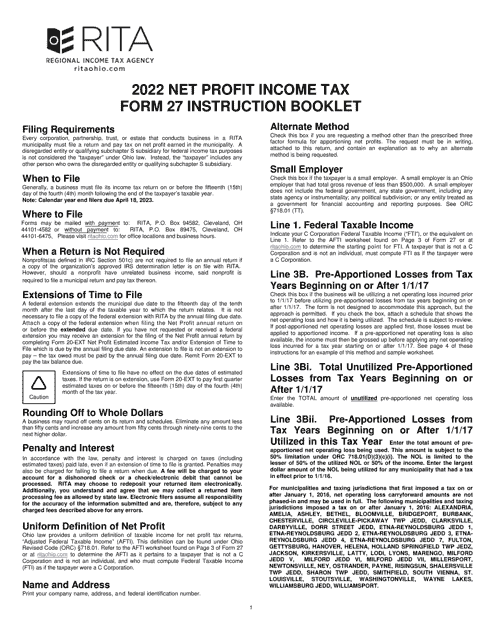

Instructions for Form 27

for the current year.

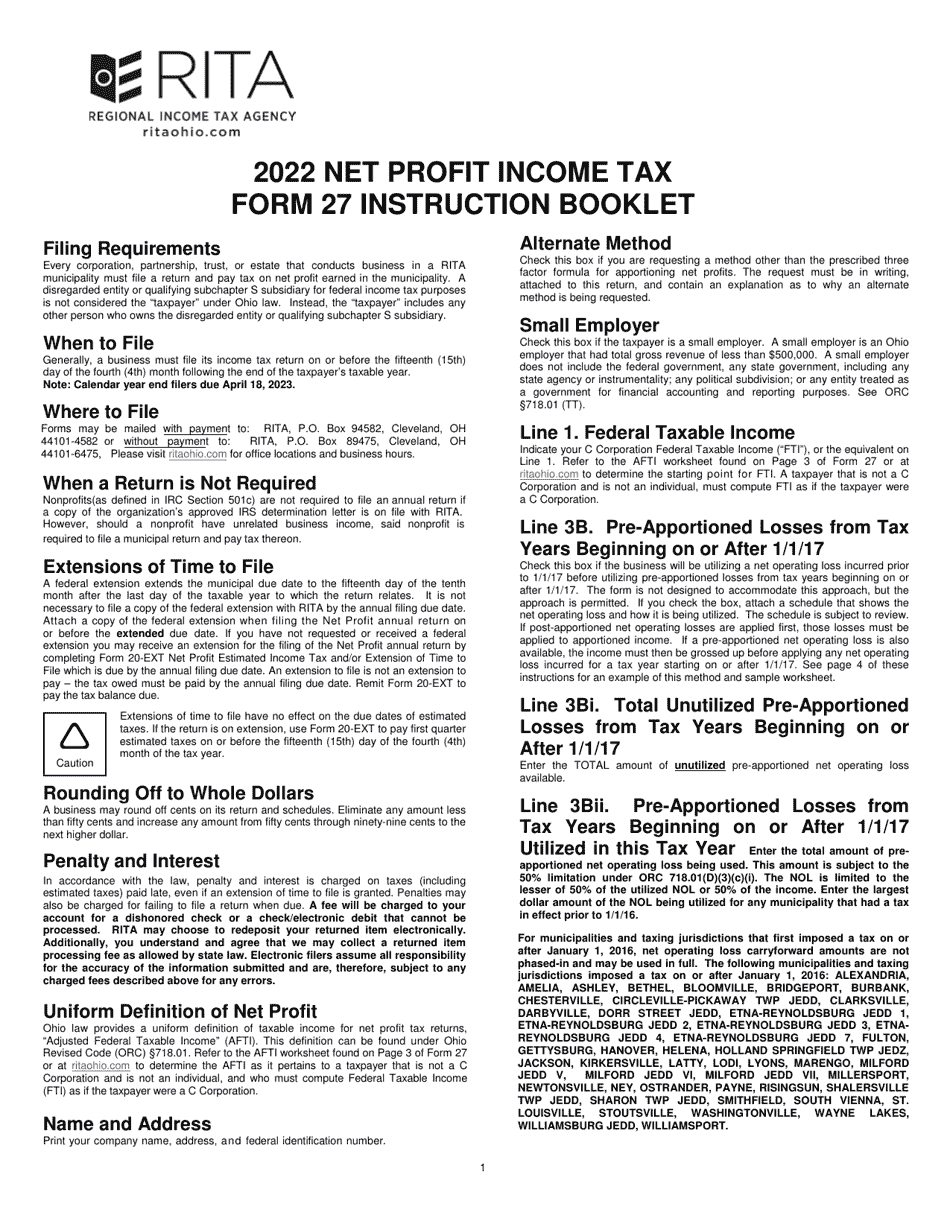

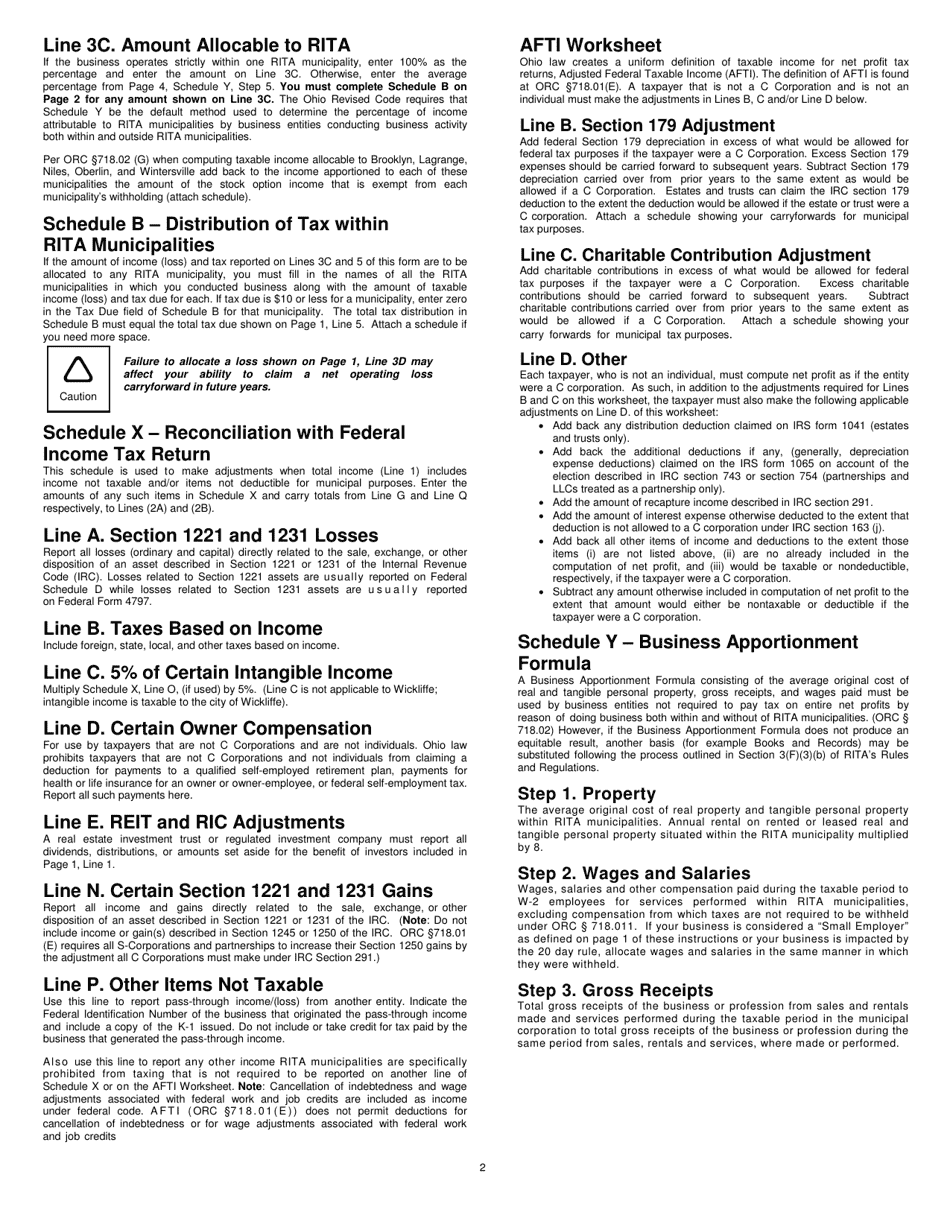

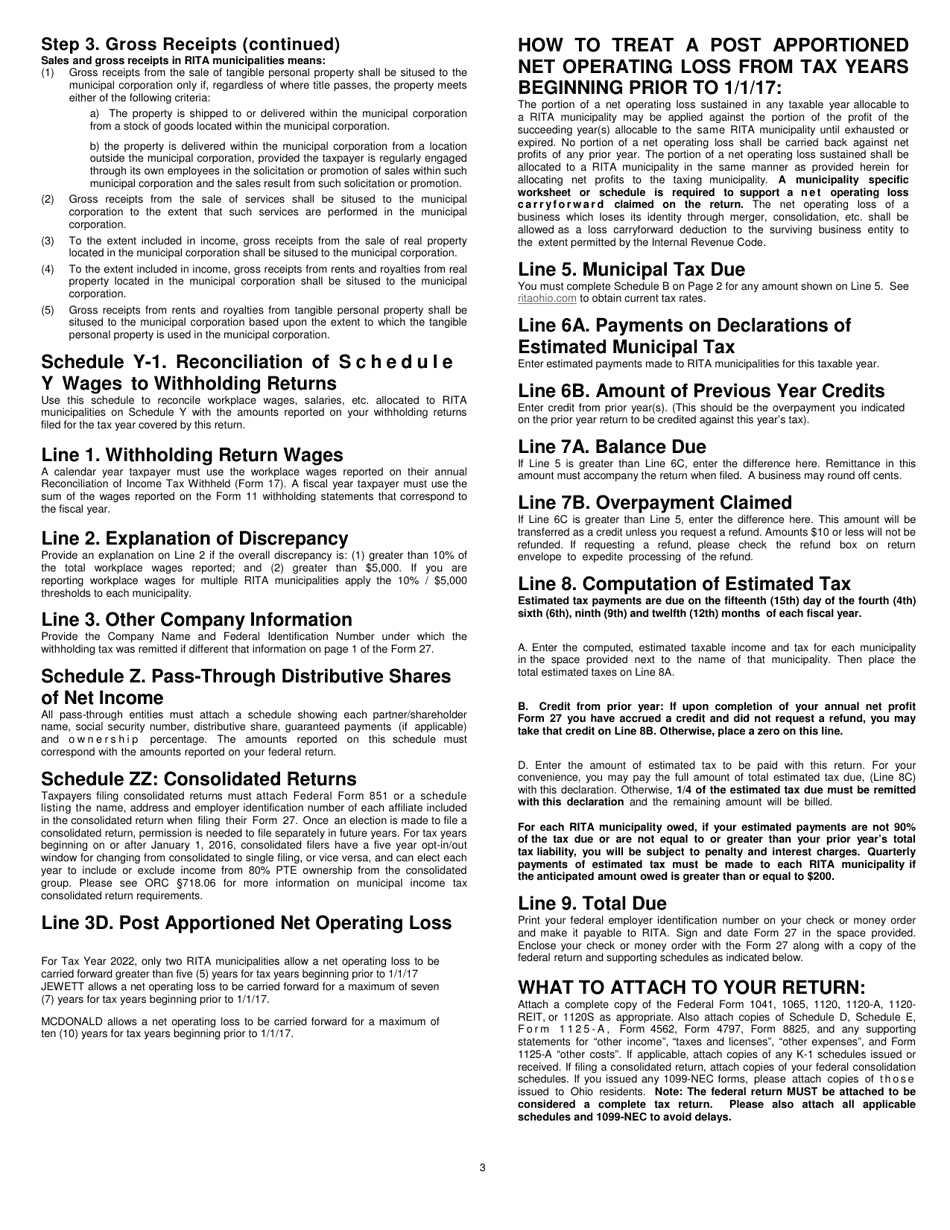

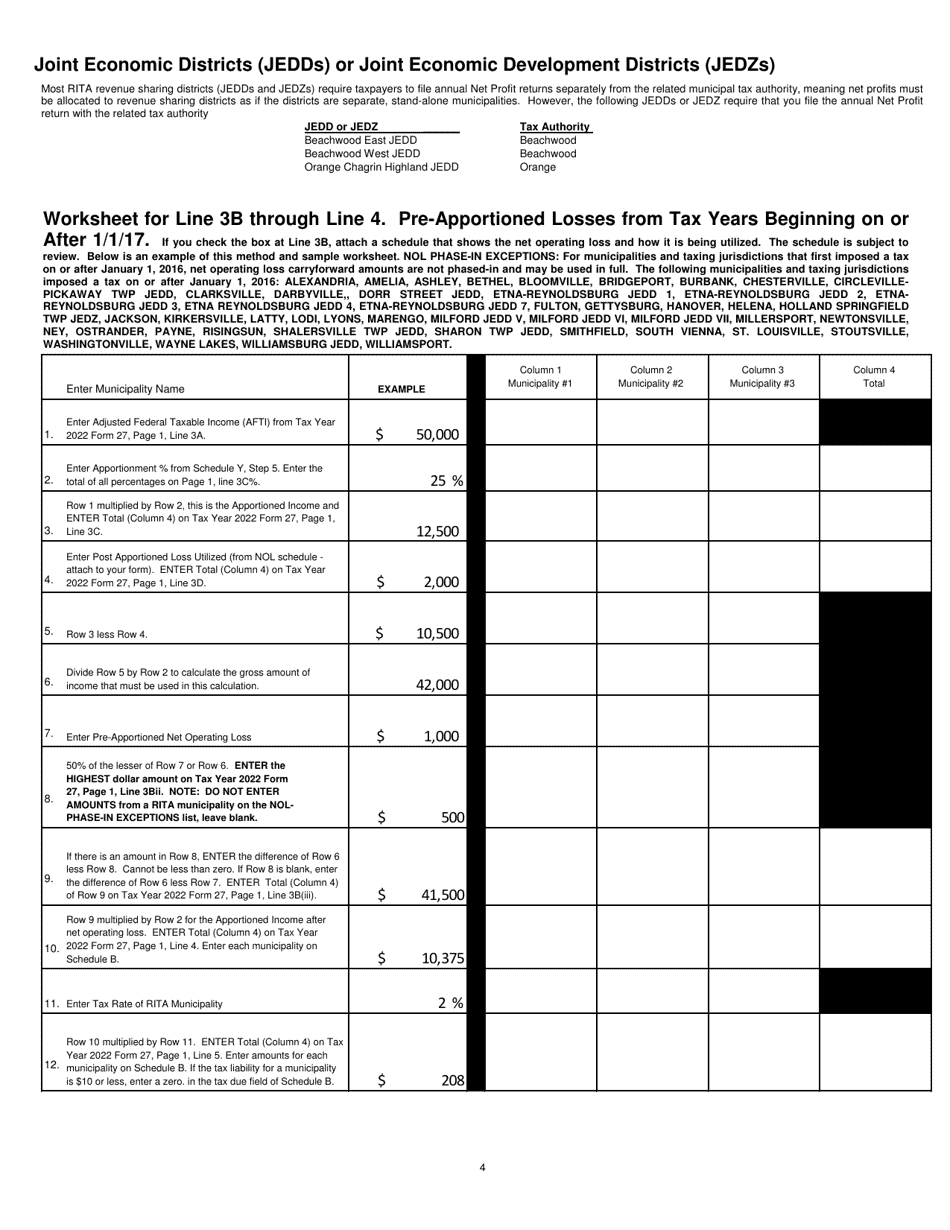

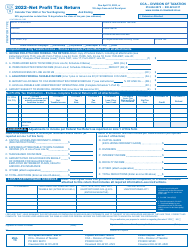

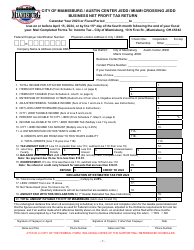

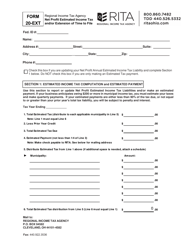

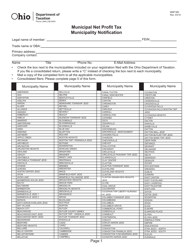

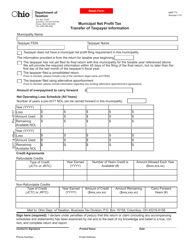

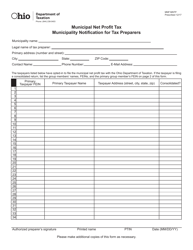

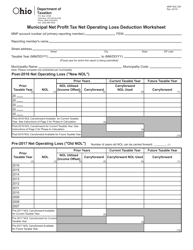

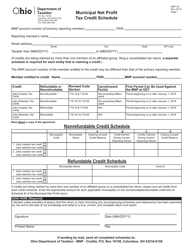

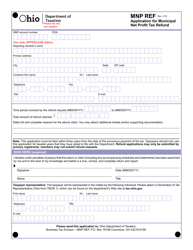

Instructions for Form 27 Rita Net Profit Tax Return - Ohio

This document contains official instructions for Form 27 , Rita Net Profit Tax Return - a form released and collected by the Ohio Regional Income Tax Agency (RITA).

FAQ

Q: What is Form 27?

A: Form 27 is the Rita Net Profit Tax Return for Ohio.

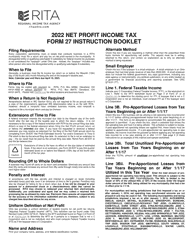

Q: Who needs to file Form 27?

A: Individuals or business entities that have net profits in Ohio and are subject to the Rita tax need to file Form 27.

Q: What is the Rita tax?

A: The Rita tax is a local municipal tax imposed on net profits earned within the municipality.

Q: When is the due date for filing Form 27?

A: The due date for filing Form 27 varies depending on the municipality. It is typically April 15th, but you should check with your local tax office for the exact deadline.

Q: Do I need to attach any supporting documents with Form 27?

A: Yes, you may need to attach supporting documentation such as federal income tax returns, profit and loss statements, and partnership or corporation schedules. Check the instructions on Form 27 for the specific requirements.

Q: What happens if I don't file Form 27?

A: If you are required to file Form 27 and fail to do so, you may face penalties and interest on the unpaid tax amount.

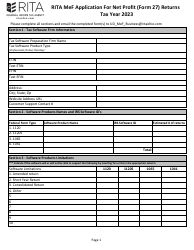

Q: Can I e-file Form 27?

A: Yes, many municipalities in Ohio offer the option to e-file Form 27. Check with your local tax office to see if they accept electronic filing.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Regional Income Tax Agency (RITA).