This version of the form is not currently in use and is provided for reference only. Download this version of

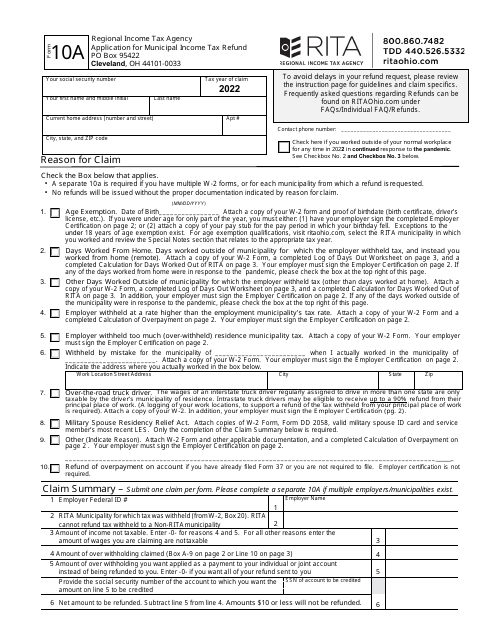

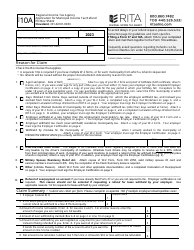

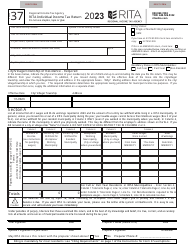

Form 10A

for the current year.

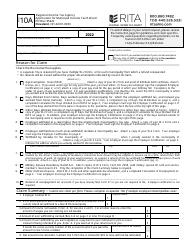

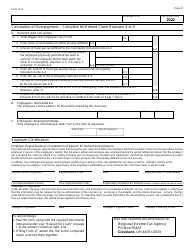

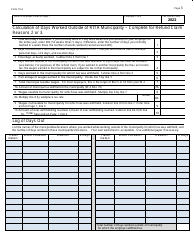

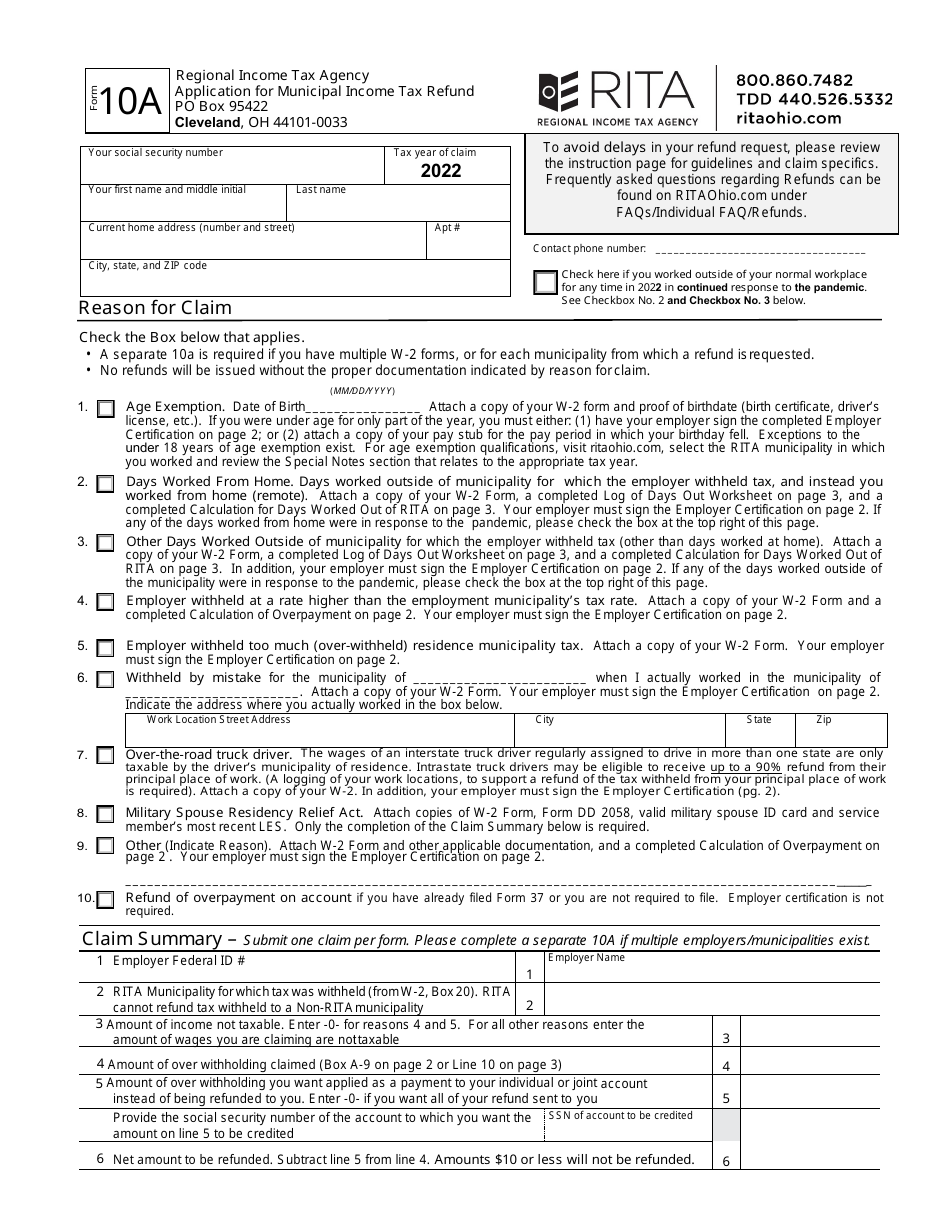

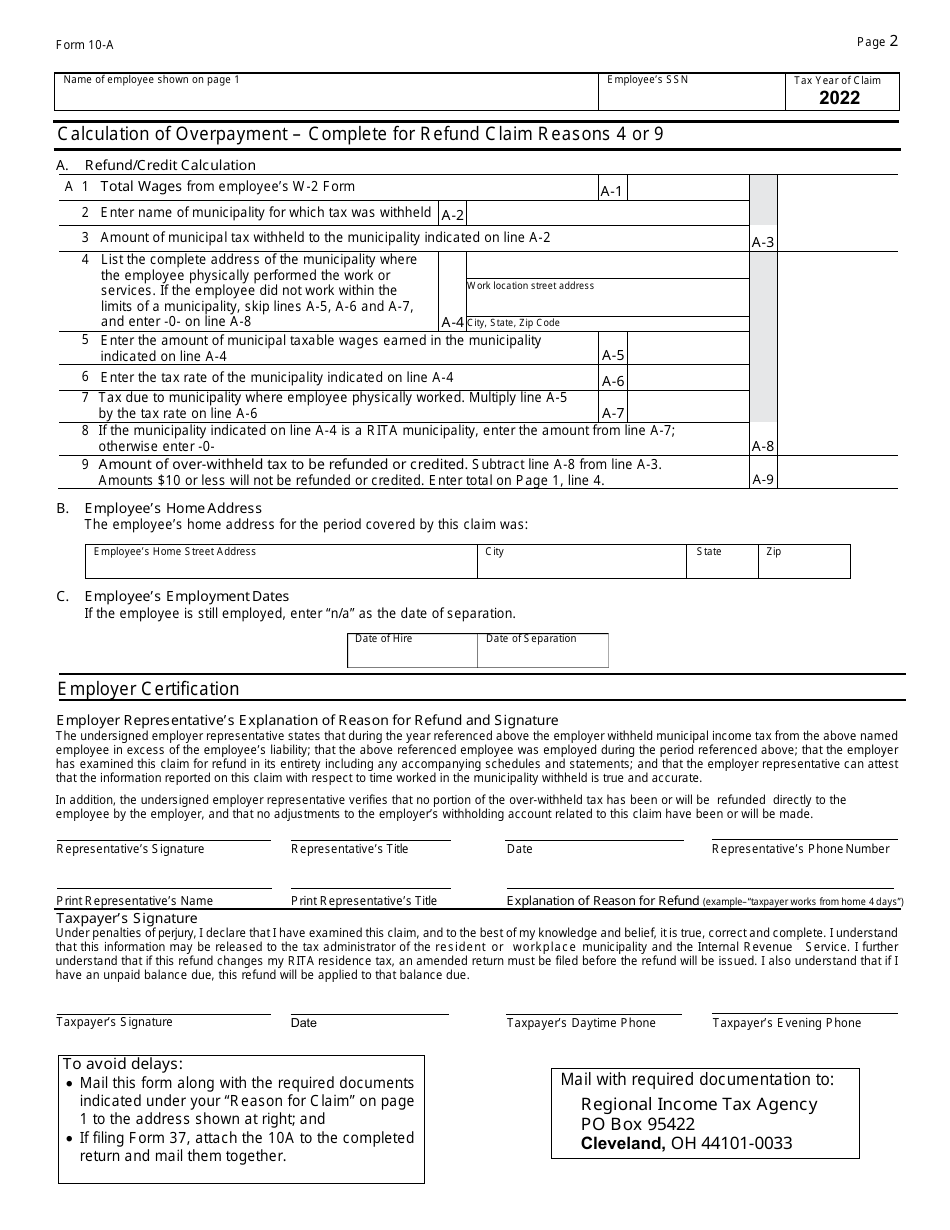

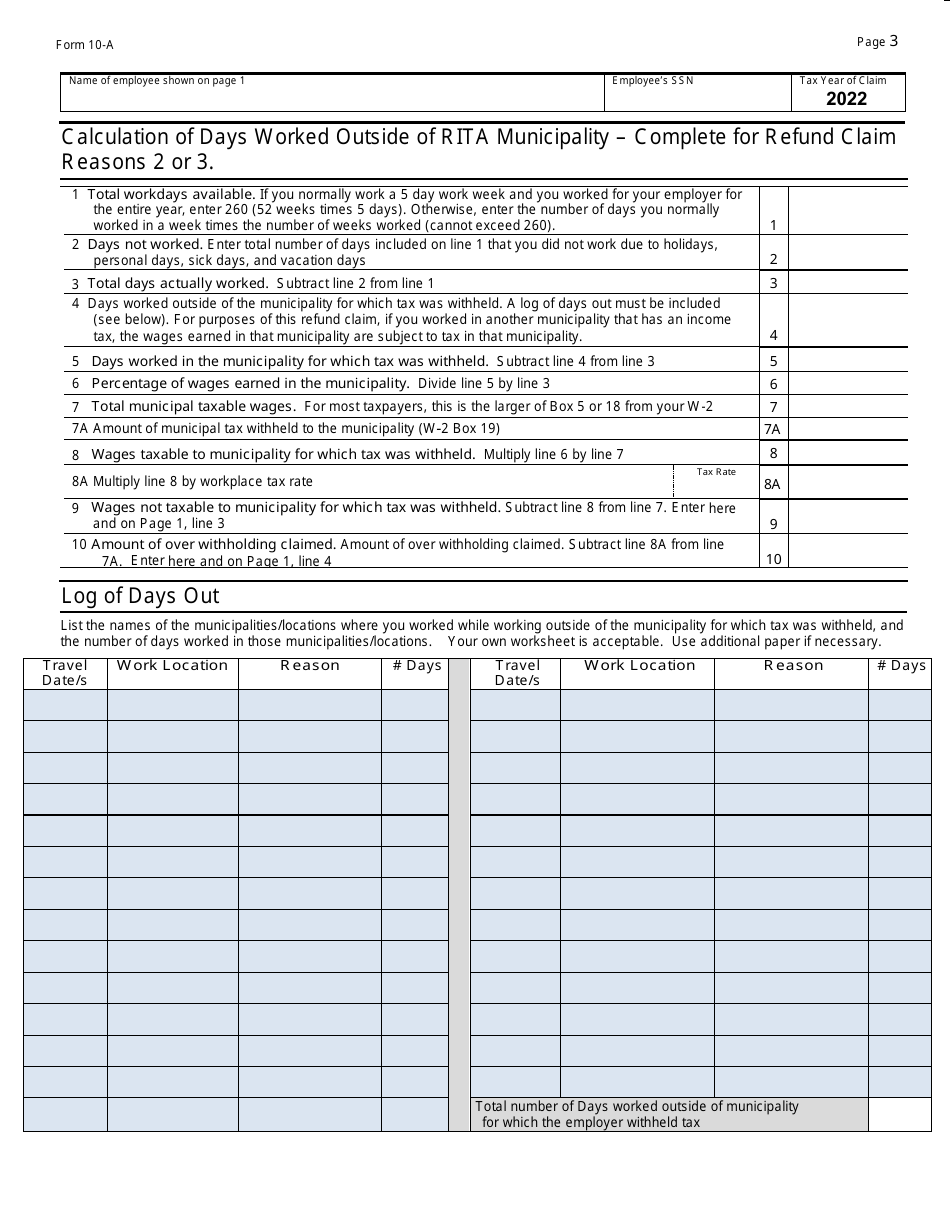

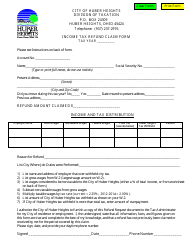

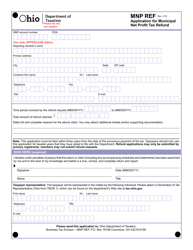

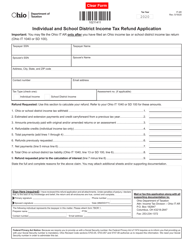

Form 10A Application for Municipal Income Tax Refund - Ohio

What Is Form 10A?

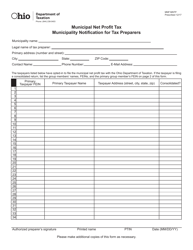

This is a legal form that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 10A?

A: Form 10A is an application for a municipal income tax refund in Ohio.

Q: Who can use Form 10A?

A: Ohio residents who paid municipal income tax and want to apply for a refund can use Form 10A.

Q: What information is required on Form 10A?

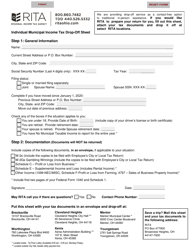

A: Form 10A requires information such as your name, address, and Social Security number, as well as details about the taxes you paid and the reason for your refund request.

Q: Can I submit Form 10A electronically?

A: Yes, you can submit Form 10A electronically if the municipality you're filing for accepts electronic filing.

Q: Are there any deadlines for submitting Form 10A?

A: The deadline for submitting Form 10A varies depending on the municipality. You should check with your municipality for their specific deadline.

Q: How long does it take to process a Form 10A?

A: The processing time for Form 10A refunds varies, but it can take up to several weeks.

Q: What should I do if I made a mistake on Form 10A?

A: If you made a mistake on Form 10A, you should contact the Ohio Department of Taxation for instructions on how to correct it.

Q: Is there a fee to file Form 10A?

A: No, there is no fee to file Form 10A.

Form Details:

- The latest edition provided by the Ohio Regional Income Tax Agency (RITA);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10A by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (RITA).