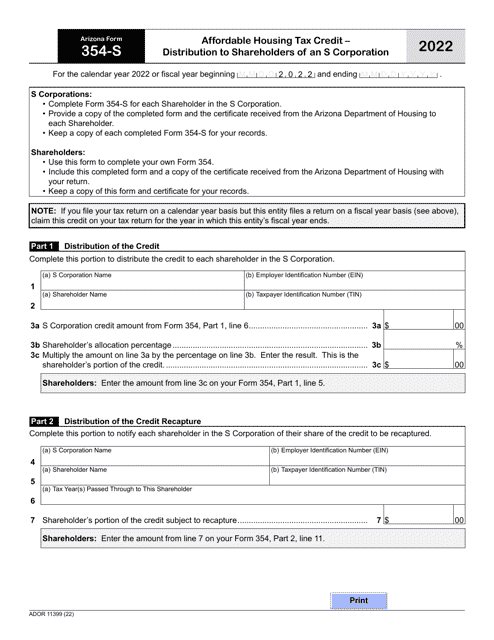

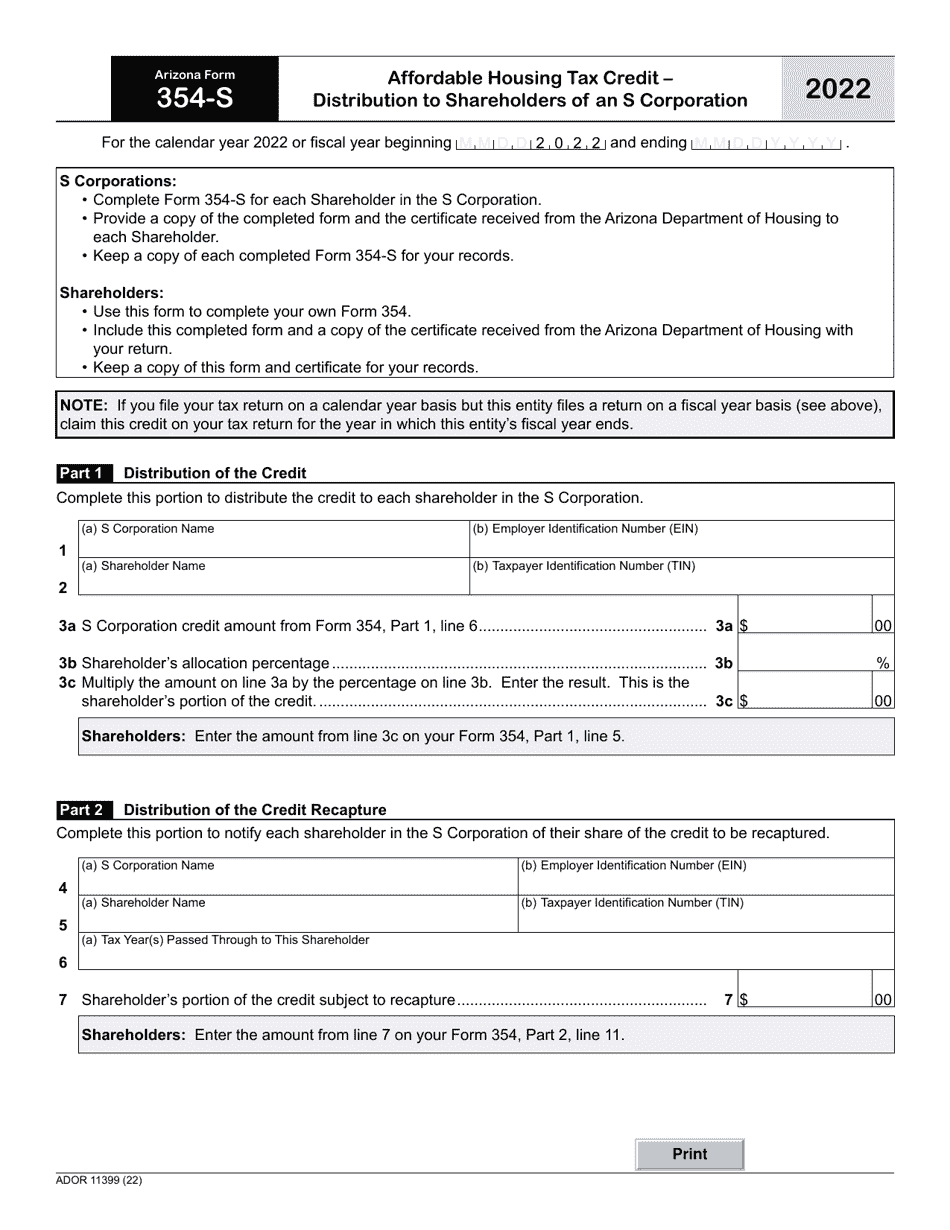

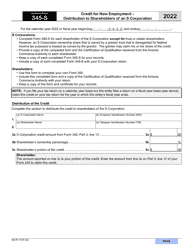

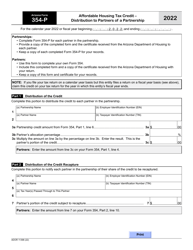

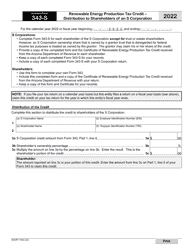

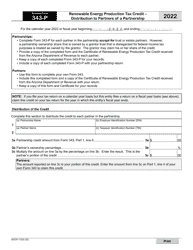

Arizona Form 354-S (ADOR11399) Affordable Housing Tax Credit - Distribution to Shareholders of an S Corporation - Arizona

What Is Arizona Form 354-S (ADOR11399)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 354-S?

A: Arizona Form 354-S is a tax form used for reporting the distribution of affordable housingtax credits to shareholders of an S Corporation in Arizona.

Q: Who needs to file Arizona Form 354-S?

A: Shareholders of an S Corporation in Arizona who have received affordable housing tax credits need to file Arizona Form 354-S.

Q: What is the purpose of Arizona Form 354-S?

A: The purpose of Arizona Form 354-S is to report the distribution of affordable housing tax credits to shareholders of an S Corporation.

Q: Are there any filing fees for Arizona Form 354-S?

A: There are no filing fees for Arizona Form 354-S.

Q: When is the deadline to file Arizona Form 354-S?

A: The deadline to file Arizona Form 354-S is typically April 15th of the following year, or the same deadline as the individual income tax return.

Q: Are extensions available for filing Arizona Form 354-S?

A: Yes, extensions may be available for filing Arizona Form 354-S. Check with the Arizona Department of Revenue for more information.

Q: What should I do if I made an error on Arizona Form 354-S?

A: If you made an error on Arizona Form 354-S, you should file an amended form as soon as possible to correct the mistake.

Q: Is Arizona Form 354-S only for residents of Arizona?

A: No, Arizona Form 354-S is for shareholders of an S Corporation located in Arizona, regardless of residency.

Q: What happens if I don't file Arizona Form 354-S?

A: Failure to file Arizona Form 354-S may result in penalties and fines imposed by the Arizona Department of Revenue.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 354-S (ADOR11399) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.