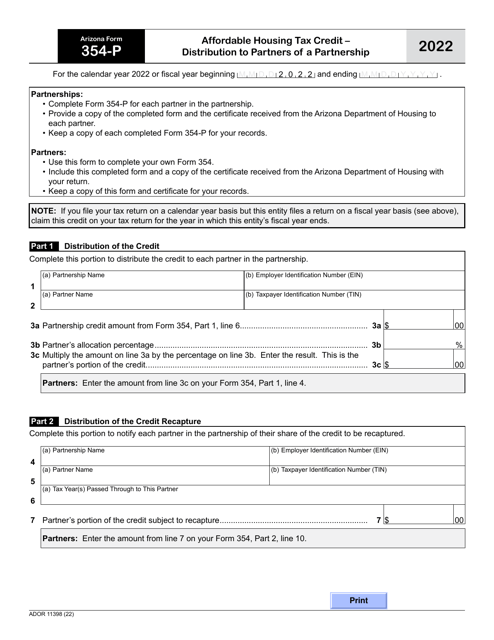

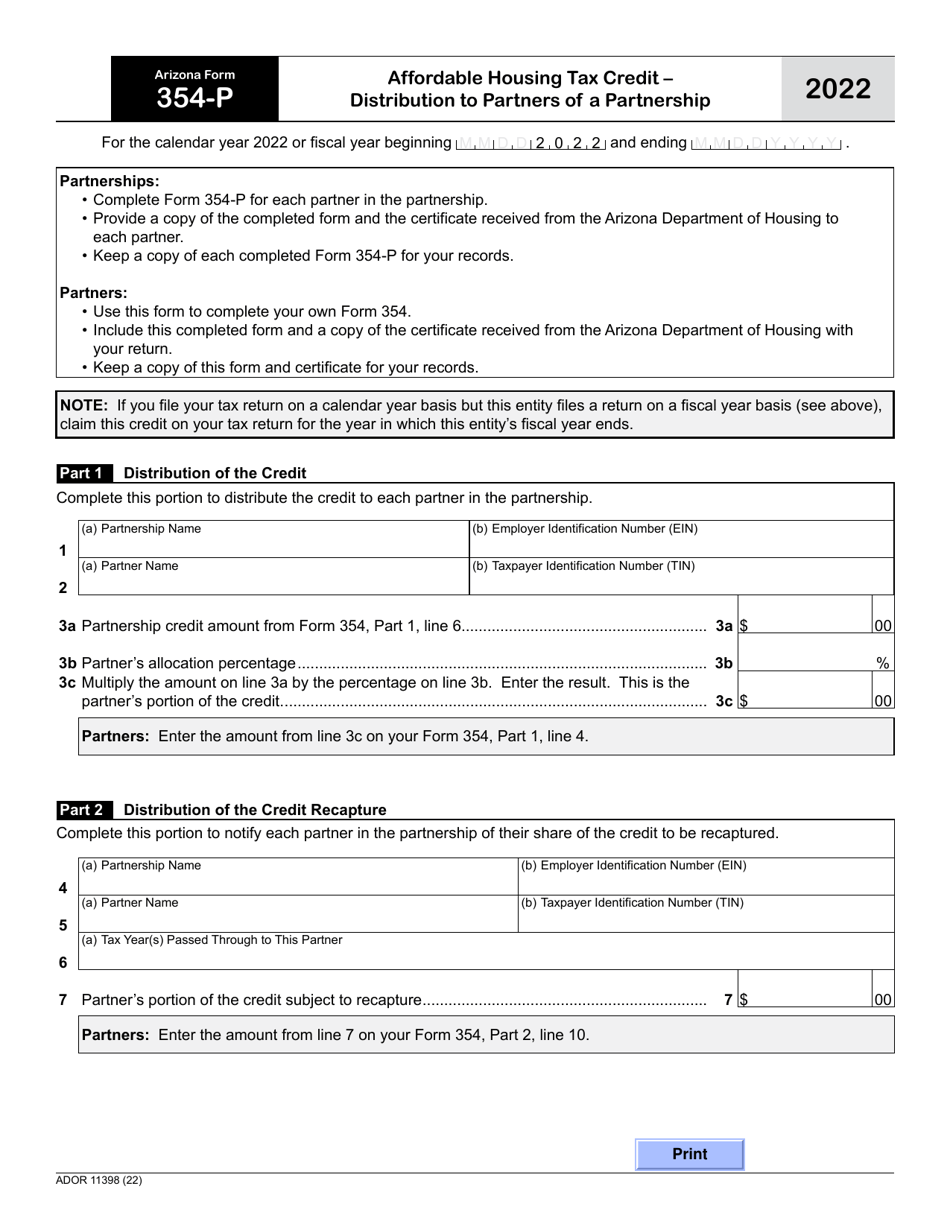

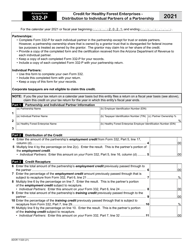

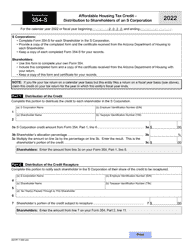

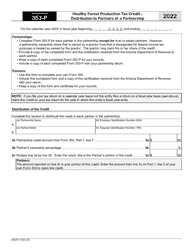

Arizona Form 354-P (ADOR11398) Affordable Housing Tax Credit - Distribution to Partners of a Partnership - Arizona

What Is Arizona Form 354-P (ADOR11398)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 354-P?

A: Arizona Form 354-P is a tax form used to report the distribution of Affordable HousingTax Credit to partners of a partnership in Arizona.

Q: What is the purpose of Arizona Form 354-P?

A: The purpose of Arizona Form 354-P is to provide necessary information about the distribution of Affordable Housing Tax Credit to partners of a partnership in Arizona.

Q: Who needs to file Arizona Form 354-P?

A: Partnerships distributing Affordable Housing Tax Credit to partners in Arizona need to file Arizona Form 354-P.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 354-P (ADOR11398) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.