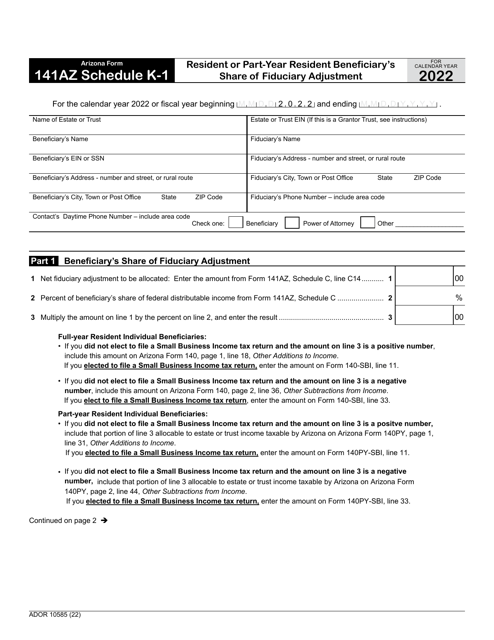

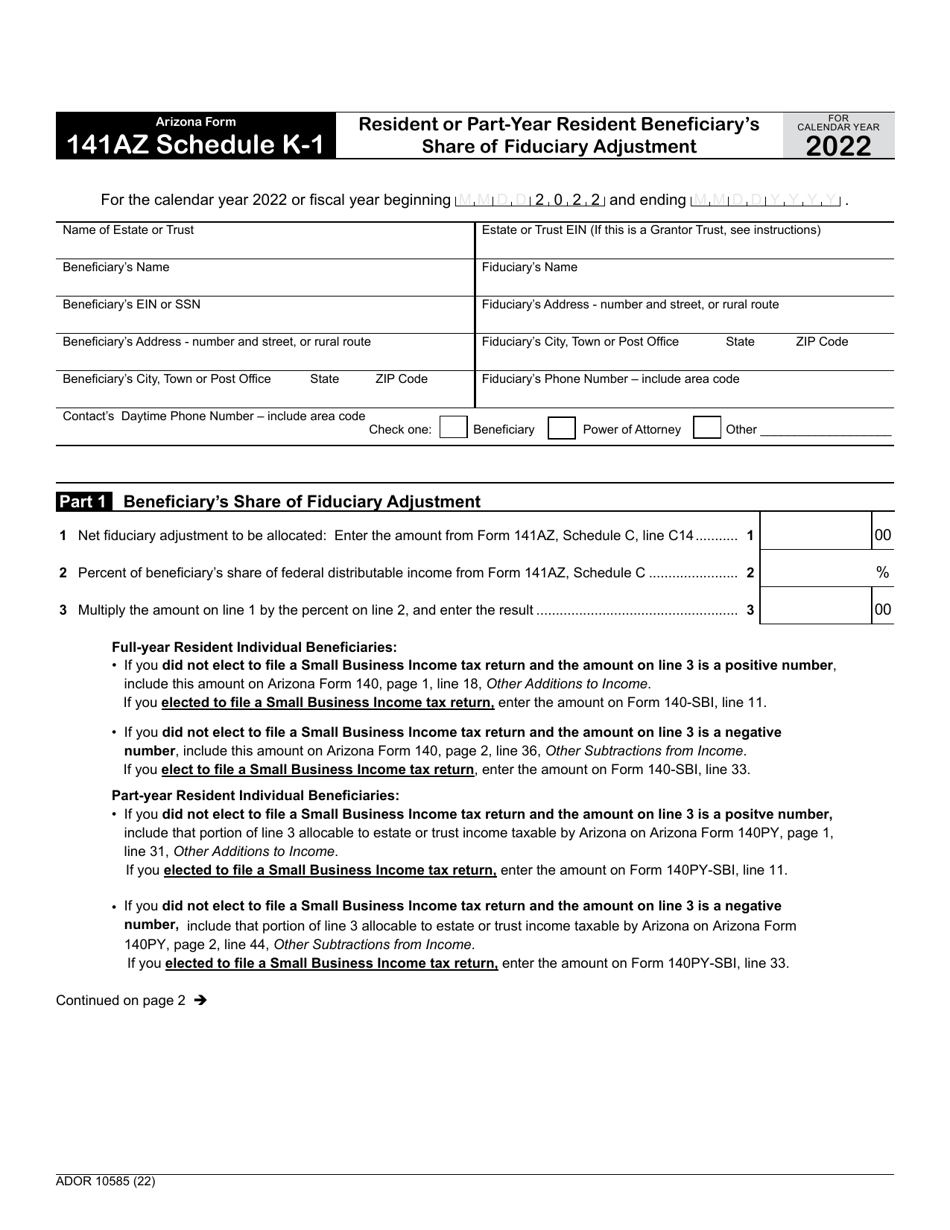

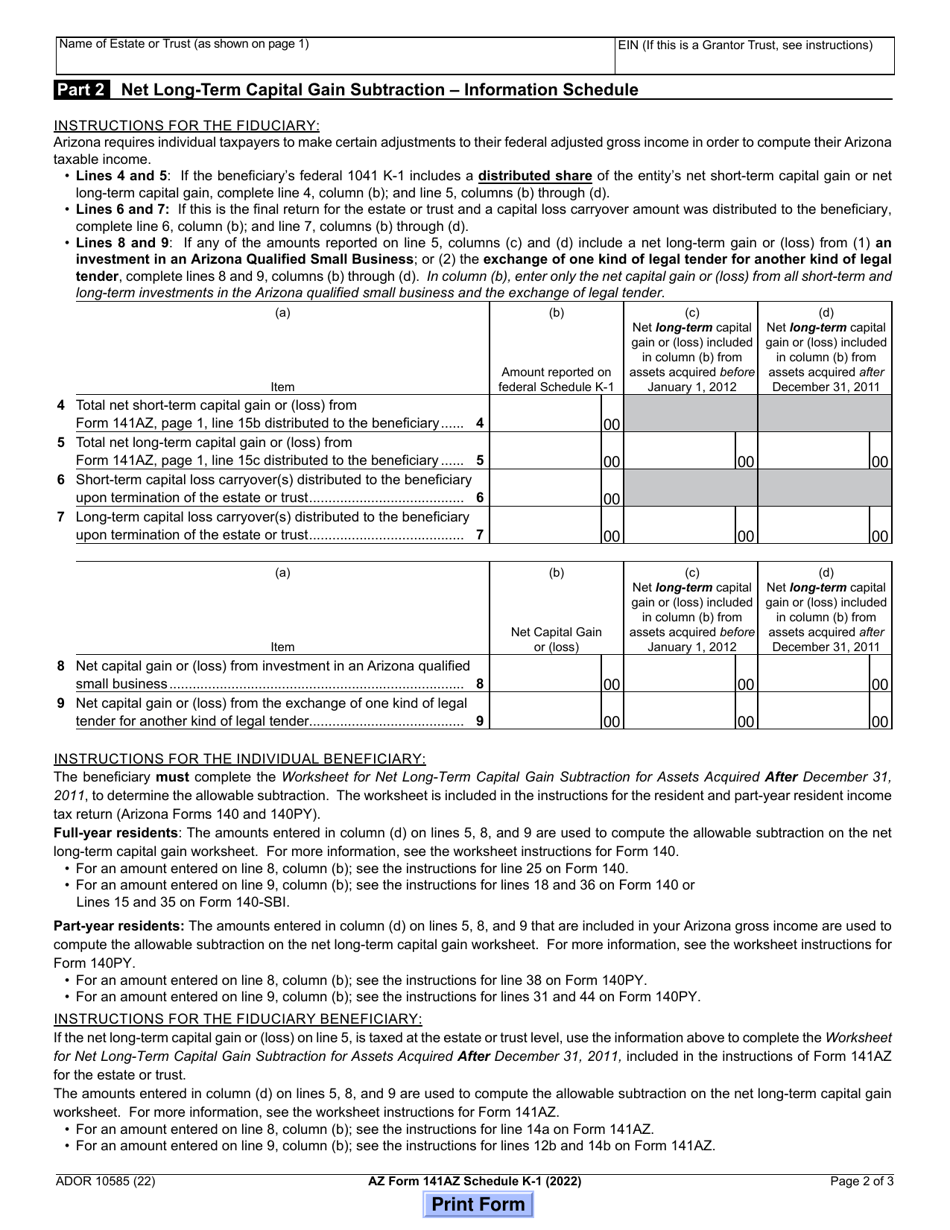

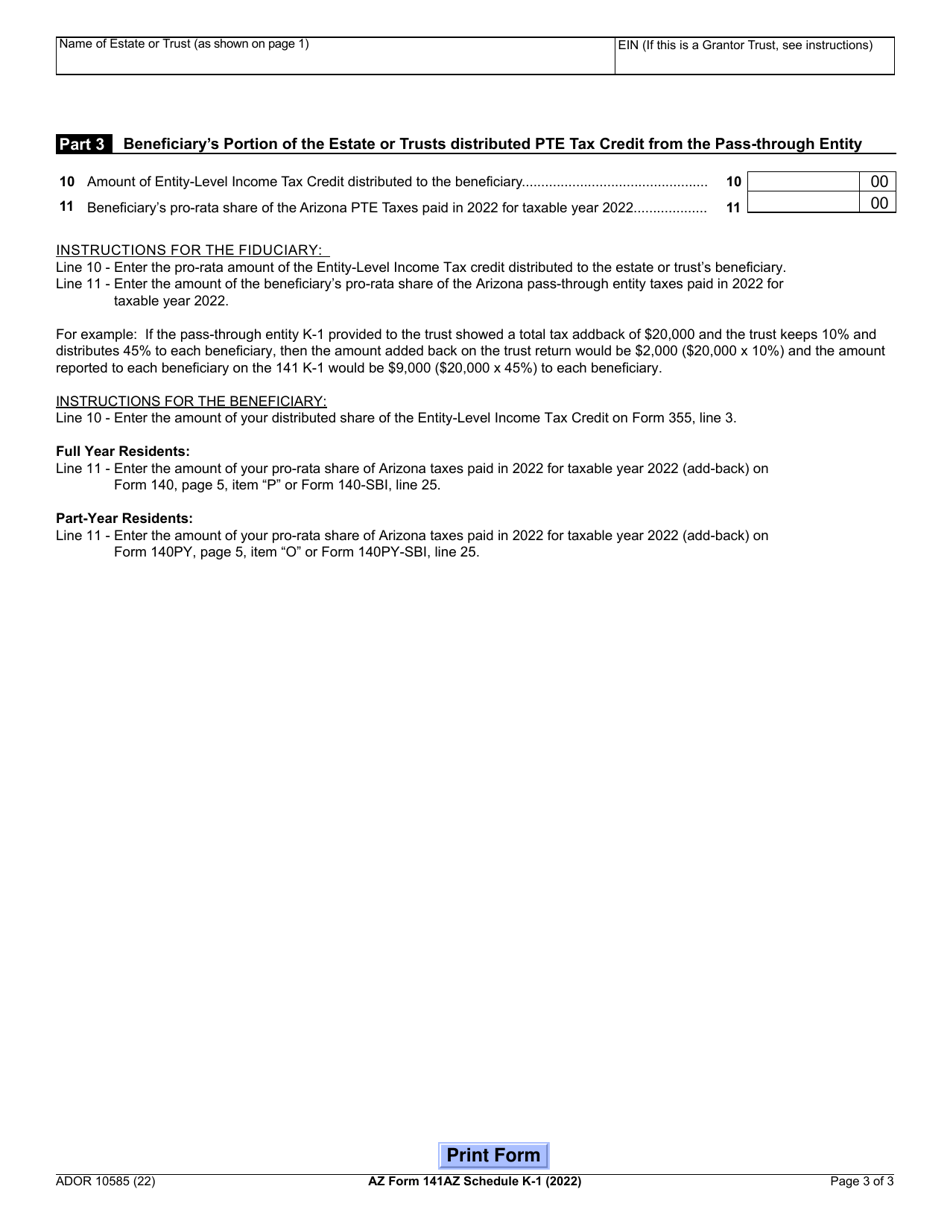

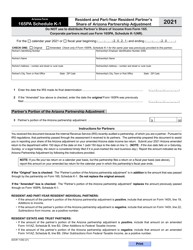

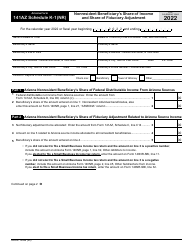

Arizona Form 141AZ (ADOR10585) Schedule K-1 Resident or Part-Year Resident Beneficiary's Share of Fiduciary Adjustment - Arizona

What Is Arizona Form 141AZ (ADOR10585) Schedule K-1?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 141AZ?

A: Arizona Form 141AZ is a tax form used by Arizona residents or part-year residents who are beneficiaries of a fiduciary.

Q: What is Schedule K-1?

A: Schedule K-1 is a specific section within Arizona Form 141AZ that details a resident or part-year resident beneficiary's share of fiduciary adjustments.

Q: Who needs to file Arizona Form 141AZ?

A: Arizona residents or part-year residents who are beneficiaries of a fiduciary need to file Arizona Form 141AZ.

Q: What information does Schedule K-1 include?

A: Schedule K-1 includes the resident or part-year resident beneficiary's share of fiduciary adjustments, such as income, deductions, and credits.

Q: Does Arizona Form 141AZ have any specific requirements?

A: Yes, Arizona Form 141AZ has specific requirements regarding the completion of Schedule K-1. It is important to carefully review the instructions provided with the form.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 141AZ (ADOR10585) Schedule K-1 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.