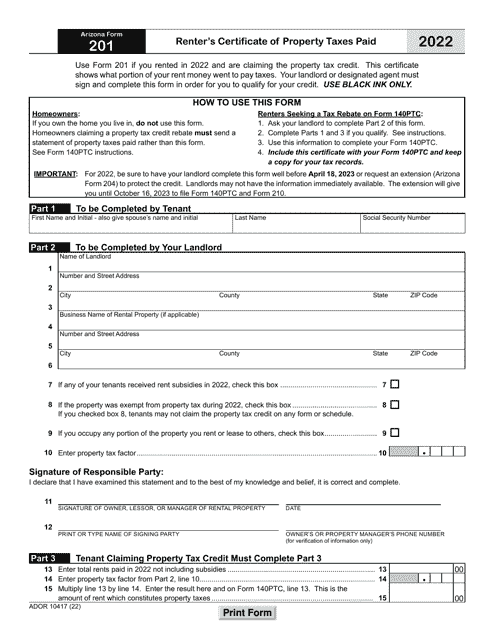

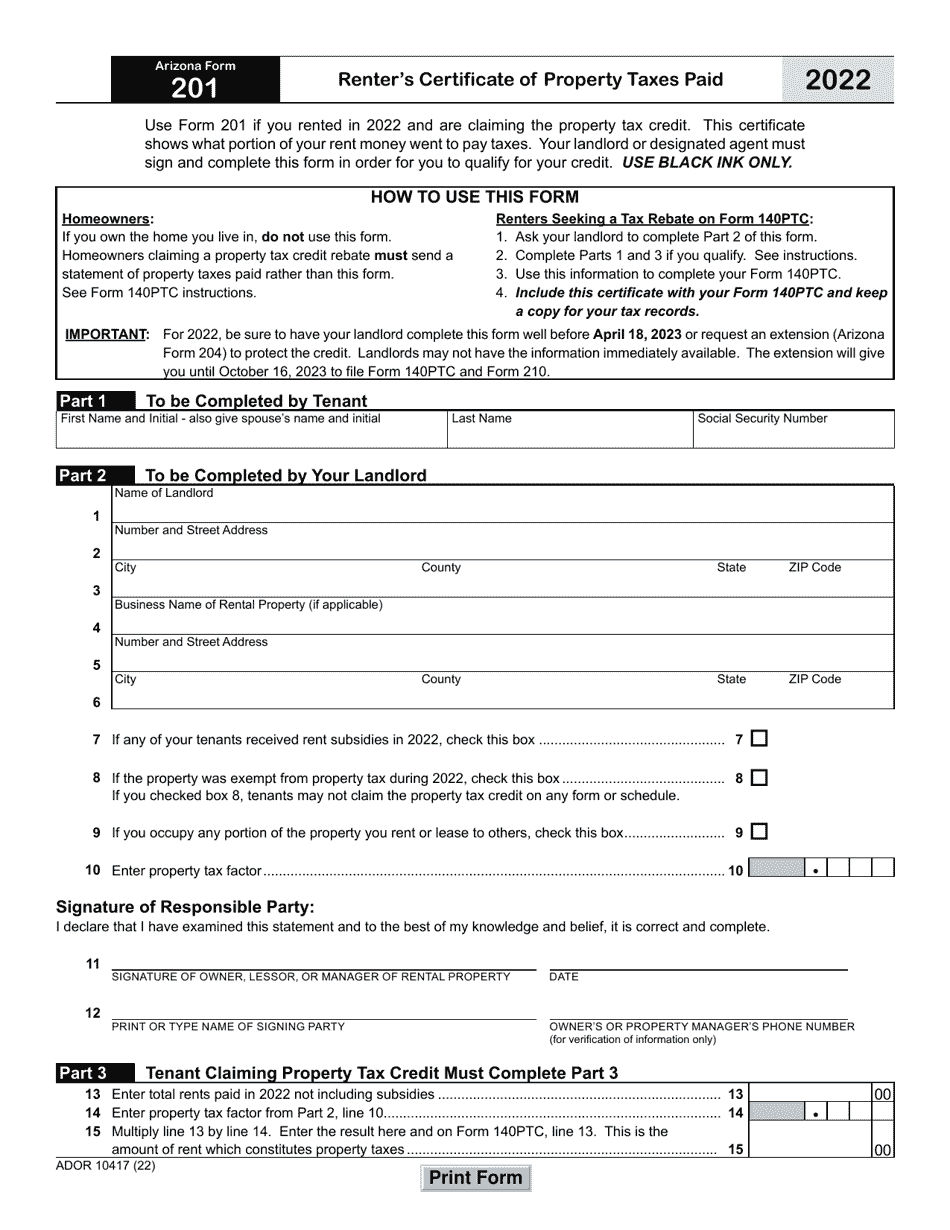

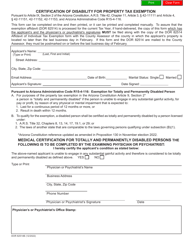

Arizona Form 201 (ADOR10417) Renter's Certificate of Property Taxes Paid - Arizona

What Is Arizona Form 201 (ADOR10417)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 201?

A: Arizona Form 201 is the Renter's Certificate of Property Taxes Paid in Arizona.

Q: Who needs to fill out Arizona Form 201?

A: Rental property tenants in Arizona who have paid property taxes for the rental property need to fill out Arizona Form 201.

Q: What is the purpose of Arizona Form 201?

A: The purpose of Arizona Form 201 is to certify the amount of property taxes paid by the tenant for the rental property.

Q: When is Arizona Form 201 due?

A: Arizona Form 201 is due on or before April 15th of each year.

Q: What information is required on Arizona Form 201?

A: Arizona Form 201 requires the tenant to provide information such as their name, address, landlord's name and address, and the amount of property taxes paid for the rental property.

Q: Can I claim a tax credit with Arizona Form 201?

A: No, Arizona Form 201 is used to certify the amount of property taxes paid, but it does not allow for a tax credit or deduction.

Q: What happens if I don't file Arizona Form 201?

A: If you are required to file Arizona Form 201 and fail to do so, you may lose the benefit of any property tax relief provided by the state.

Q: Do I need to attach any supporting documents to Arizona Form 201?

A: No, you do not need to attach any supporting documents to Arizona Form 201, but you should keep records of the property taxes paid in case of an audit.

Q: Can I e-file Arizona Form 201?

A: No, Arizona Form 201 cannot be e-filed and must be submitted by mail or in person.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 201 (ADOR10417) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.