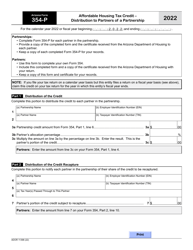

Instructions for Arizona Form 318, ADOR10942, Arizona Form 318-P, ADOR11325, Arizona Form 318-1, ADOR91-0013 - Arizona

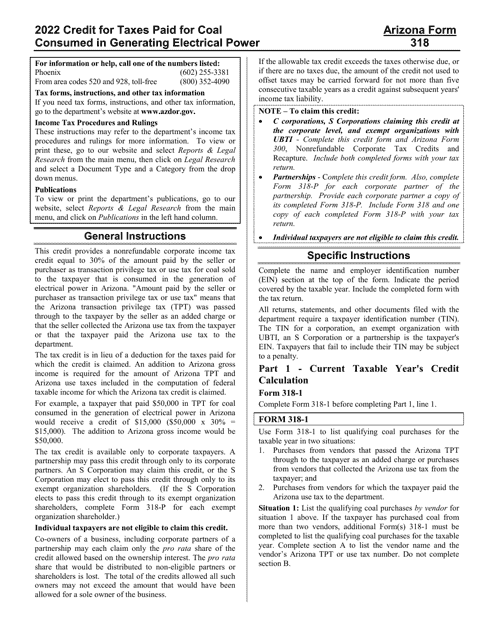

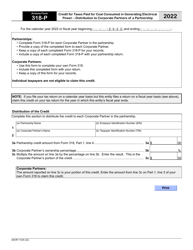

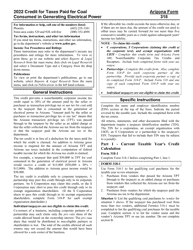

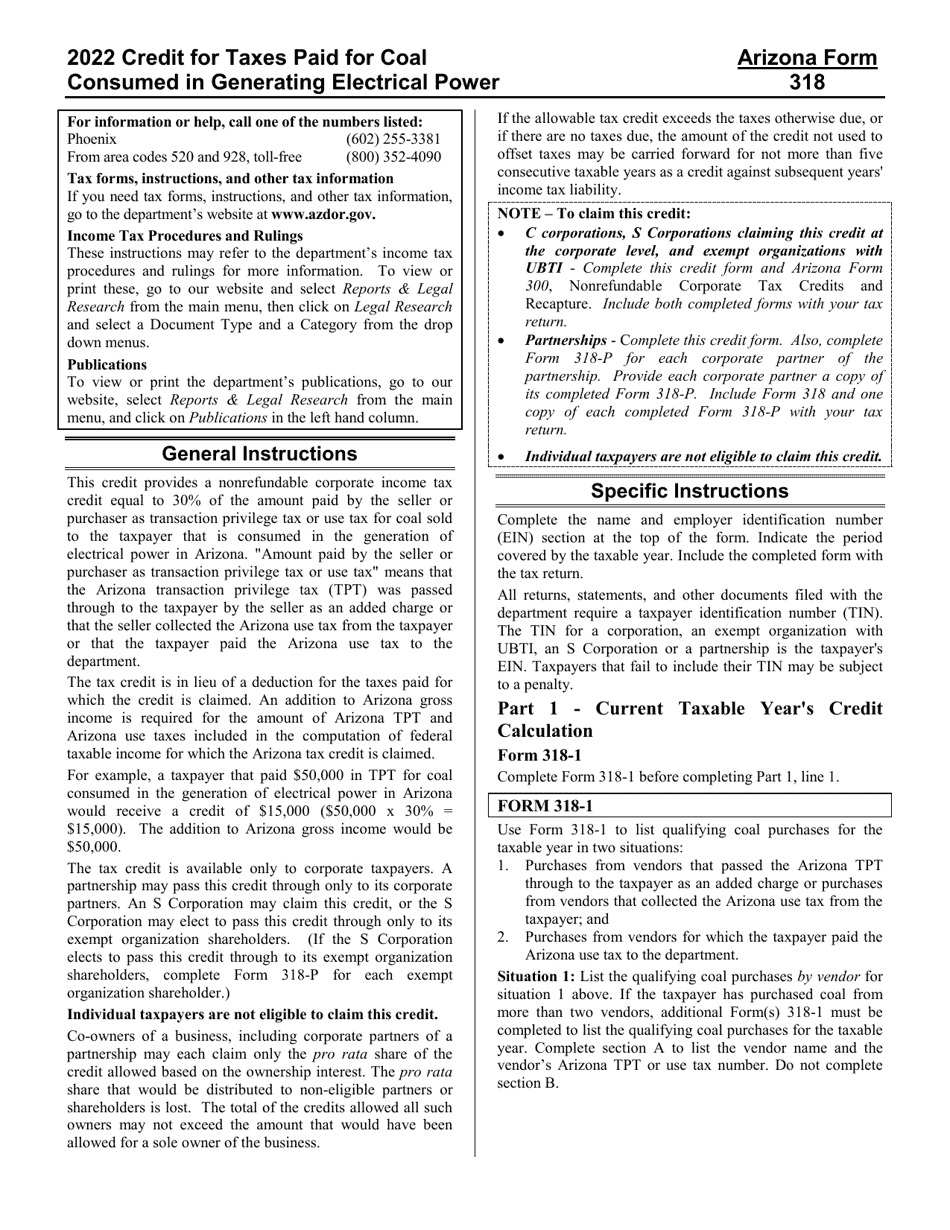

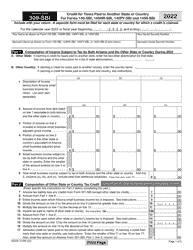

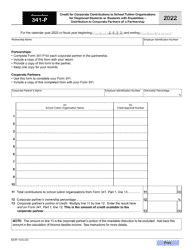

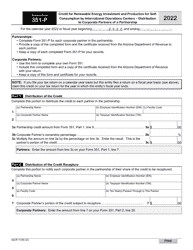

This document contains official instructions for Arizona Form 318 , Form ADOR10942 , Arizona Form 318-P , Form ADOR11325 , Arizona Form 318-1 , and Form ADOR91-0013 . All forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 318 (ADOR10942) is available for download through this link. The latest available Arizona Form 318-P (ADOR11325) can be downloaded through this link.

FAQ

Q: What are Arizona Form 318, ADOR10942, Arizona Form 318-P, ADOR11325, Arizona Form 318-1, and ADOR91-0013?

A: These are various forms used in Arizona for tax purposes.

Q: What is Arizona Form 318 used for?

A: Arizona Form 318 is used for reporting and paying Retail Transaction Privilege Tax.

Q: What is ADOR10942 used for?

A: ADOR10942 is a form used for claiming the refund of a solar energy device tax credit.

Q: What is Arizona Form 318-P used for?

A: Arizona Form 318-P is used for reporting and paying Prepaid Wireless E-911 Excise Tax.

Q: What is ADOR11325 used for?

A: ADOR11325 is a form used for claiming a tax credit for contributions made to certified school tuition organizations.

Q: What is Arizona Form 318-1 used for?

A: Arizona Form 318-1 is used for reporting and paying Bed and Bedding Excise Tax.

Q: What is ADOR91-0013 used for?

A: ADOR91-0013 is a form used for requesting a waiver of interest and penalties for unpaid taxes in certain situations.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.