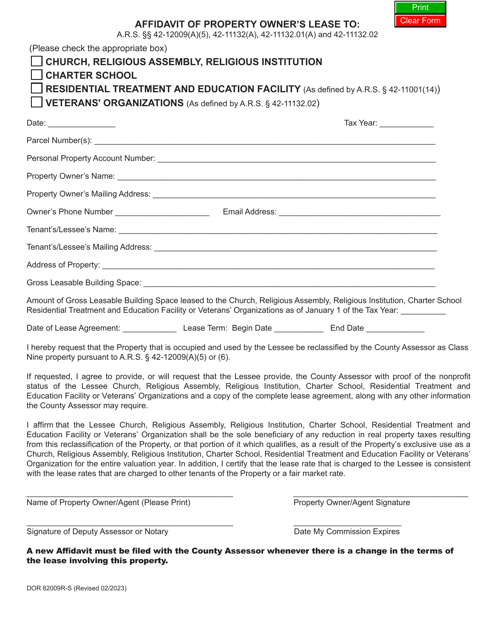

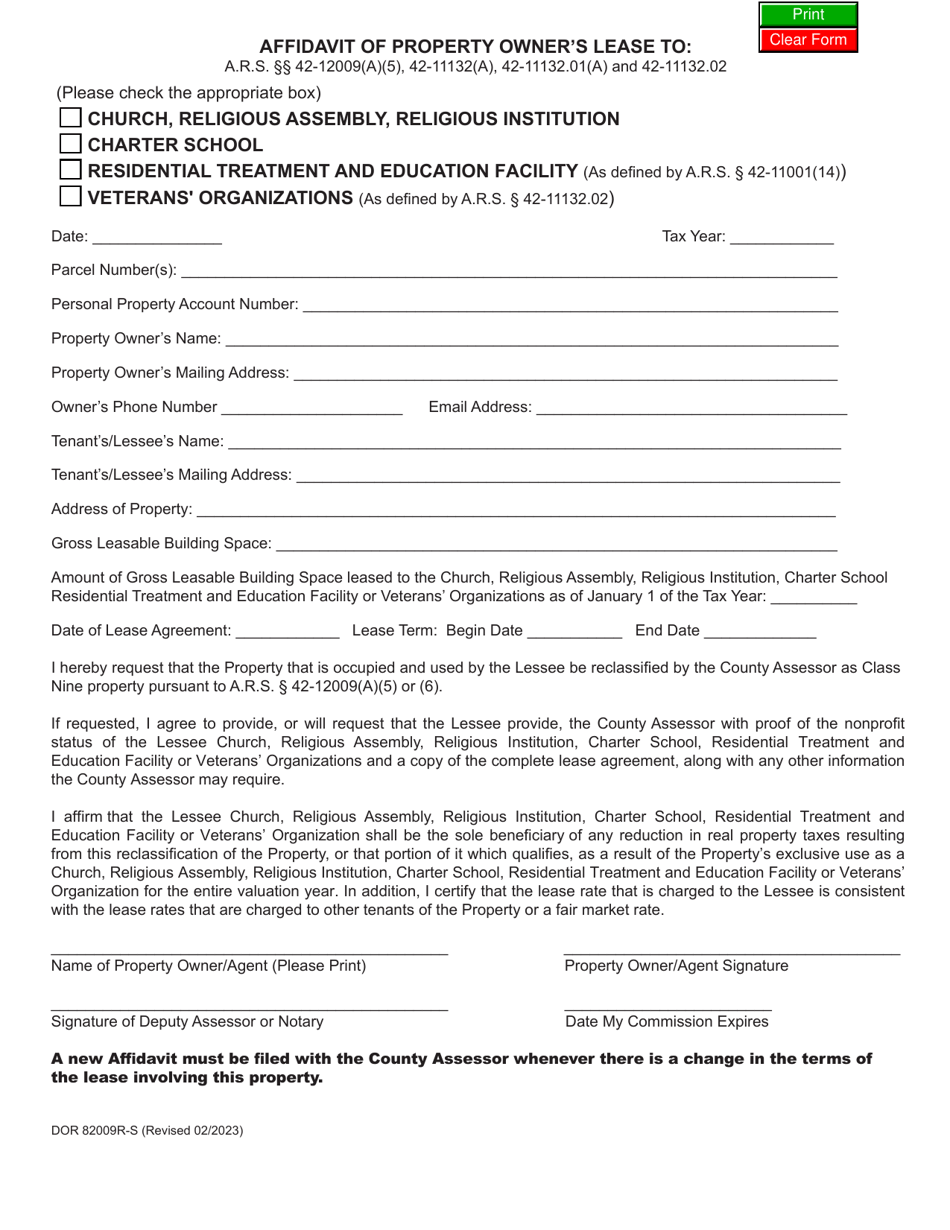

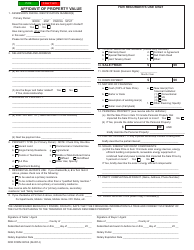

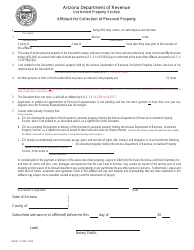

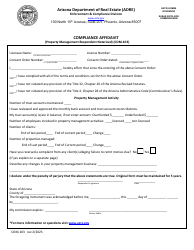

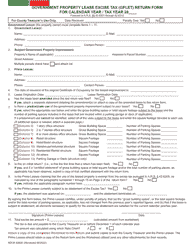

Form DOR82009R-S Affidavit of Property Owner's Lease - Arizona

What Is Form DOR82009R-S?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DOR82009R-S?

A: Form DOR82009R-S is the Affidavit of Property Owner's Lease in Arizona.

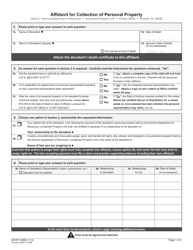

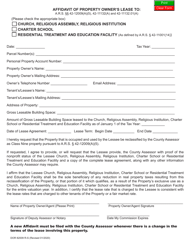

Q: Who should use Form DOR82009R-S?

A: Property owners in Arizona who have leased their property to a tenant.

Q: What is the purpose of Form DOR82009R-S?

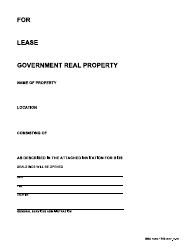

A: The form is used to certify and provide information about the lease agreement between a property owner and a tenant in Arizona.

Q: Can Form DOR82009R-S be used for commercial properties?

A: Yes, this form can be used for both residential and commercial properties.

Q: What information is required on Form DOR82009R-S?

A: The form requires information about the property owner, tenant, lease terms, and proof of occupancy.

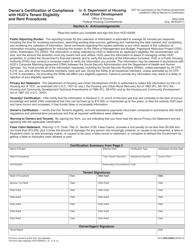

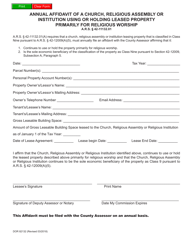

Q: Is Form DOR82009R-S mandatory?

A: Yes, property owners in Arizona who have leased their property are required to submit this form to the Arizona Department of Revenue.

Q: Are there any fees associated with Form DOR82009R-S?

A: There are no fees associated with submitting Form DOR82009R-S.

Q: When should Form DOR82009R-S be filed?

A: Form DOR82009R-S should be filed within 30 days of entering into a lease agreement or whenever there is a change in lease terms.

Q: What are the consequences of not filing Form DOR82009R-S?

A: Failure to file this form may result in penalties imposed by the Arizona Department of Revenue.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOR82009R-S by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.