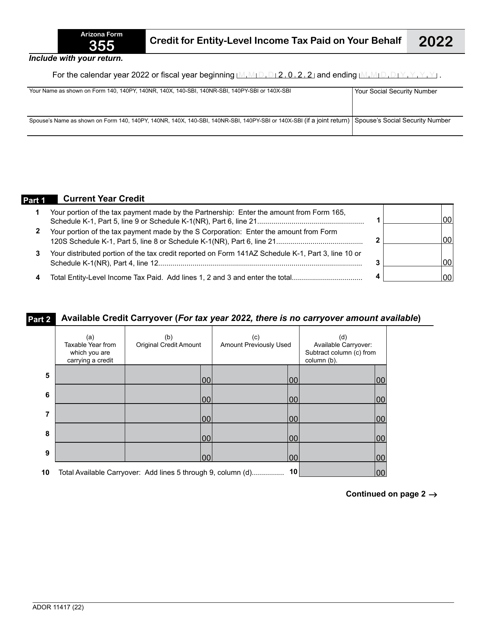

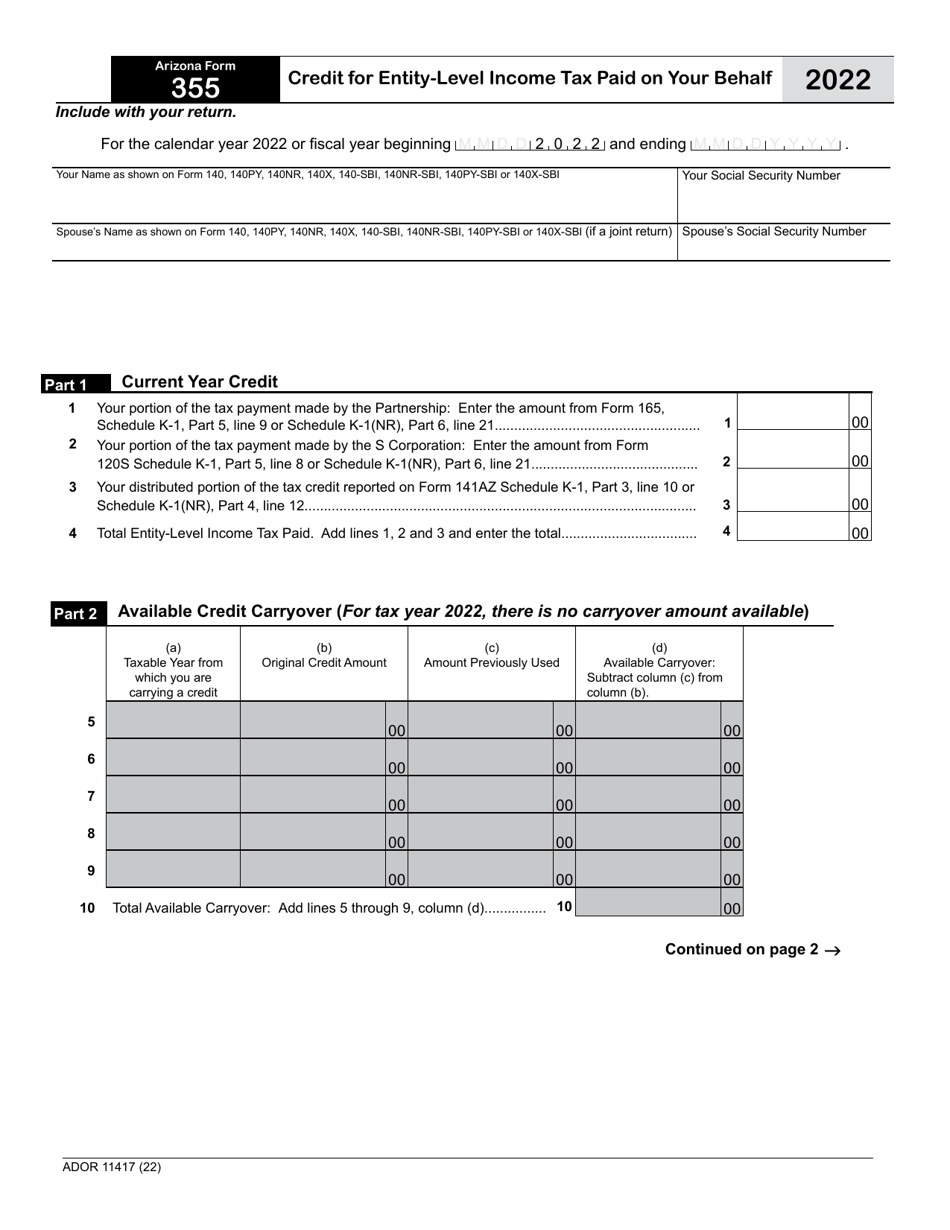

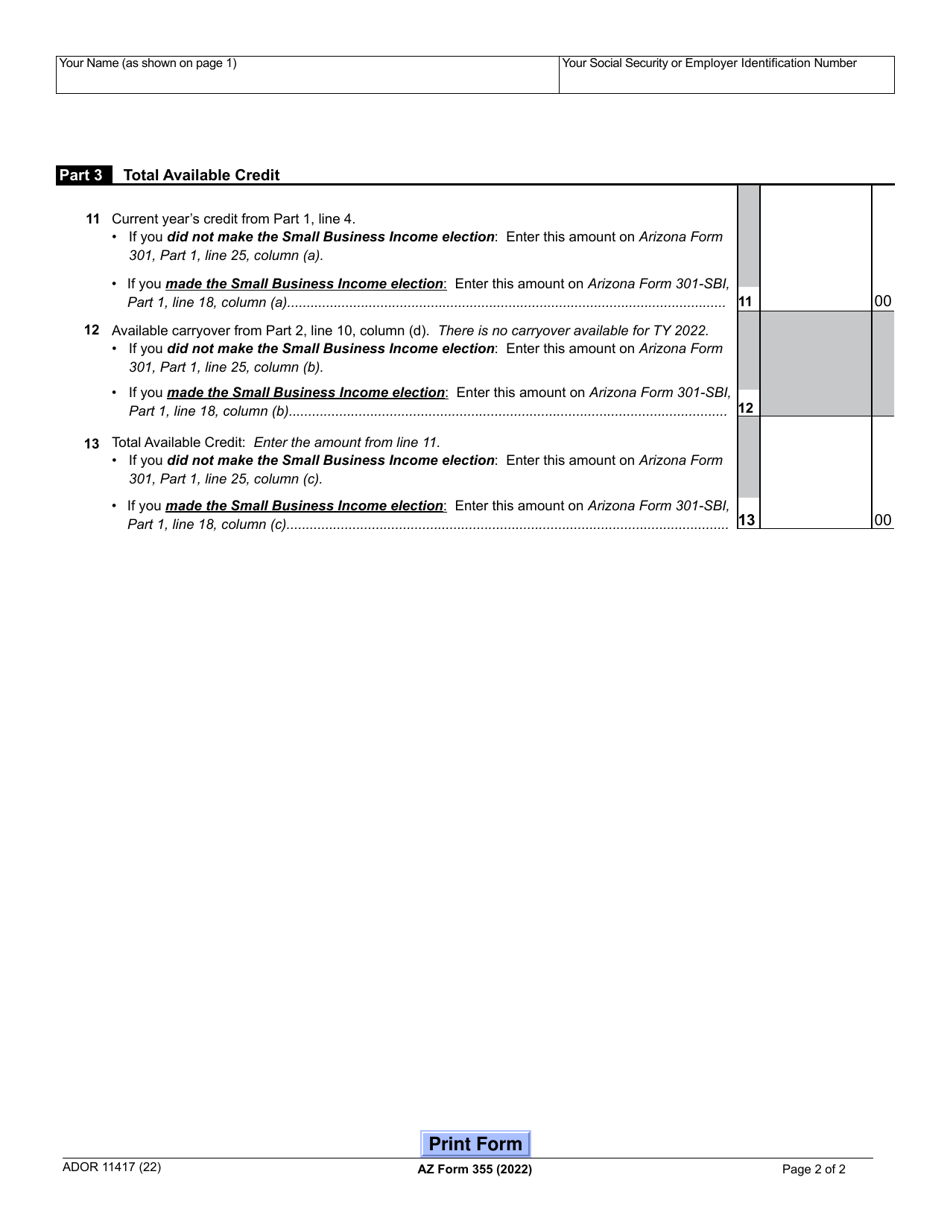

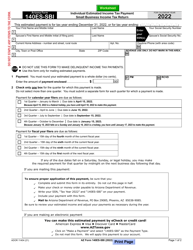

Arizona Form 355 (ADOR11417) Credit for Entity-Level Income Tax Paid on Your Behalf - Arizona

What Is Arizona Form 355 (ADOR11417)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 355?

A: Arizona Form 355 is a tax form used to claim the credit for entity-level income tax paid on your behalf in Arizona.

Q: Who should file Arizona Form 355?

A: You should file Arizona Form 355 if you are a pass-through entity (such as a partnership or S corporation) that has paid Arizona income tax on behalf of its owners or shareholders.

Q: What is the purpose of filing Arizona Form 355?

A: The purpose of filing Arizona Form 355 is to claim a credit for the entity-level income tax paid on behalf of the owners or shareholders.

Q: Can individuals claim the credit on their personal tax returns?

A: No, individuals cannot claim the credit on their personal tax returns. The credit can only be claimed by the pass-through entity on Arizona Form 355.

Q: What supporting documentation is required when filing Arizona Form 355?

A: When filing Arizona Form 355, you will need to attach a copy of your federal return, Schedule K-1s for each partner or shareholder, and any other supporting documentation as required by the form instructions.

Q: When is the deadline to file Arizona Form 355?

A: The deadline to file Arizona Form 355 is the same as the deadline for the pass-through entity's federal tax return, which is typically March 15th.

Q: Are there any penalties for not filing Arizona Form 355?

A: Yes, there are penalties for not filing Arizona Form 355. The penalty is $25 per month or part of a month for each owner or shareholder, up to a maximum of $500.

Q: Can I e-file Arizona Form 355?

A: No, as of now, Arizona Form 355 can only be filed by mail. E-filing is not available.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 355 (ADOR11417) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.