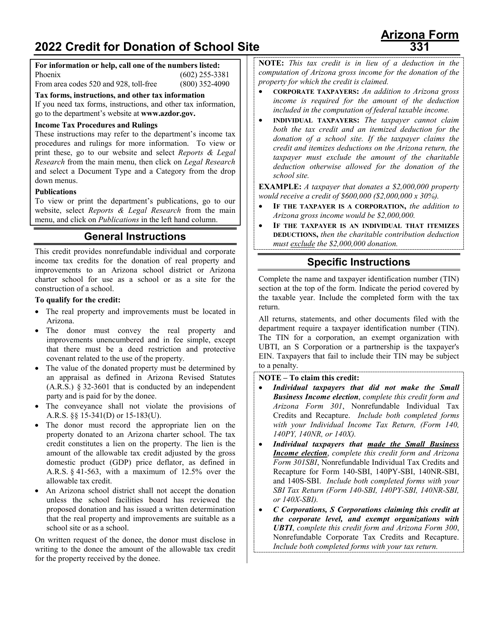

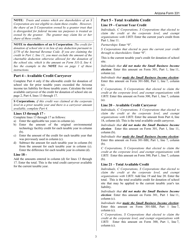

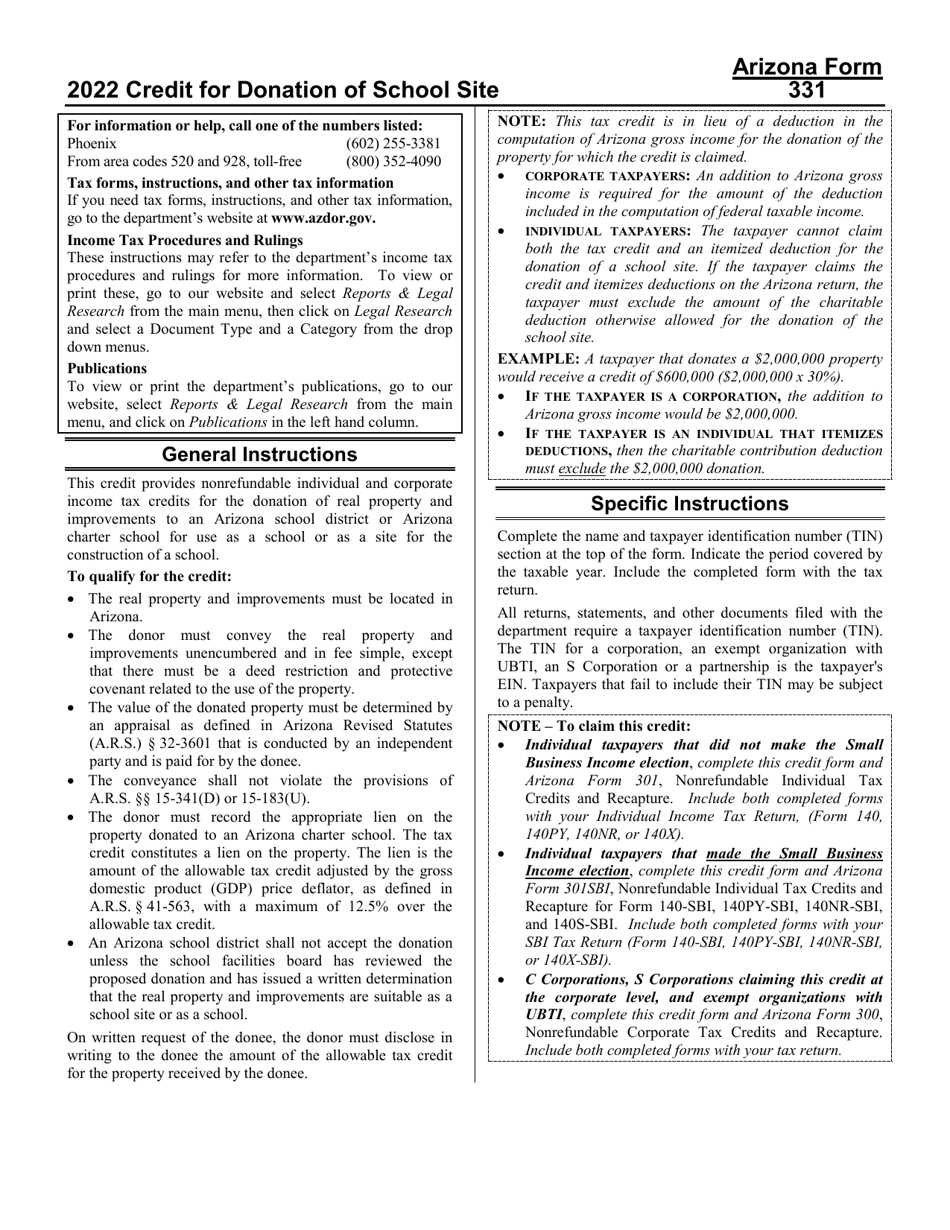

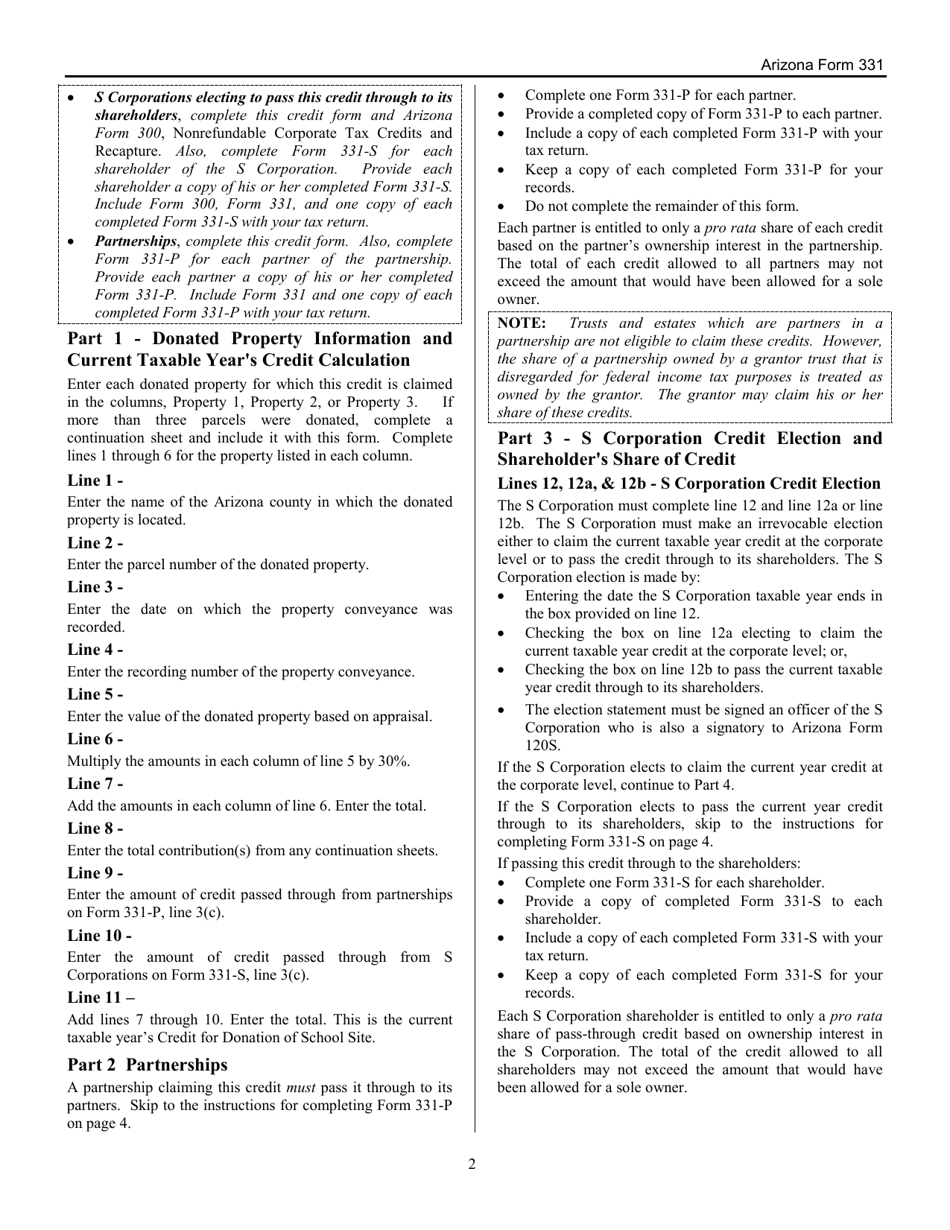

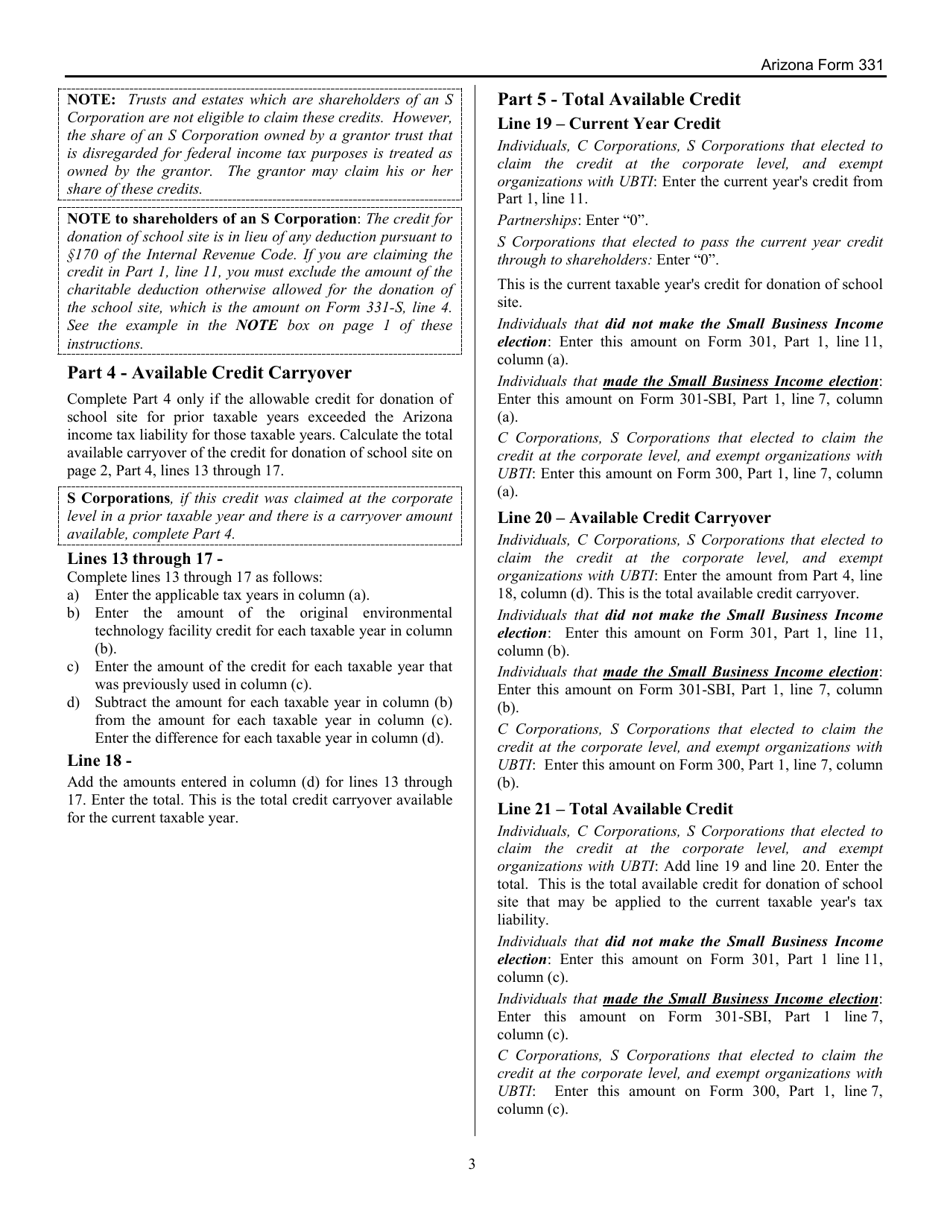

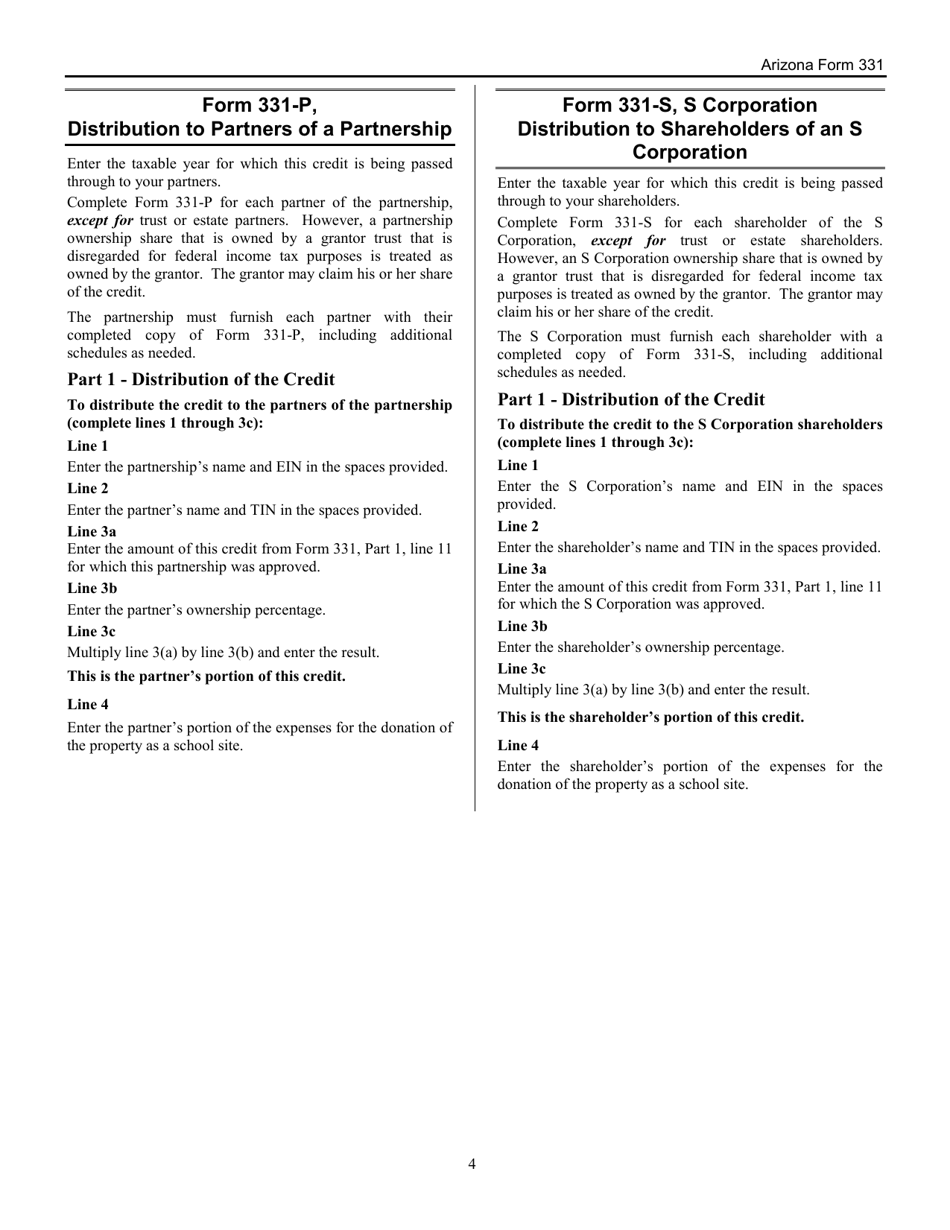

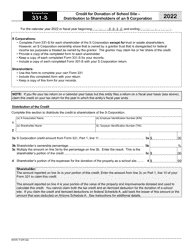

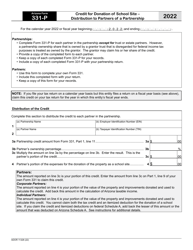

Instructions for Arizona Form 331, ADOR10537 Credit for Donation of School Site - Arizona

This document contains official instructions for Arizona Form 331 , and Form ADOR10537 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 331 (ADOR10537) is available for download through this link.

FAQ

Q: What is Arizona Form 331?

A: Arizona Form 331 is a tax form for claiming the ADOR10537 Credit for Donation of School Site in Arizona.

Q: What is the purpose of Arizona Form 331?

A: The purpose of Arizona Form 331 is to claim a tax credit for the donation of a school site in Arizona.

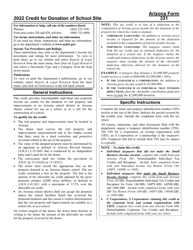

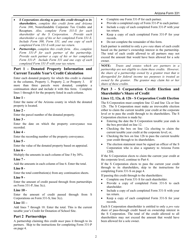

Q: Who can use Arizona Form 331?

A: Any taxpayer who has made a qualifying donation of a school site in Arizona can use Arizona Form 331.

Q: What is the ADOR10537 Credit for Donation of School Site?

A: ADOR10537 Credit for Donation of School Site is a tax credit that allows individuals or corporations to receive a credit for donating a school site in Arizona.

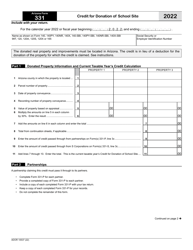

Q: What documents do I need to complete Arizona Form 331?

A: To complete Arizona Form 331, you will need documentation related to the donation of the school site, such as proof of ownership and a description of the property.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.