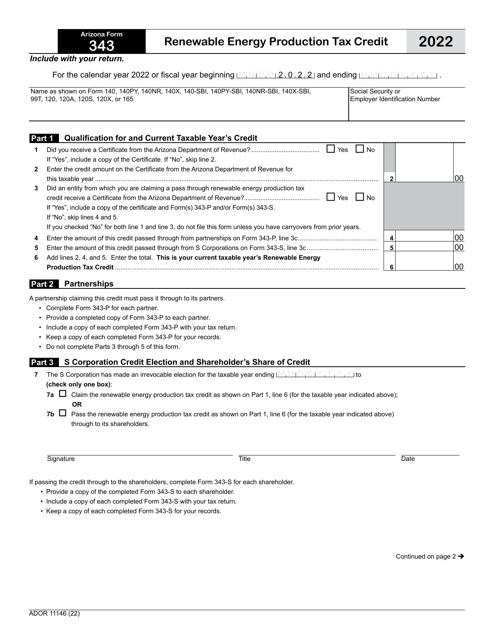

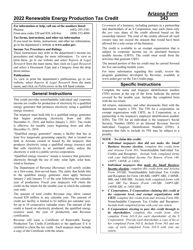

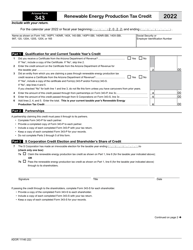

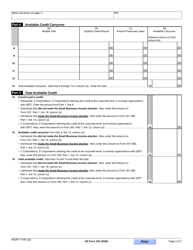

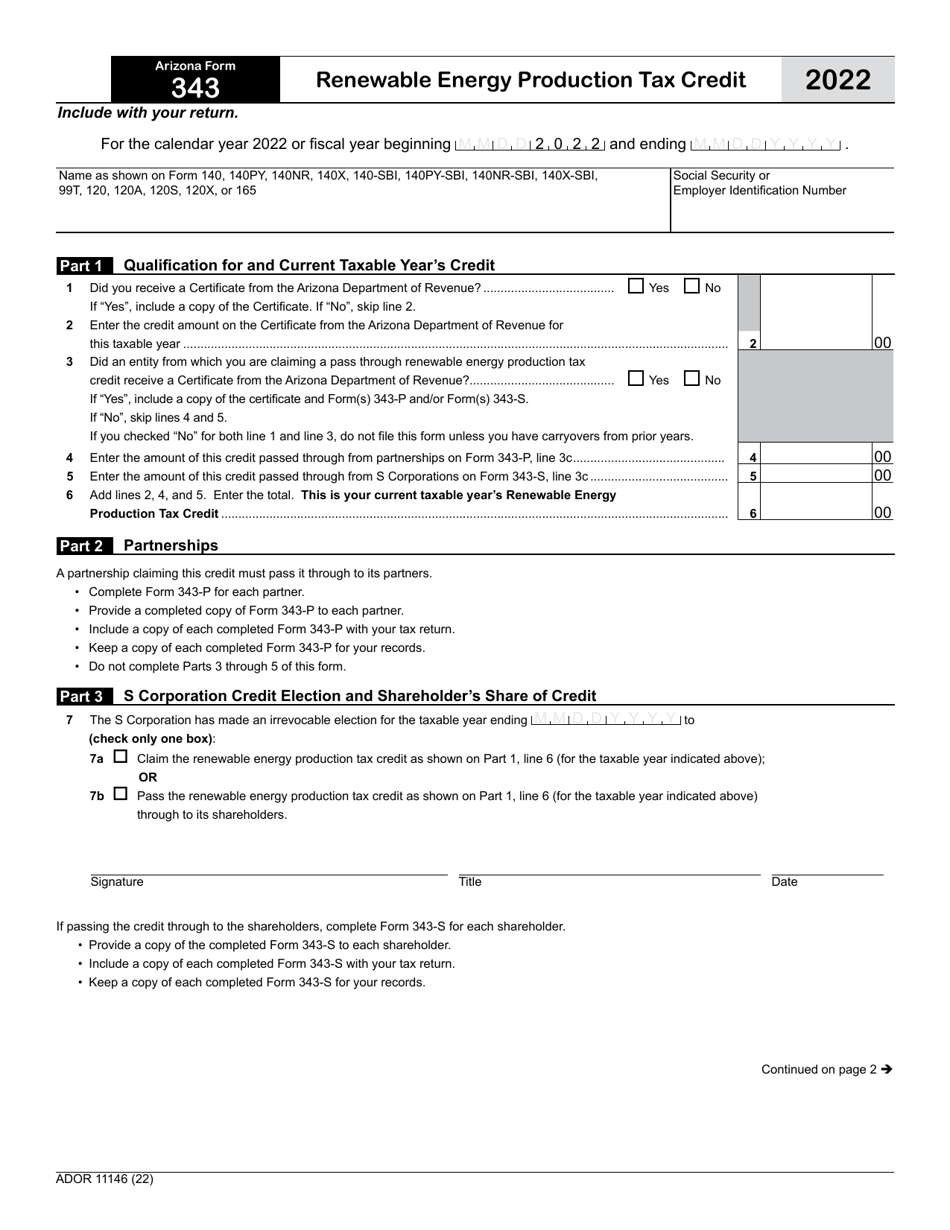

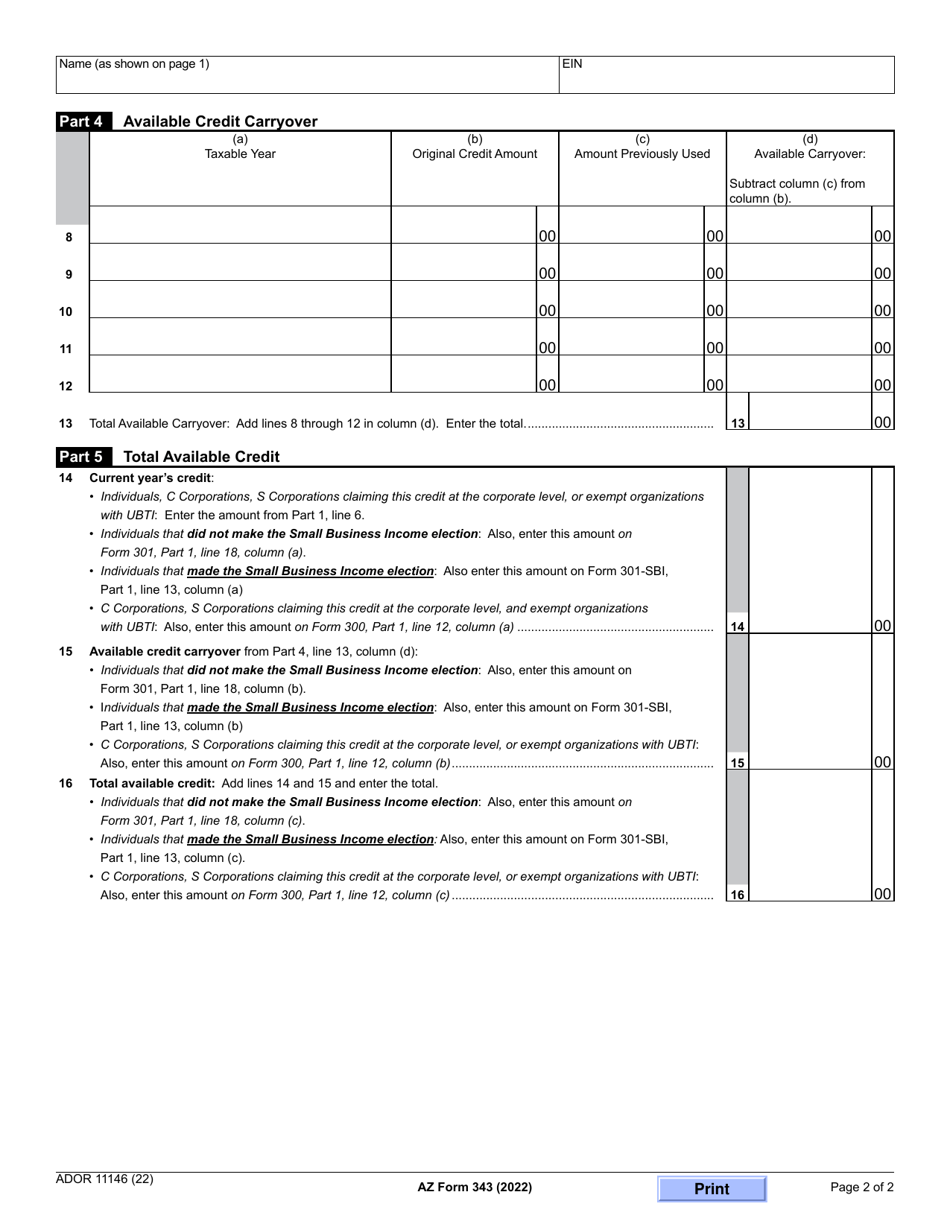

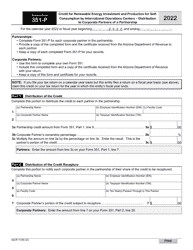

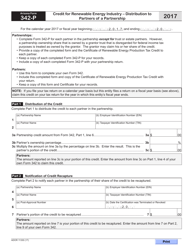

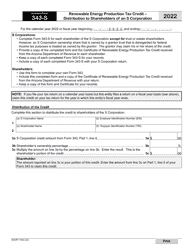

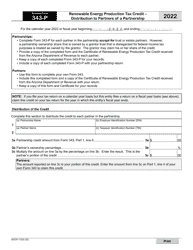

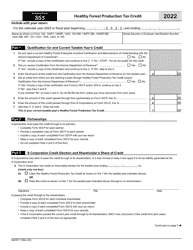

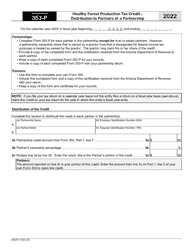

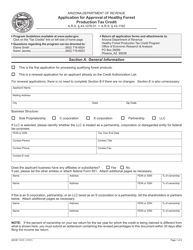

Arizona Form 343 (ADOR11146) Renewable Energy Production Tax Credit - Arizona

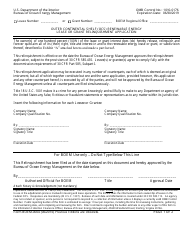

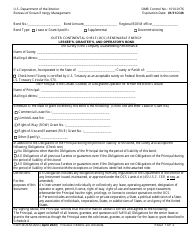

What Is Arizona Form 343 (ADOR11146)?

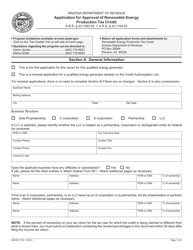

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 343?

A: Arizona Form 343 is the form used to claim the Renewable Energy Production Tax Credit in Arizona.

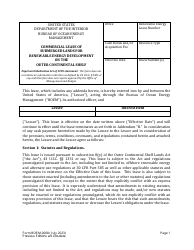

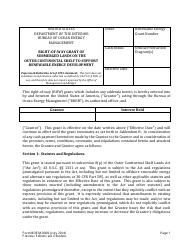

Q: What is the Renewable Energy Production Tax Credit?

A: The Renewable Energy Production Tax Credit is a tax credit available in Arizona for the production of renewable energy.

Q: Who is eligible to claim the tax credit?

A: Eligible taxpayers are individuals, corporations, partnerships, and other entities that produce renewable energy in Arizona.

Q: What types of renewable energy qualify for the tax credit?

A: Qualifying renewable energy sources include solar, wind, hydroelectric, biomass, and geothermal energy.

Q: How much is the tax credit?

A: The amount of the tax credit depends on the amount of renewable energy produced and other factors. Please refer to the instructions on Form 343 for specific details.

Q: Are there any deadlines for filing Arizona Form 343?

A: Yes, the tax credit must be claimed on or before April 15 of the year following the tax year in which the renewable energy was produced.

Q: Can the tax credit be carried forward or transferred?

A: No, the tax credit cannot be carried forward to future years or transferred to another taxpayer.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 343 (ADOR11146) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.