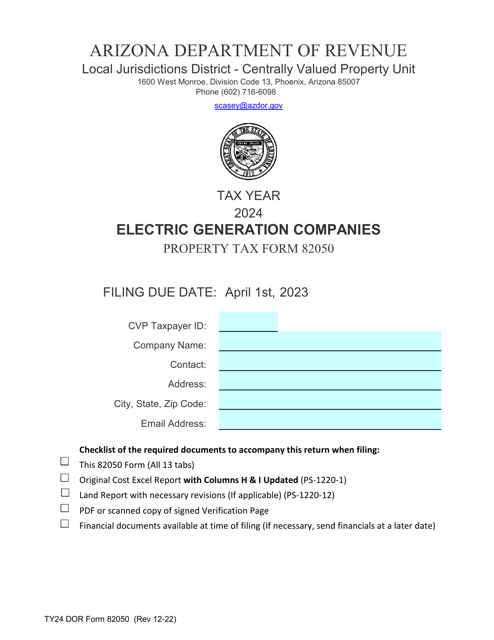

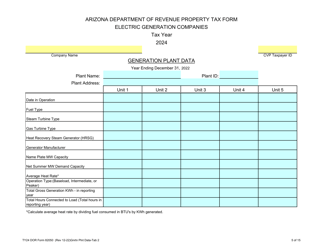

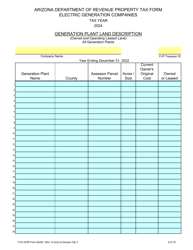

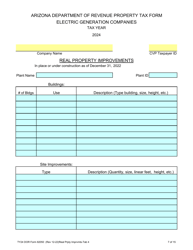

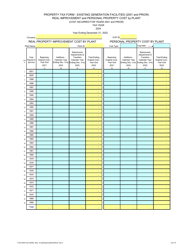

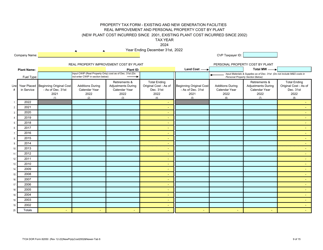

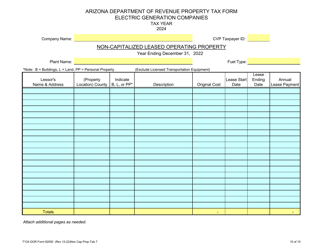

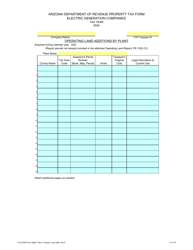

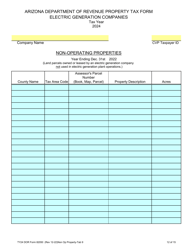

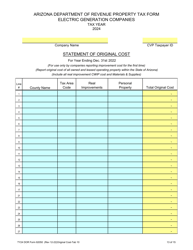

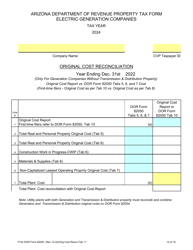

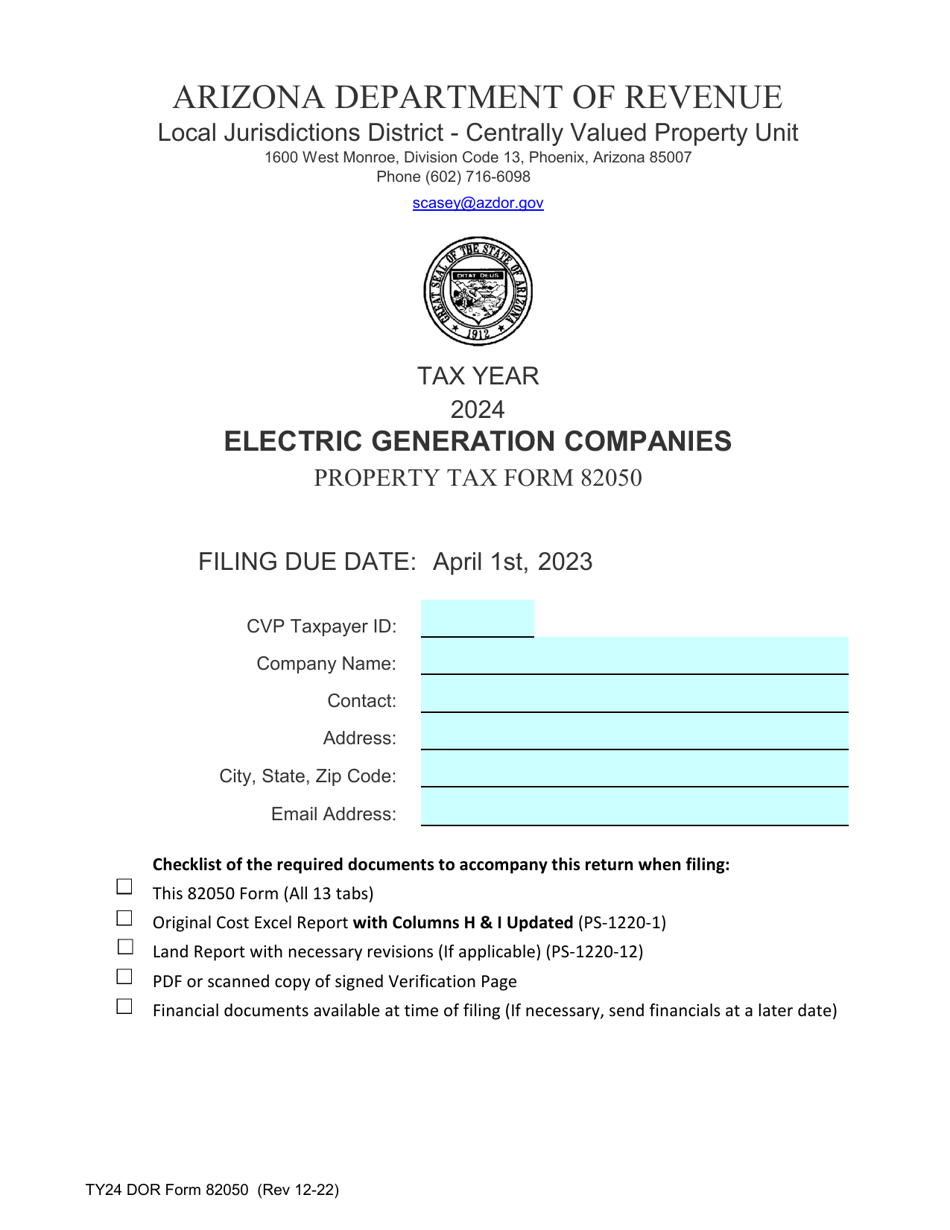

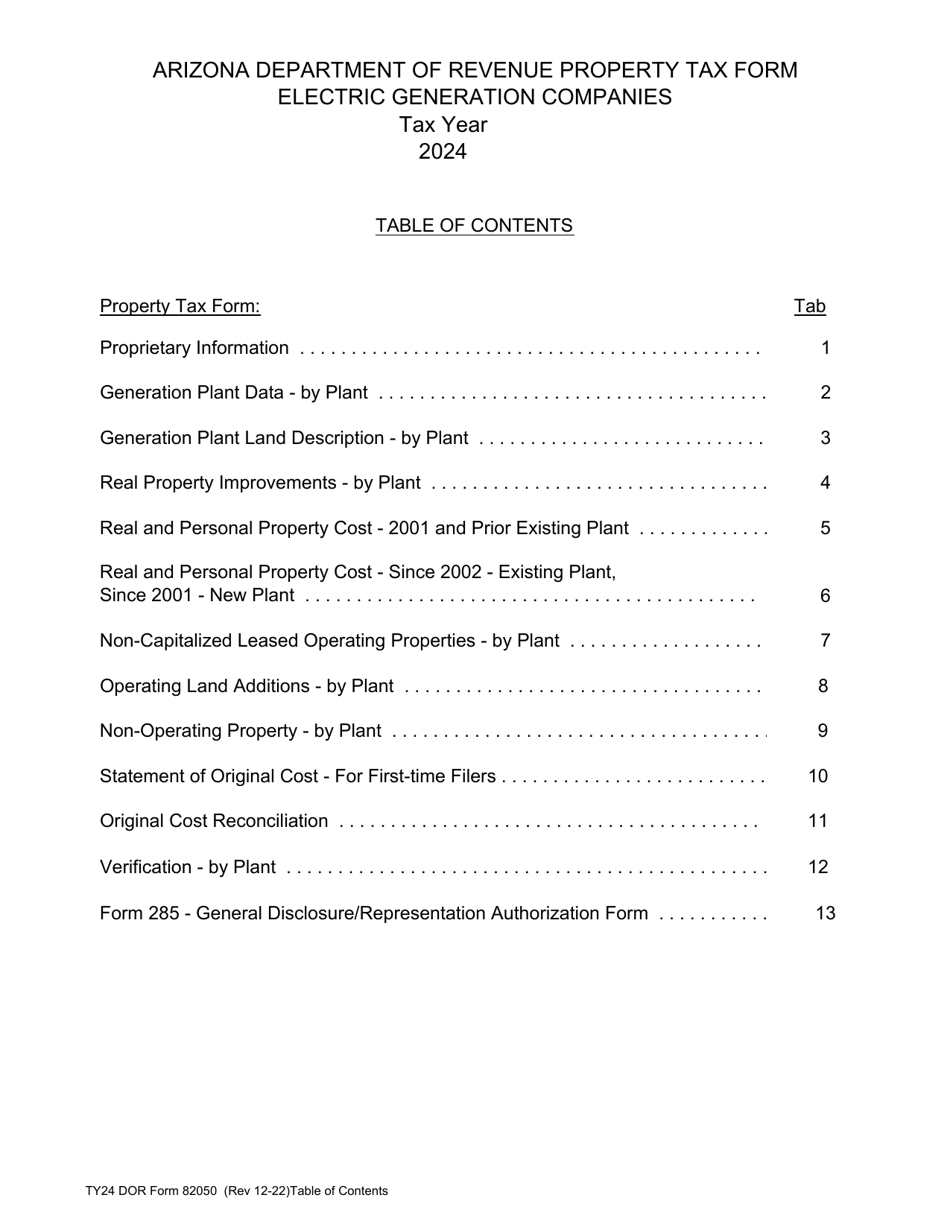

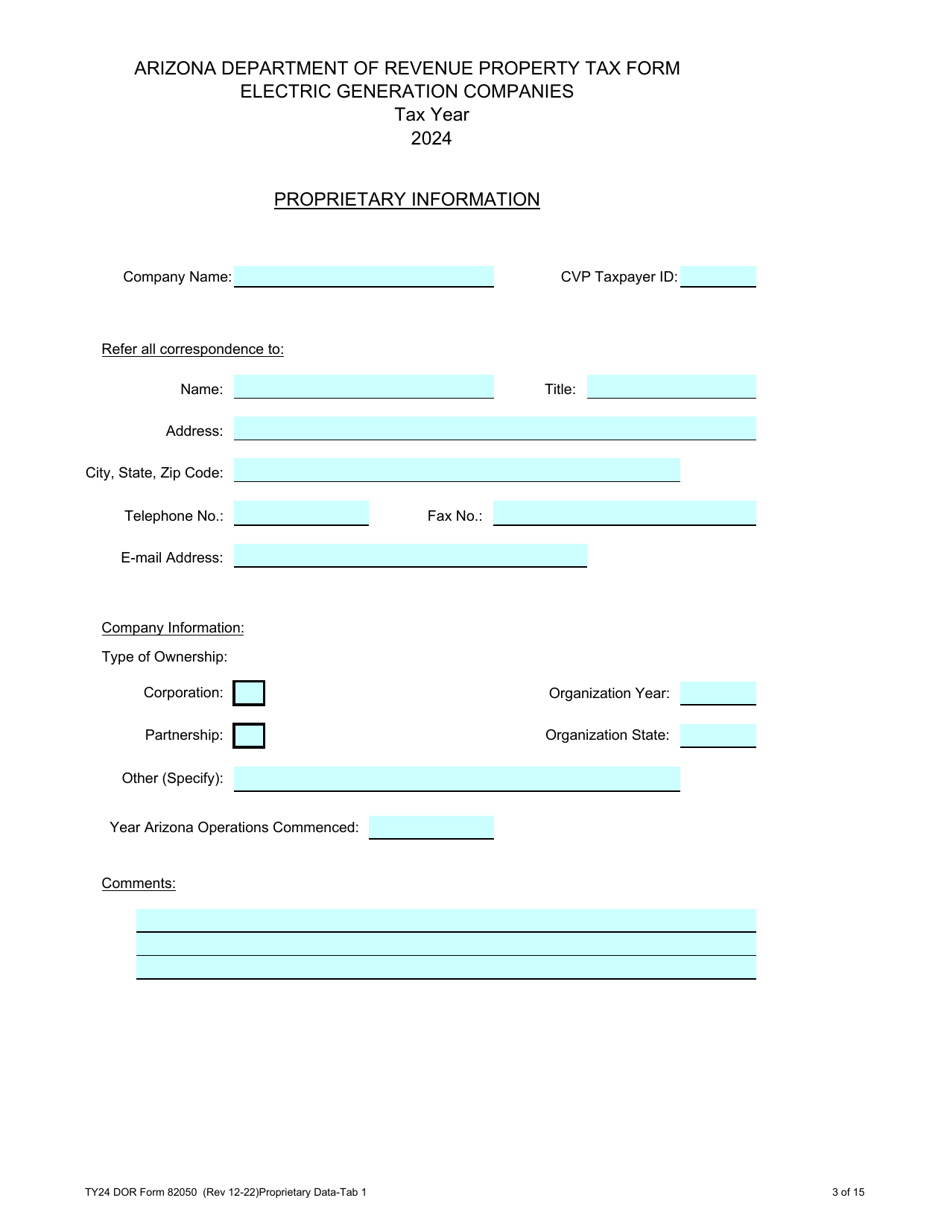

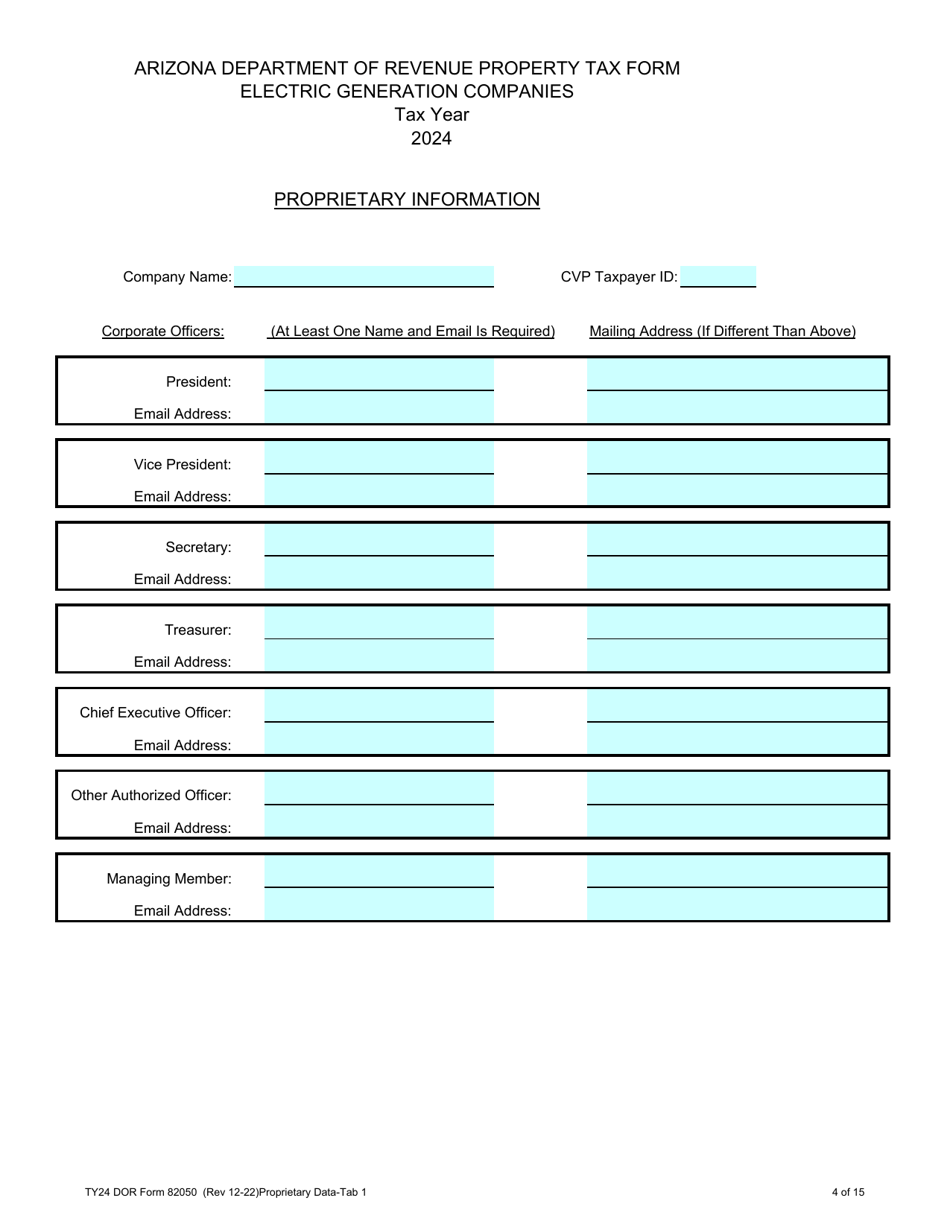

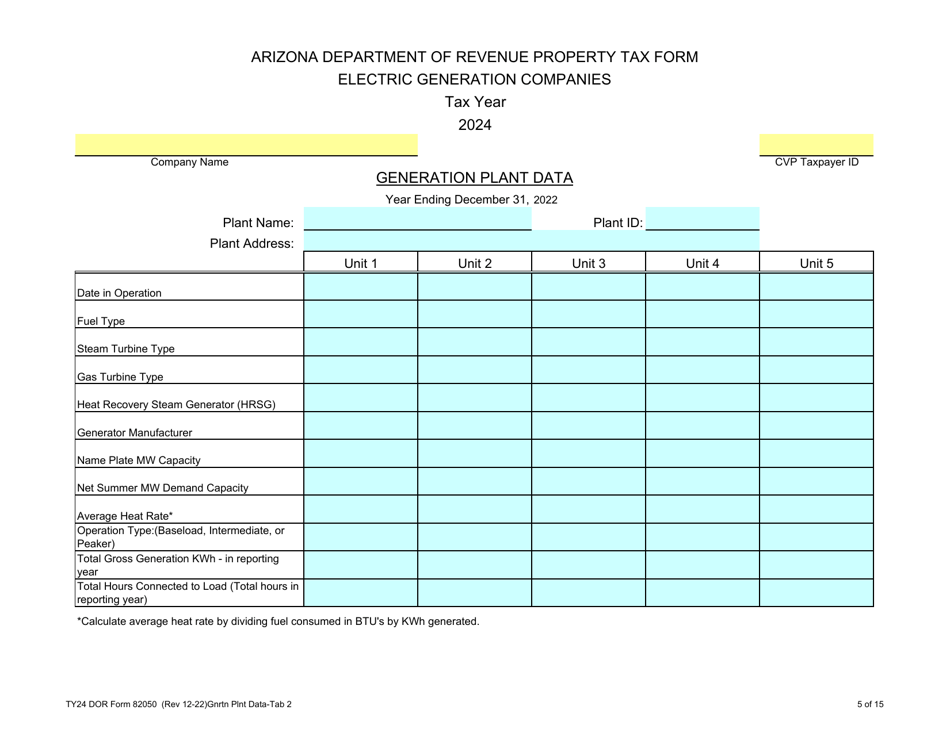

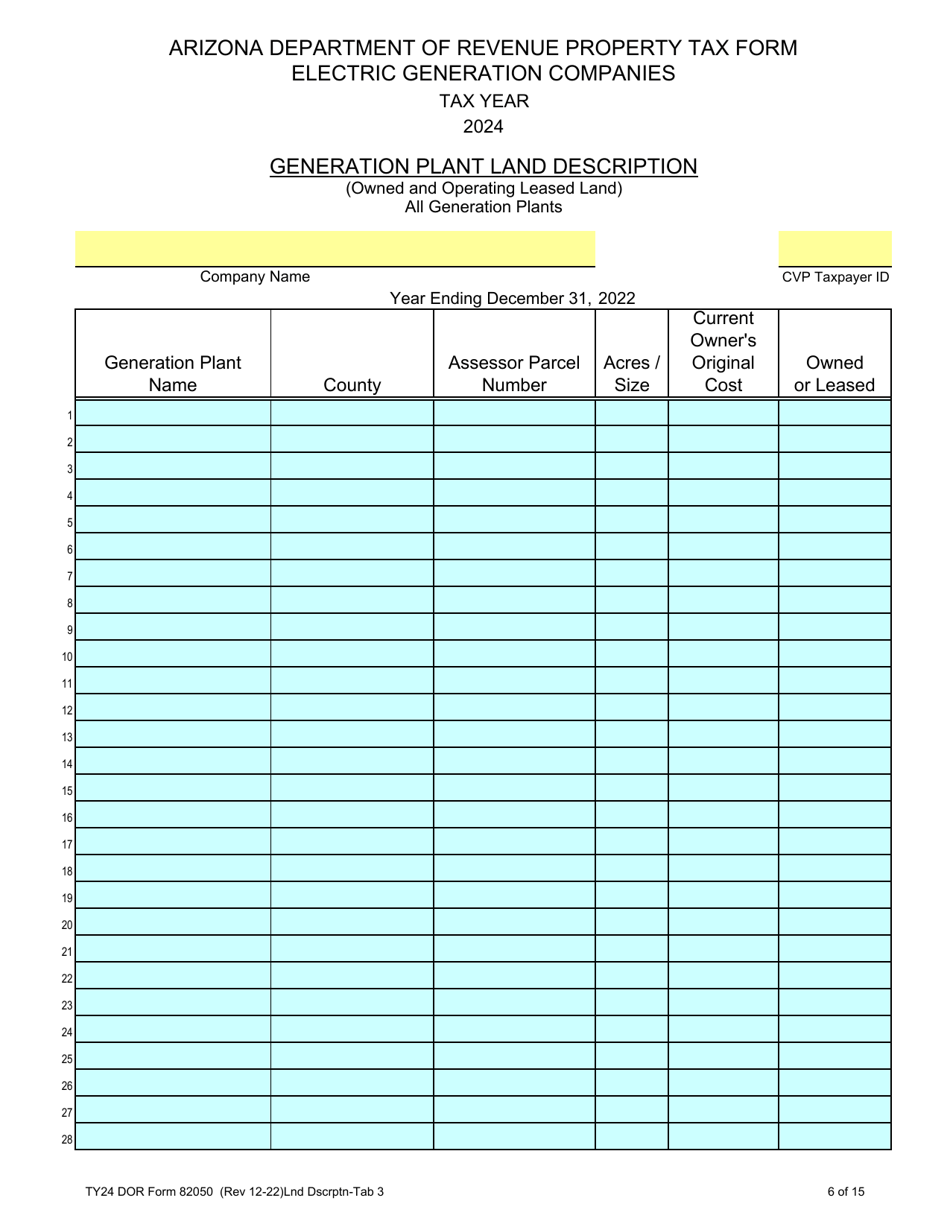

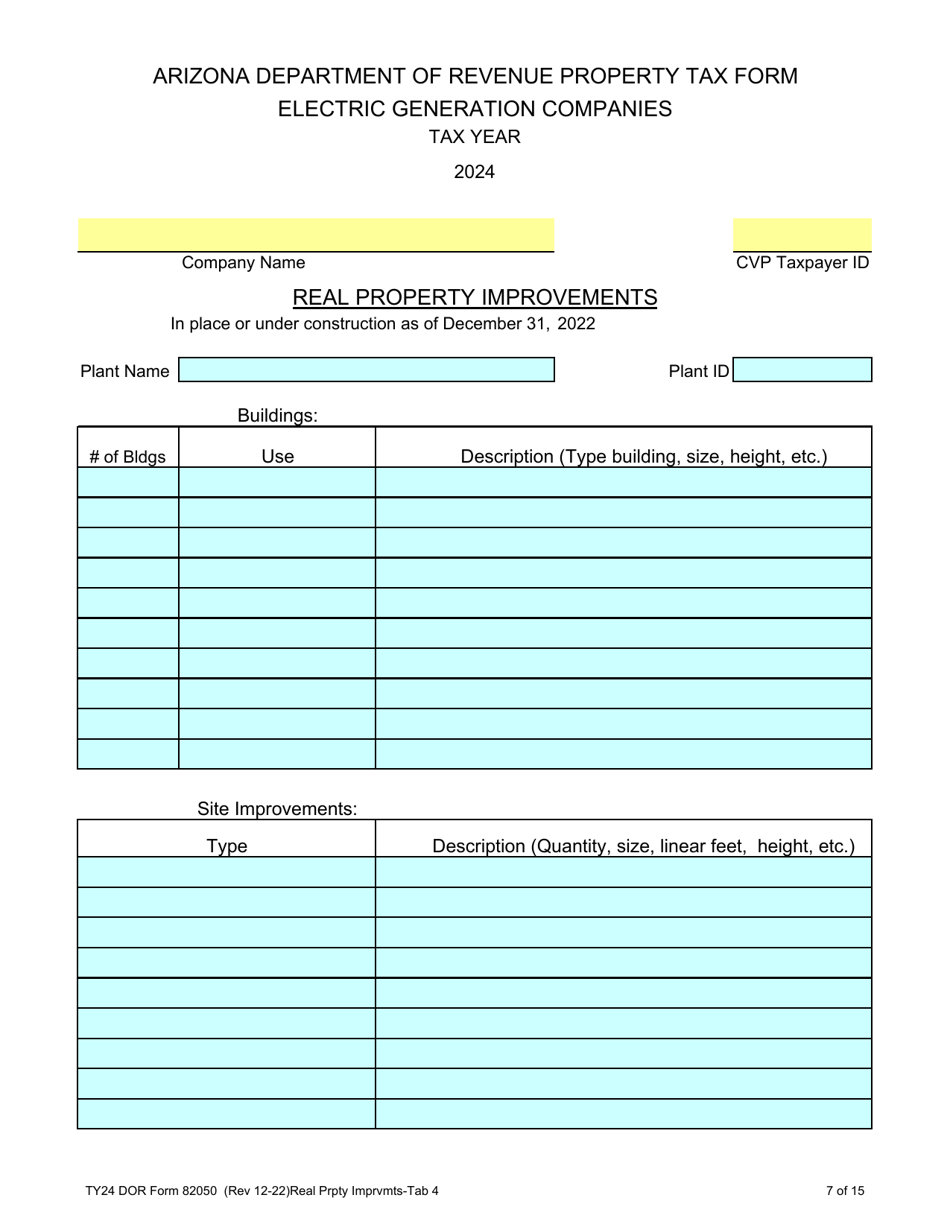

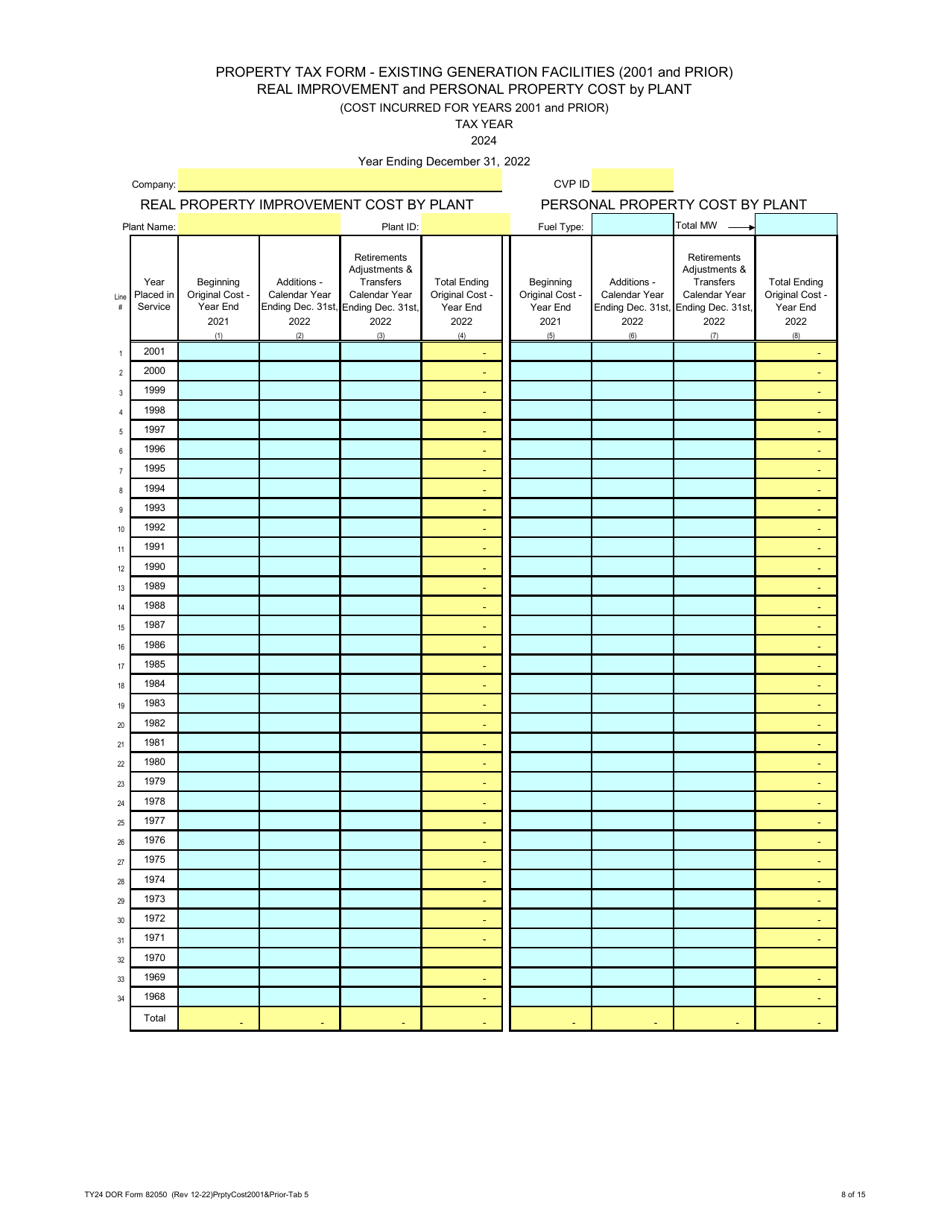

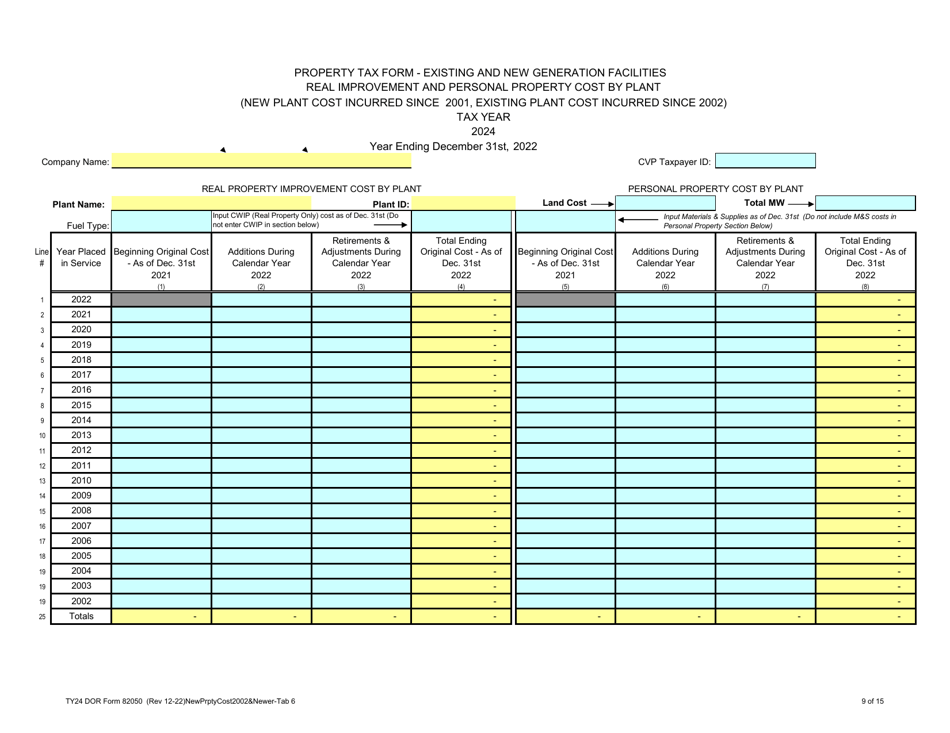

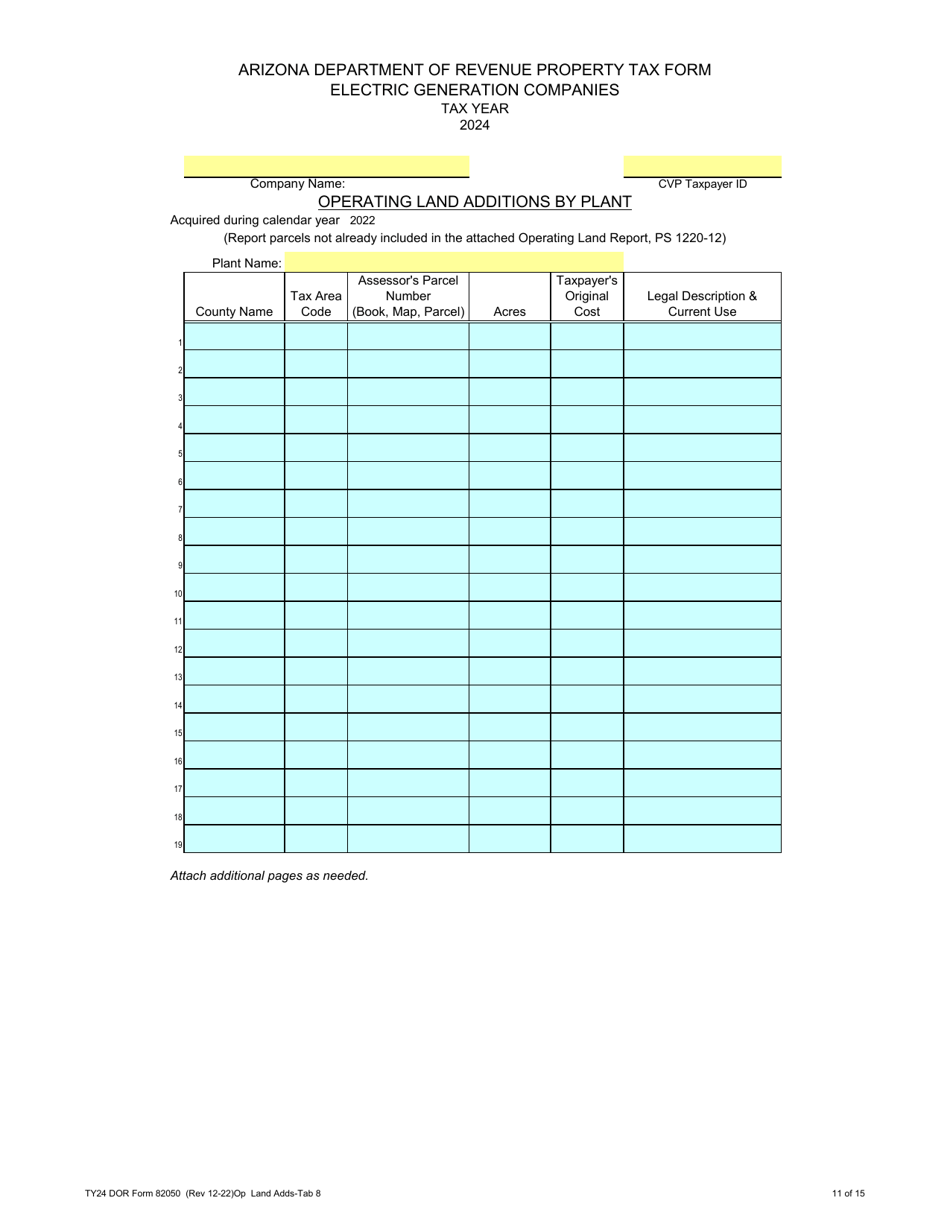

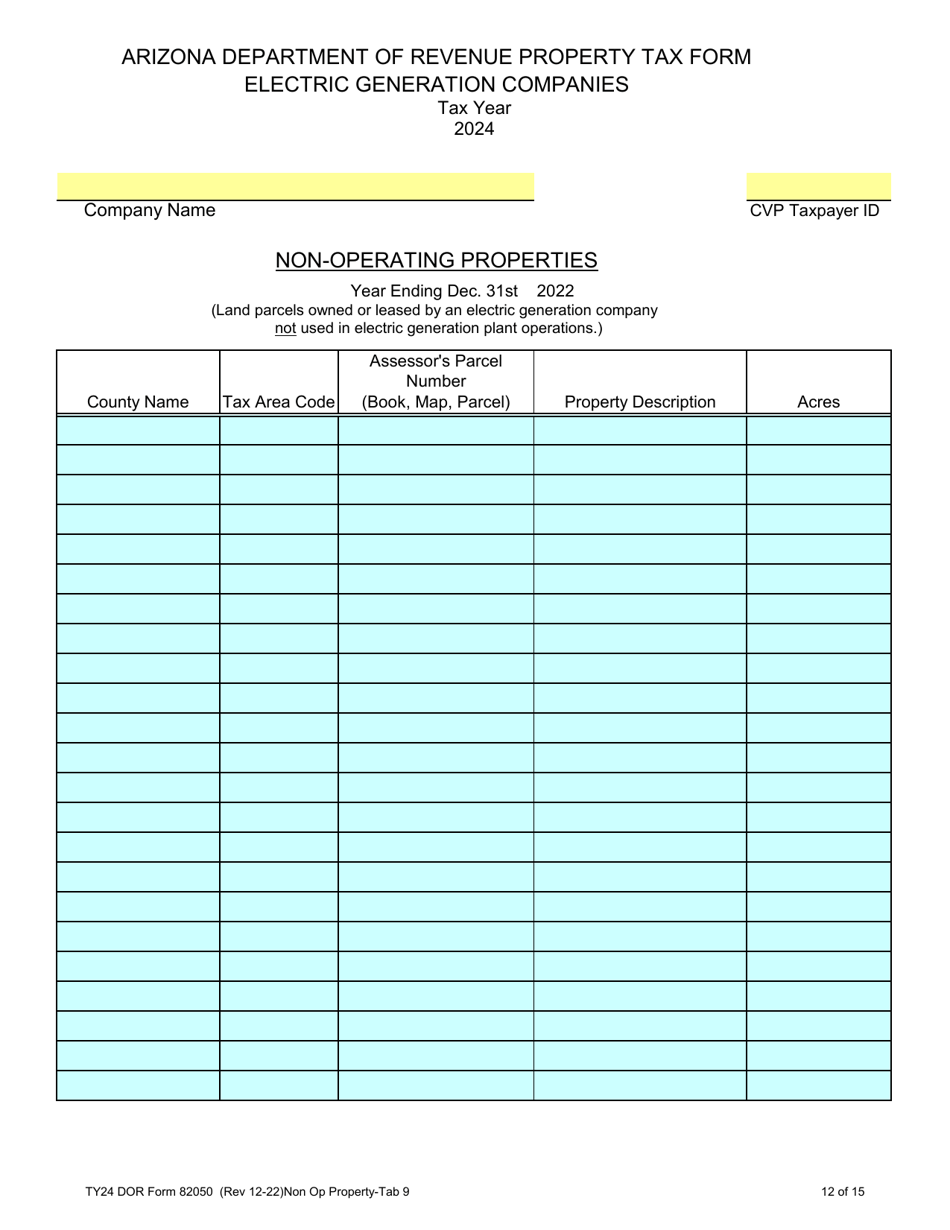

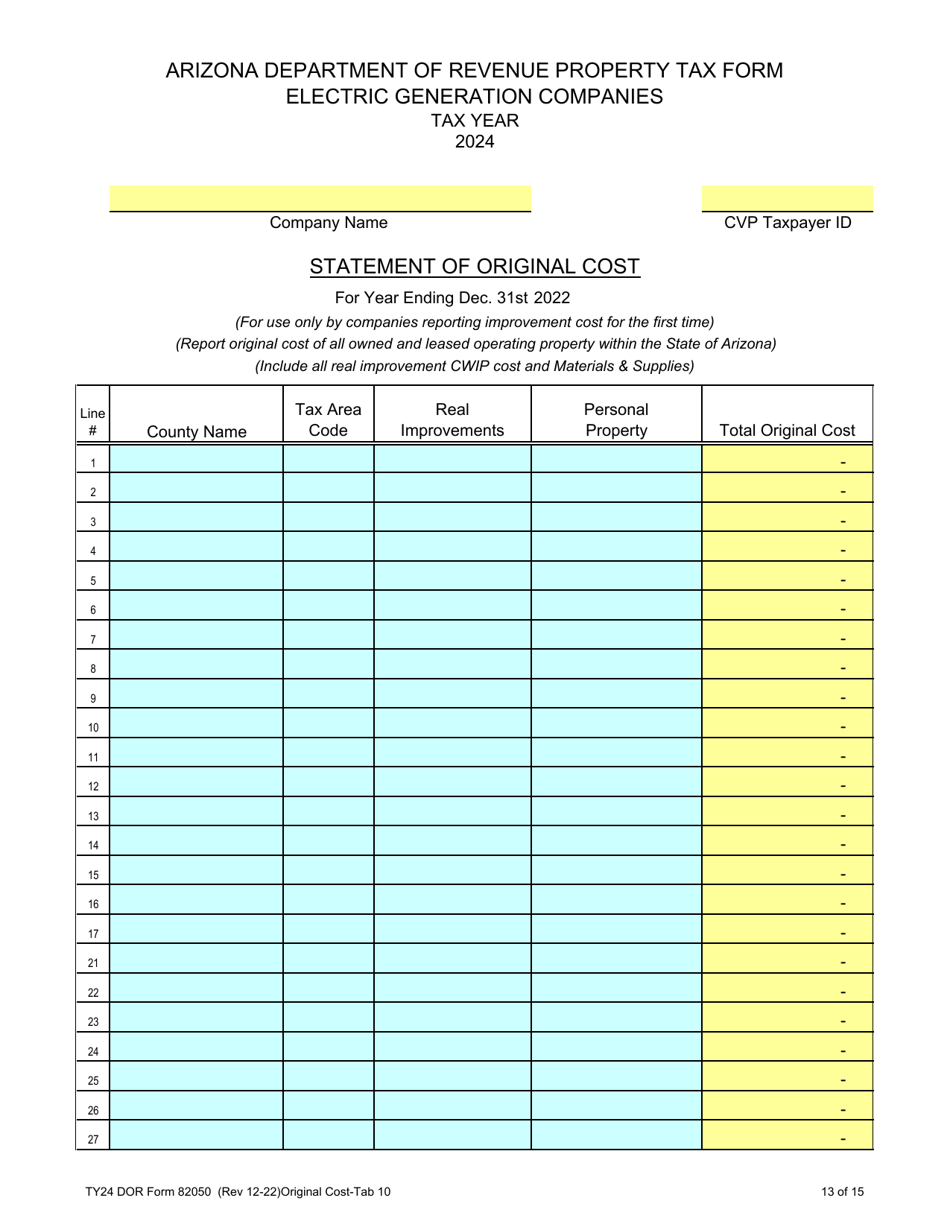

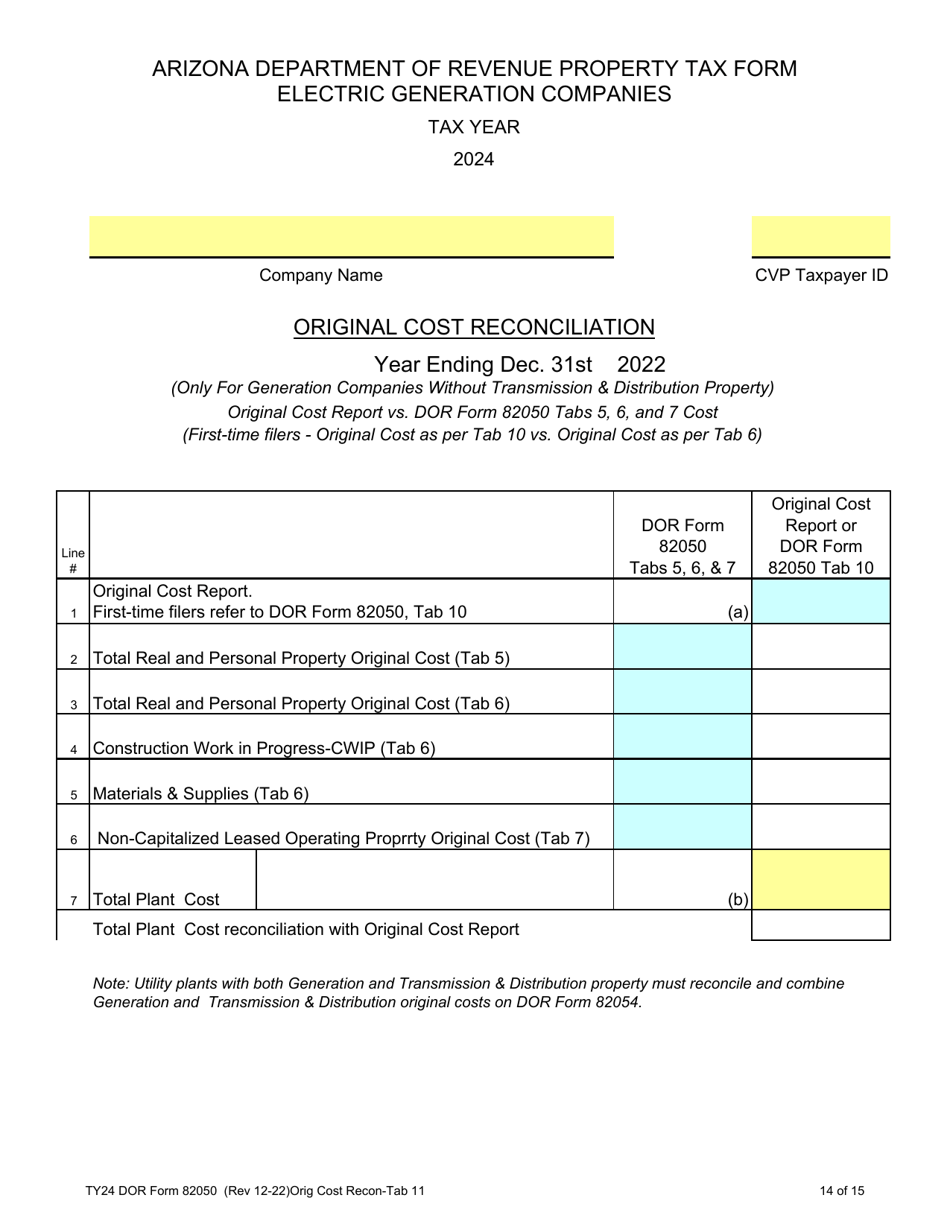

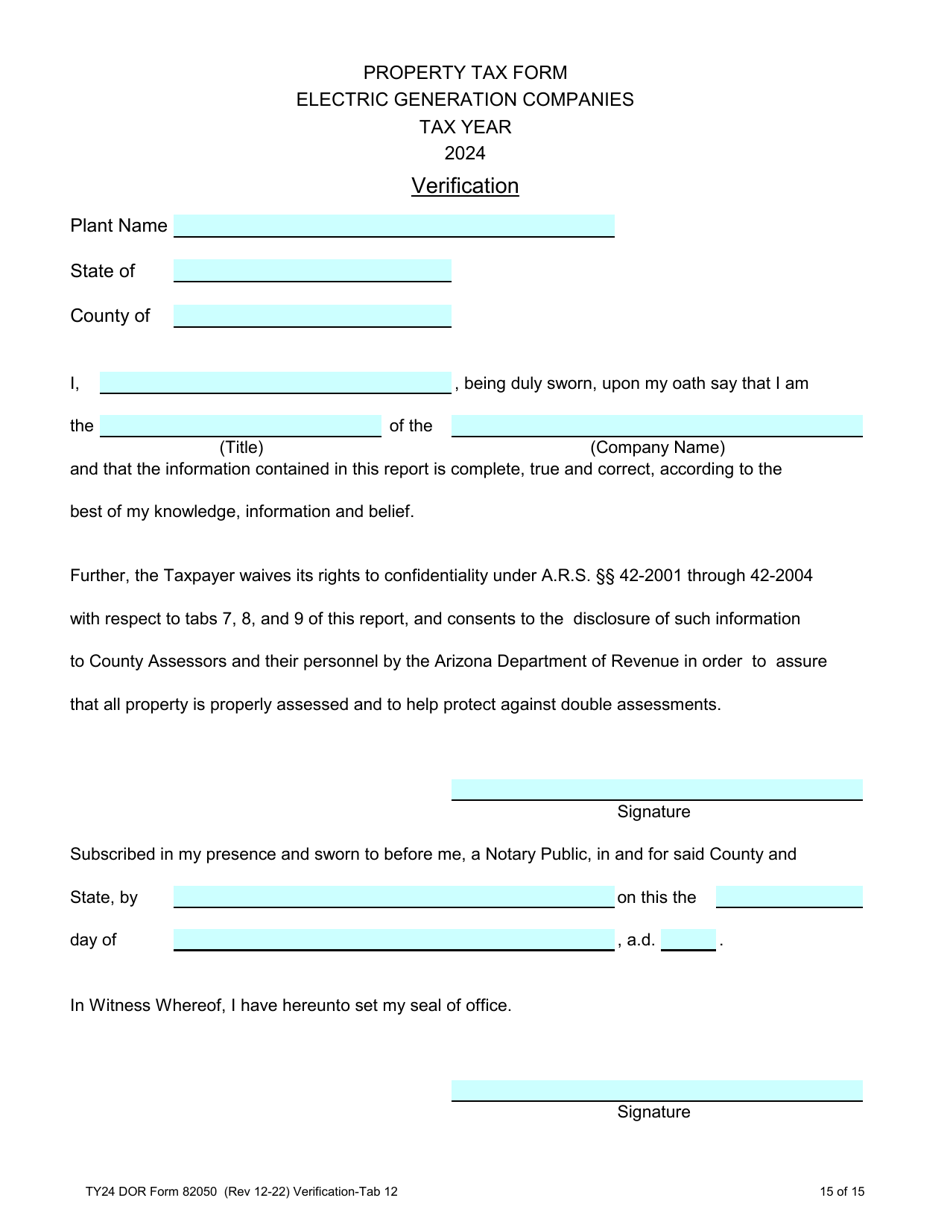

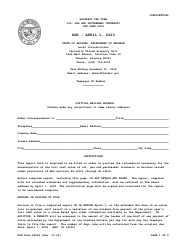

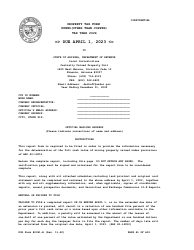

Form 82050 Electric Generation Companies Property Tax Form - Arizona

What Is Form 82050?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 82050?

A: Form 82050 is the Electric Generation Companies Property Tax Form in Arizona.

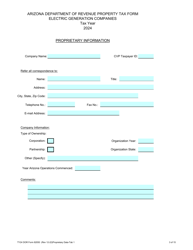

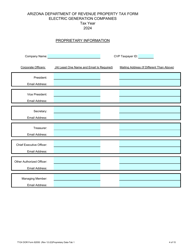

Q: Who needs to file Form 82050?

A: Electric generation companies in Arizona need to file Form 82050.

Q: What is the purpose of Form 82050?

A: The purpose of Form 82050 is to report property taxes for electric generation companies in Arizona.

Q: How often do you need to file Form 82050?

A: Form 82050 is an annual form and needs to be filed once a year.

Q: Are there any deadlines for filing Form 82050?

A: Yes, the deadline for filing Form 82050 is usually April 30th of the reporting year.

Q: Are there any penalties for late filing of Form 82050?

A: Yes, there may be penalties for late filing of Form 82050.

Q: Is there a fee for filing Form 82050?

A: No, there is no fee for filing Form 82050.

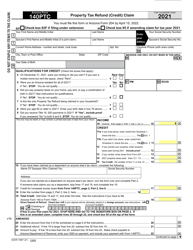

Q: Are there any exemptions or deductions available on Form 82050?

A: Yes, there may be exemptions and deductions available on Form 82050. It is recommended to consult the instructions or a tax professional.

Q: Can Form 82050 be filed electronically?

A: Yes, Form 82050 can be filed electronically through the e-file system of the Arizona Department of Revenue.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 82050 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.