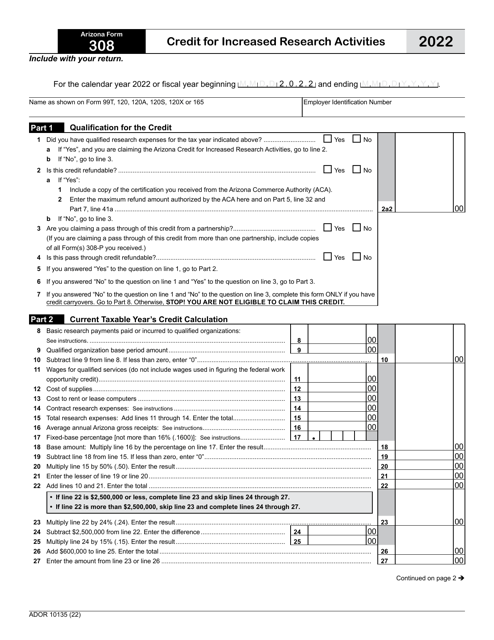

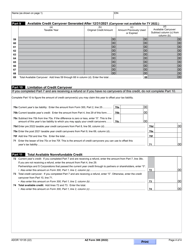

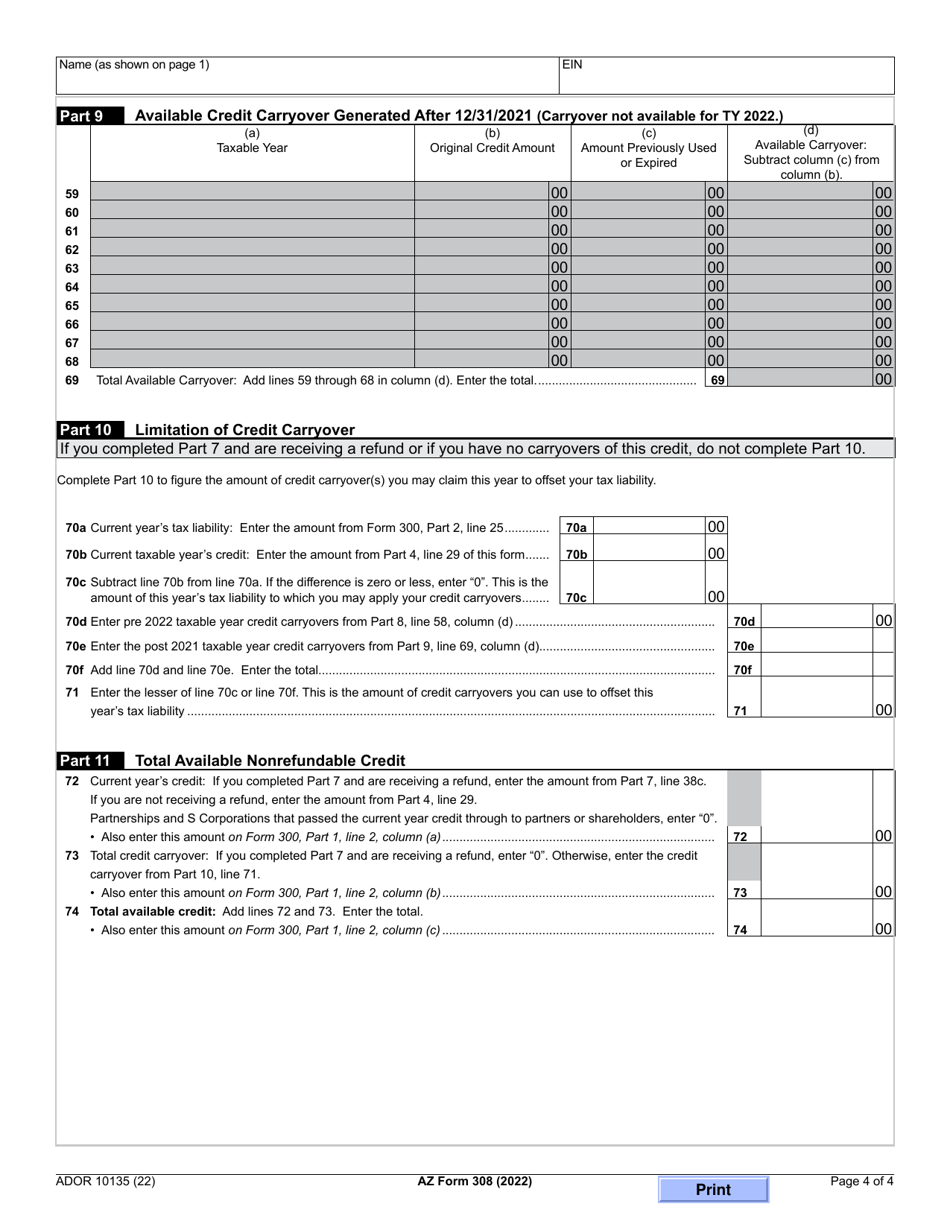

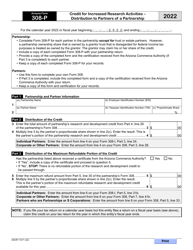

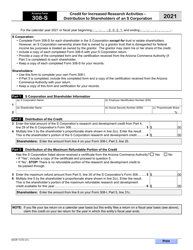

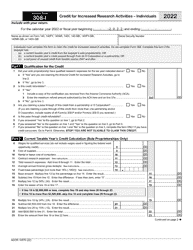

Arizona Form 308 (ADOR10135) Credit for Increased Research Activities - Arizona

What Is Arizona Form 308 (ADOR10135)?

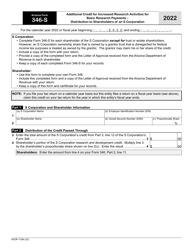

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 308?

A: Arizona Form 308 is the Credit for Increased Research Activities form issued by the Arizona Department of Revenue (ADOR).

Q: What is the purpose of Arizona Form 308?

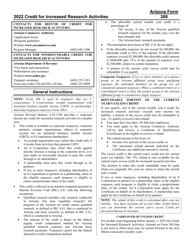

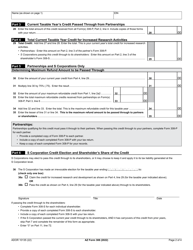

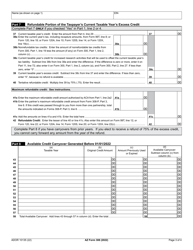

A: The purpose of Arizona Form 308 is to claim the Credit for Increased Research Activities for eligible research expenses incurred in Arizona.

Q: Who can use Arizona Form 308?

A: Arizona taxpayers who have conducted qualified research activities in the state and incurred eligible research expenses can use Arizona Form 308.

Q: What are qualified research activities?

A: Qualified research activities are activities undertaken to discover technological information that is intended to be useful in the development of new or improved business components.

Q: What are eligible research expenses?

A: Eligible research expenses include wages, supplies, contract research expenses, and certain depreciable property used in qualified research activities.

Q: Is there a deadline for filing Arizona Form 308?

A: Yes, Arizona Form 308 must be filed by the due date of the taxpayer's Arizona income tax return, typically April 15th.

Q: Are there any limitations on the credit amount?

A: Yes, the credit for increased research activities is subject to certain limitations based on the taxpayer's qualified research expenses and income.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 308 (ADOR10135) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.