This version of the form is not currently in use and is provided for reference only. Download this version of

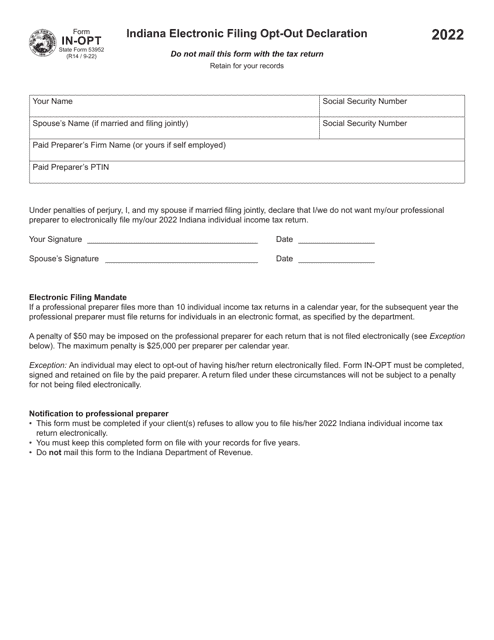

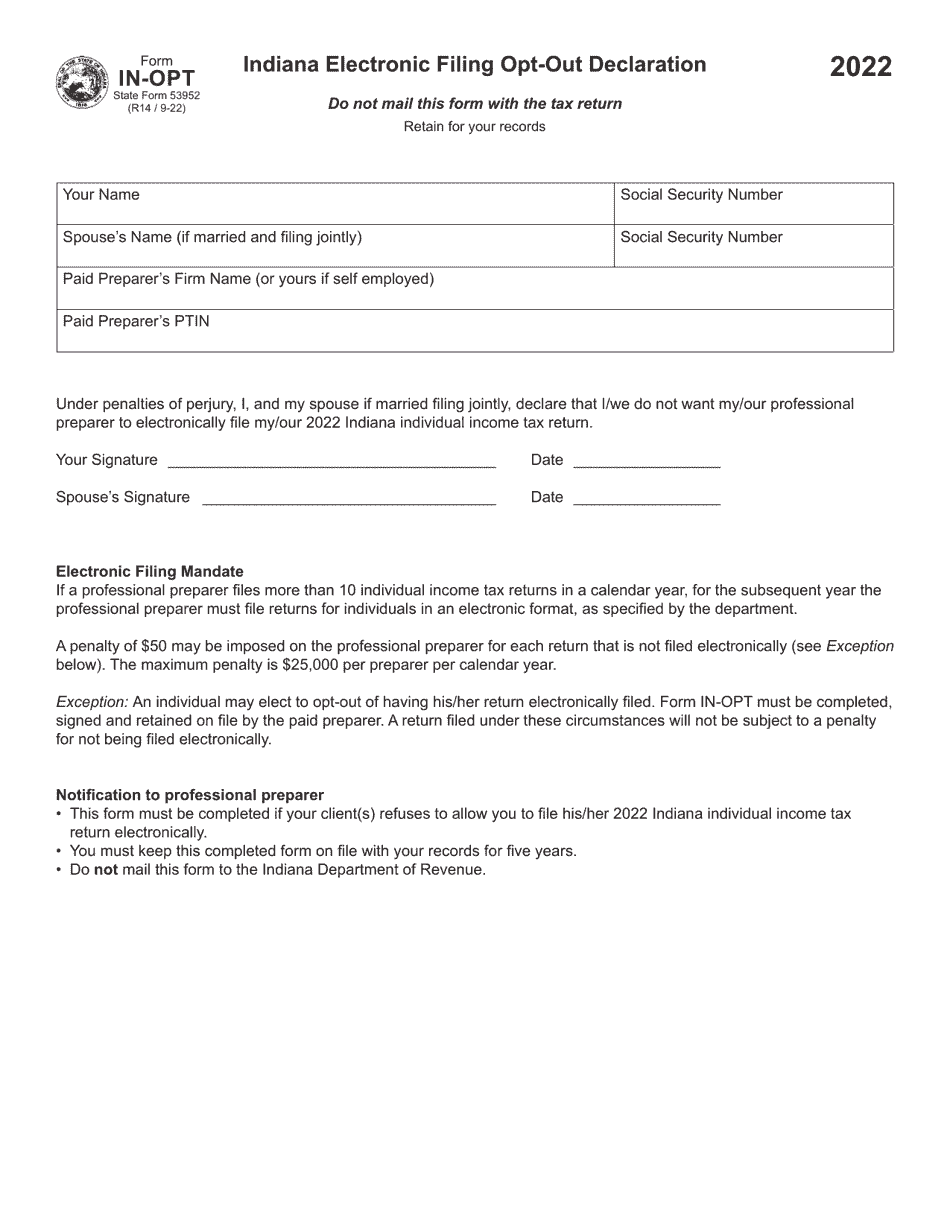

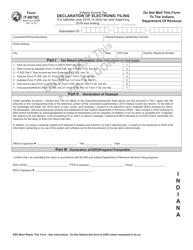

Form IN-OPT (State Form 53952)

for the current year.

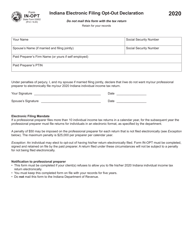

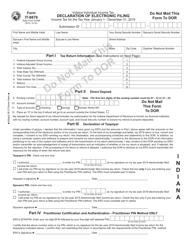

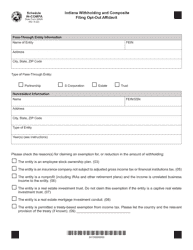

Form IN-OPT (State Form 53952) Indiana Electronic Filing Opt-Out Declaration - Indiana

What Is Form IN-OPT (State Form 53952)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IN-OPT form?

A: The IN-OPT form is the Indiana Electronic Filing Opt-Out Declaration.

Q: What is the purpose of the IN-OPT form?

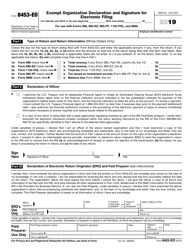

A: The purpose of the IN-OPT form is to declare that you choose to opt-out of electronic filing for your state taxes in Indiana.

Q: Can I opt-out of electronic filing for my Indiana state taxes?

A: Yes, you can opt-out of electronic filing for your Indiana state taxes by filling out and submitting the IN-OPT form.

Q: Do I need to submit the IN-OPT form every year?

A: No, once you submit the IN-OPT form, you will be opted-out of electronic filing for future years unless you choose to opt-in again.

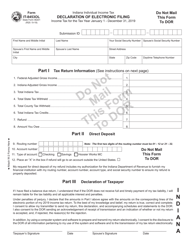

Q: What information do I need to provide on the IN-OPT form?

A: You will need to provide your name, address, social security number, and indicate that you choose to opt-out of electronic filing.

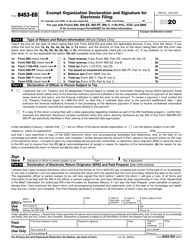

Q: Can I change my mind and opt-in to electronic filing after submitting the IN-OPT form?

A: Yes, you can change your mind and opt-in to electronic filing by notifying the Indiana Department of Revenue.

Q: Is there a deadline to submit the IN-OPT form?

A: There is no specific deadline mentioned for submitting the IN-OPT form, but it is recommended to submit it before the tax filing deadline.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IN-OPT (State Form 53952) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.