This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-40 (State Form 47907) Schedule CT-40

for the current year.

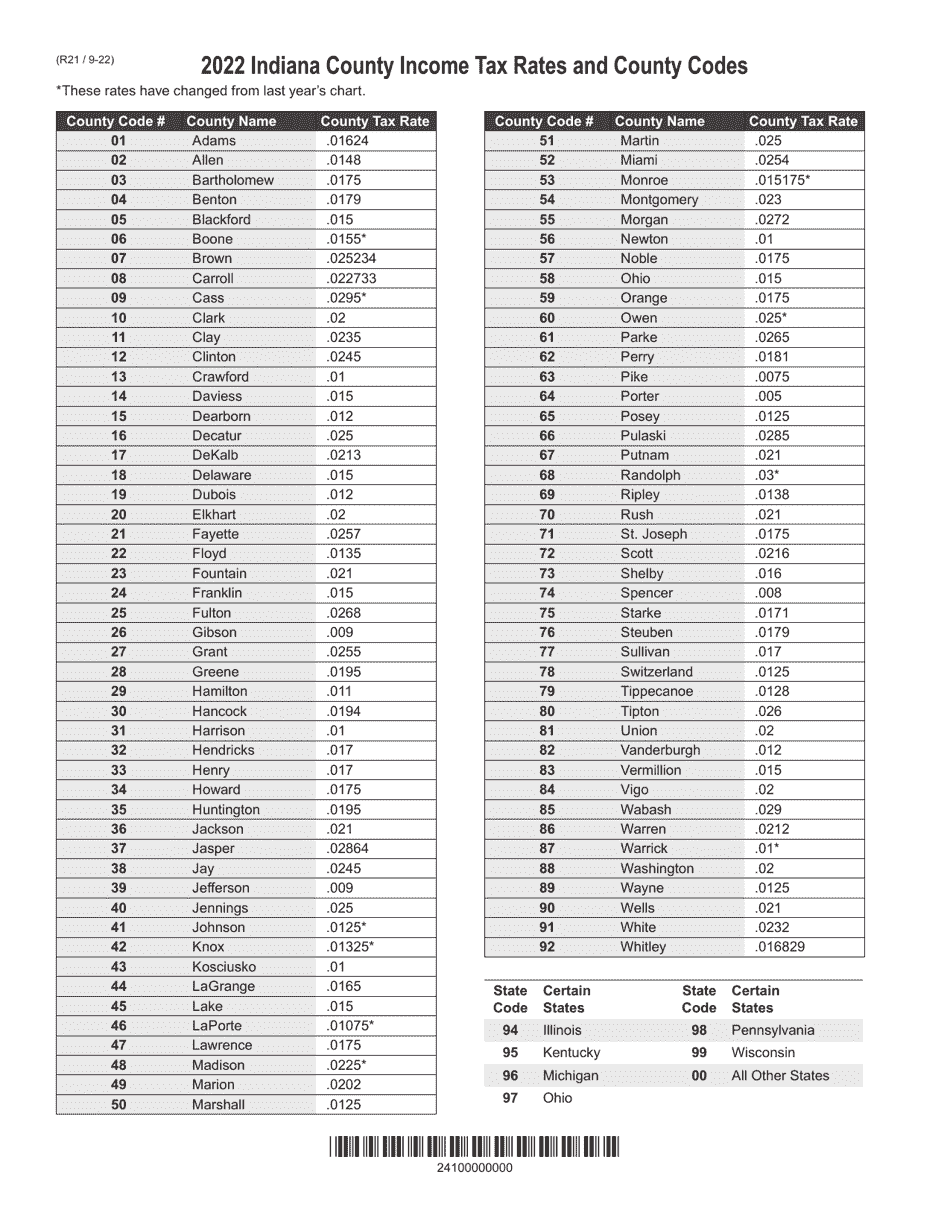

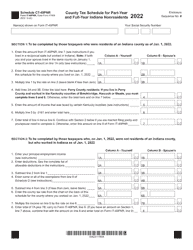

Form IT-40 (State Form 47907) Schedule CT-40 County Tax Schedule for Full-Year Indiana Residents - Indiana

What Is Form IT-40 (State Form 47907) Schedule CT-40?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is a state tax form for Indiana residents.

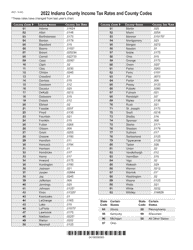

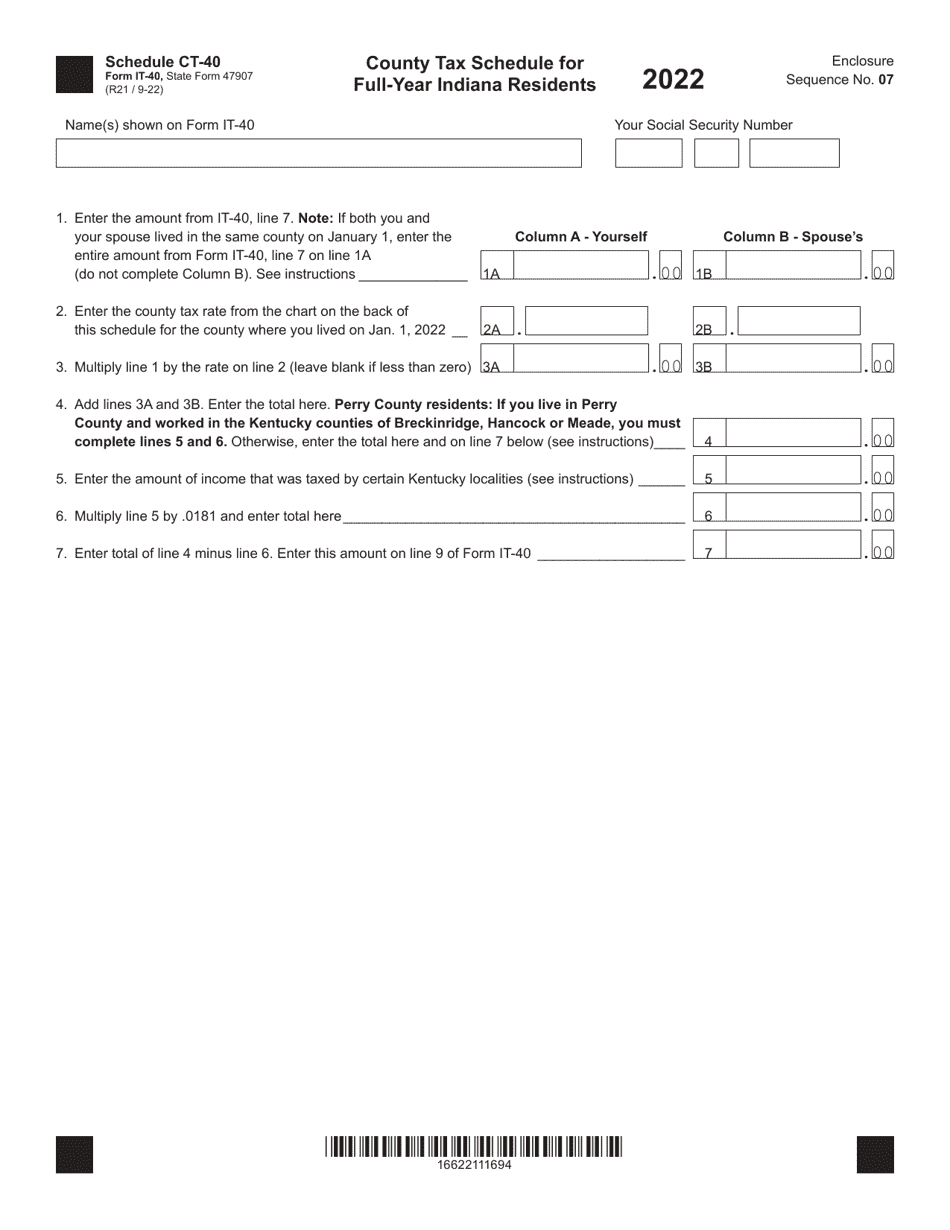

Q: What is Schedule CT-40?

A: Schedule CT-40 is the County Tax Schedule for full-year Indiana residents.

Q: Who needs to file Form IT-40?

A: Indiana residents need to file Form IT-40.

Q: What is the purpose of Schedule CT-40?

A: Schedule CT-40 is used to calculate county tax for Indiana residents.

Q: When is Form IT-40 and Schedule CT-40 due?

A: Form IT-40 and Schedule CT-40 are due on April 15th of each year.

Q: Do I need to file Schedule CT-40 if I don't owe any county tax?

A: Yes, you still need to file Schedule CT-40 even if you don't owe any county tax.

Q: Are there any penalties for filing Form IT-40 and Schedule CT-40 late?

A: Yes, there are penalties for filing Form IT-40 and Schedule CT-40 late. It is important to file on time to avoid penalties.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (State Form 47907) Schedule CT-40 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.