This version of the form is not currently in use and is provided for reference only. Download this version of

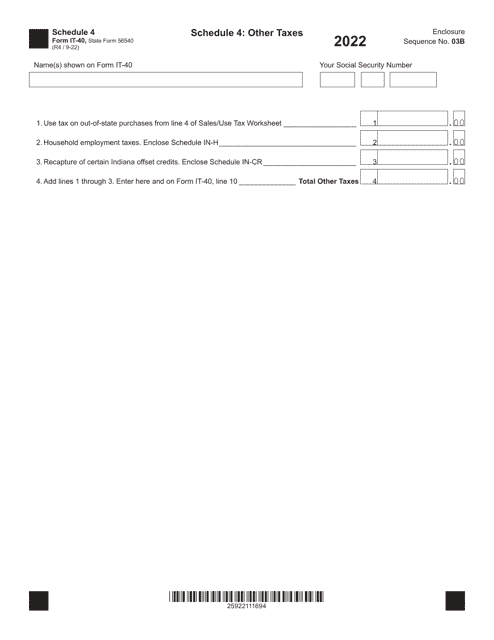

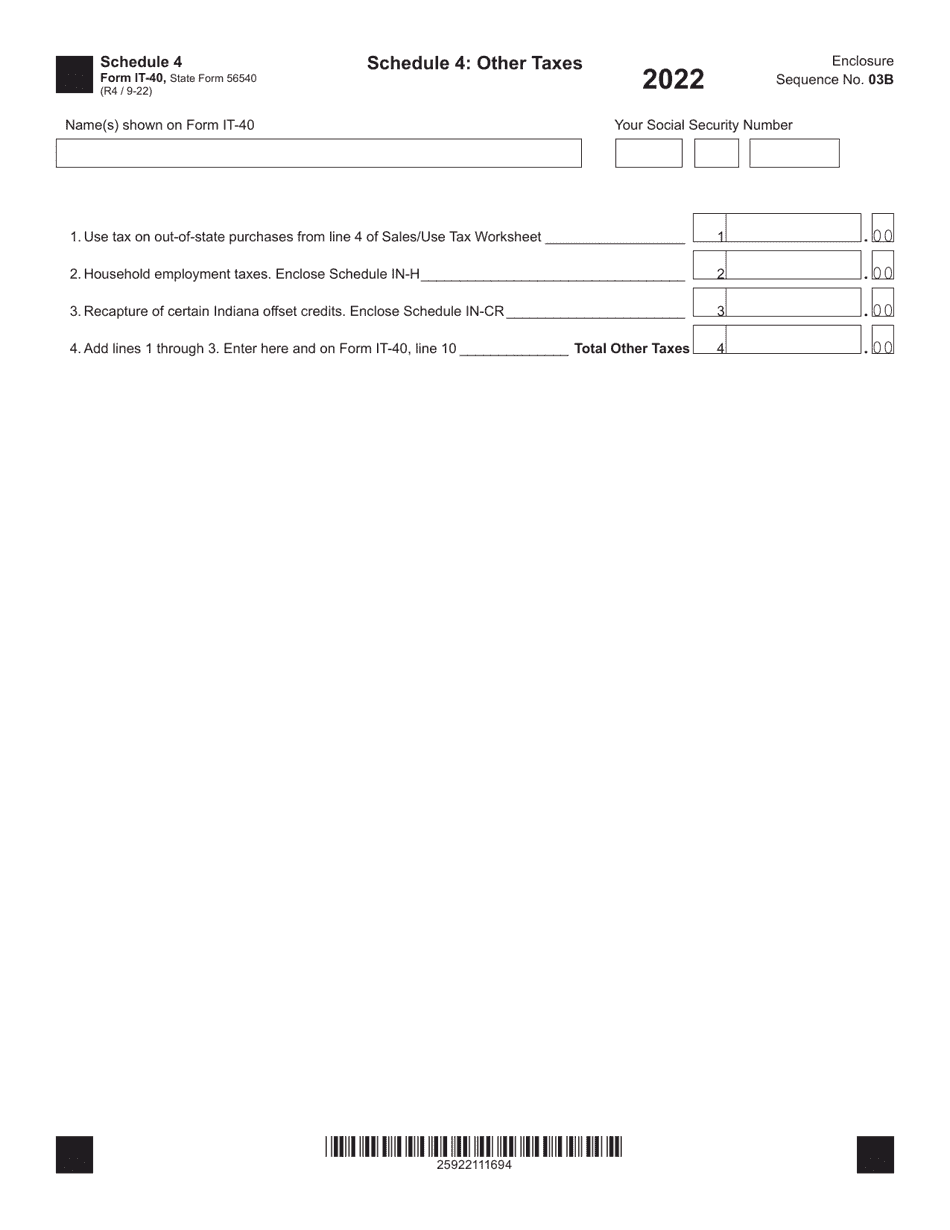

Form IT-40 (State Form 56540) Schedule 4

for the current year.

Form IT-40 (State Form 56540) Schedule 4 Other Taxes - Indiana

What Is Form IT-40 (State Form 56540) Schedule 4?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is the Indiana individual income tax return form.

Q: What is Schedule 4 on Form IT-40?

A: Schedule 4 is the section on Form IT-40 that deals with other taxes.

Q: What are other taxes?

A: Other taxes refer to any additional taxes or fees that you may owe apart from the regular income tax.

Q: What types of taxes are included in Schedule 4?

A: Types of taxes that may be included in Schedule 4 are county option income tax, county economic development income tax, and any other local taxes.

Q: Do I need to complete Schedule 4?

A: You should complete Schedule 4 if you owe any other taxes in addition to the regular income tax.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (State Form 56540) Schedule 4 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.