This version of the form is not currently in use and is provided for reference only. Download this version of

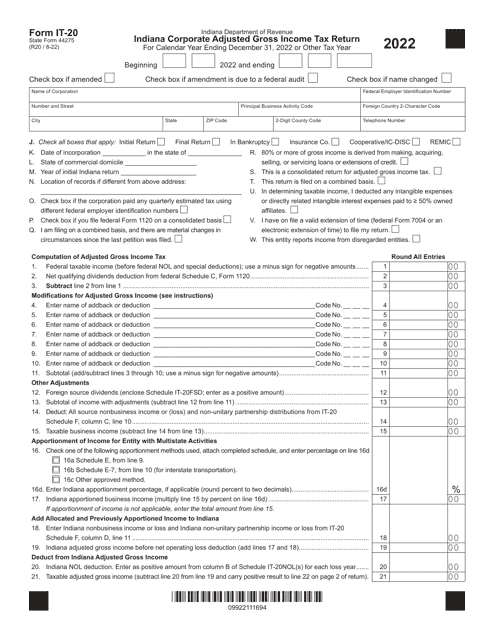

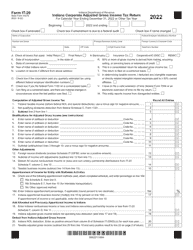

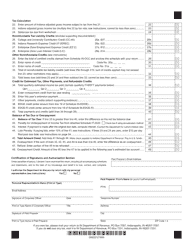

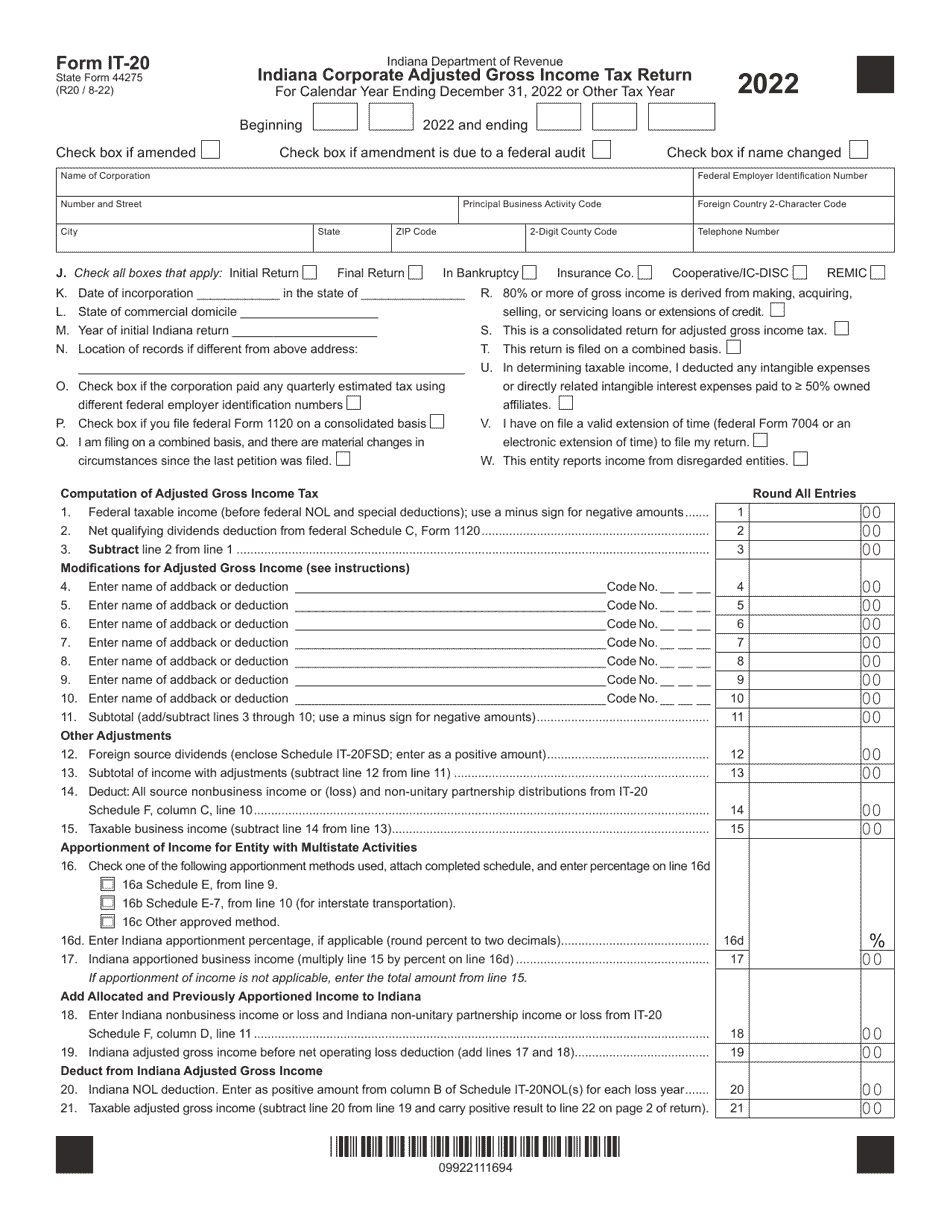

Form IT-20 (State Form 44275)

for the current year.

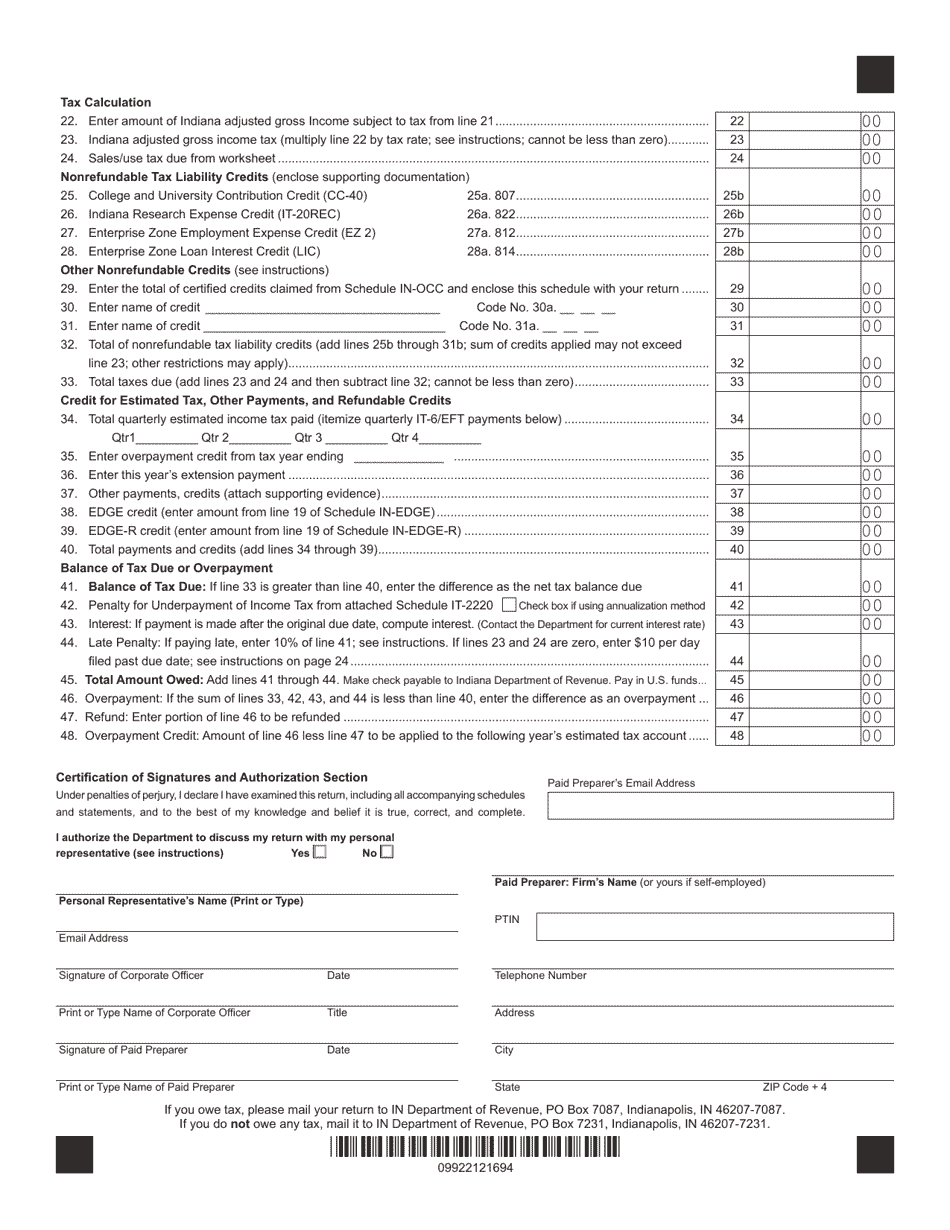

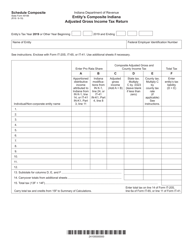

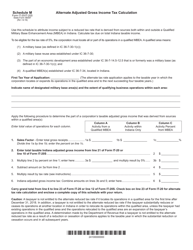

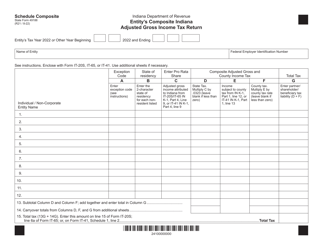

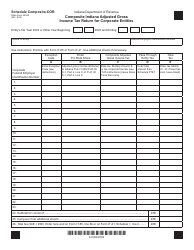

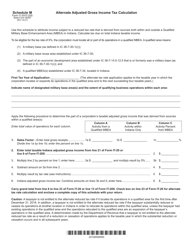

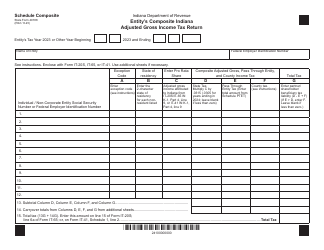

Form IT-20 (State Form 44275) Indiana Corporate Adjusted Gross Income Tax Return - Indiana

What Is Form IT-20 (State Form 44275)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-20?

A: Form IT-20 is the Indiana Corporate Adjusted Gross Income Tax Return.

Q: What is the purpose of Form IT-20?

A: The purpose of Form IT-20 is to report and pay corporate adjusted gross income tax to the state of Indiana.

Q: Is Form IT-20 specific to Indiana residents?

A: Yes, Form IT-20 is specific to Indiana residents who have corporate income to report.

Q: When is Form IT-20 due?

A: Form IT-20 is generally due on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form IT-20?

A: Yes, there may be penalties for late filing of Form IT-20. It is important to file the form on time to avoid penalties and interest charges.

Q: What should I do if I need help with Form IT-20?

A: If you need help with Form IT-20, you should contact the Indiana Department of Revenue or consult a tax professional.

Q: Is there a fee for filing Form IT-20?

A: No, there is no fee for filing Form IT-20. However, you may have to pay taxes owed based on your corporate income.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-20 (State Form 44275) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.