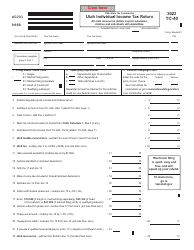

This version of the form is not currently in use and is provided for reference only. Download this version of

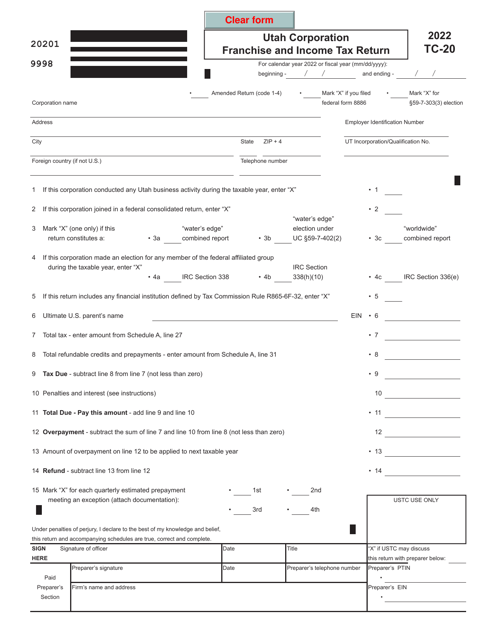

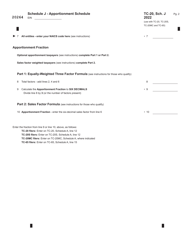

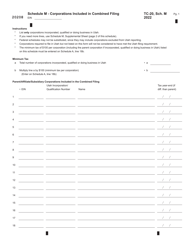

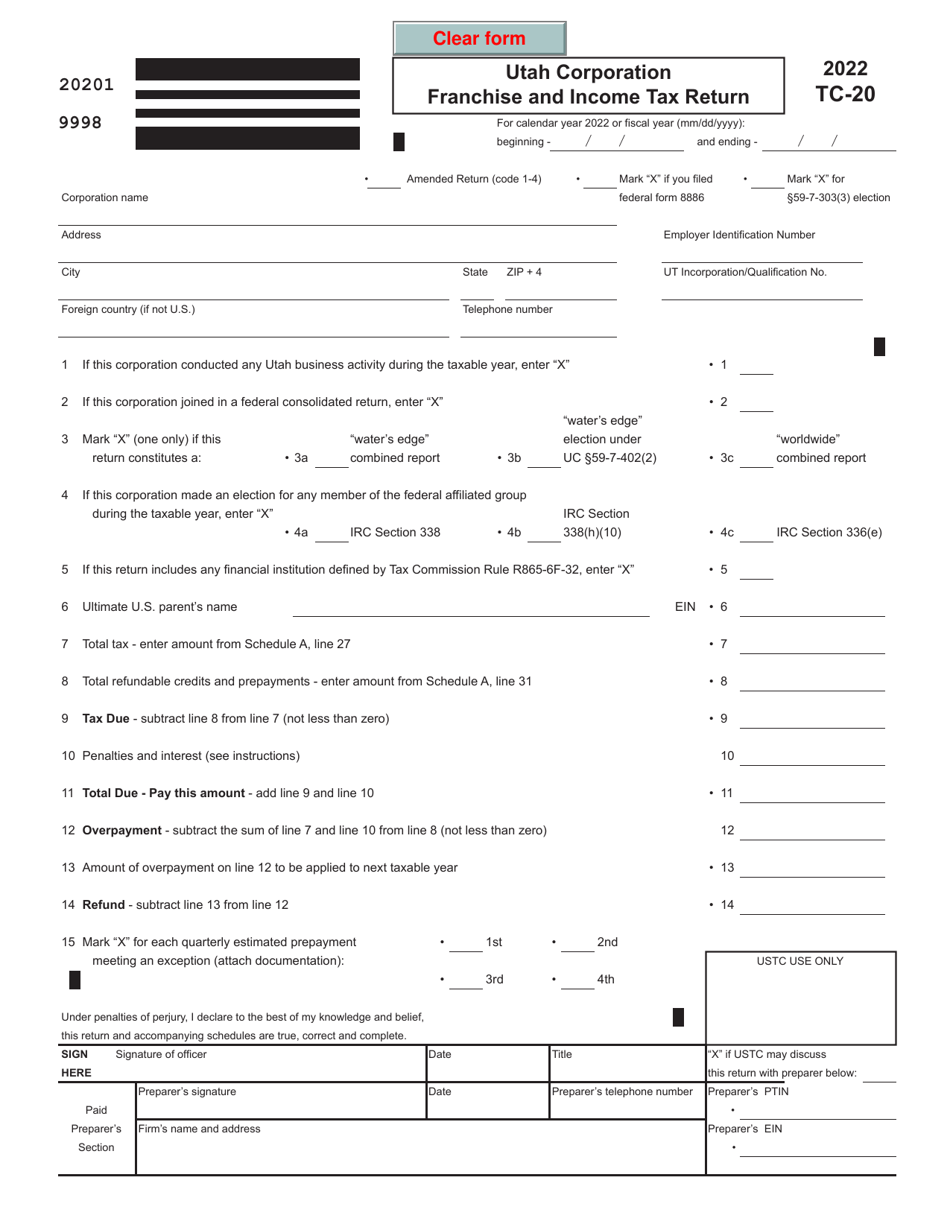

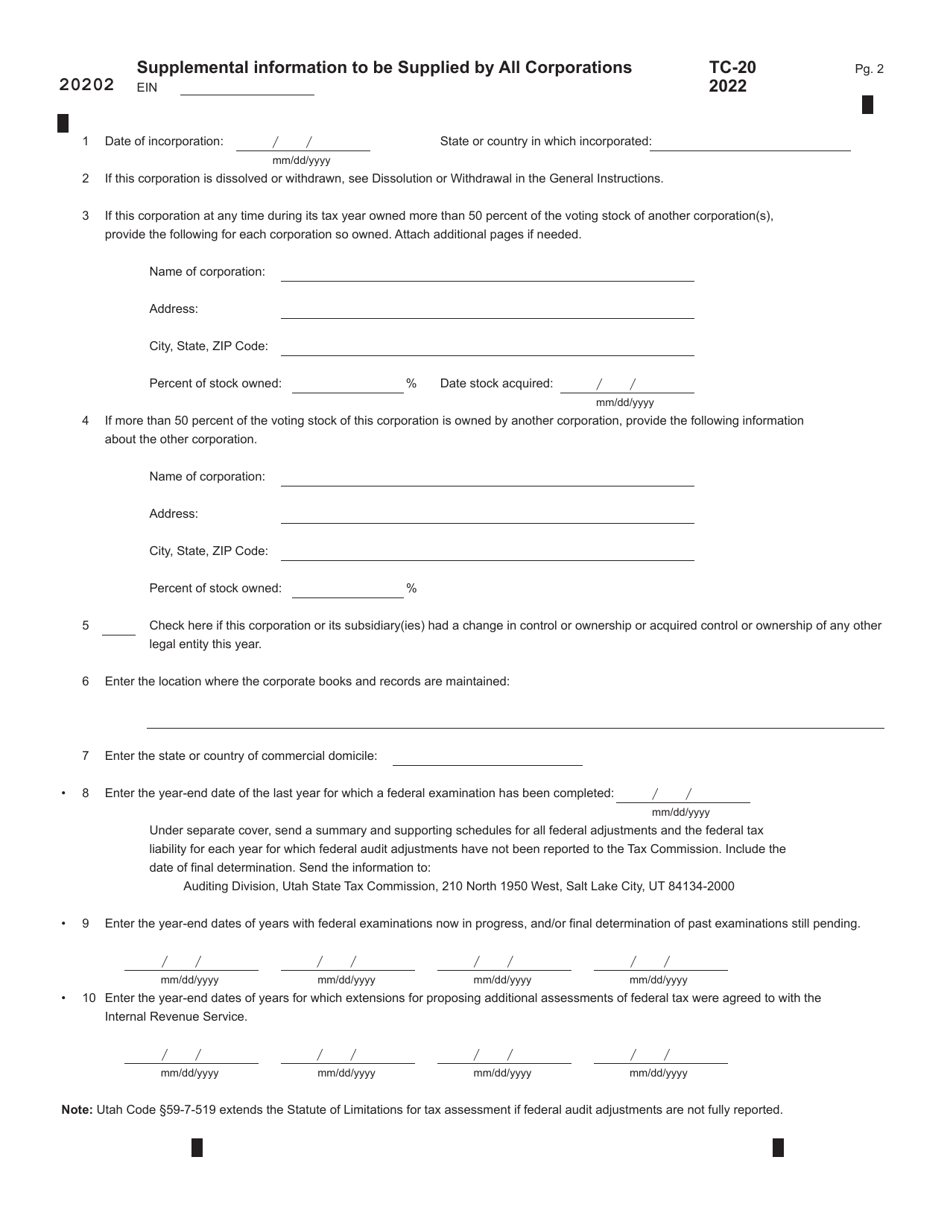

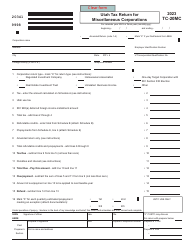

Form TC-20

for the current year.

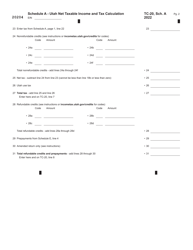

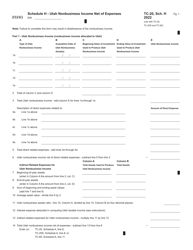

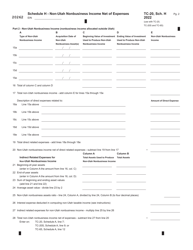

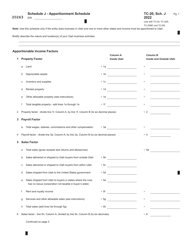

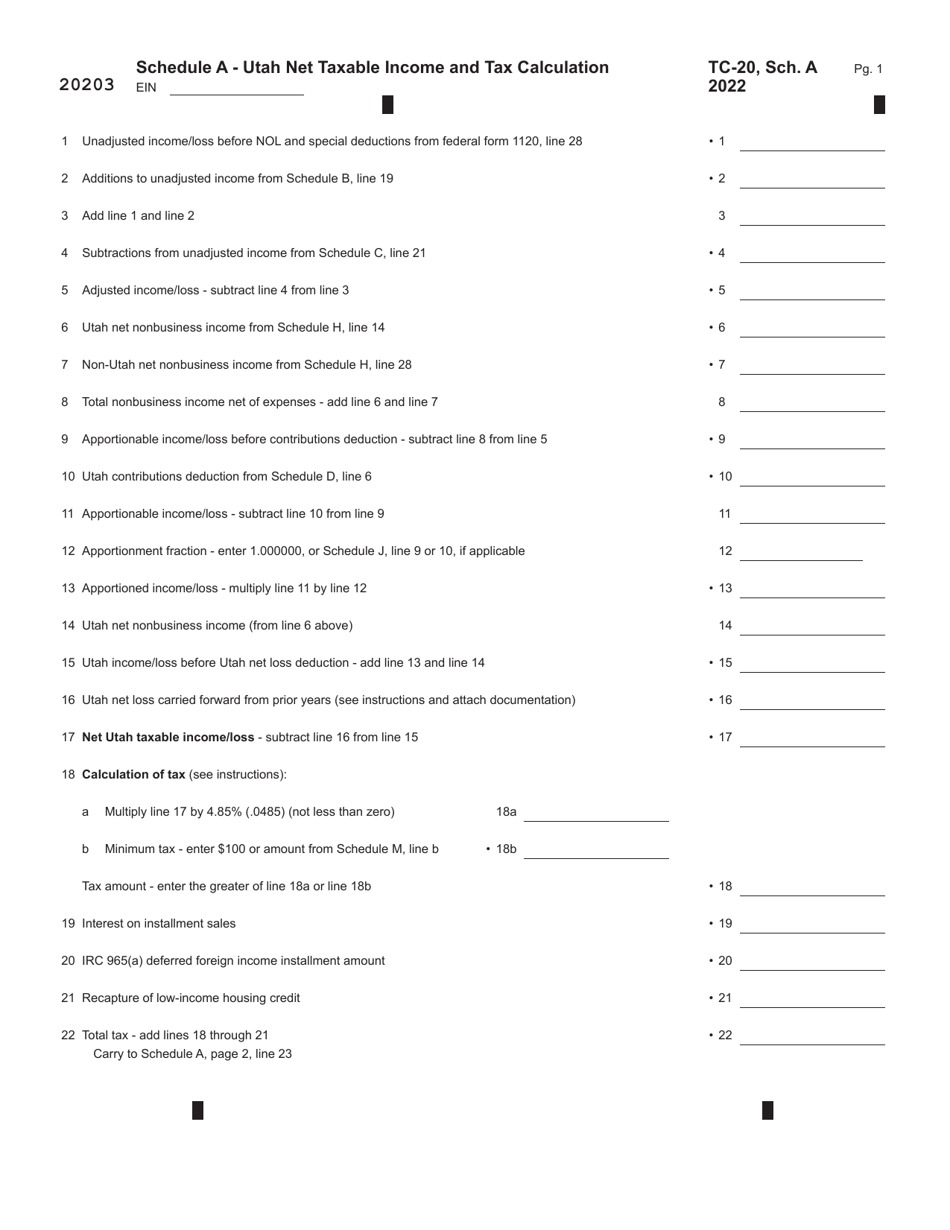

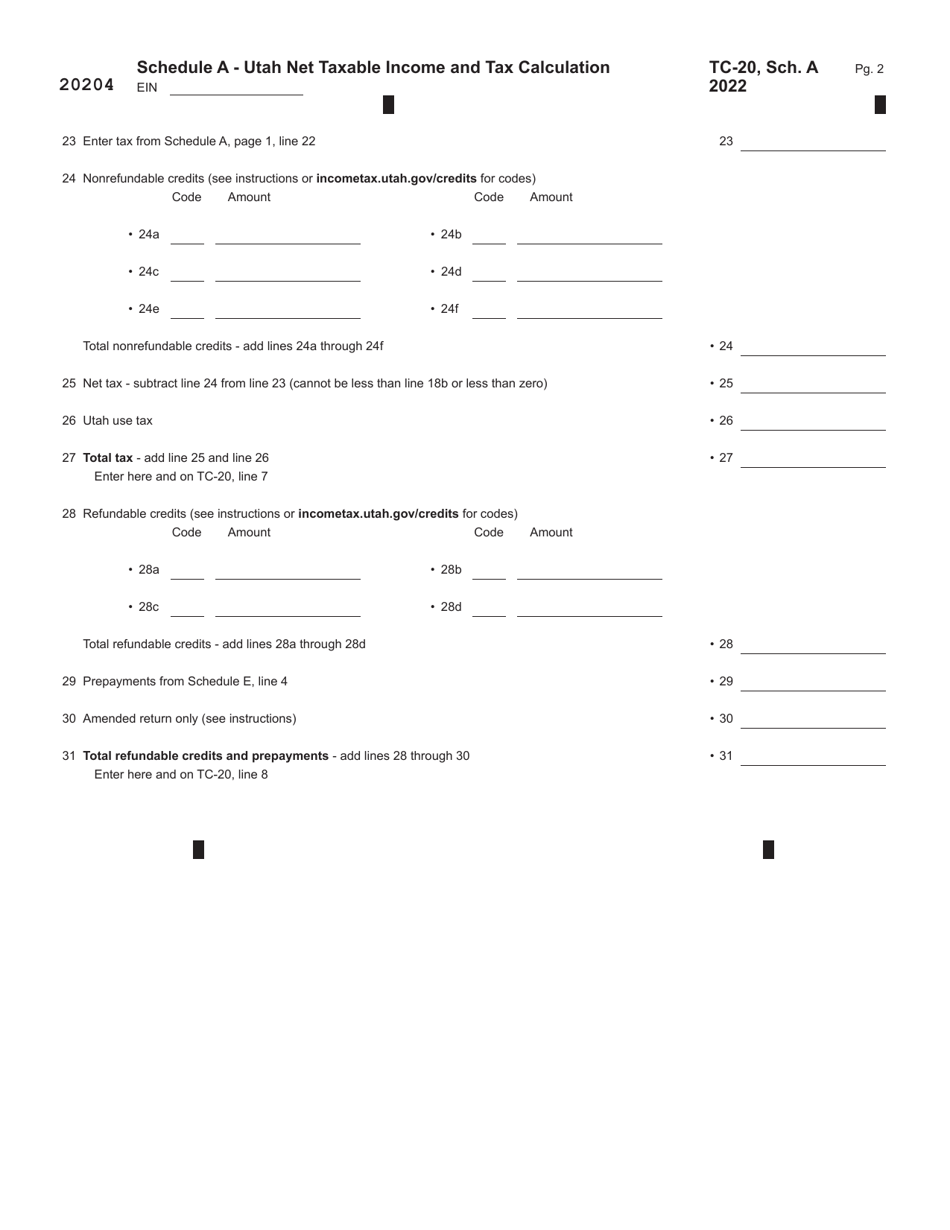

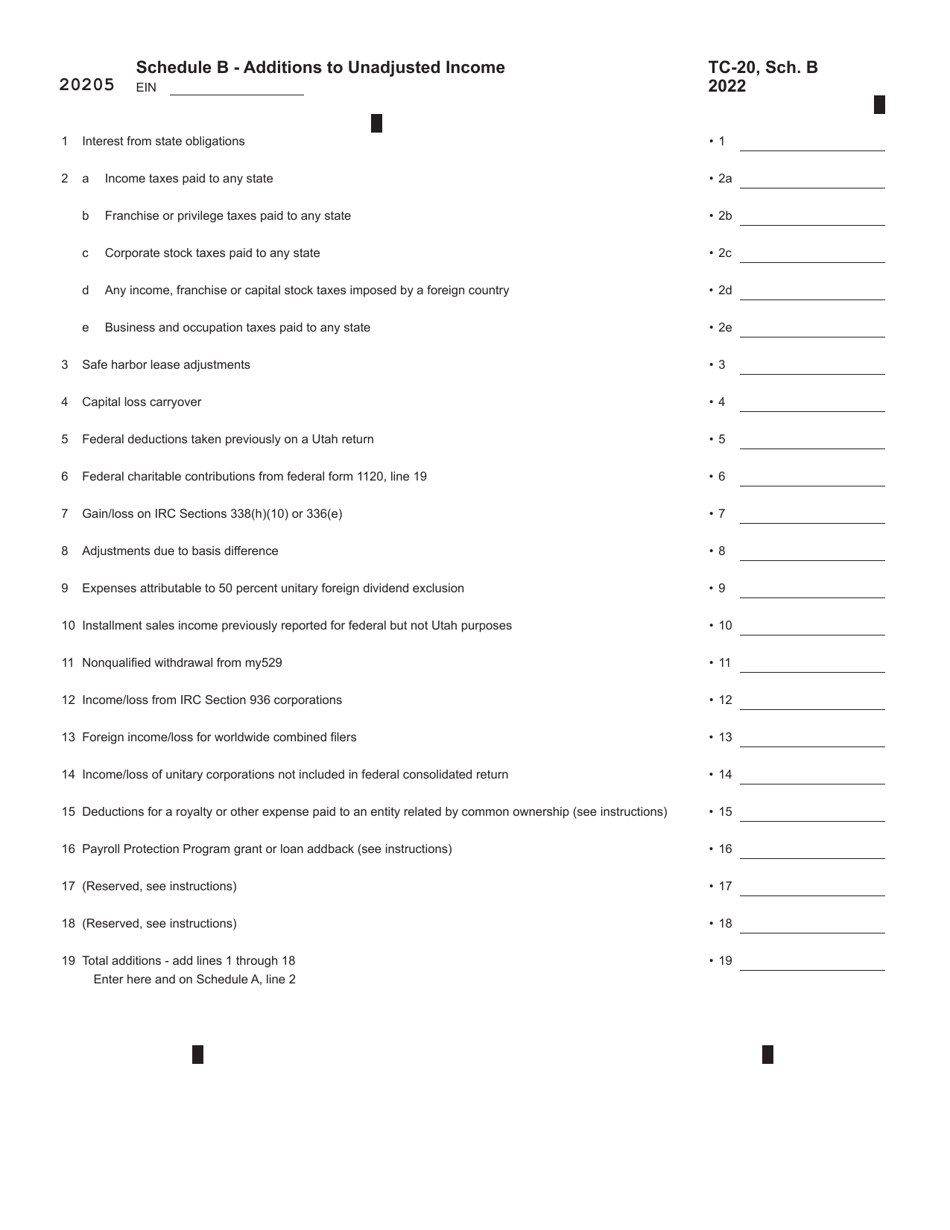

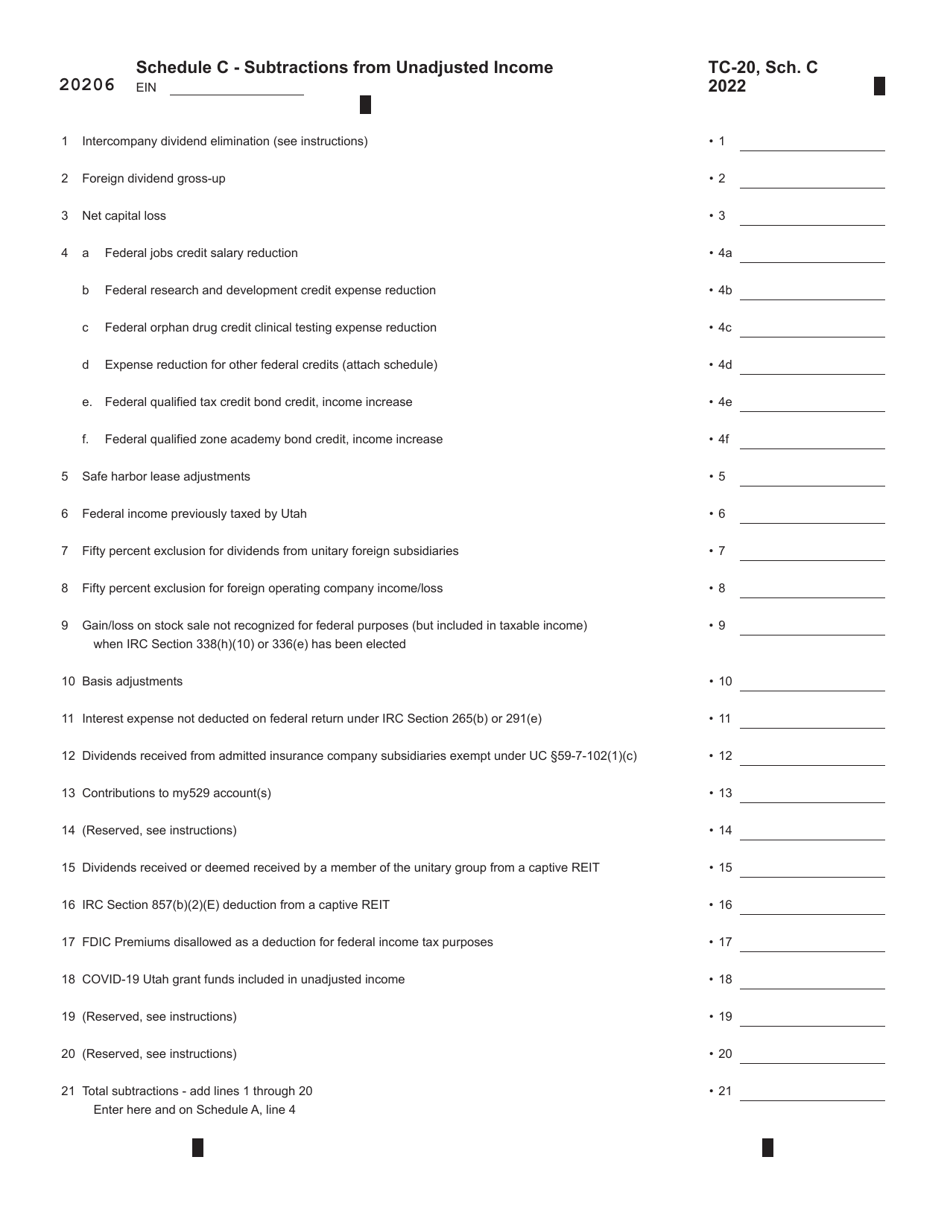

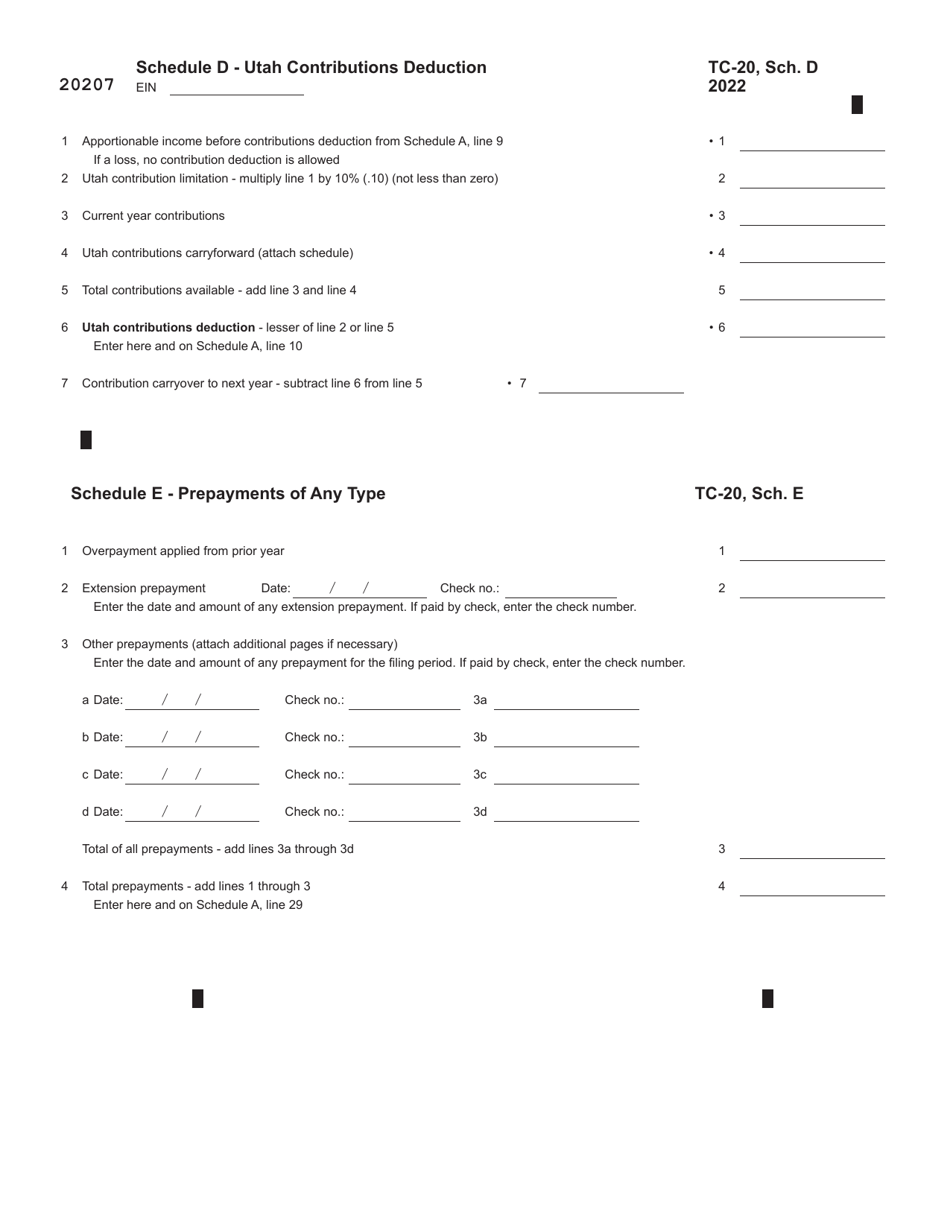

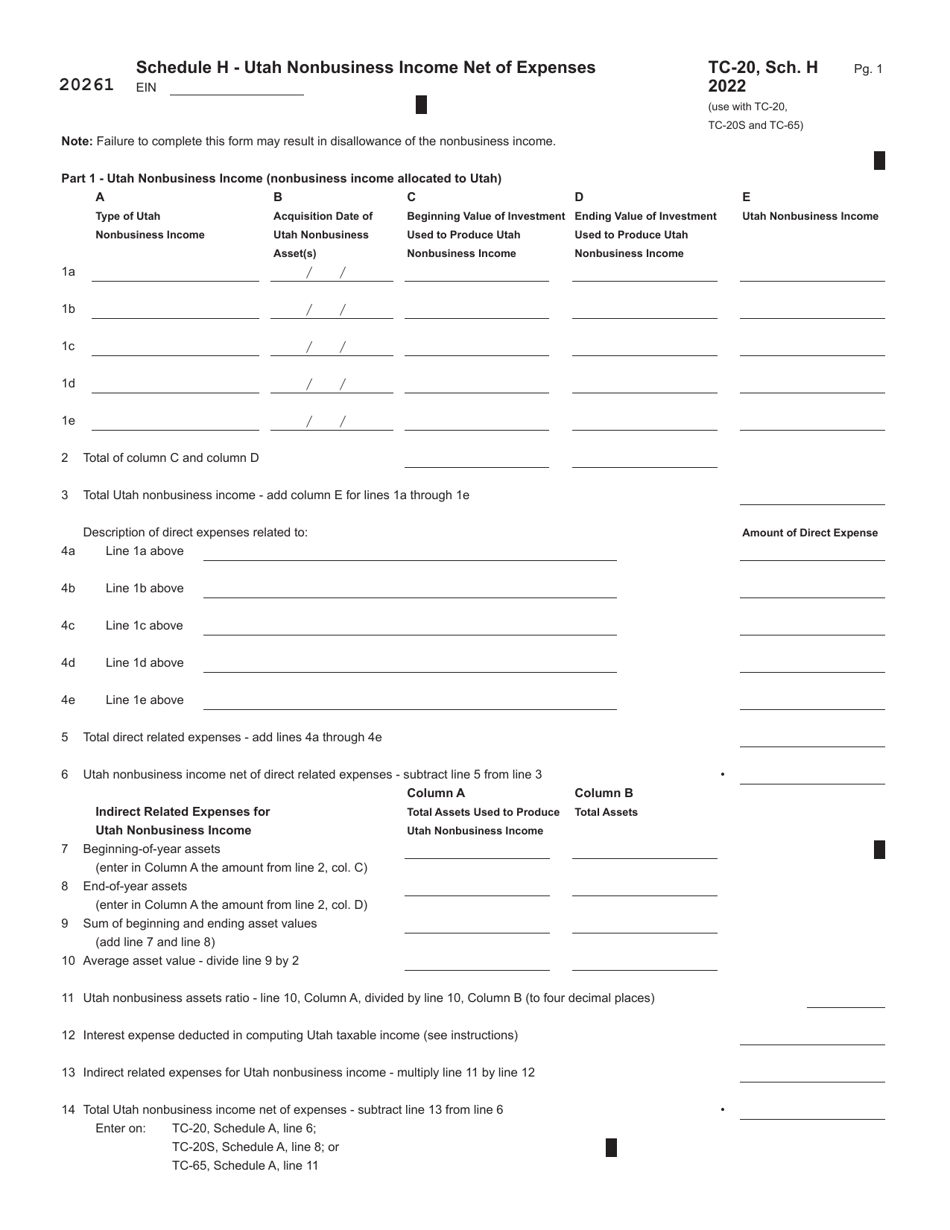

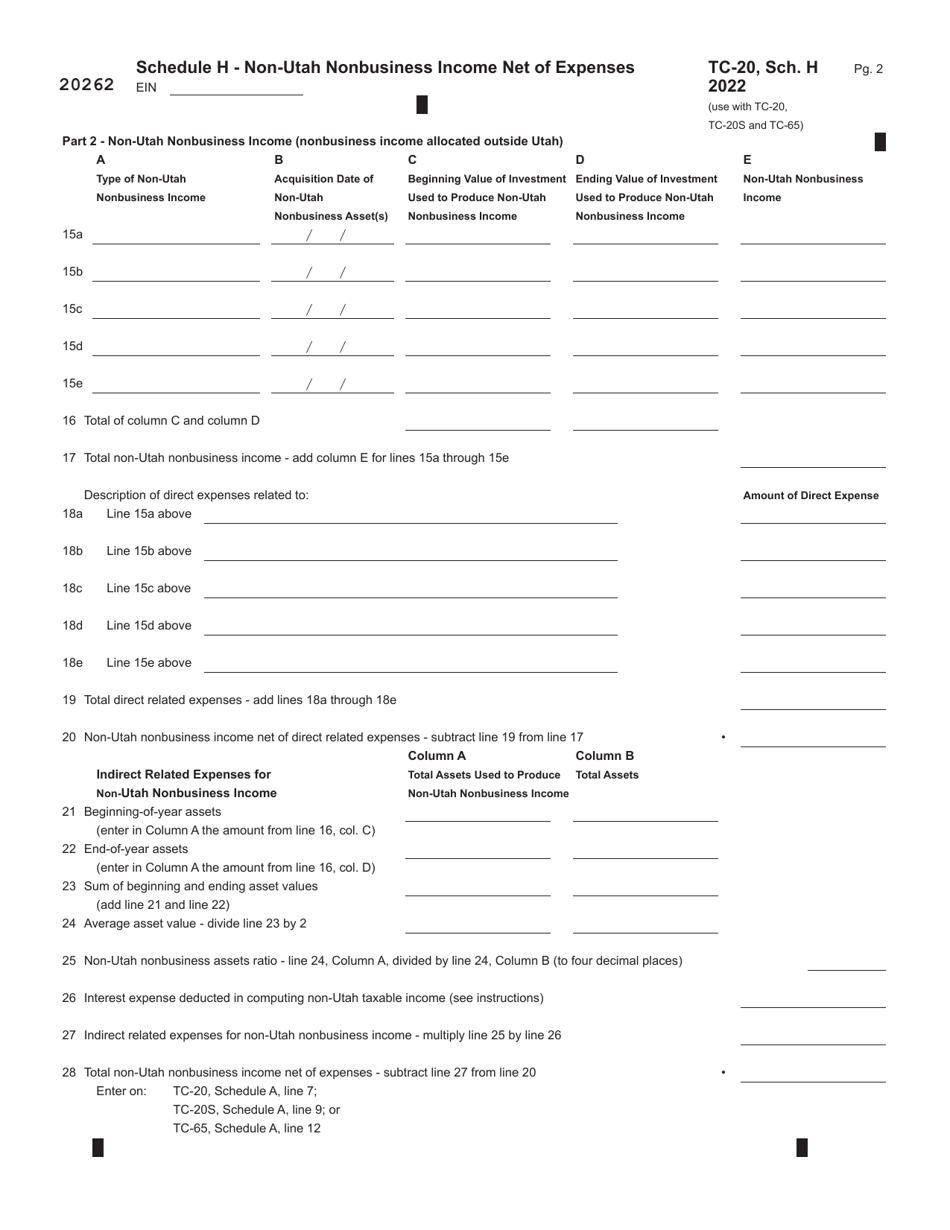

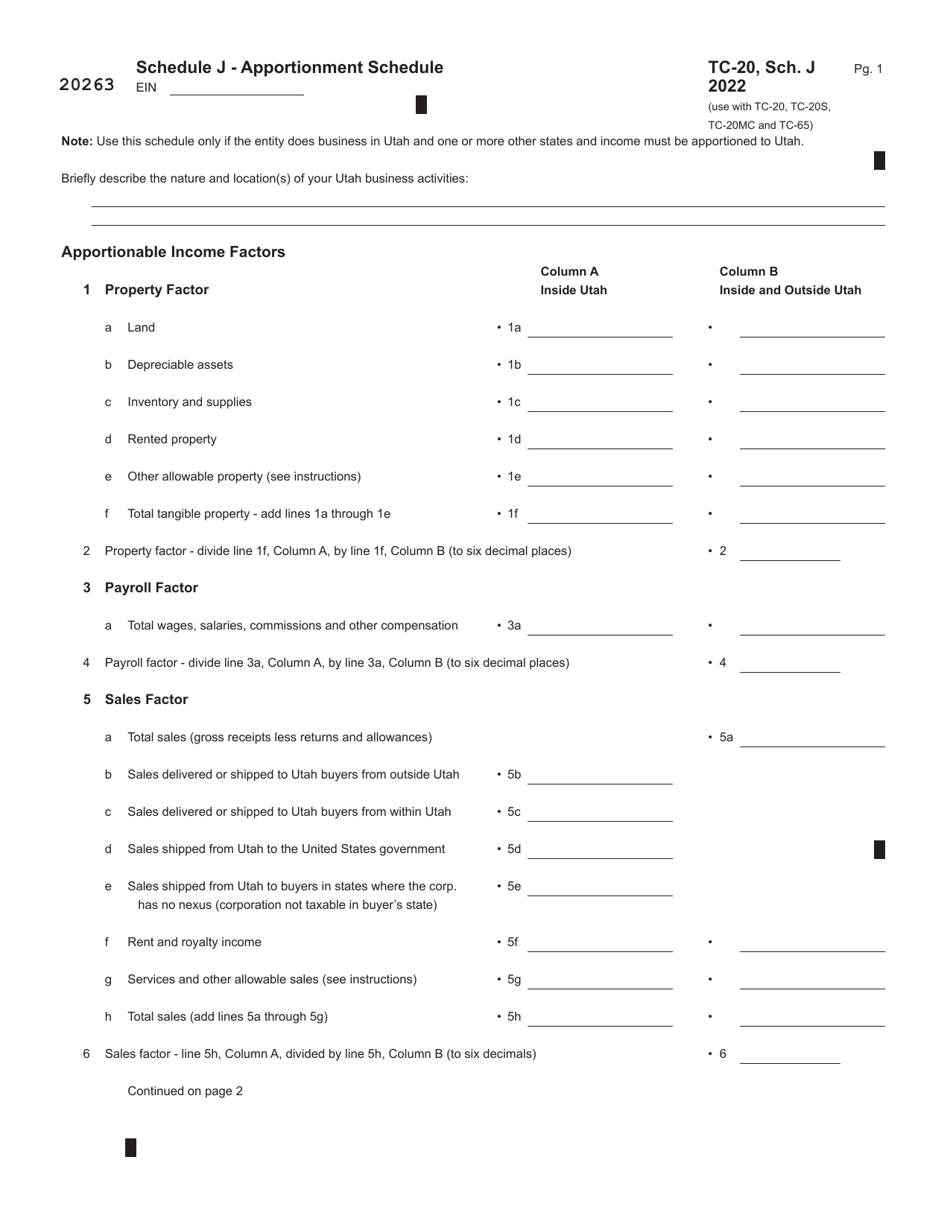

Form TC-20 Utah Corporation Franchise and Income Tax Return - Utah

What Is Form TC-20?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. Check the official instructions before completing and submitting the form.

FAQ

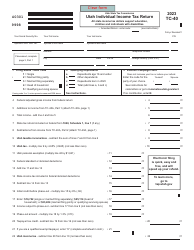

Q: What is Form TC-20?

A: Form TC-20 is the Utah Corporation Franchise and Income Tax Return.

Q: Who needs to file Form TC-20?

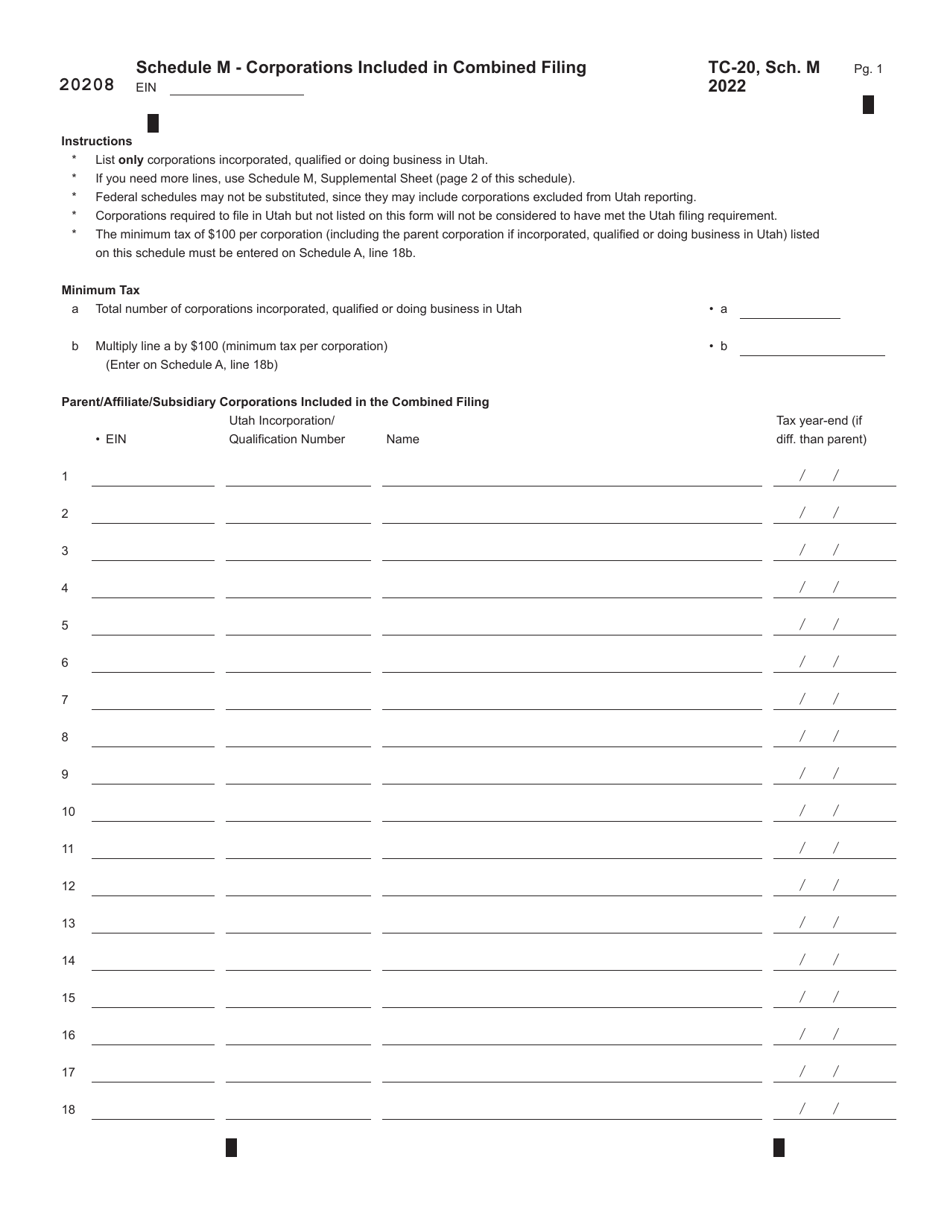

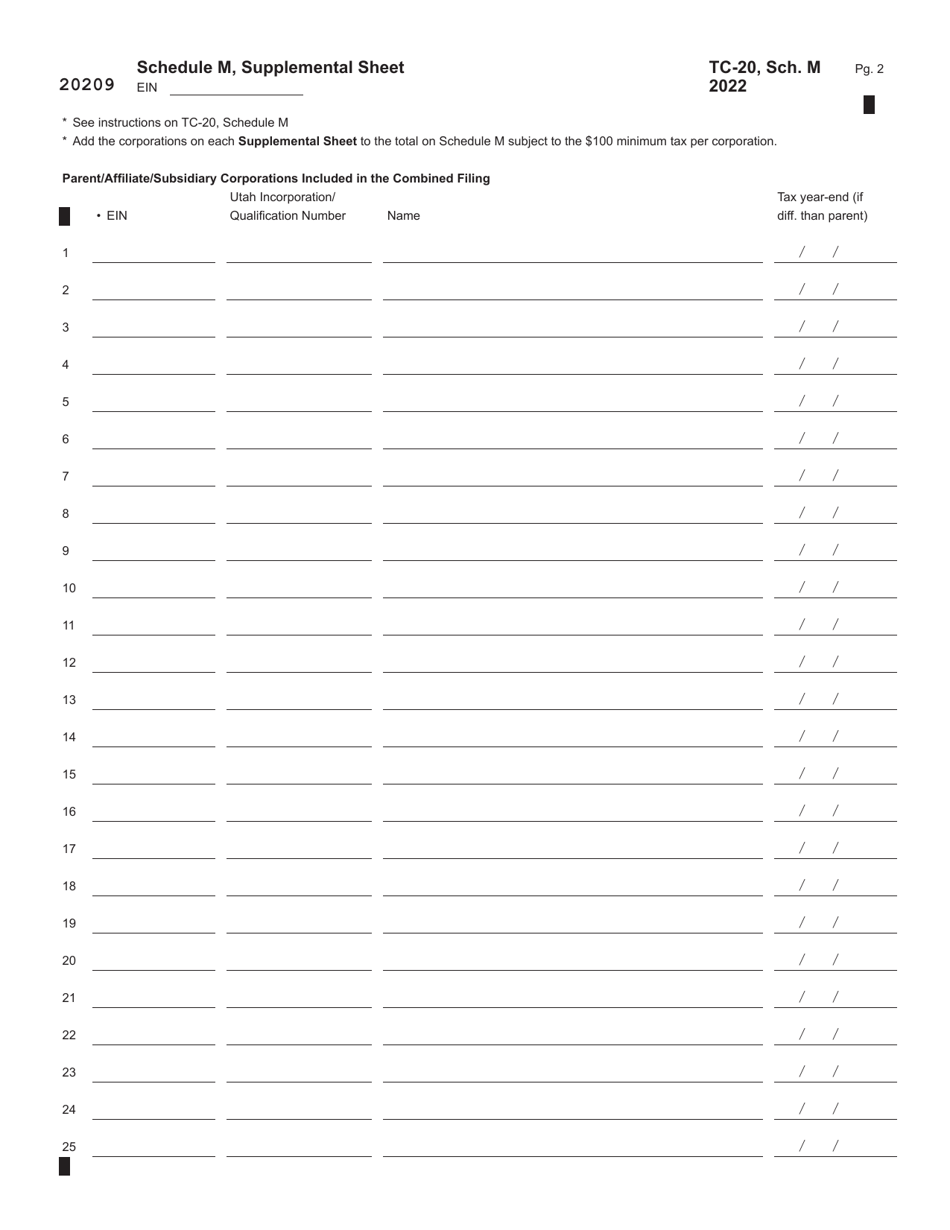

A: Any corporation doing business in Utah or incorporated in Utah must file Form TC-20.

Q: What is the purpose of Form TC-20?

A: Form TC-20 is used to report the corporation's income and calculate the franchise tax owed to the state of Utah.

Q: When is Form TC-20 due?

A: Form TC-20 is due on the 15th day of the 4th month following the end of the corporation's tax year.

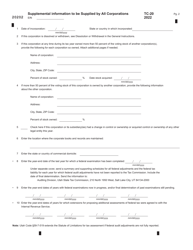

Q: What information is required to complete Form TC-20?

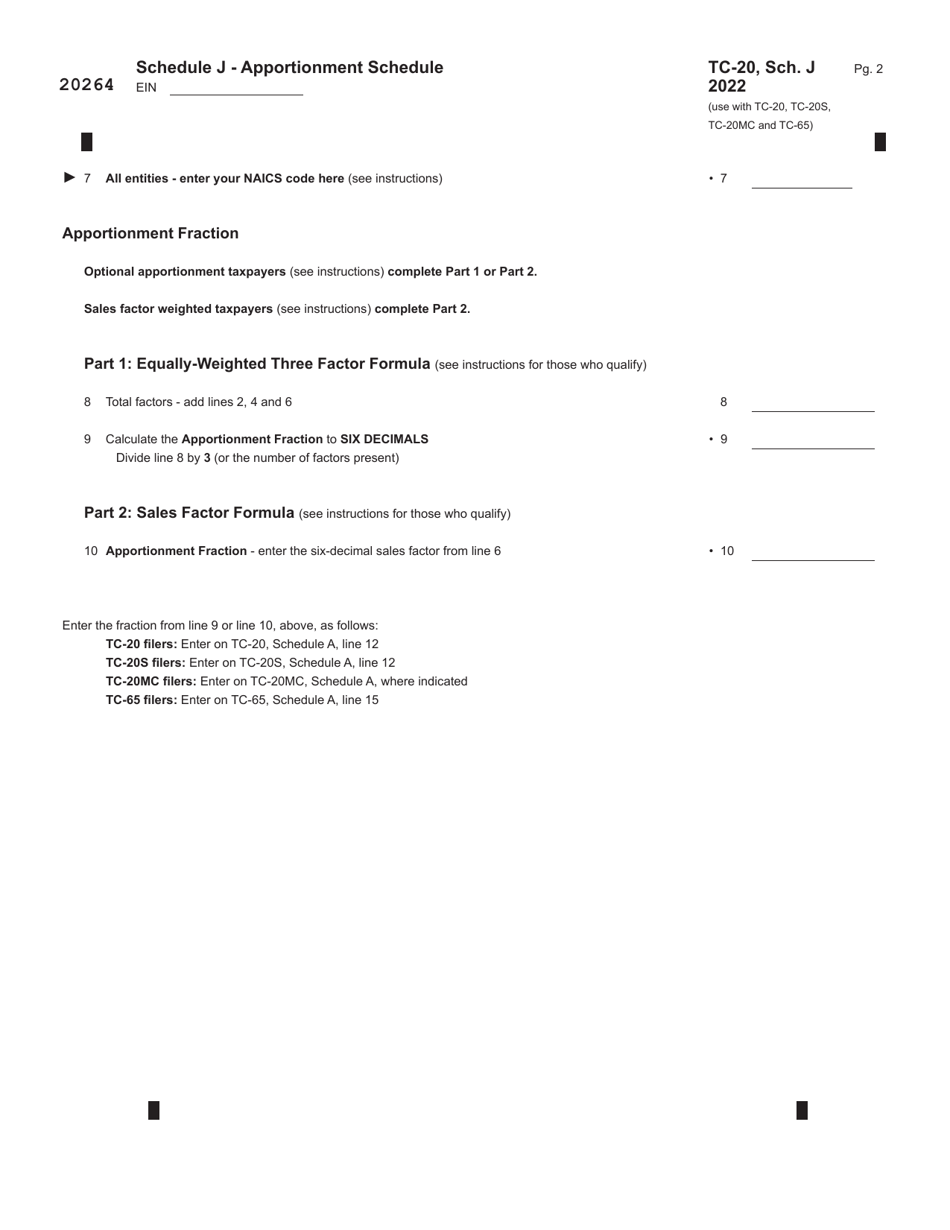

A: Some of the information required on Form TC-20 includes the corporation's revenue, deductions, credits, and apportionment factors.

Q: Are there any penalties for late filing of Form TC-20?

A: Yes, penalties may be assessed for late filing or underpayment of the franchise tax.

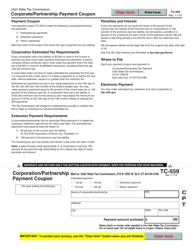

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-20 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.