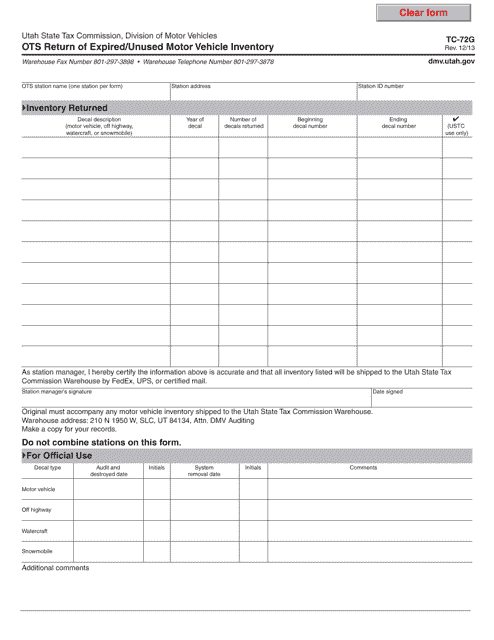

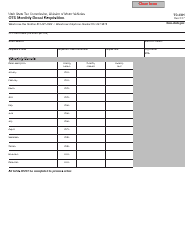

Form TC-72G Ots Return of Expired / Unused Motor Vehicle Inventory - Utah

What Is Form TC-72G?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-72G?

A: Form TC-72G is the Ots Return of Expired/Unused Motor Vehicle Inventory form in Utah.

Q: What is the purpose of Form TC-72G?

A: The purpose of Form TC-72G is to report and return expired or unused motor vehicle inventory in Utah.

Q: Who needs to file Form TC-72G?

A: Motor vehicle dealers in Utah who have expired or unused inventory must file Form TC-72G.

Q: When is Form TC-72G due?

A: Form TC-72G is due by the 30th day of each month for the previous month's inventory.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-72G by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.