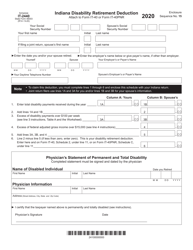

This version of the form is not currently in use and is provided for reference only. Download this version of

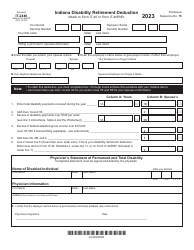

State Form 46003 Schedule IT-2440

for the current year.

State Form 46003 Schedule IT-2440 Indiana Disability Retirement Deduction - Indiana

What Is State Form 46003 Schedule IT-2440?

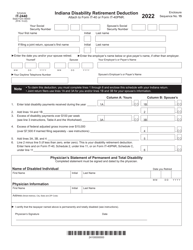

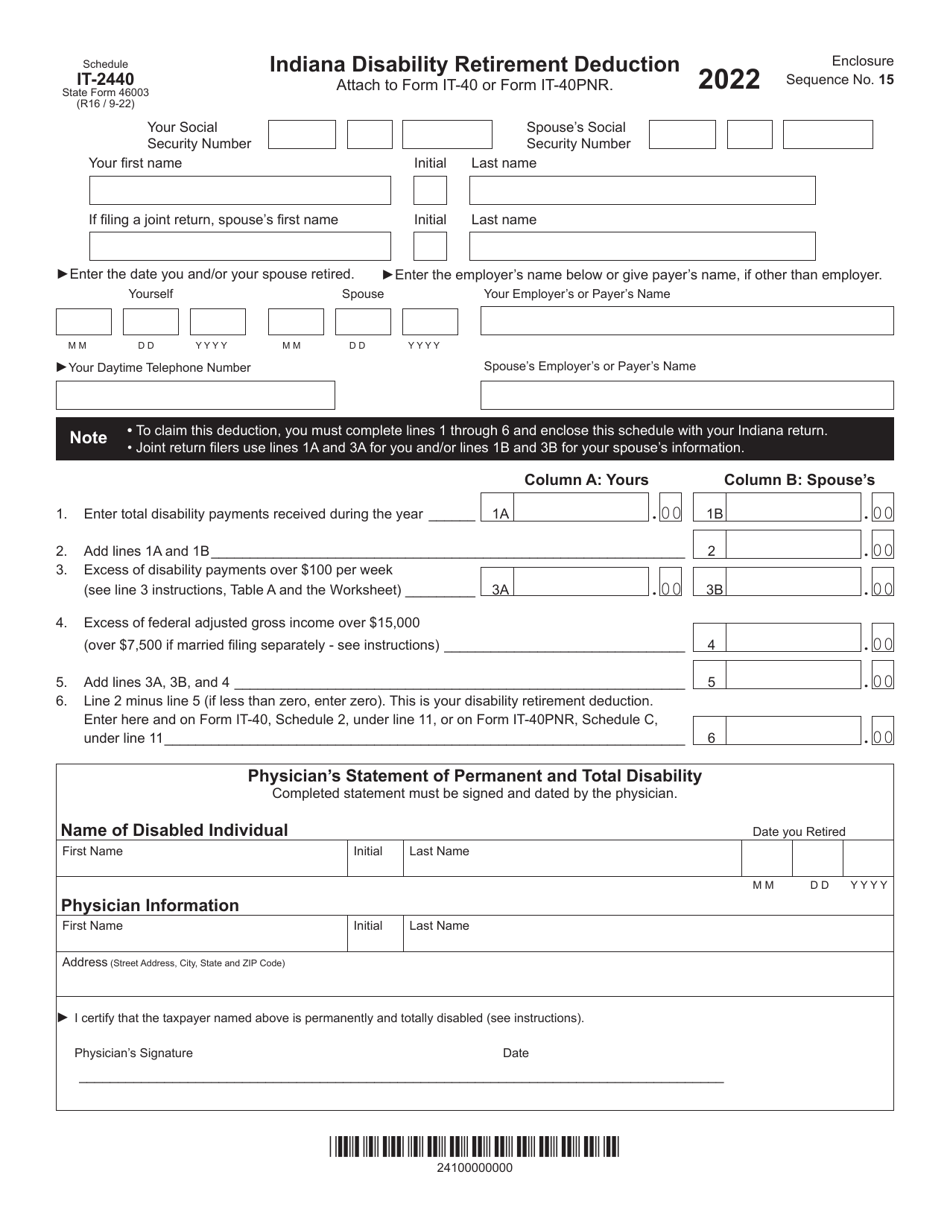

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 46003 Schedule IT-2440?

A: Form 46003 Schedule IT-2440 is used to claim the Indiana Disability Retirement Deduction in Indiana.

Q: What is the Indiana Disability Retirement Deduction?

A: The Indiana Disability Retirement Deduction is a deduction that retired individuals with disabilities can claim on their Indiana state taxes.

Q: Who is eligible for the Indiana Disability Retirement Deduction?

A: Individuals who are retired and have a disability are eligible for the Indiana Disability Retirement Deduction.

Q: How much is the Indiana Disability Retirement Deduction?

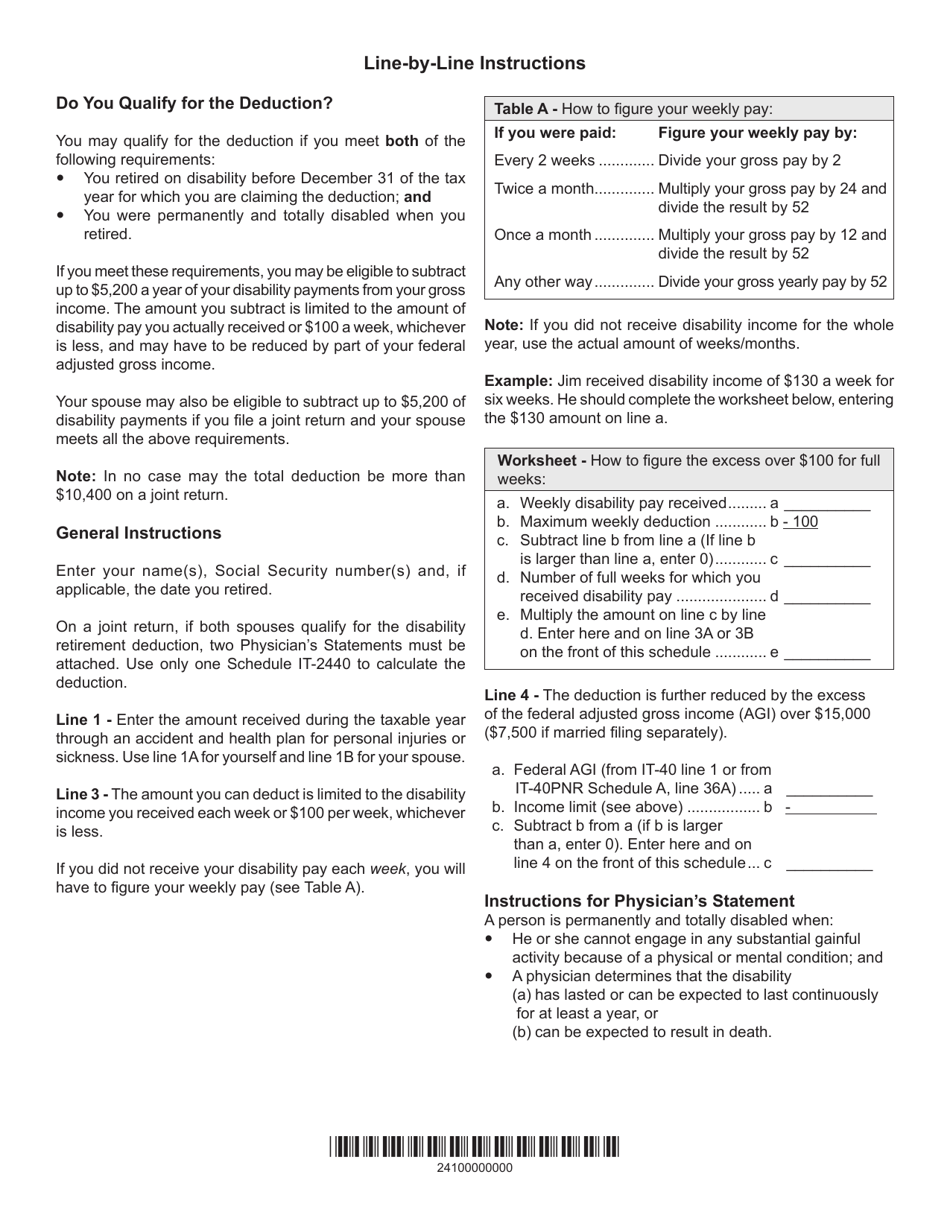

A: The amount of the Indiana Disability Retirement Deduction varies depending on the individual's circumstances. It is best to refer to the instructions on Form 46003 Schedule IT-2440 for specific details.

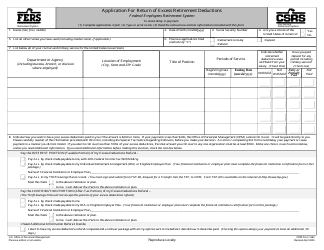

Q: How do I claim the Indiana Disability Retirement Deduction?

A: To claim the Indiana Disability Retirement Deduction, you must complete Form 46003 Schedule IT-2440 and include it with your Indiana state tax return.

Q: Are there any qualification requirements for the Indiana Disability Retirement Deduction?

A: Yes, there are certain qualification requirements for the Indiana Disability Retirement Deduction. You must meet the criteria outlined on Form 46003 Schedule IT-2440.

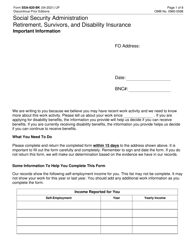

Q: Can I claim the Indiana Disability Retirement Deduction if I receive Social Security disability benefits?

A: Yes, if you meet the other qualification requirements, you can still claim the Indiana Disability Retirement Deduction even if you receive Social Security disability benefits.

Q: Is the Indiana Disability Retirement Deduction refundable?

A: No, the Indiana Disability Retirement Deduction is not refundable. It is a deduction that can help reduce your taxable income.

Q: Can I claim the Indiana Disability Retirement Deduction if I am not retired?

A: No, the Indiana Disability Retirement Deduction is only available to individuals who are retired.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 46003 Schedule IT-2440 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.