This version of the form is not currently in use and is provided for reference only. Download this version of

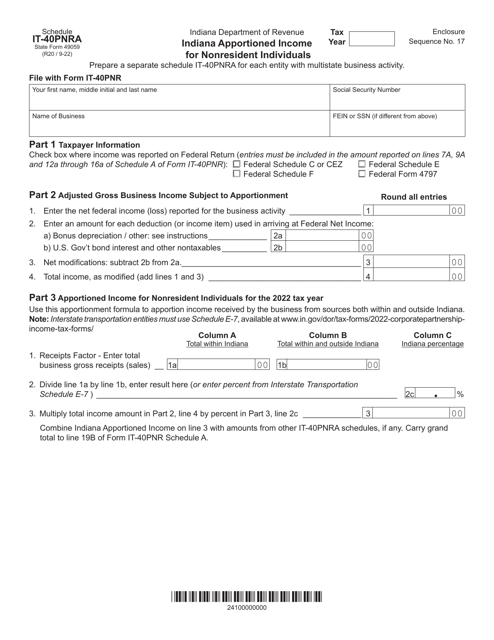

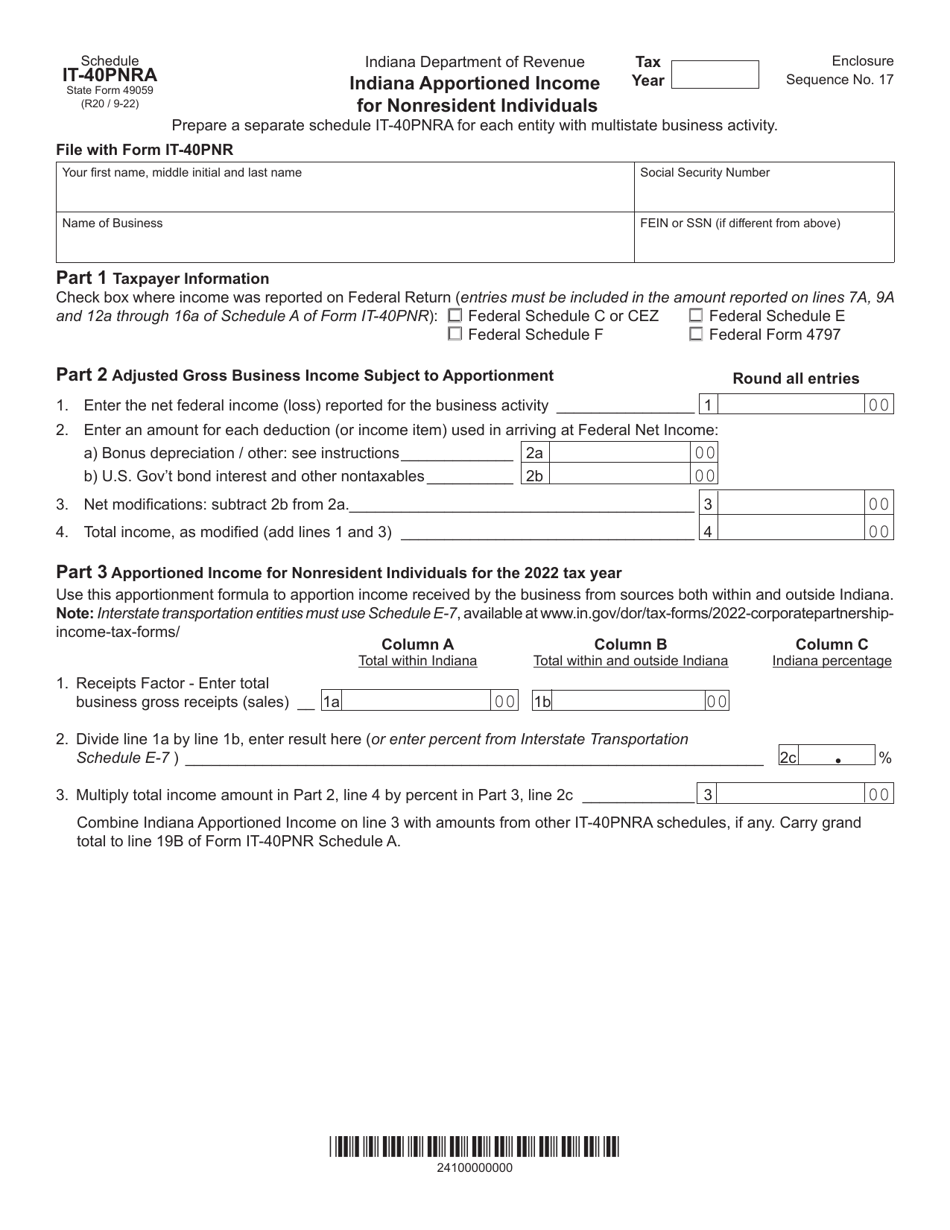

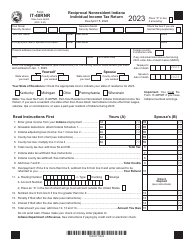

State Form 49059 Schedule IT-40PNRA

for the current year.

State Form 49059 Schedule IT-40PNRA Indiana Apportioned Income for Nonresident Individuals - Indiana

What Is State Form 49059 Schedule IT-40PNRA?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 49059 Schedule IT-40PNRA?

A: State Form 49059 Schedule IT-40PNRA is a form used in Indiana to report apportioned income for nonresident individuals.

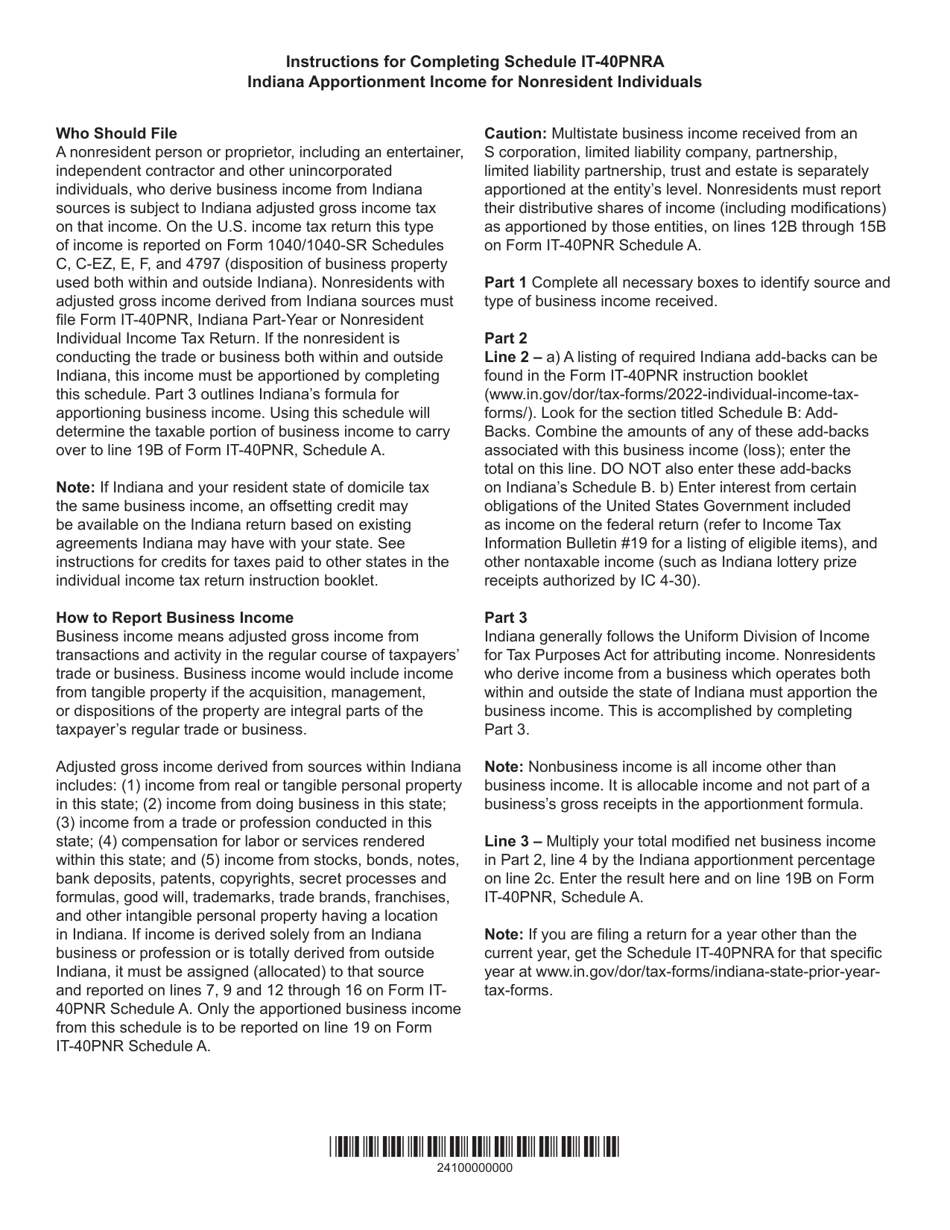

Q: Who needs to file State Form 49059 Schedule IT-40PNRA?

A: Nonresident individuals who have apportioned income in Indiana need to file State Form 49059 Schedule IT-40PNRA.

Q: What is apportioned income?

A: Apportioned income refers to income earned in multiple states, which is divided or allocated based on a formula.

Q: What is the purpose of State Form 49059 Schedule IT-40PNRA?

A: The purpose of State Form 49059 Schedule IT-40PNRA is to calculate and report the portion of a nonresident individual's income that is subject to Indiana tax.

Q: Is State Form 49059 Schedule IT-40PNRA required for residents of Indiana?

A: No, State Form 49059 Schedule IT-40PNRA is only required for nonresident individuals who have apportioned income in Indiana.

Q: Are there any deadlines for filing State Form 49059 Schedule IT-40PNRA?

A: The deadline for filing State Form 49059 Schedule IT-40PNRA is the same as the deadline for filing the individual income tax return in Indiana, which is typically April 15th.

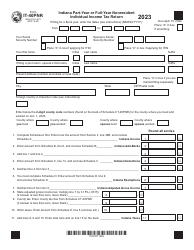

Q: What information do I need to complete State Form 49059 Schedule IT-40PNRA?

A: To complete State Form 49059 Schedule IT-40PNRA, you will need information about the nonresident individual's total income, income allocated to Indiana, and the apportionment formula used.

Q: Can I e-file State Form 49059 Schedule IT-40PNRA?

A: Yes, electronic filing options are available for State Form 49059 Schedule IT-40PNRA in Indiana.

Q: Is there a fee for filing State Form 49059 Schedule IT-40PNRA?

A: There is no specific fee for filing State Form 49059 Schedule IT-40PNRA, but there may be applicable tax preparation or filing fees depending on the software or service used.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49059 Schedule IT-40PNRA by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.