This version of the form is not currently in use and is provided for reference only. Download this version of

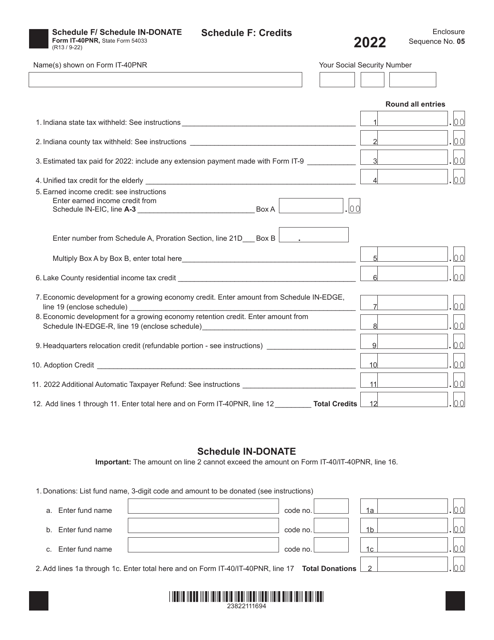

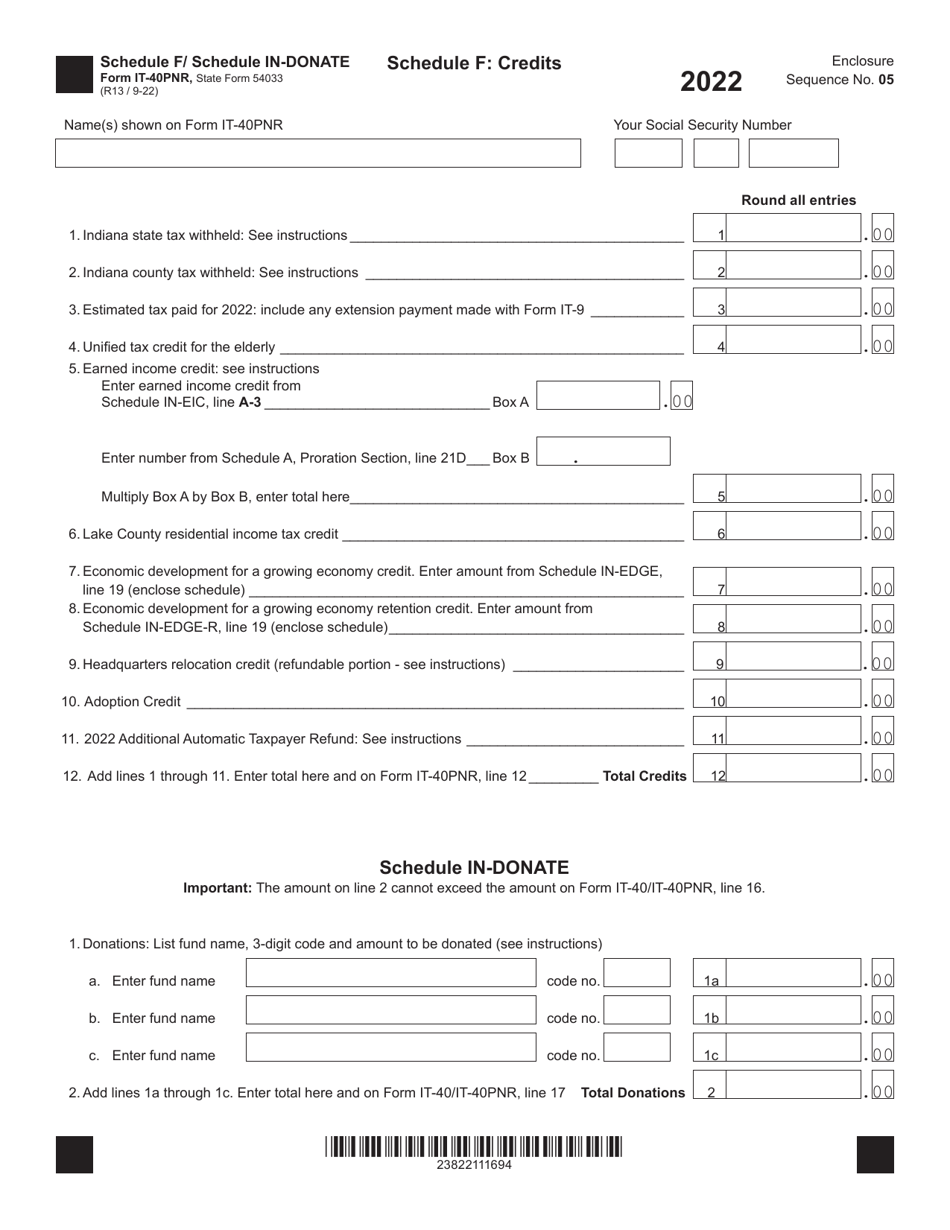

Form IT-40PNR (State Form 54033) Schedule F, IN-DONATE

for the current year.

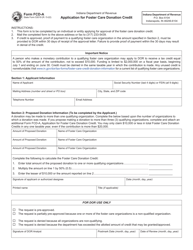

Form IT-40PNR (State Form 54033) Schedule F, IN-DONATE Credits / Donations - Indiana

What Is Form IT-40PNR (State Form 54033) Schedule F, IN-DONATE?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40PNR?

A: Form IT-40PNR is the Indiana Schedule F form for taxpayers who are filing as part-year or nonresident individuals.

Q: What is Schedule F?

A: Schedule F is the section of Form IT-40PNR that pertains to IN-DONATE Credits/Donations in Indiana.

Q: What are IN-DONATE Credits/Donations?

A: IN-DONATE Credits/Donations refer to tax credits or deductions that can be claimed for charitable contributions made in Indiana.

Q: What information is required on Schedule F (Form IT-40PNR)?

A: Schedule F requires taxpayers to provide details of their charitable contributions made in Indiana.

Q: How do I file Form IT-40PNR and Schedule F?

A: Form IT-40PNR and Schedule F can be filed electronically or by mail, along with the rest of your state income tax return in Indiana.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 54033) Schedule F, IN-DONATE by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.