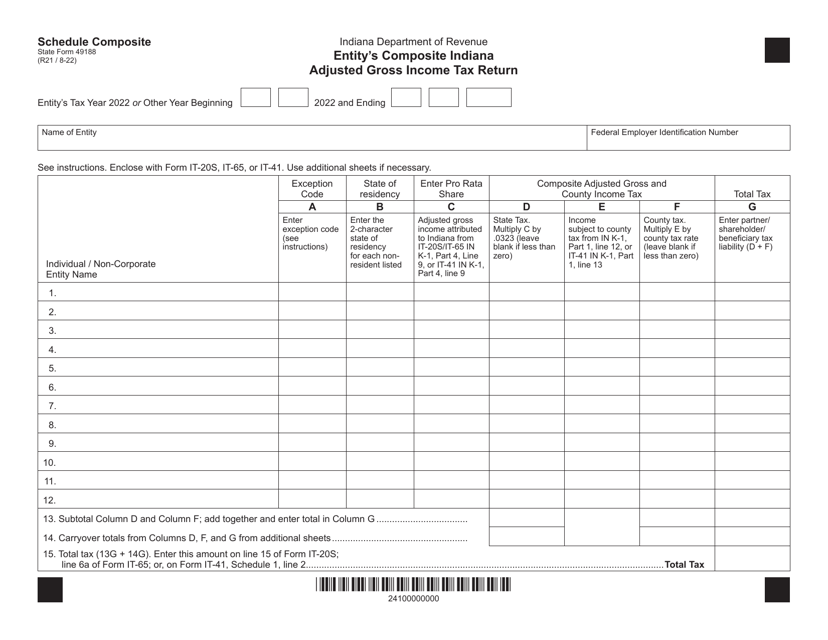

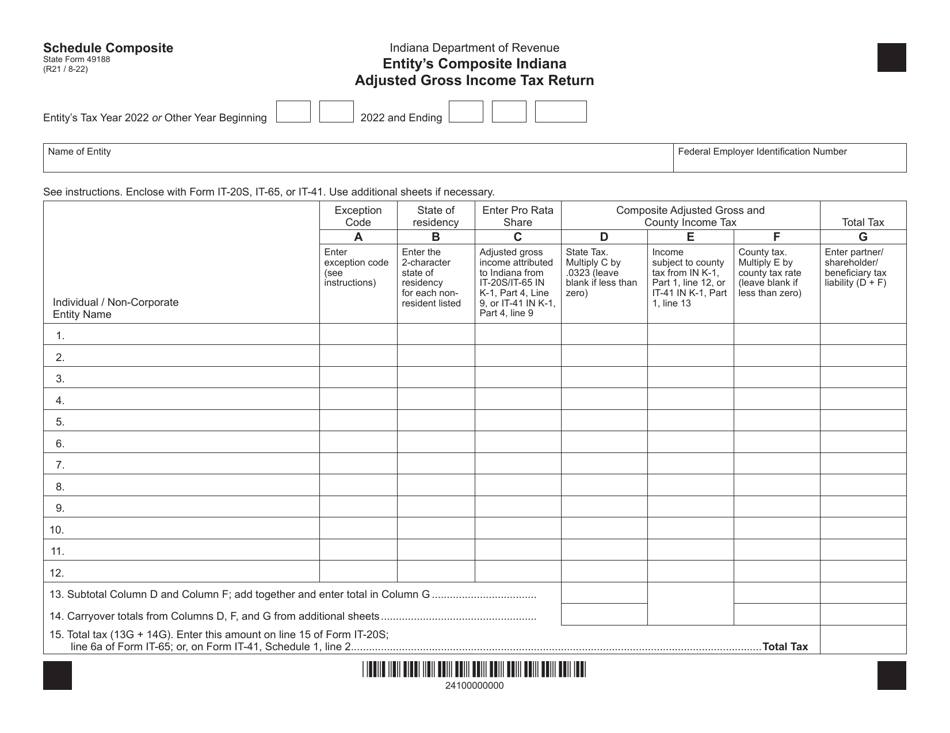

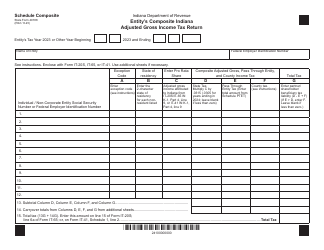

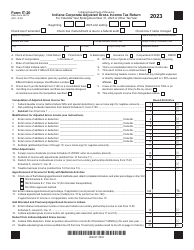

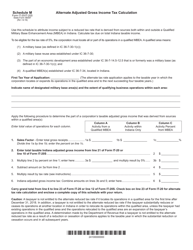

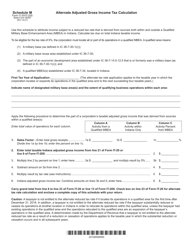

Form 49188 Schedule COMPOSITE Entity's Composite Indiana Adjusted Gross Income Tax Return - Indiana

What Is Form 49188 Schedule COMPOSITE?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 49188 Schedule COMPOSITE?

A: Form 49188 Schedule COMPOSITE is the Composite Indiana Adjusted Gross Income Tax Return for entities in Indiana.

Q: Who needs to file Form 49188 Schedule COMPOSITE?

A: Entities that have nonresident members conducting business in Indiana but are not required to file a separate Indiana income tax return need to file Form 49188 Schedule COMPOSITE.

Q: What is Composite Indiana Adjusted Gross Income Tax?

A: Composite Indiana Adjusted Gross Income Tax is a tax that is calculated on behalf of nonresident members of an entity conducting business in Indiana.

Q: How do I file Form 49188 Schedule COMPOSITE?

A: Form 49188 Schedule COMPOSITE should be filed along with the entity's Indiana income tax return.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 49188 Schedule COMPOSITE by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.