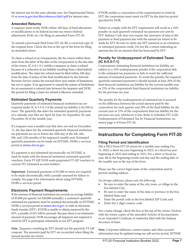

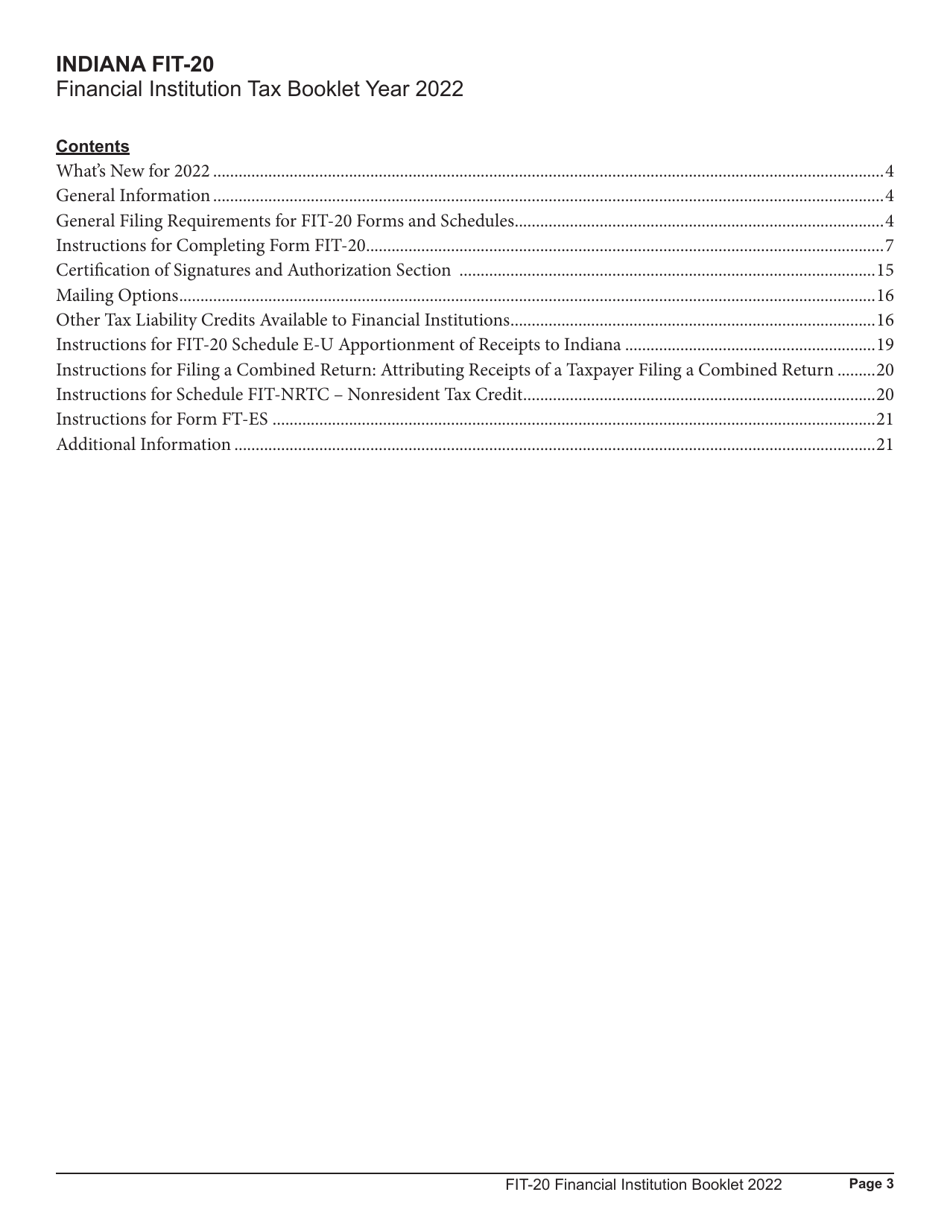

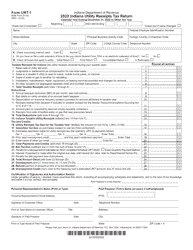

Instructions for Form FIT-20, State Form 44623 Schedule E-U, FIT-ES, FIT-NRTC Financial Institution Tax Return - Indiana

This document contains official instructions for Schedule E-U , Schedule FIT-ES , and Schedule FIT-NRTC for Form FIT-20 , and State Form 44623 . . These documents are released and collected by the Indiana Department of Revenue. An up-to-date fillable Form FIT-20 (State Form 44622) Schedule E-U is available for download through this link.

FAQ

Q: What is Form FIT-20?

A: Form FIT-20 is a Financial Institution Tax Return in Indiana.

Q: What is the purpose of Form FIT-20?

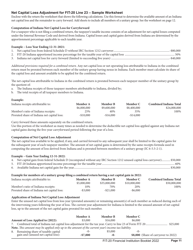

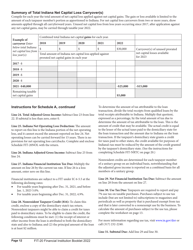

A: Form FIT-20 is used by financial institutions to report their income and calculate their tax liability in Indiana.

Q: What other schedules are associated with Form FIT-20?

A: Form FIT-20 is associated with Schedule E-U, FIT-ES, and FIT-NRTC.

Q: What is Schedule E-U?

A: Schedule E-U is a supplemental schedule for reporting income and deductions of a financial institution in Indiana.

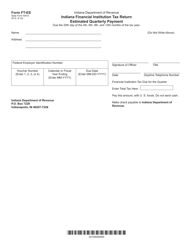

Q: What is FIT-ES?

A: FIT-ES is a schedule used to compute the estimated tax liability of a financial institution in Indiana.

Q: What is FIT-NRTC?

A: FIT-NRTC is a schedule for calculating the nonrefundable renter's tax credit for financial institutions in Indiana.

Q: Who needs to file Form FIT-20?

A: Financial institutions operating in Indiana are required to file Form FIT-20.

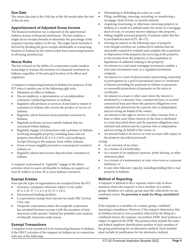

Q: Are there any filing deadlines for Form FIT-20?

A: Yes, financial institutions must file Form FIT-20 by the 15th day of the 4th month following the end of their fiscal year.

Q: Are there any penalties for late filing of Form FIT-20?

A: Yes, financial institutions may be subject to penalties for late filing or failure to file Form FIT-20 in Indiana.

Instruction Details:

- This 22-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Indiana Department of Revenue.