This version of the form is not currently in use and is provided for reference only. Download this version of

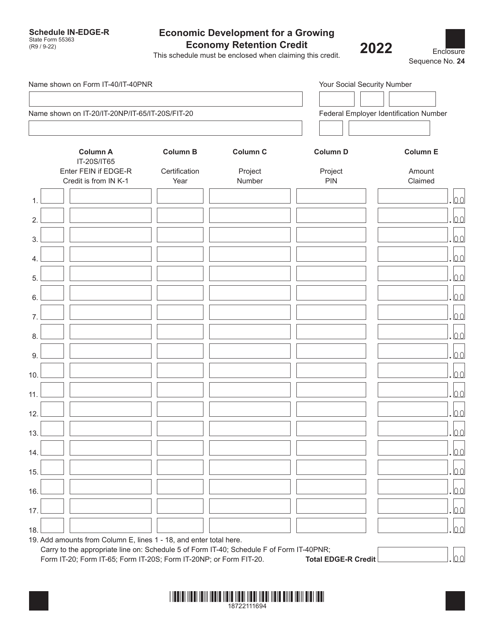

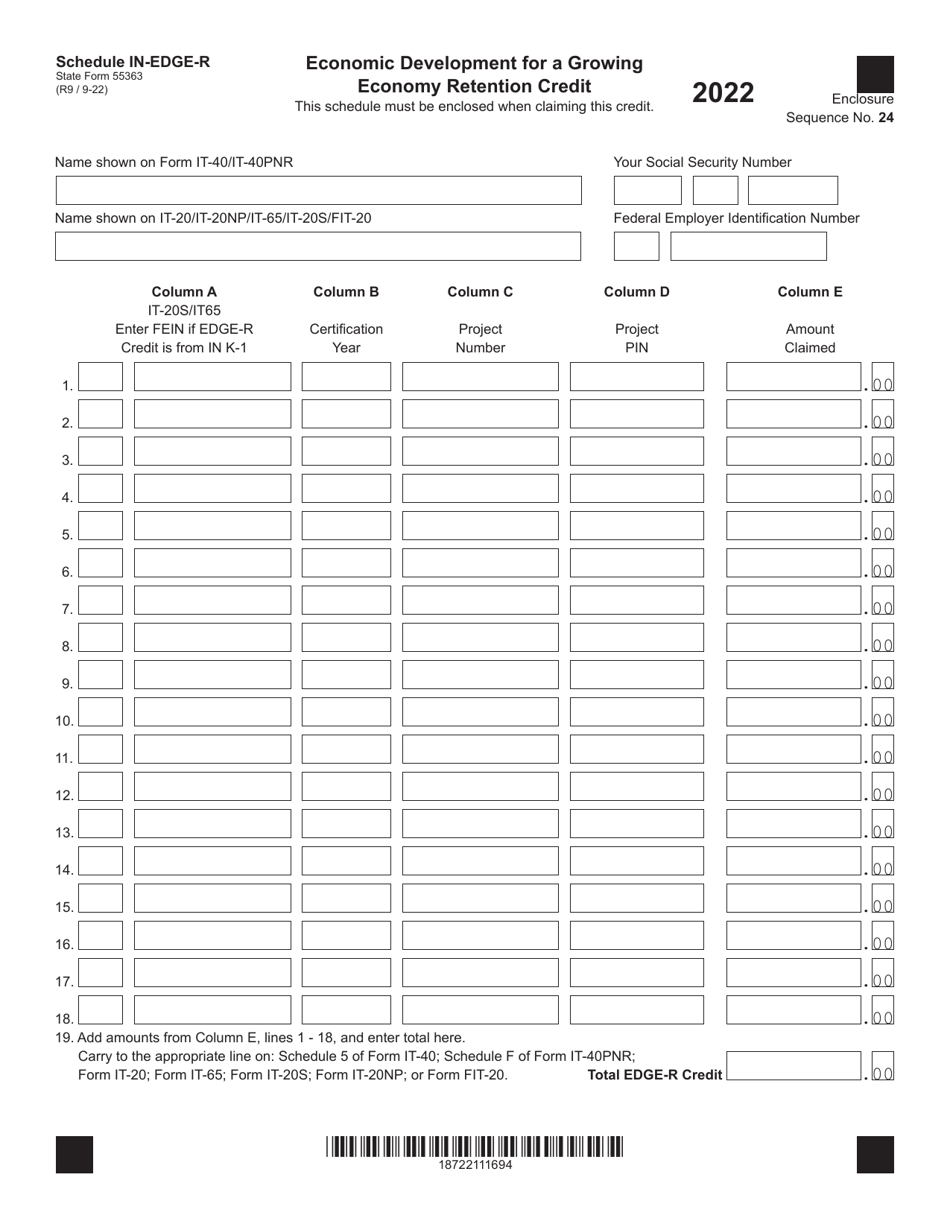

State Form 55363 Schedule IN-EDGE-R

for the current year.

State Form 55363 Schedule IN-EDGE-R Economic Development for a Growing Economy Retention Credit - Indiana

What Is State Form 55363 Schedule IN-EDGE-R?

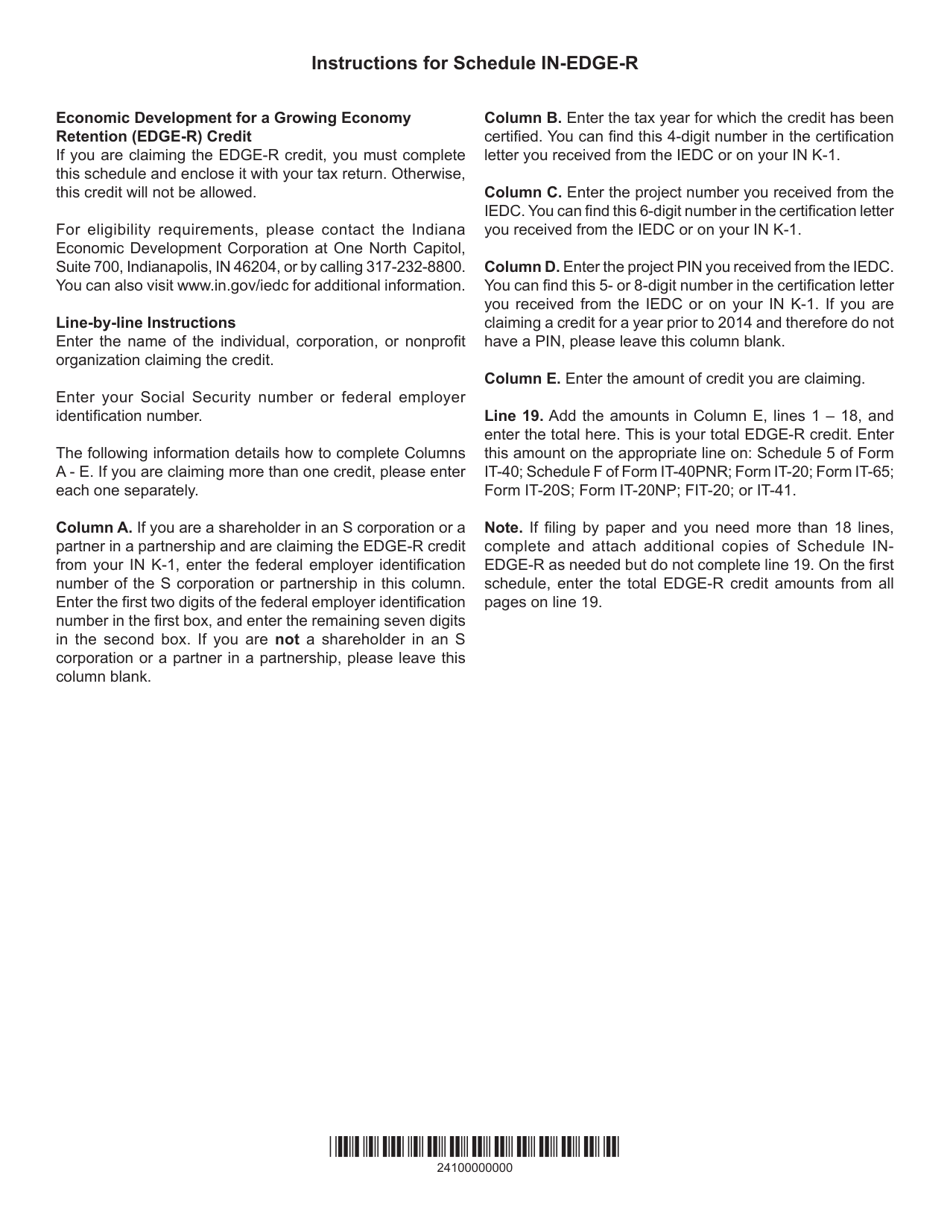

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55363?

A: Form 55363 is the Schedule IN-EDGE-R for claiming the Economic Development for a Growing Economy Retention Credit in Indiana.

Q: What is the purpose of the Economic Development for a Growing Economy Retention Credit?

A: The purpose of the Economic Development for a Growing Economy Retention Credit is to incentivize businesses to retain and create jobs in Indiana.

Q: Who is eligible for the Economic Development for a Growing Economy Retention Credit?

A: Eligibility for the Economic Development for a Growing Economy Retention Credit depends on meeting certain criteria set by the state of Indiana.

Q: What is the benefit of claiming the Economic Development for a Growing Economy Retention Credit?

A: The benefit of claiming the Economic Development for a Growing Economy Retention Credit is a reduction in state tax liability for businesses.

Q: How can I claim the Economic Development for a Growing Economy Retention Credit?

A: To claim the Economic Development for a Growing Economy Retention Credit, businesses need to complete and submit Form 55363 Schedule IN-EDGE-R along with their state tax return.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55363 Schedule IN-EDGE-R by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.