This version of the form is not currently in use and is provided for reference only. Download this version of

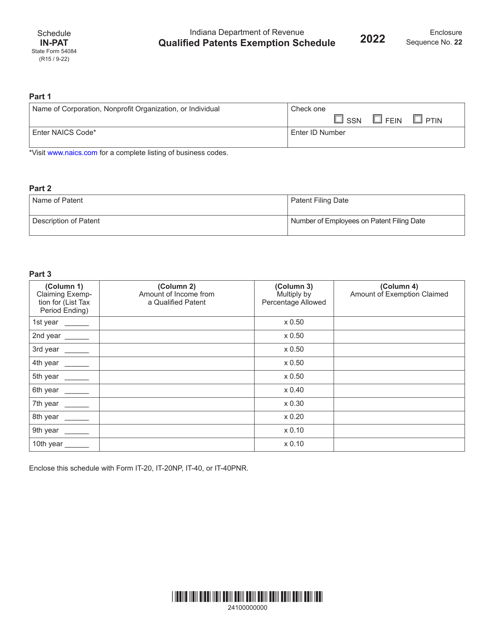

State Form 54084 Schedule IN-PAT

for the current year.

State Form 54084 Schedule IN-PAT Qualified Patents Exemption Schedule - Indiana

What Is State Form 54084 Schedule IN-PAT?

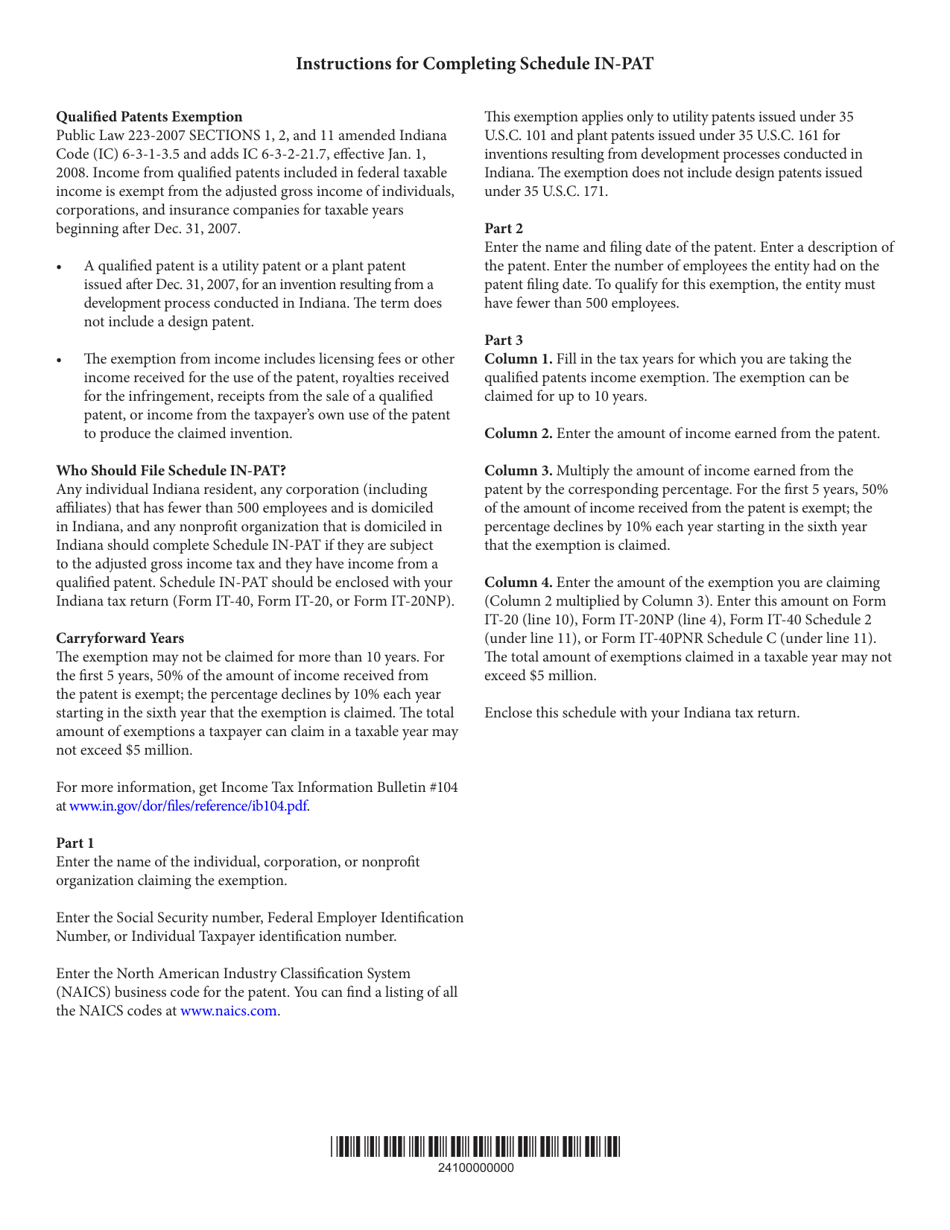

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54084?

A: Form 54084 is the Schedule IN-PAT, which is the Indiana Qualified Patents Exemption Schedule.

Q: What is the purpose of Schedule IN-PAT?

A: The purpose of Schedule IN-PAT is to claim a qualified patents exemption in Indiana.

Q: What is the qualified patents exemption in Indiana?

A: The qualified patents exemption in Indiana allows for a reduced tax rate on qualified patent income.

Q: Who needs to file Schedule IN-PAT?

A: Anyone claiming a qualified patents exemption in Indiana needs to file Schedule IN-PAT.

Q: What information is required on Schedule IN-PAT?

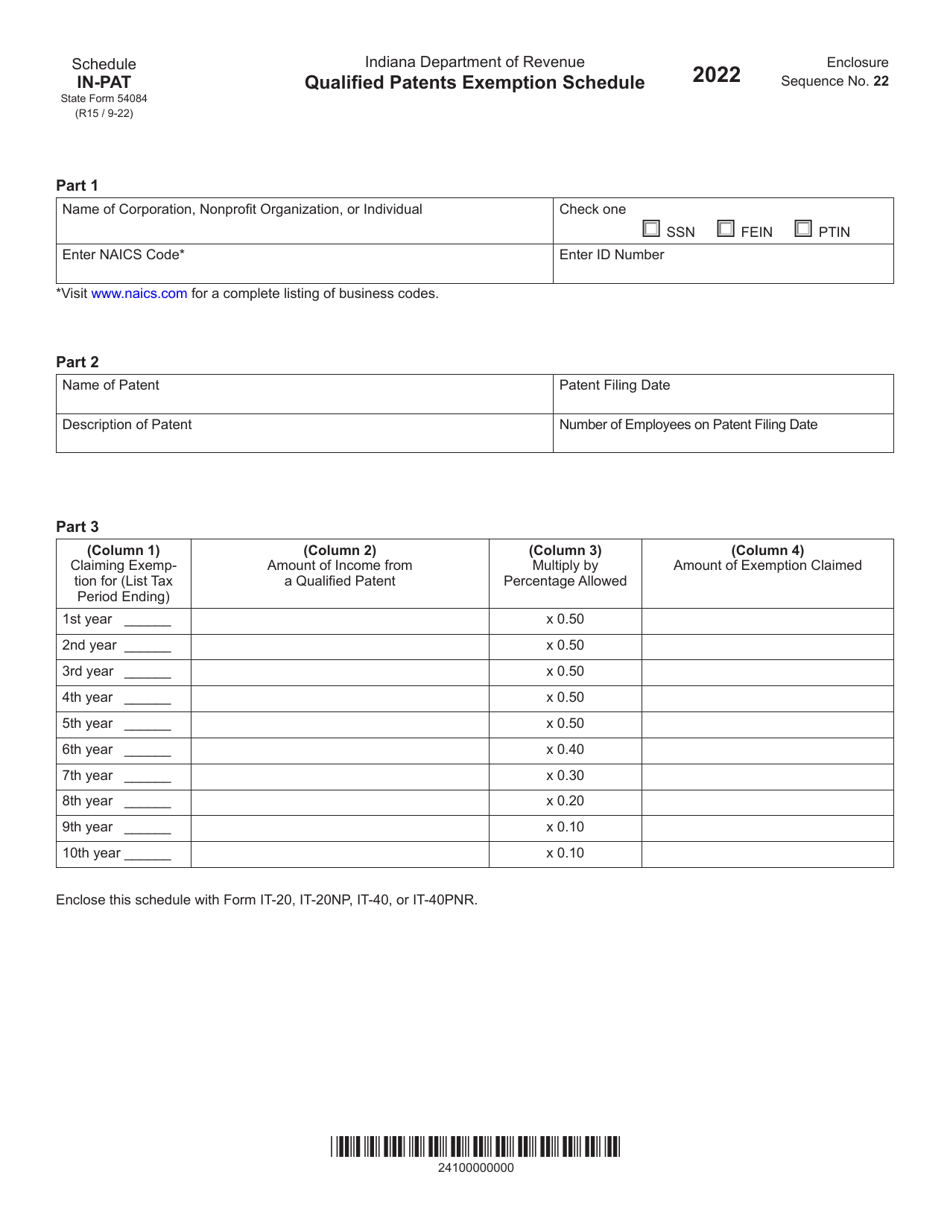

A: Schedule IN-PAT requires information about the taxpayer, the patent income, and the calculation of the exemption.

Q: When is the deadline to file Schedule IN-PAT?

A: The deadline to file Schedule IN-PAT is the same as the deadline for the Indiana state income tax return.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54084 Schedule IN-PAT by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.