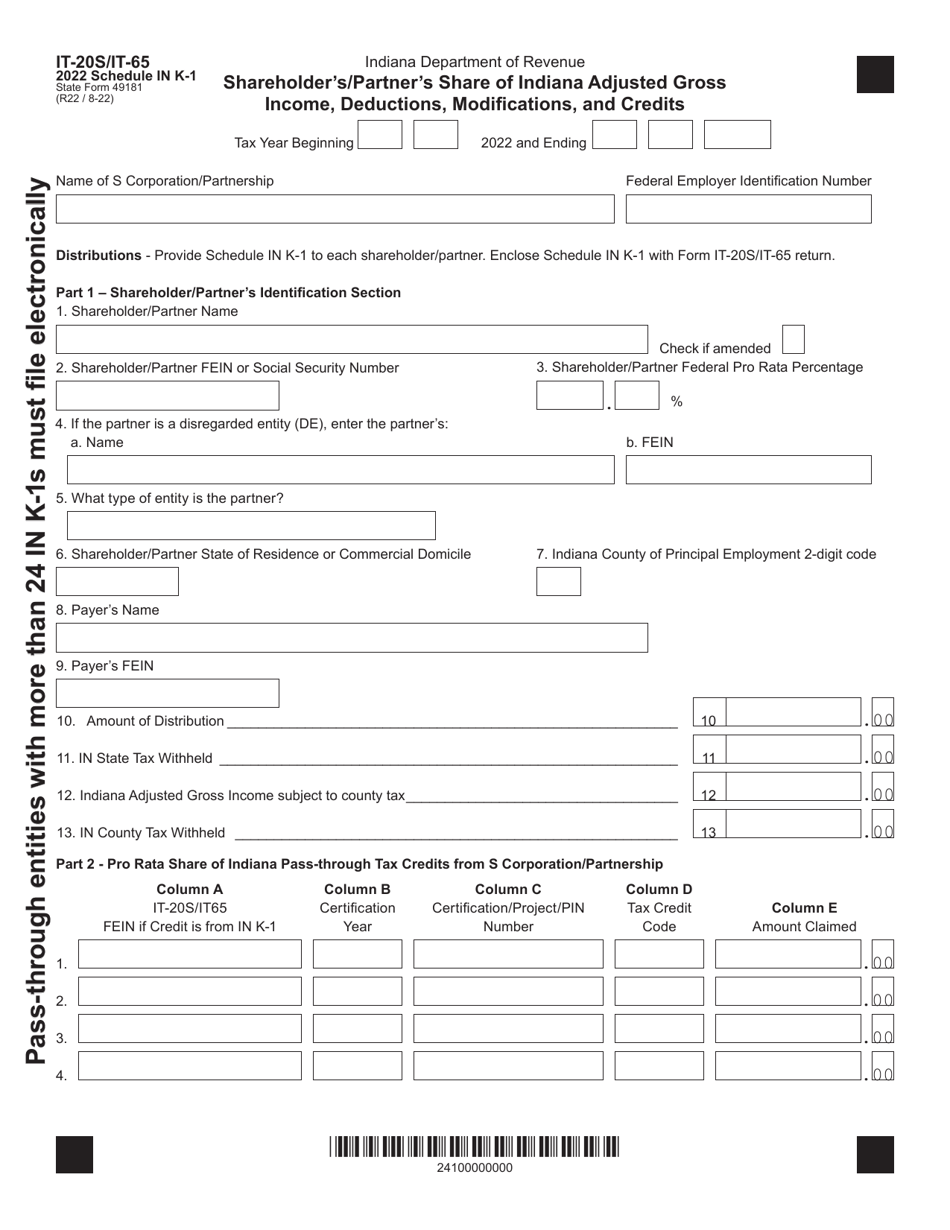

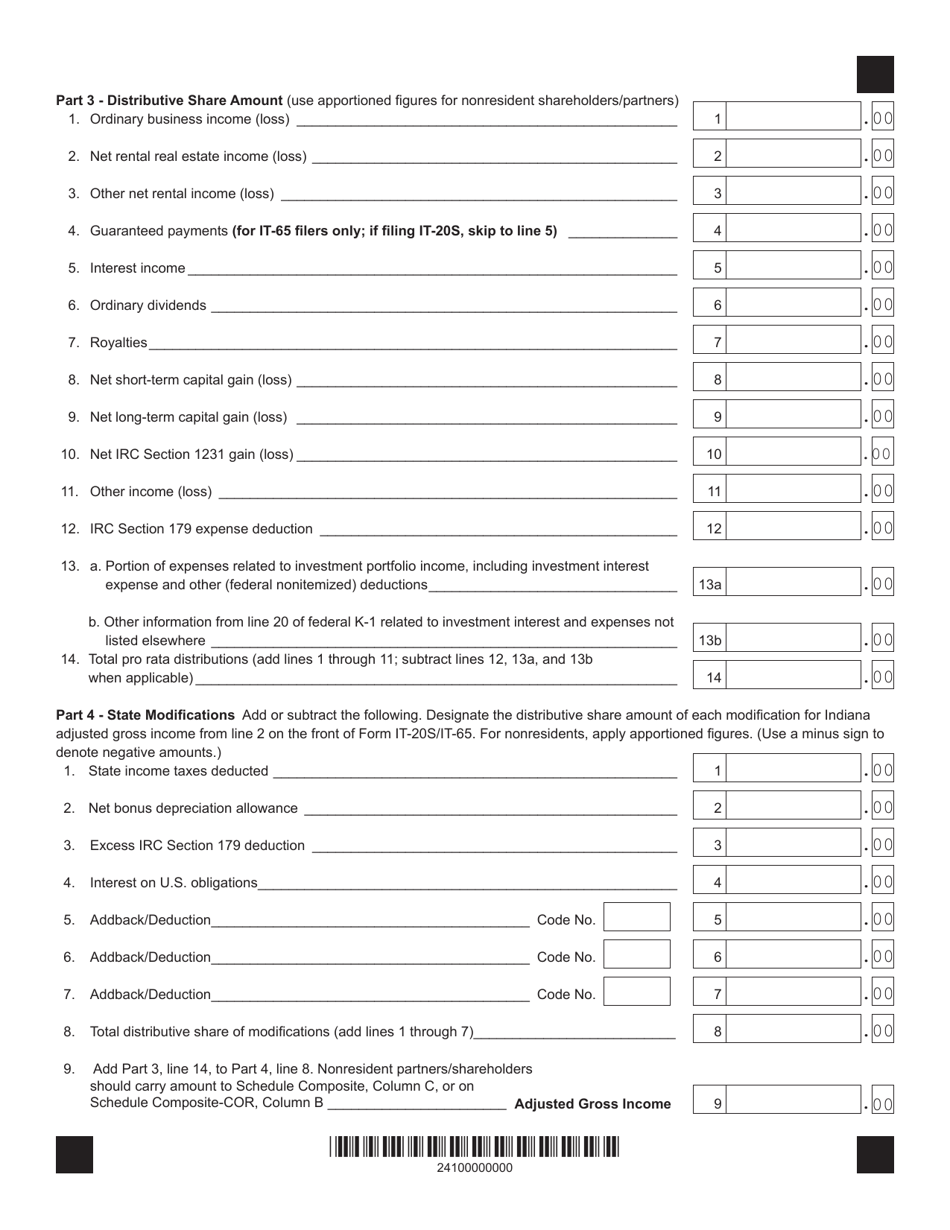

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-20S (IT-65; State Form 49181) Schedule IN K-1

for the current year.

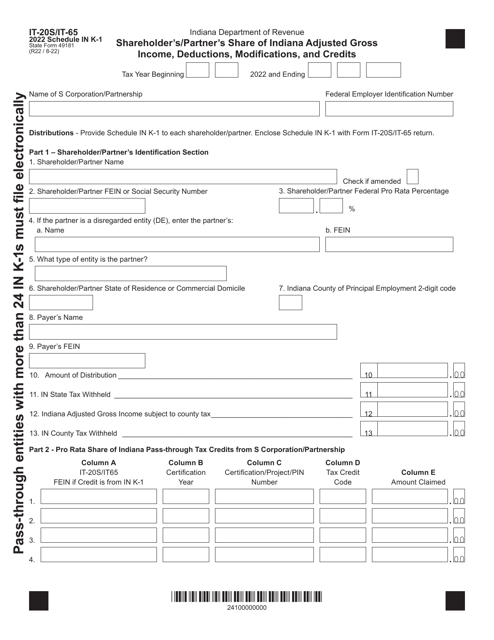

Form IT-20S (IT-65; State Form 49181) Schedule IN K-1 Shareholder's / Partner's Share of Indiana Adjusted Gross Income, Deductions, Modifications, and Credits - Indiana

What Is Form IT-20S (IT-65; State Form 49181) Schedule IN K-1?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-20S, and Form IT-65. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-20S?

A: Form IT-20S is a tax form used by S corporations in Indiana to report their income, deductions, and credits.

Q: What is Form IT-65?

A: Form IT-65 is a tax form used by partnerships in Indiana to report their income, deductions, and credits.

Q: What is State Form 49181?

A: State Form 49181 is a schedule that is filed along with Form IT-20S or IT-65, and it is used to report a shareholder's or partner's share of Indiana adjusted gross income, deductions, modifications, and credits.

Q: What is Schedule IN?

A: Schedule IN is a specific part of State Form 49181 where the shareholder or partner reports their share of income, deductions, modifications, and credits.

Q: What is a K-1?

A: A K-1 is a tax form that reports a shareholder's or partner's share of income, deductions, and credits from a pass-through entity, such as an S corporation or partnership.

Q: What does a shareholder or partner report on Schedule IN?

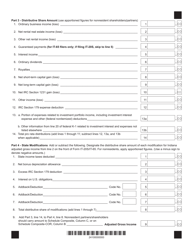

A: On Schedule IN, a shareholder or partner reports their share of Indiana adjusted gross income, deductions, modifications, and credits.

Q: Who needs to file Form IT-20S or IT-65?

A: S corporations need to file Form IT-20S, and partnerships need to file Form IT-65.

Q: Is Schedule IN required for all S corporations or partnerships?

A: Yes, Schedule IN is required for all S corporations and partnerships filing Form IT-20S or IT-65.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-20S (IT-65; State Form 49181) Schedule IN K-1 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.