This version of the form is not currently in use and is provided for reference only. Download this version of

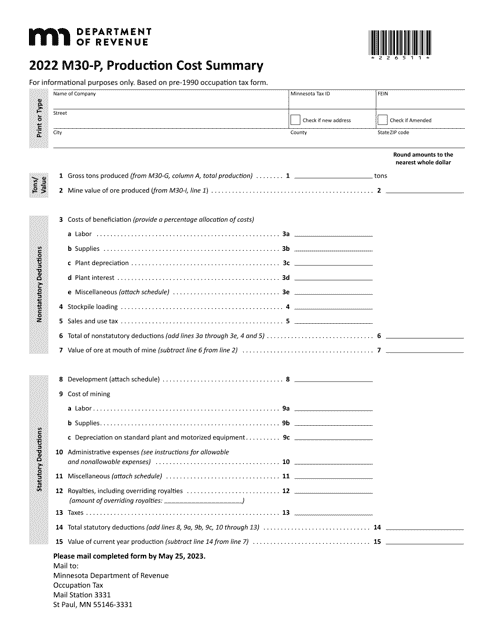

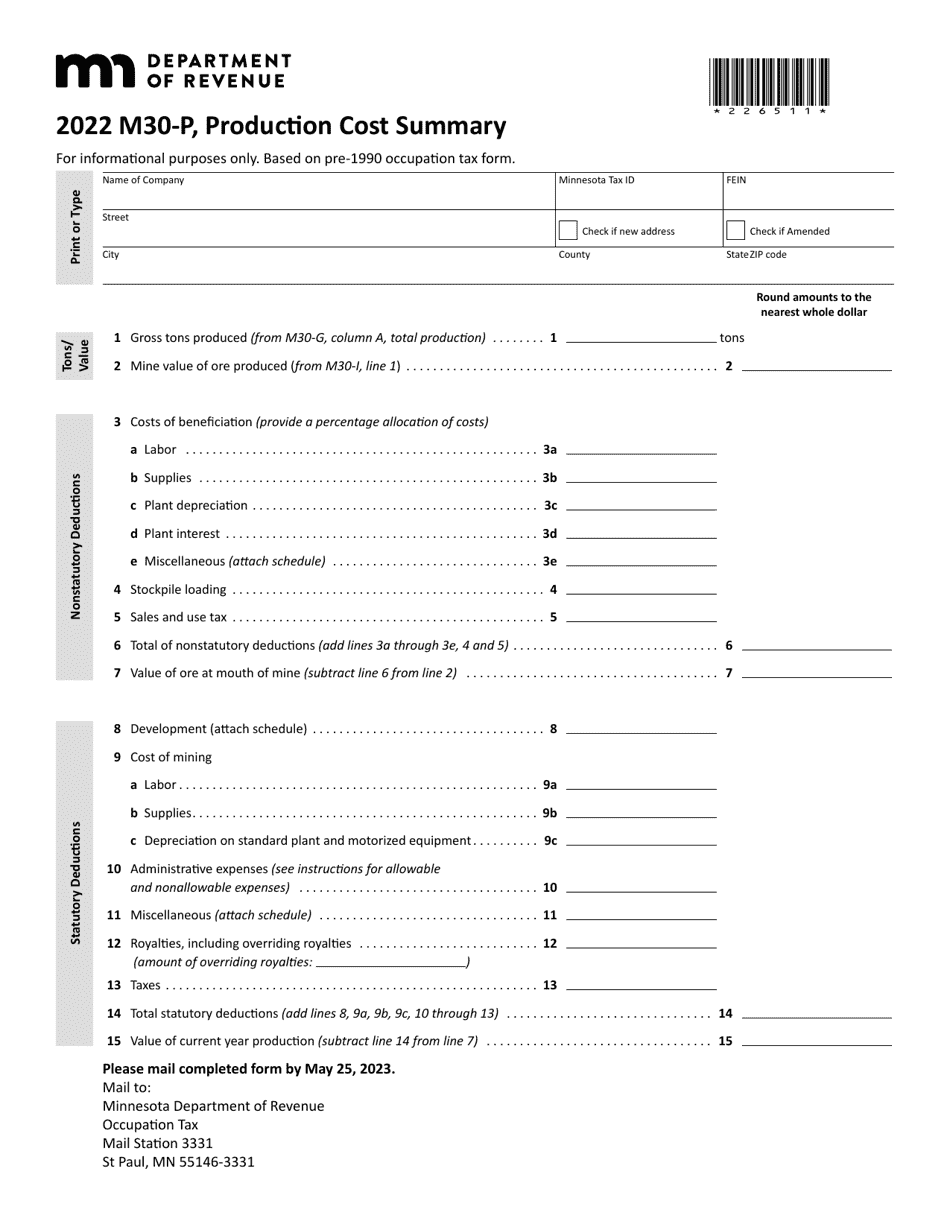

Form M30-P

for the current year.

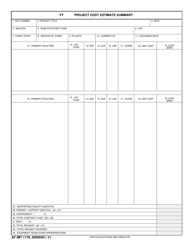

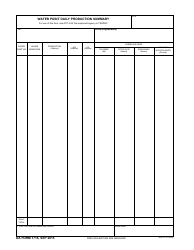

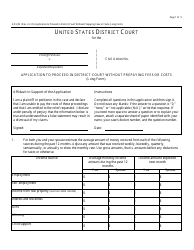

Form M30-P Production Cost Summary - Minnesota

What Is Form M30-P?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M30-P?

A: Form M30-P is a production cost summary form used in Minnesota.

Q: What is the purpose of Form M30-P?

A: The purpose of Form M30-P is to report and summarize production costs in Minnesota.

Q: Who needs to fill out Form M30-P?

A: Individuals or businesses engaged in production activities in Minnesota may need to fill out Form M30-P.

Q: What are production costs?

A: Production costs are the expenses incurred in the process of manufacturing or producing goods.

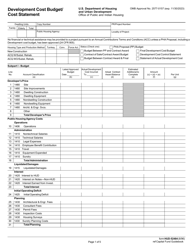

Q: What information is required on Form M30-P?

A: Form M30-P requires information such as the type of production, beginning and ending inventory, direct costs, indirect costs, and other expenses.

Q: When is Form M30-P due?

A: Form M30-P is typically due on or before the 15th day of the fourth month following the end of the production year.

Q: Are there any penalties for not filing Form M30-P?

A: Yes, failure to file Form M30-P or filing it late may result in penalties or interest charges.

Q: Can Form M30-P be filed electronically?

A: Yes, Form M30-P can be filed electronically through the Minnesota Department of Revenue's e-Services system.

Q: Are there any exemptions or deductions available on Form M30-P?

A: There may be certain exemptions and deductions available, depending on the type of production and applicable tax laws.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M30-P by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.