This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form M1PR

for the current year.

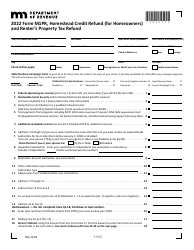

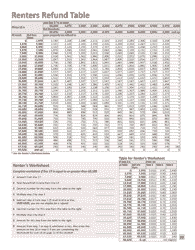

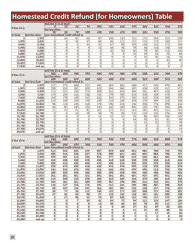

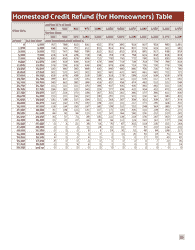

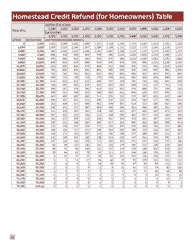

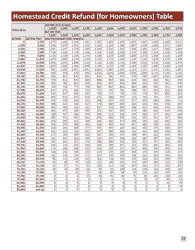

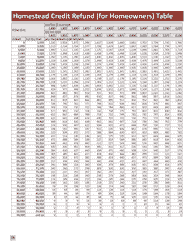

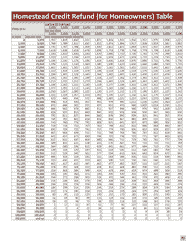

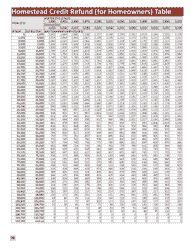

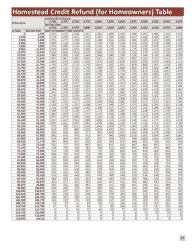

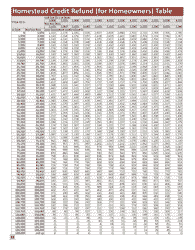

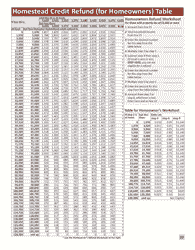

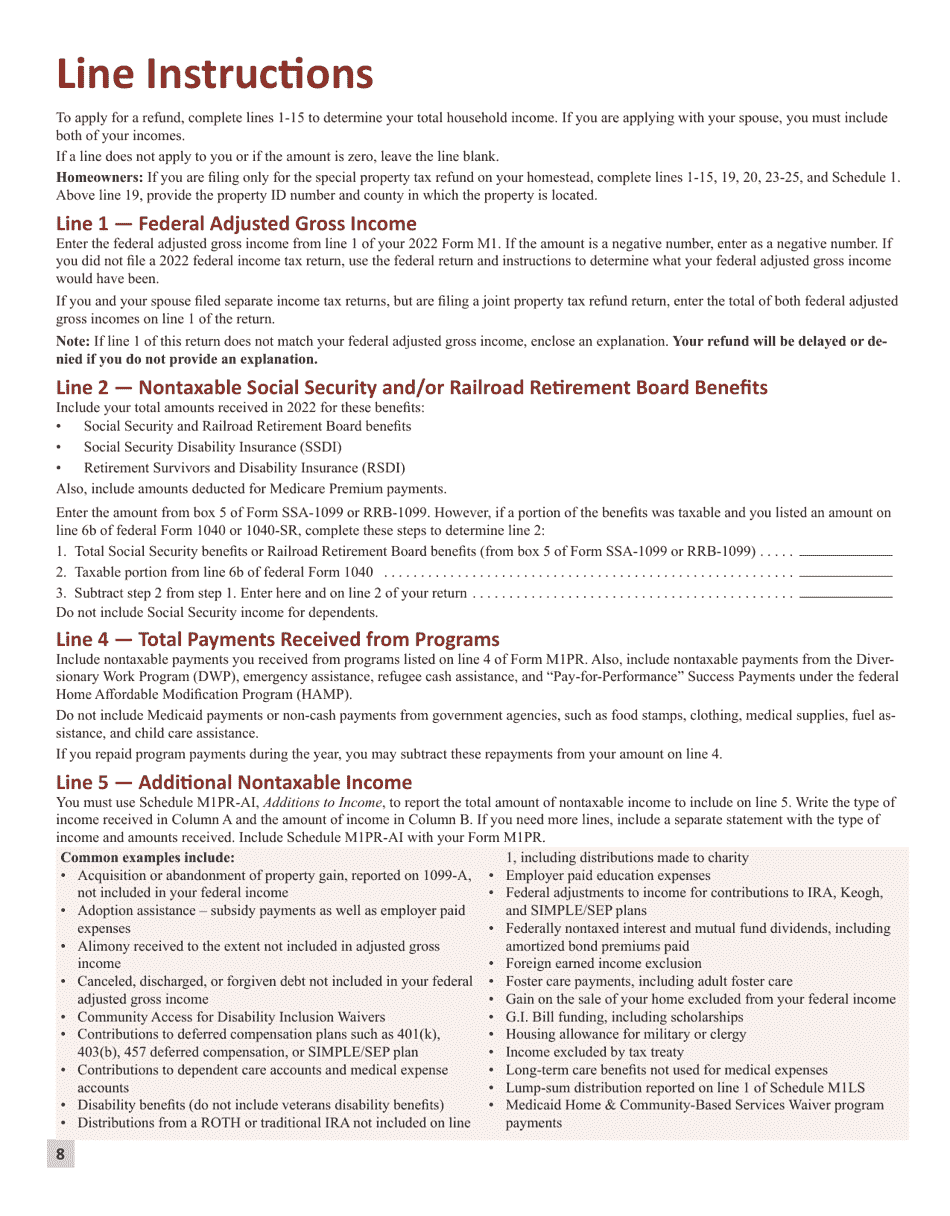

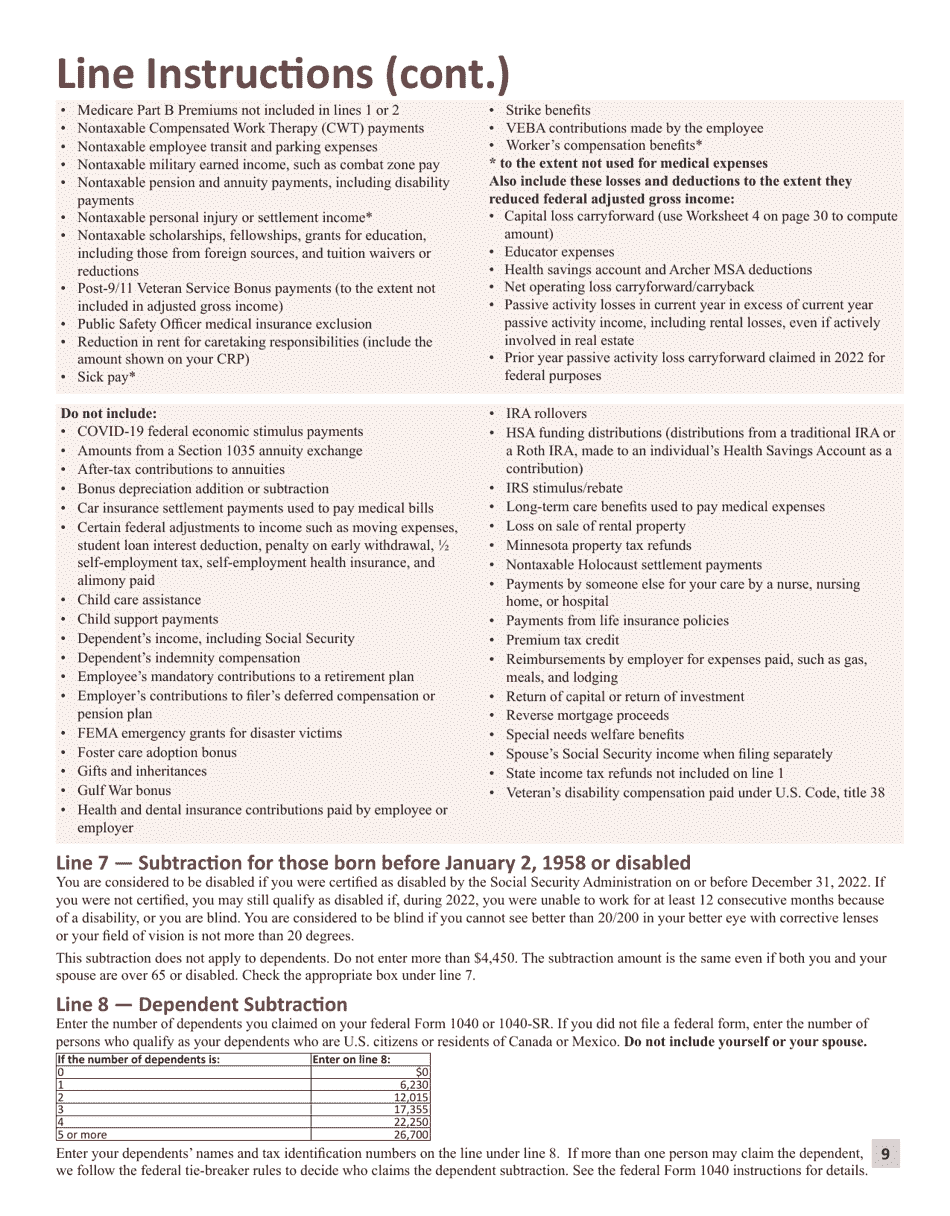

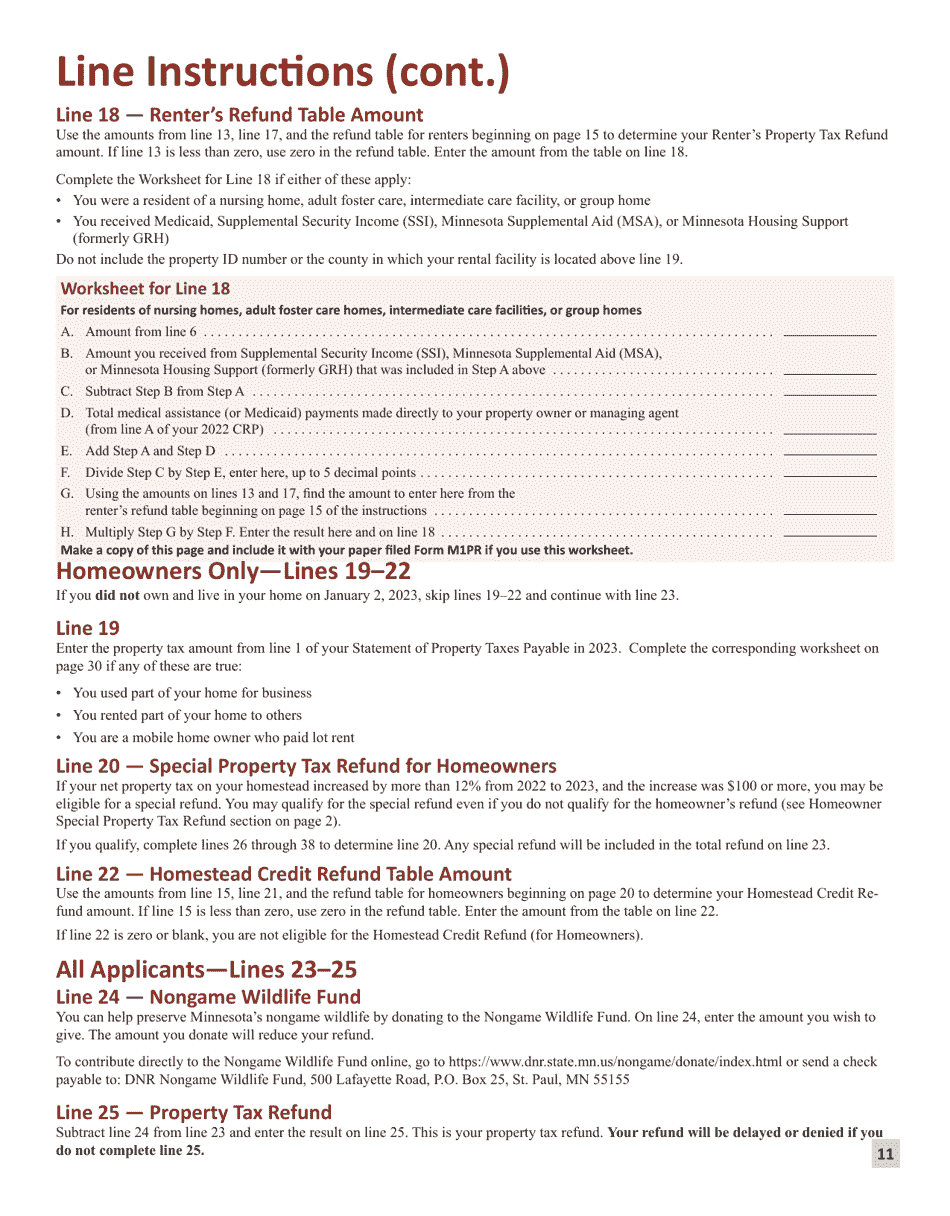

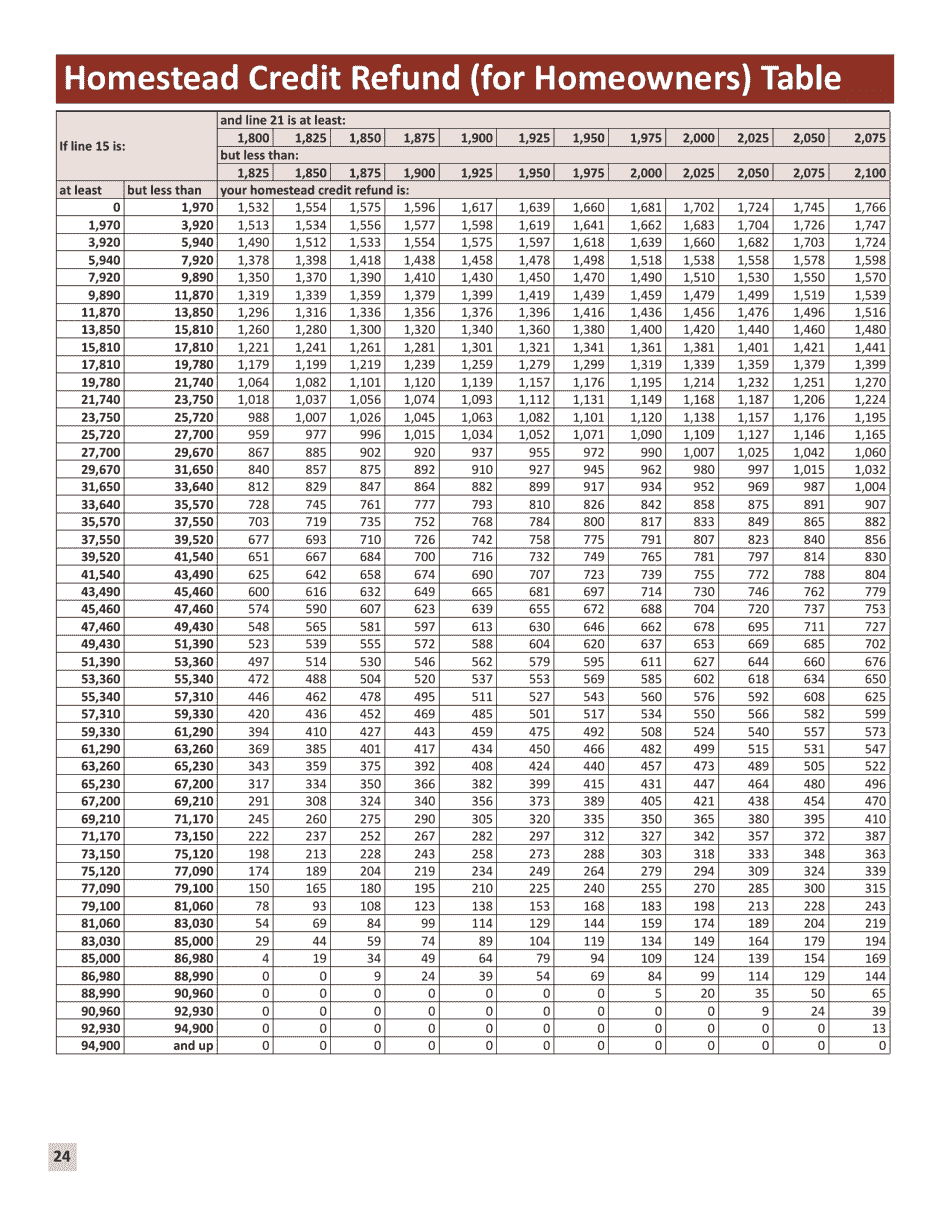

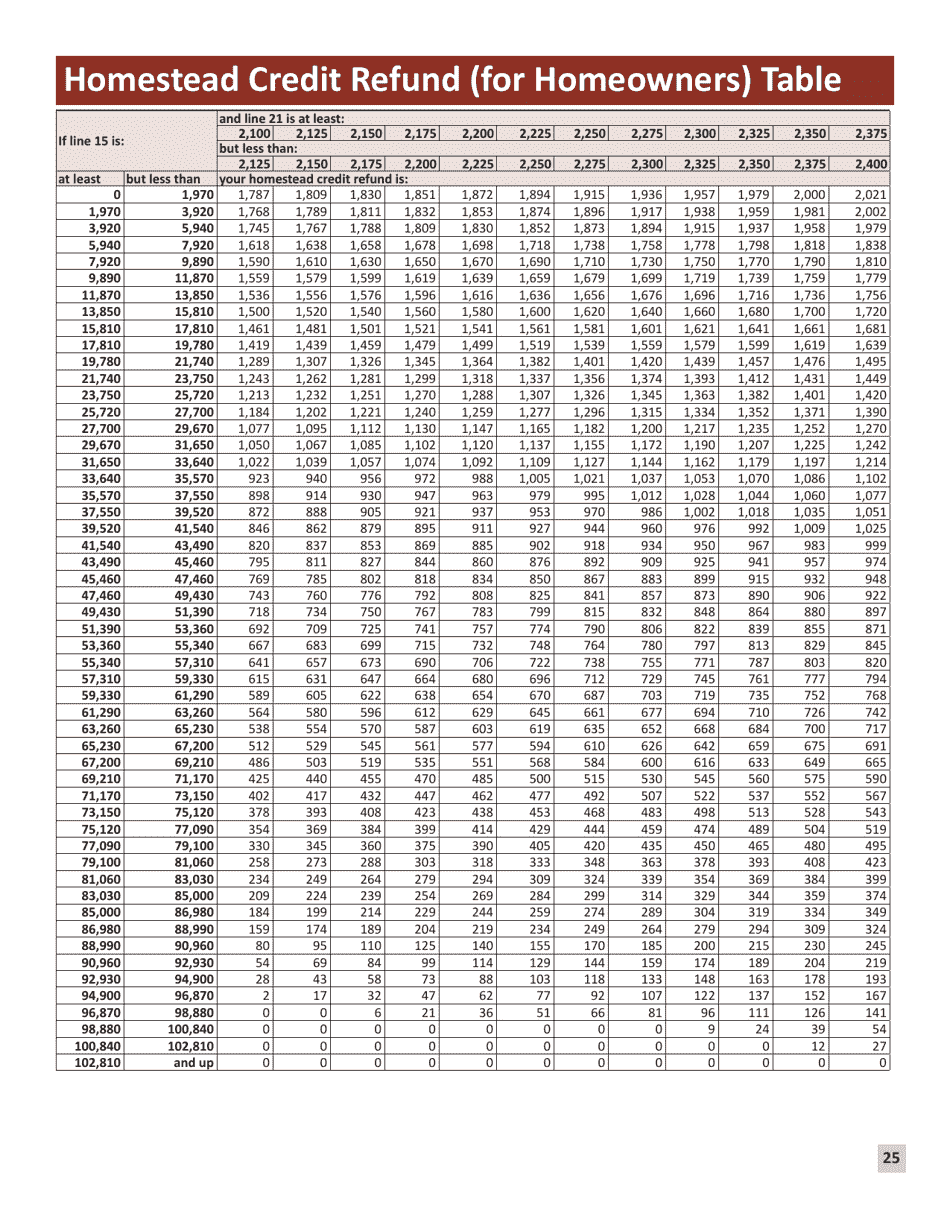

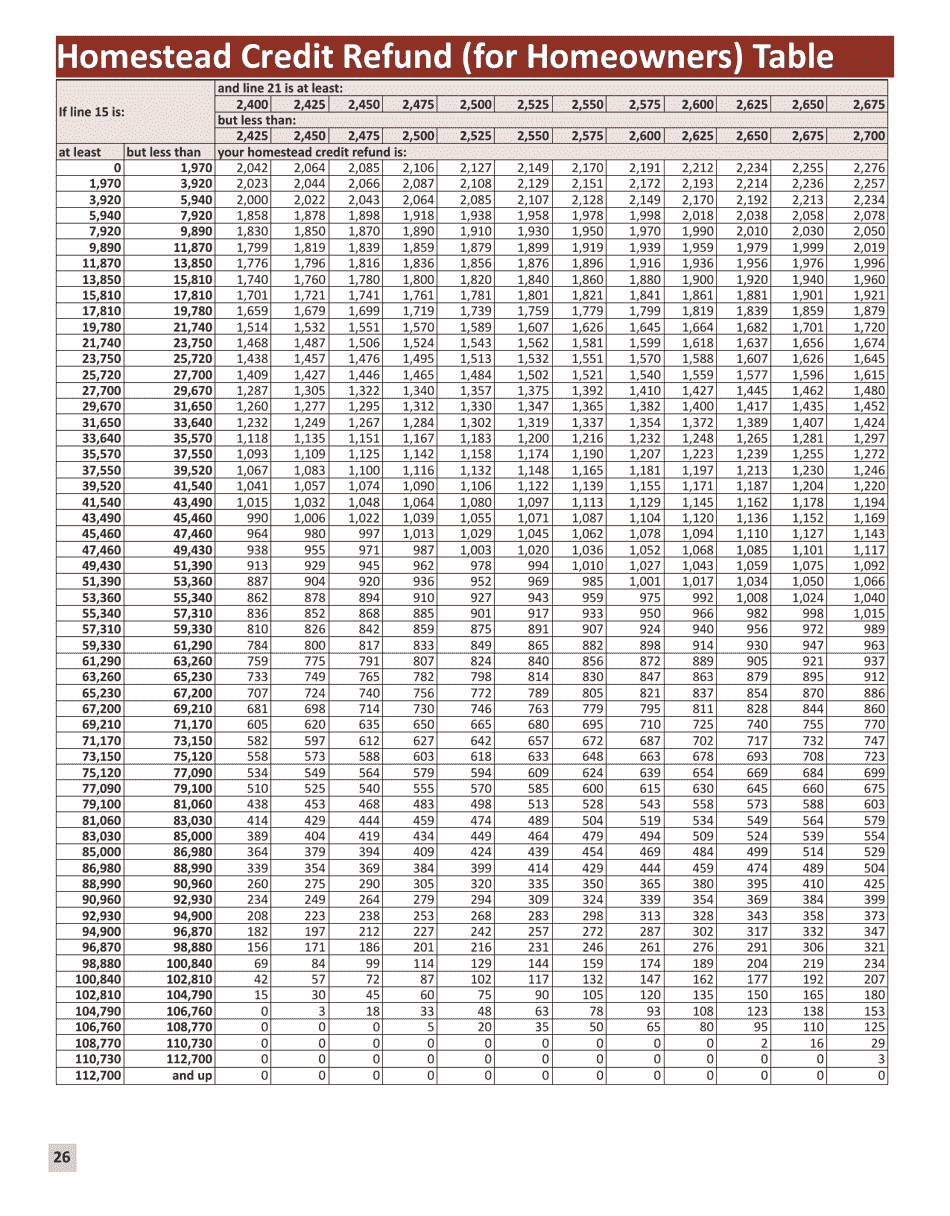

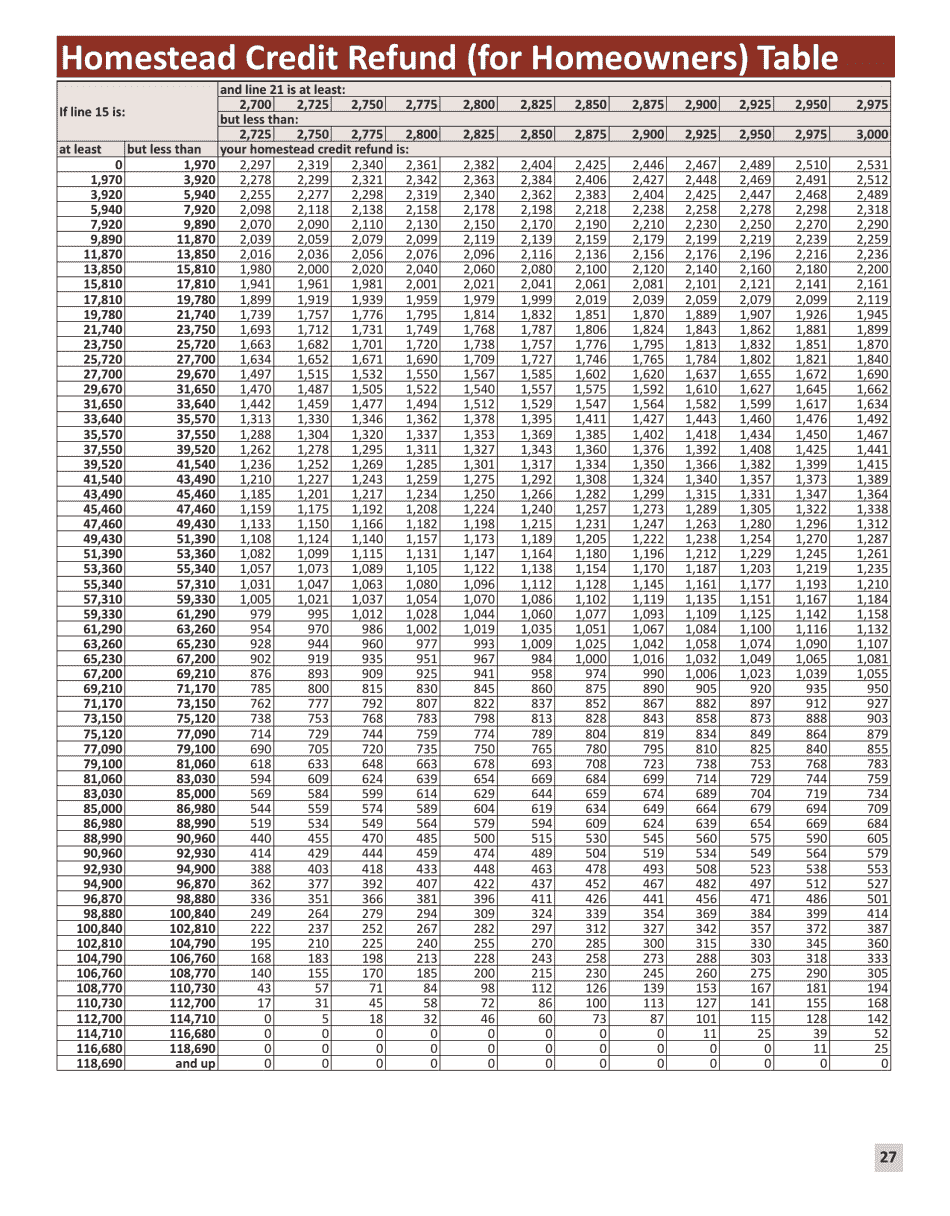

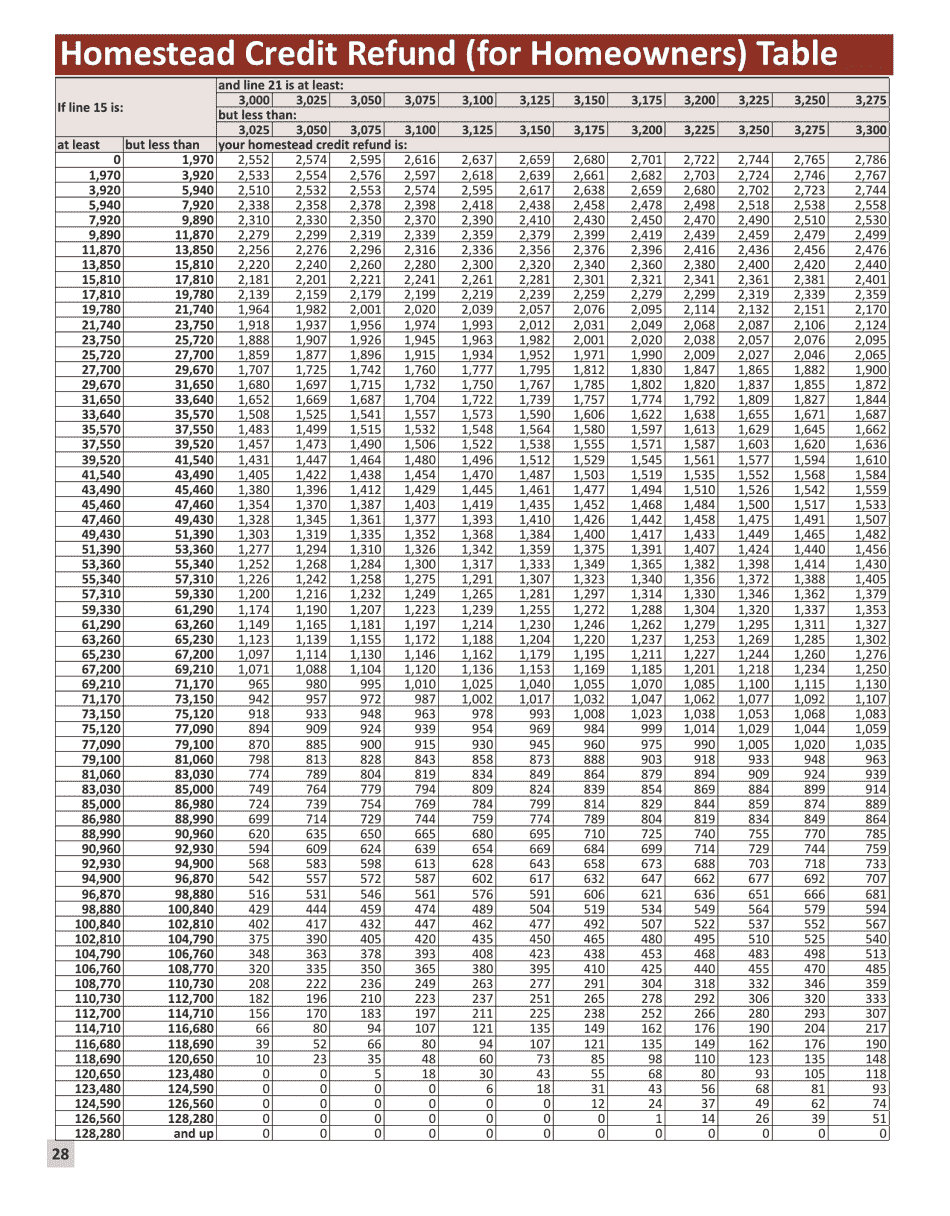

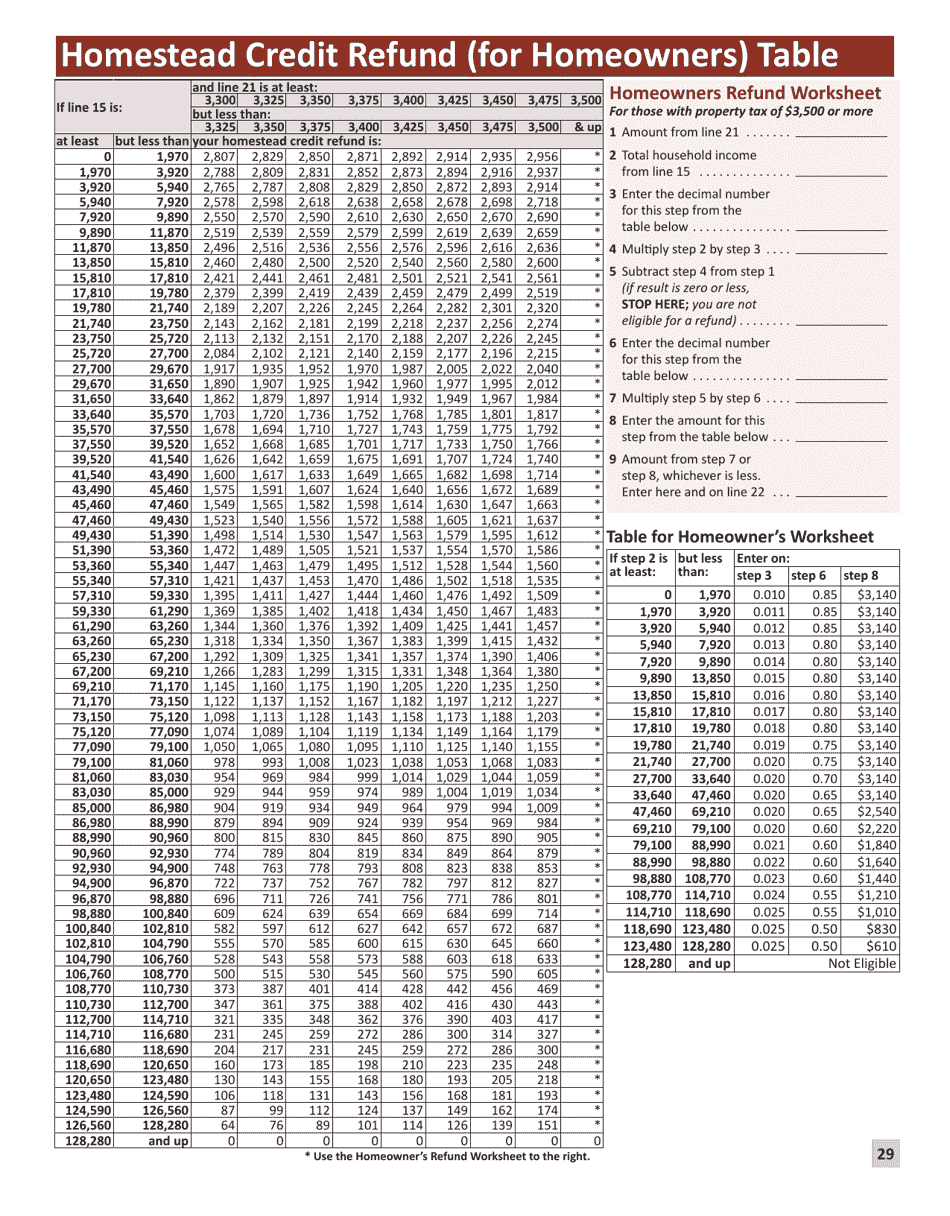

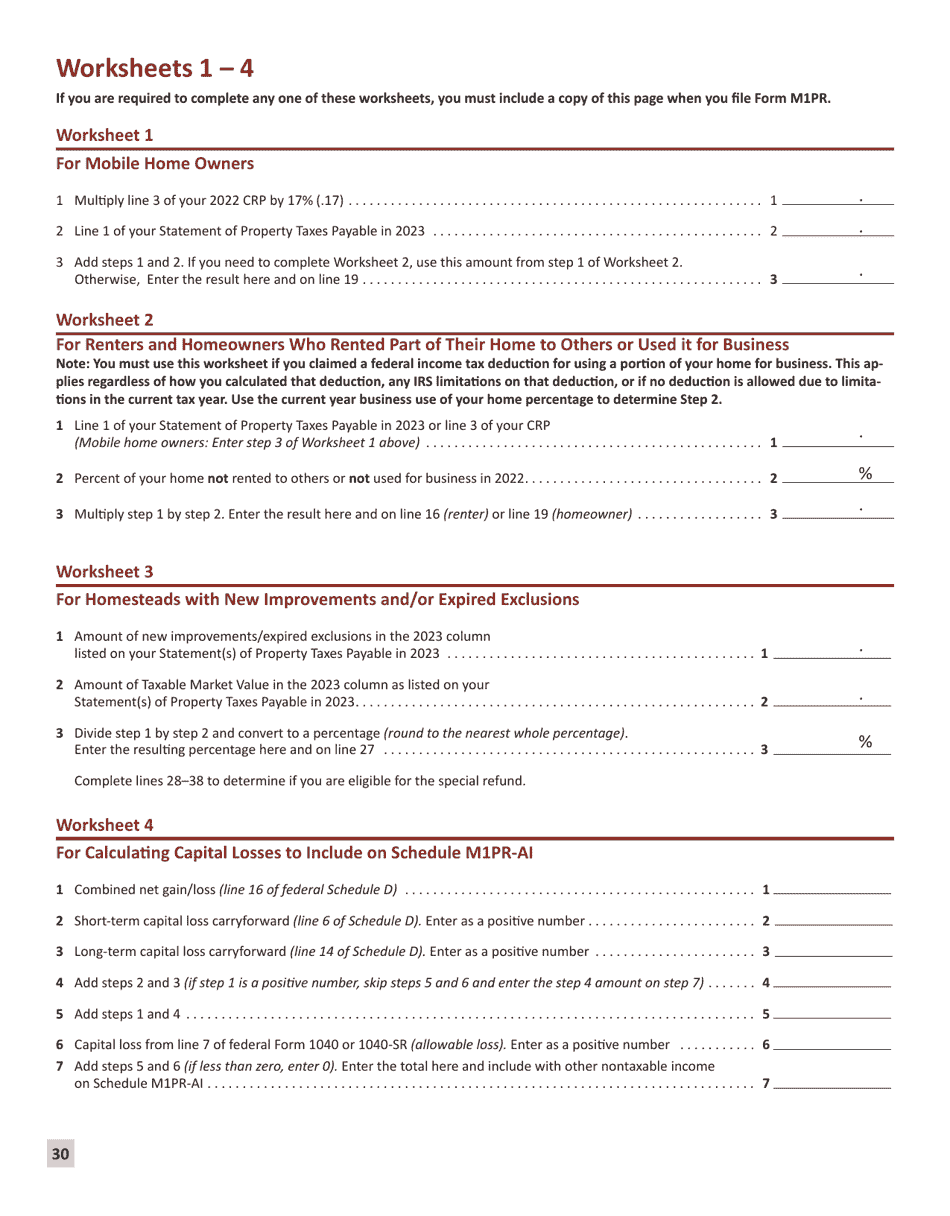

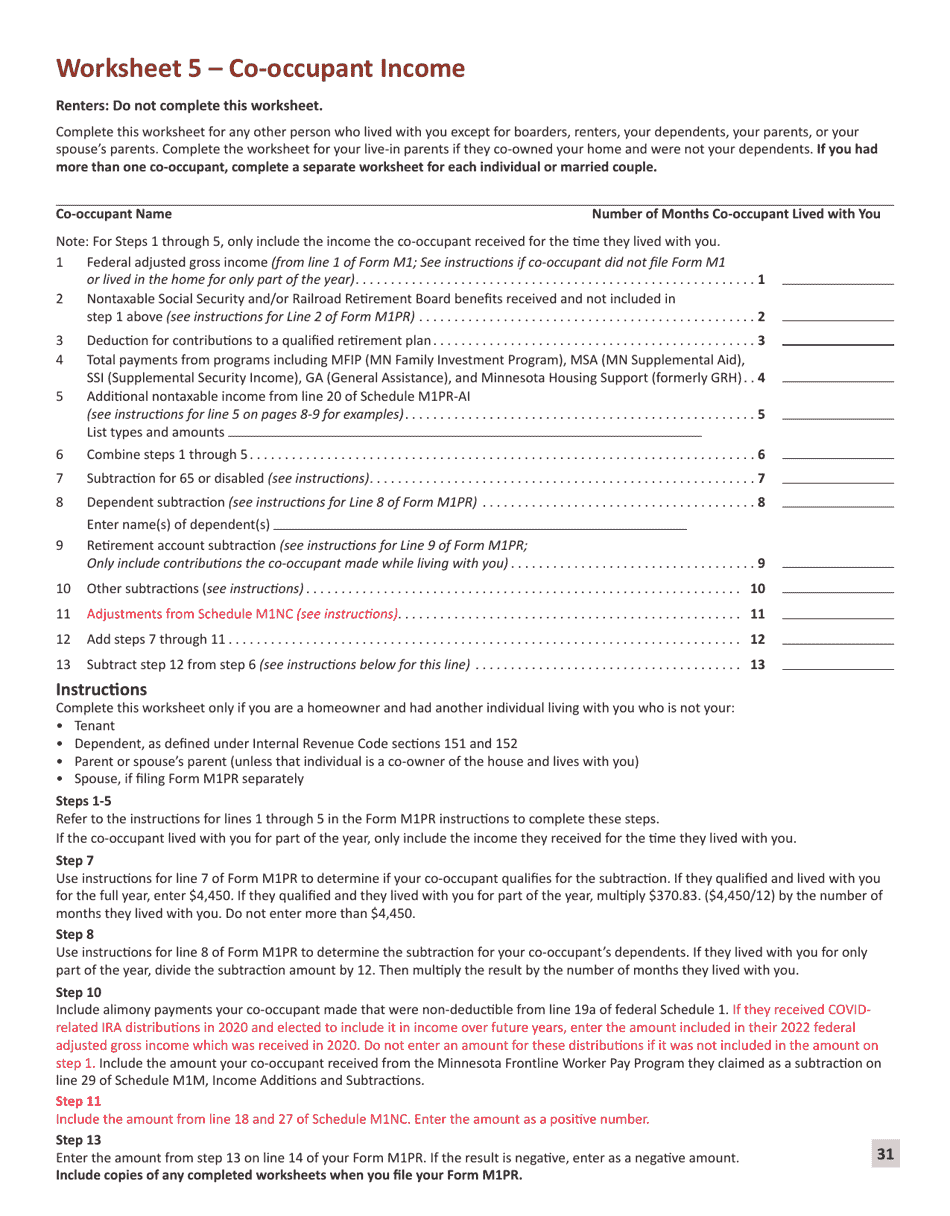

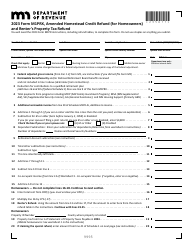

Instructions for Form M1PR Homestead Credit Refund (For Homeowners) and Renter's Property Tax Refund - Minnesota

This document contains official instructions for Form M1PR , Homestead Credit Refund (For Homeowners) and Renter's Property Tax Refund - a form released and collected by the Minnesota Department of Revenue.

FAQ

Q: What is Form M1PR?

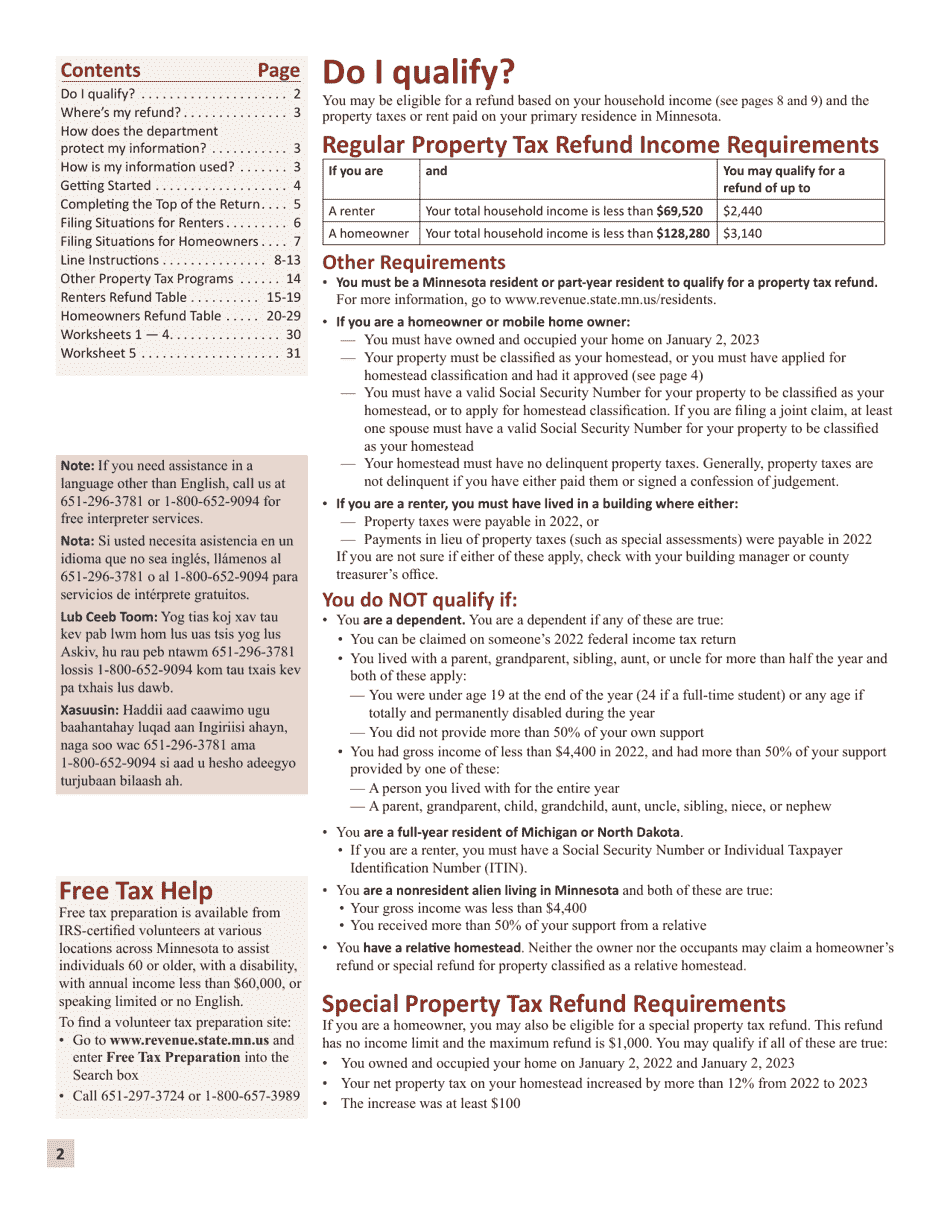

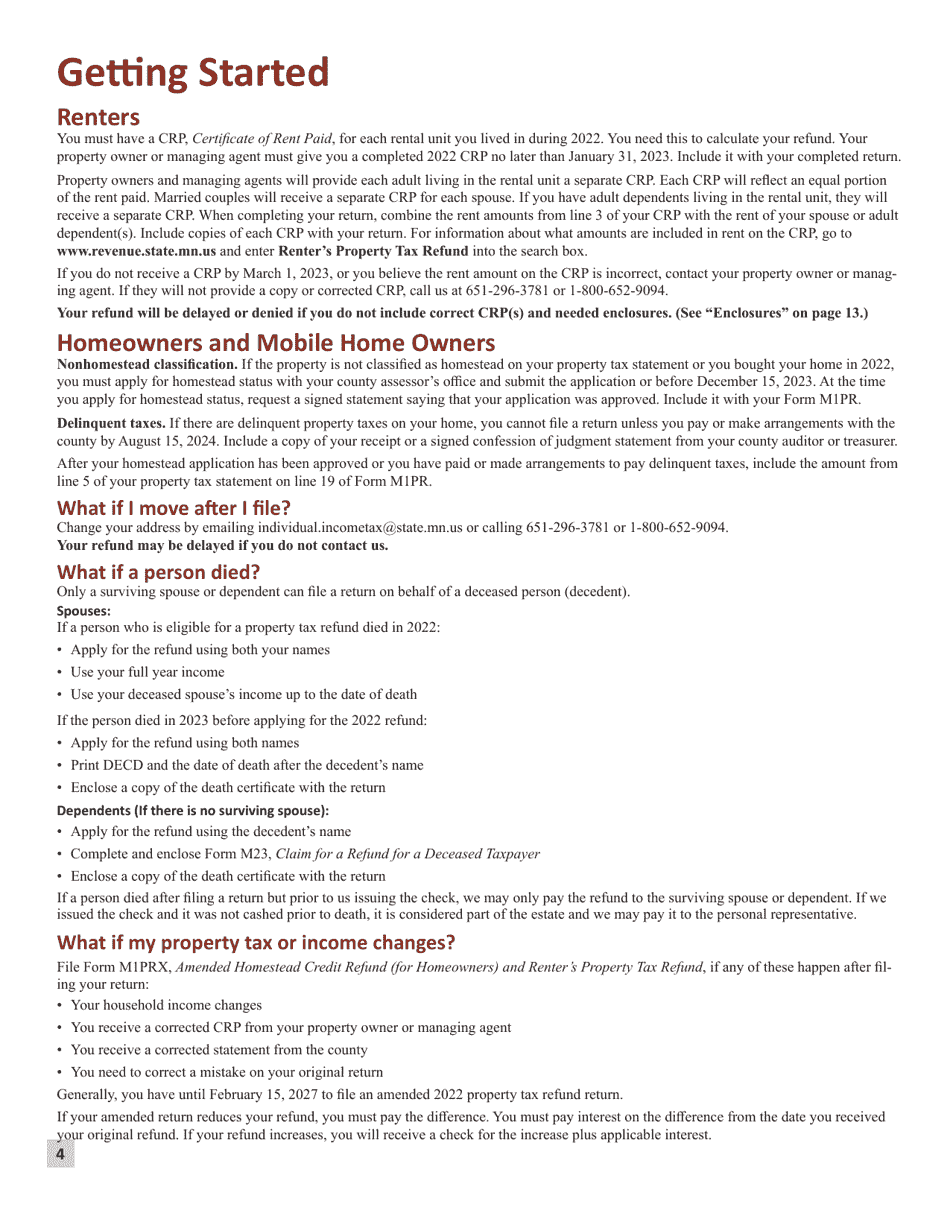

A: Form M1PR is a form used to claim the Homestead Credit Refund for homeowners and the Renter's Property Tax Refund in Minnesota.

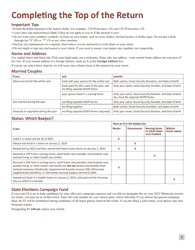

Q: Who can file Form M1PR?

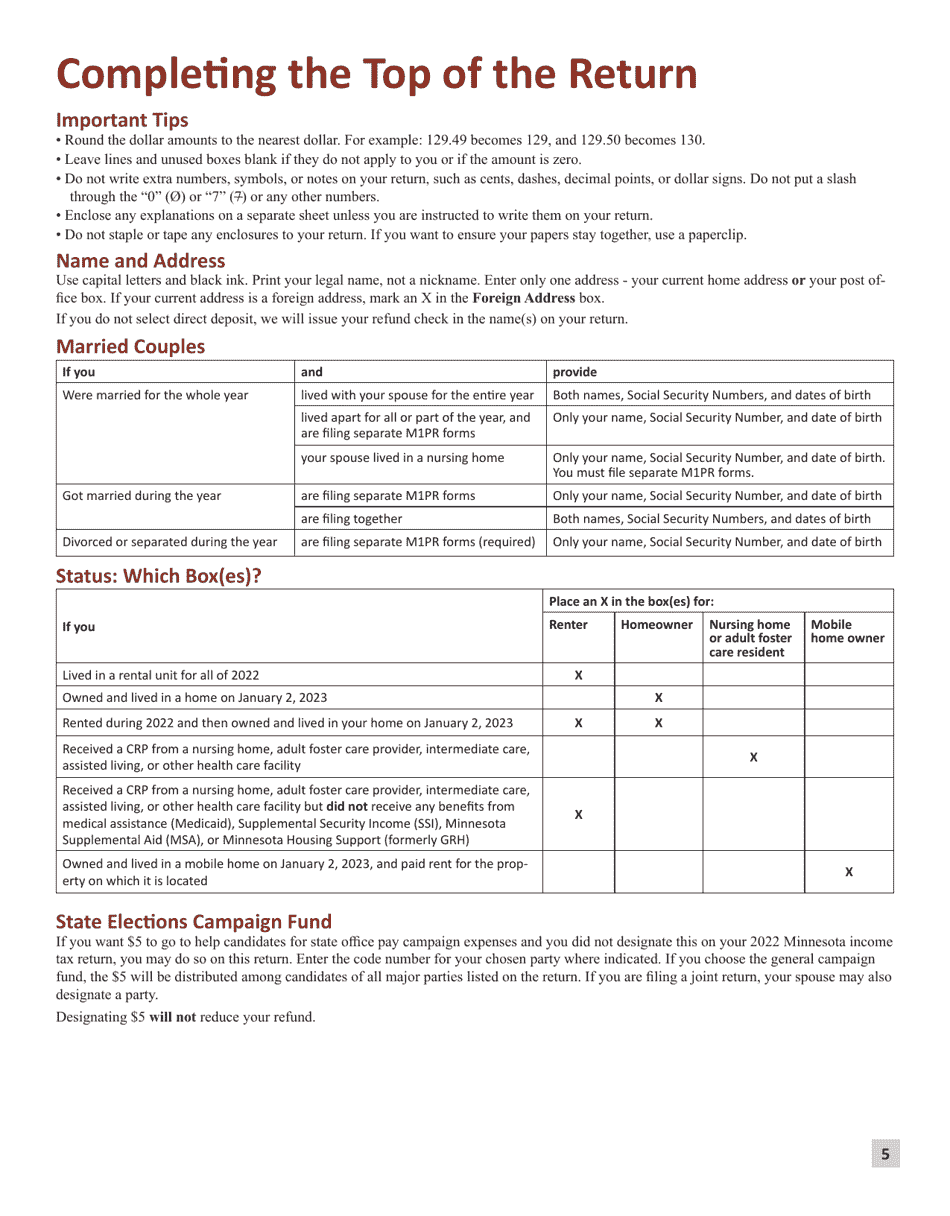

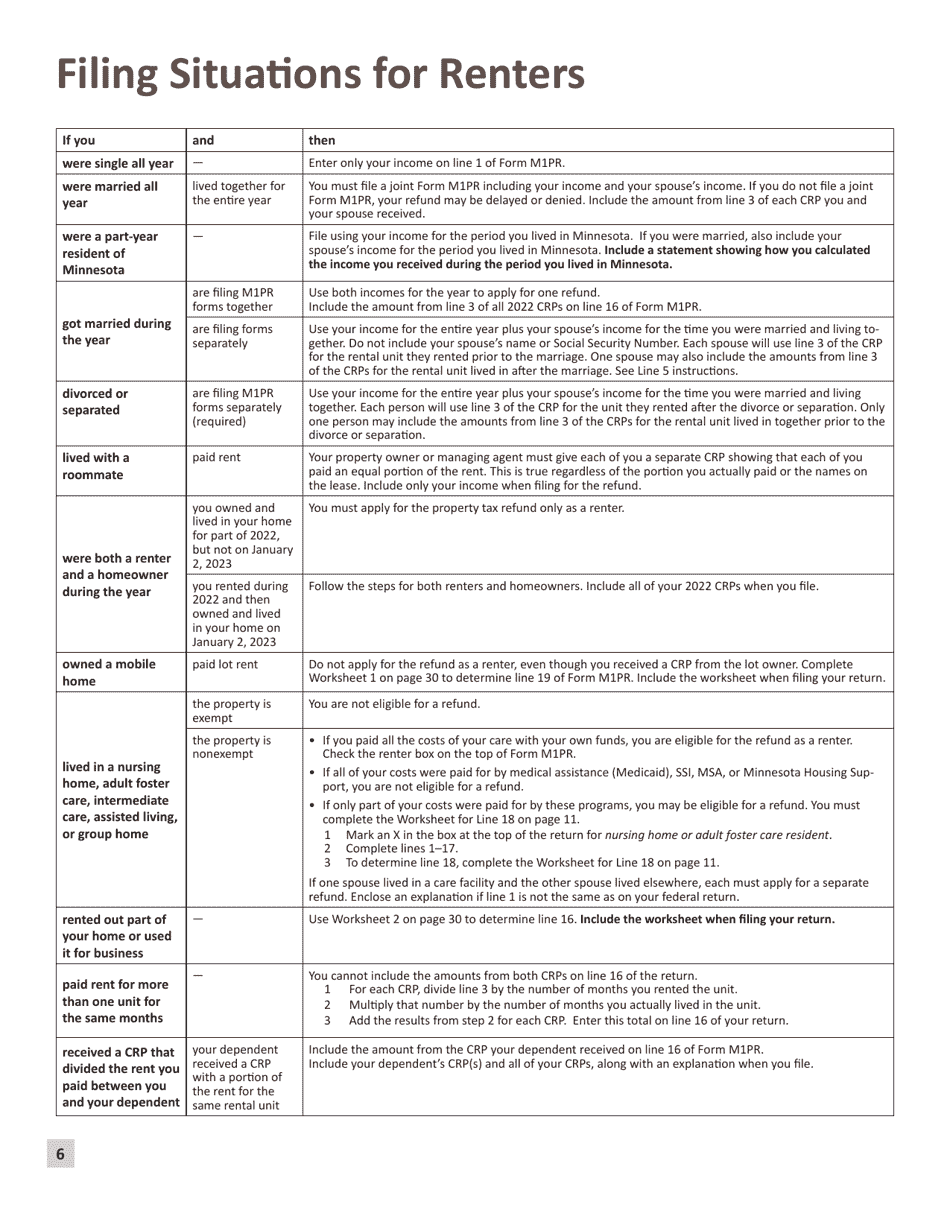

A: Homeowners and renters in Minnesota can file Form M1PR.

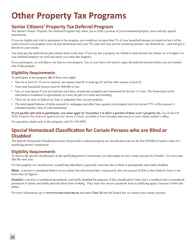

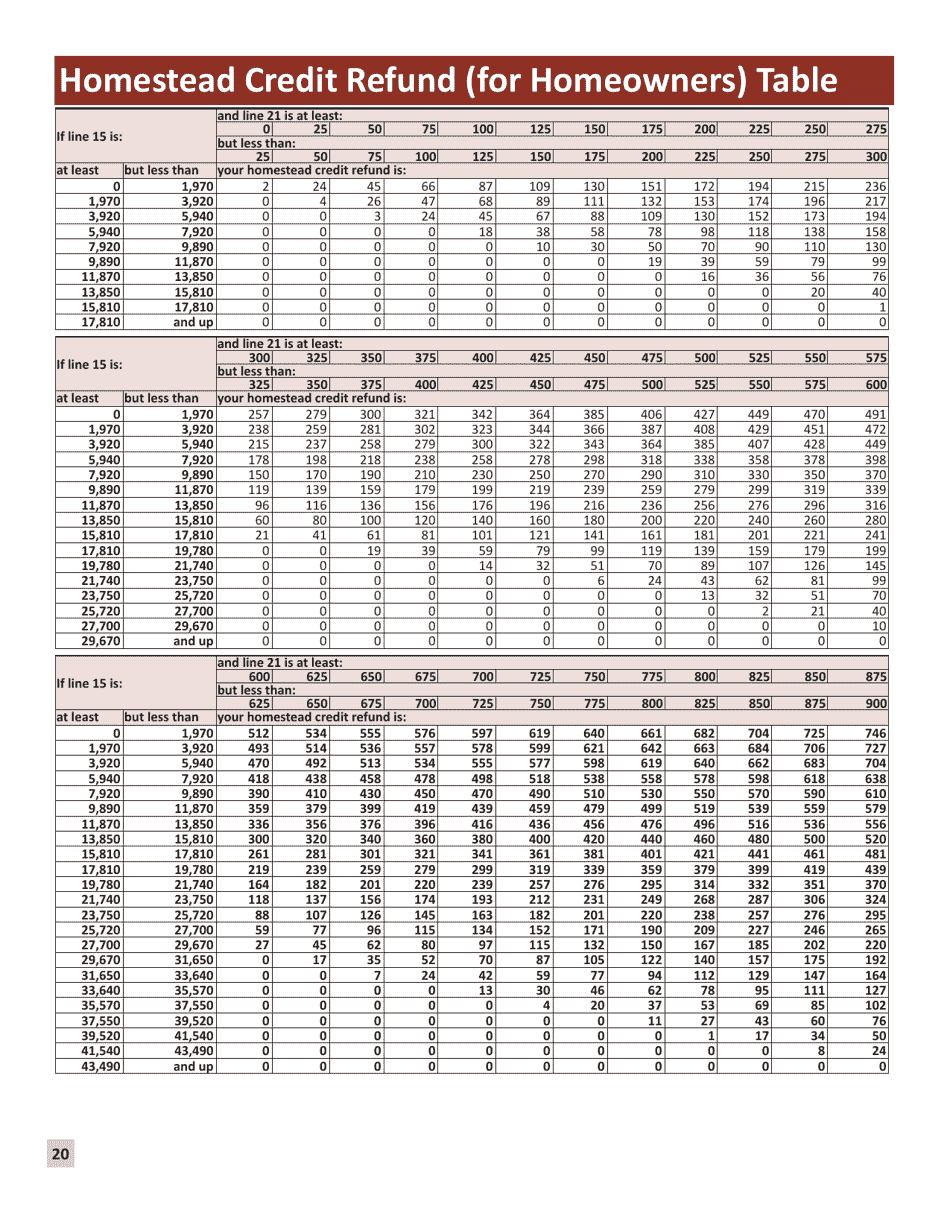

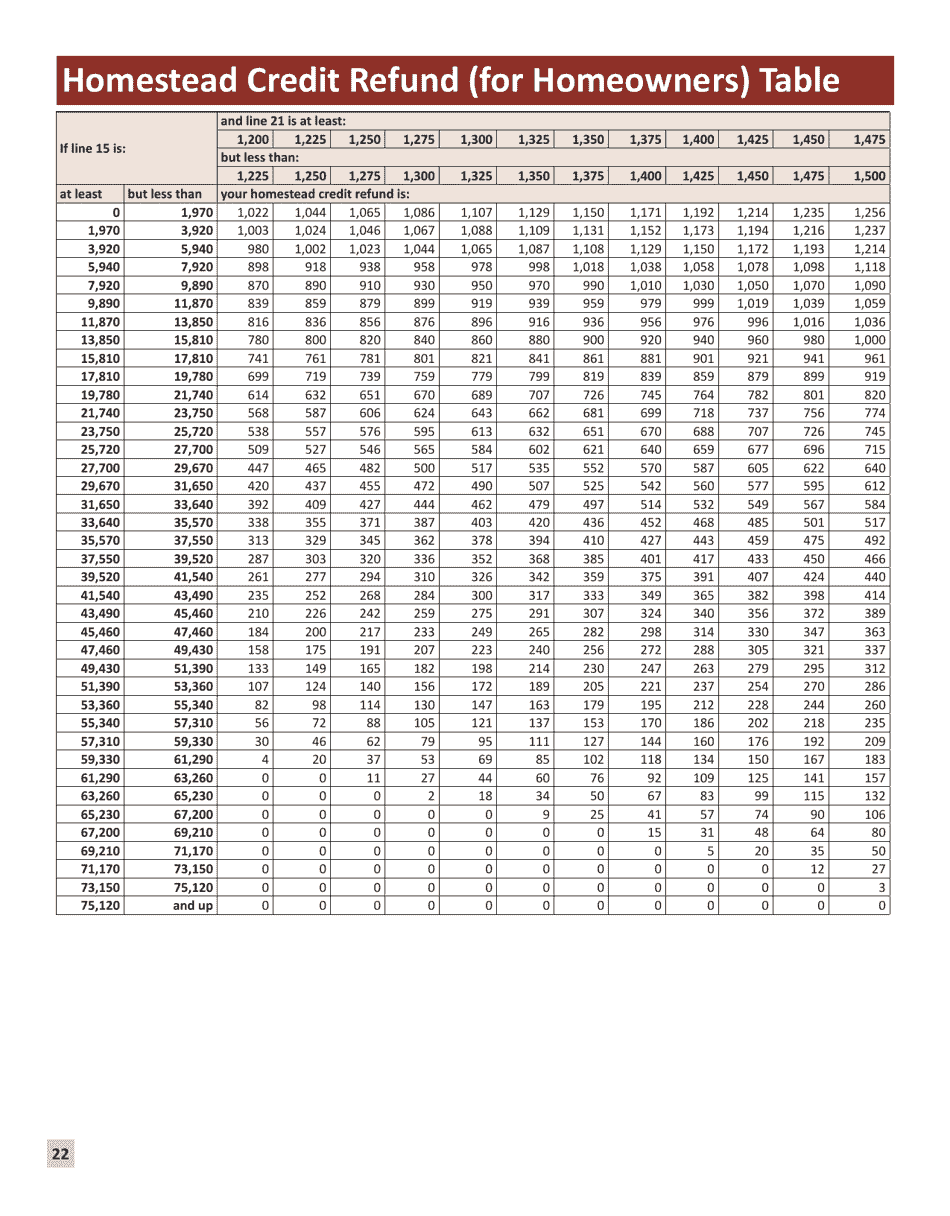

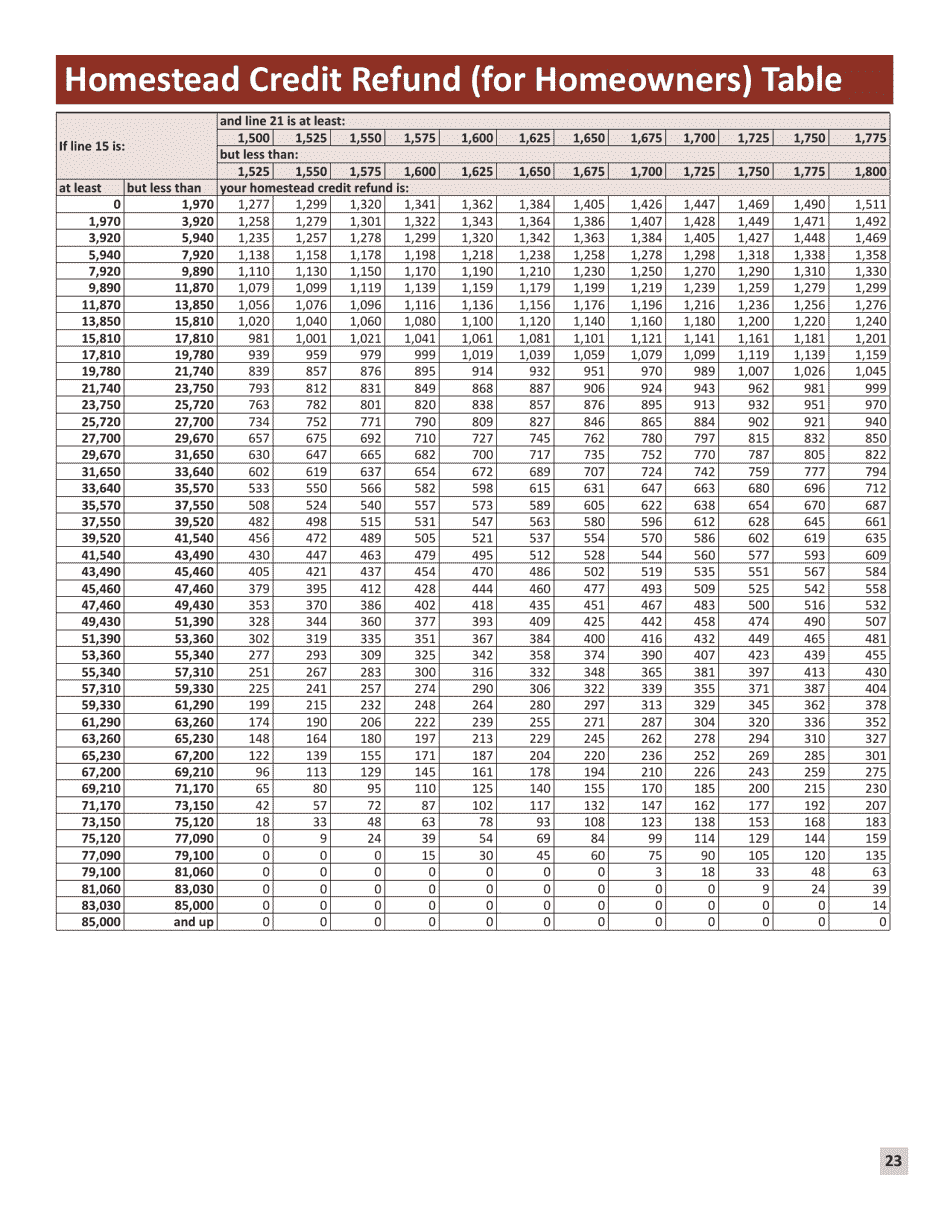

Q: What is the Homestead Credit Refund?

A: The Homestead Credit Refund is a refund for homeowners who have paid property taxes on their primary residence in Minnesota.

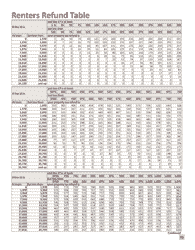

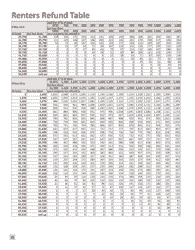

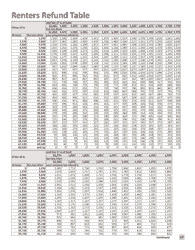

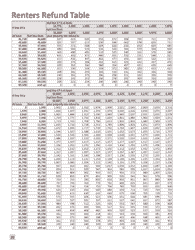

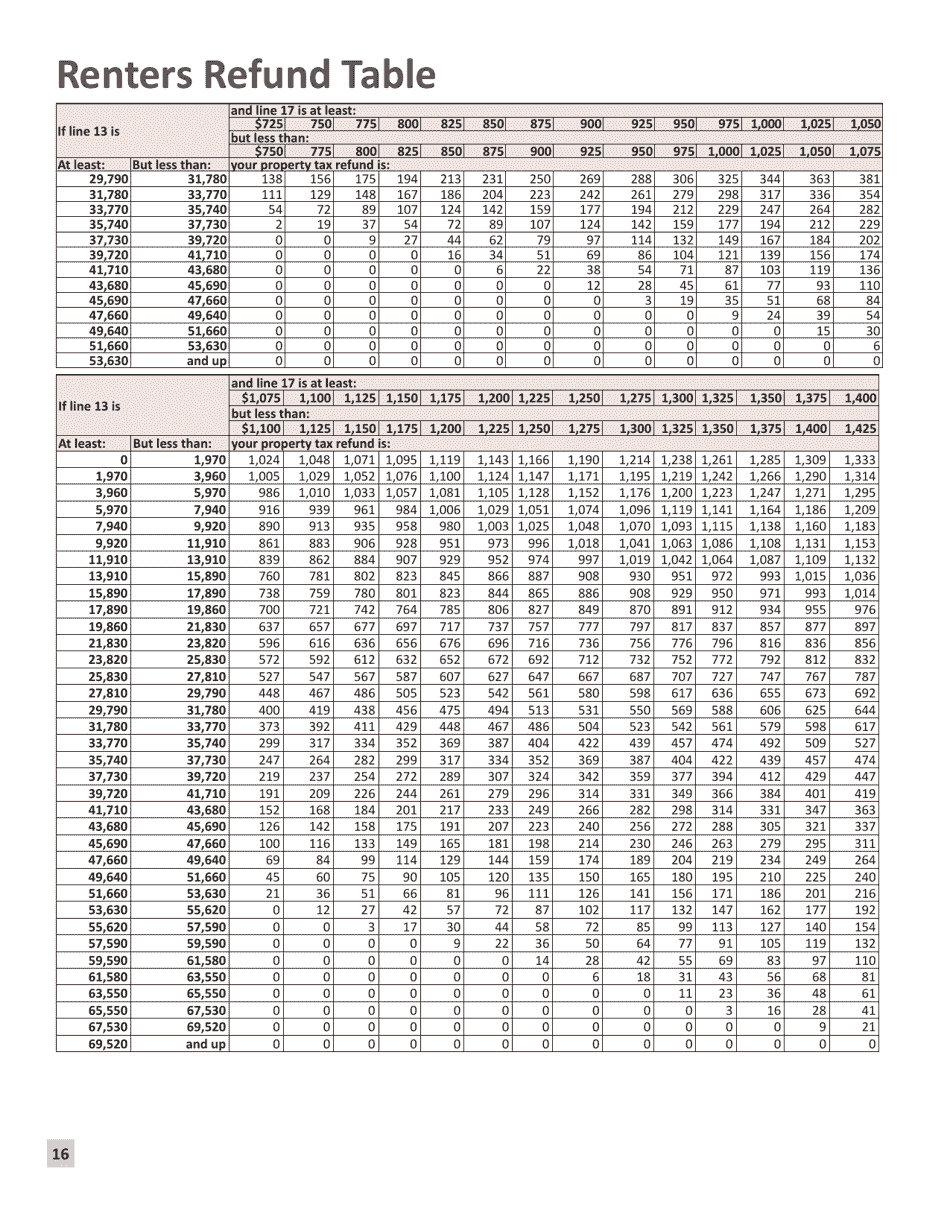

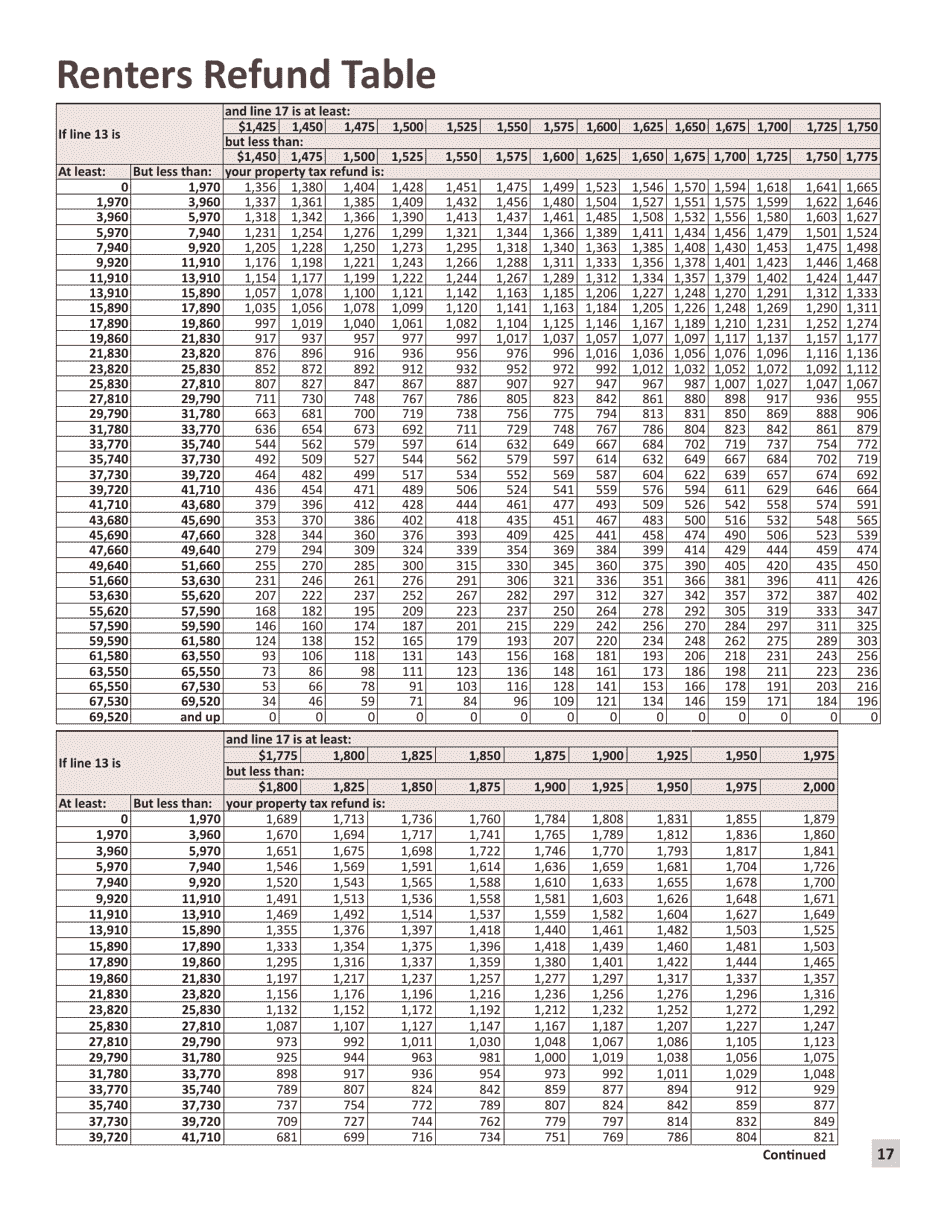

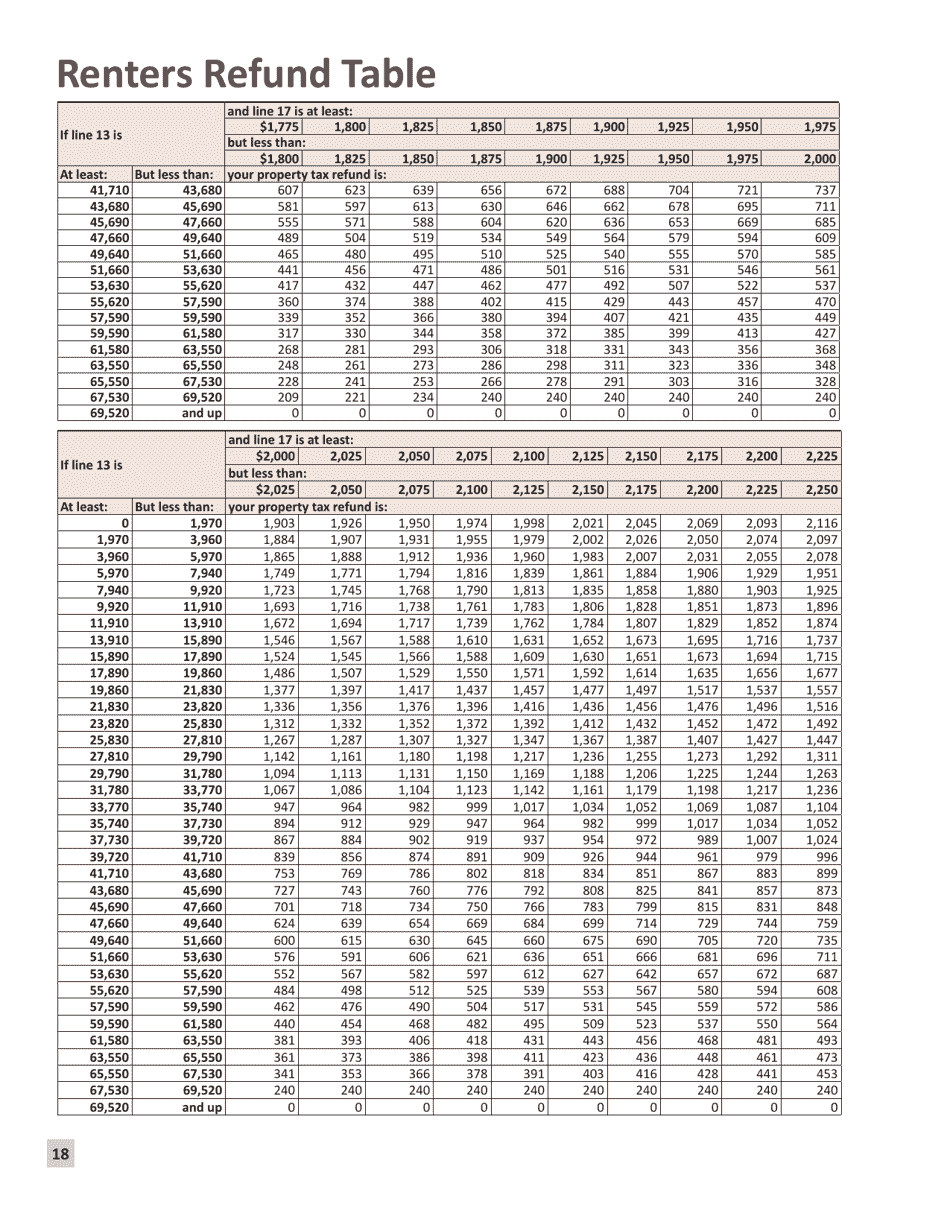

Q: What is the Renter's Property Tax Refund?

A: The Renter's Property Tax Refund is a refund for renters who have paid rent and indirectly paid property taxes through their rent in Minnesota.

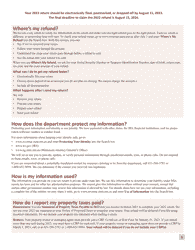

Q: How do I file Form M1PR?

A: Form M1PR can be filed electronically using eFile Minnesota or by mail.

Q: What documents do I need to file Form M1PR?

A: You will need a copy of your property tax statement or Certificate of Rent Paid (CRP), and other supporting documents if applicable.

Q: When is the deadline to file Form M1PR?

A: The deadline to file Form M1PR is August 15th of each year.

Q: How long does it take to get a refund after filing Form M1PR?

A: It typically takes about eight weeks to receive a refund after filing Form M1PR.

Q: Can I claim both the Homestead Credit Refund and the Renter's Property Tax Refund?

A: No, you can only claim either the Homestead Credit Refund or the Renter's Property Tax Refund, depending on your eligibility.

Instruction Details:

- This 32-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Minnesota Department of Revenue.