This version of the form is not currently in use and is provided for reference only. Download this version of

Form M30-RD

for the current year.

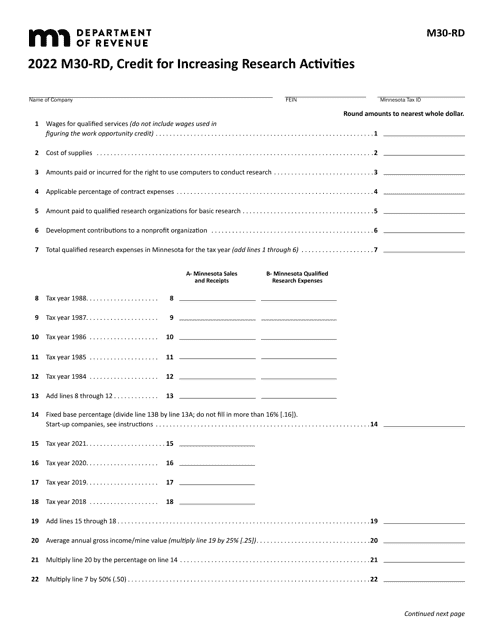

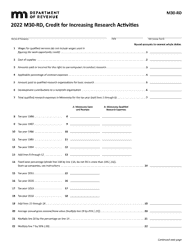

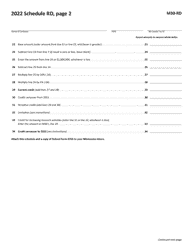

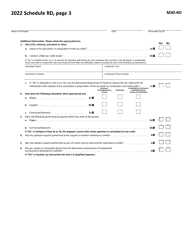

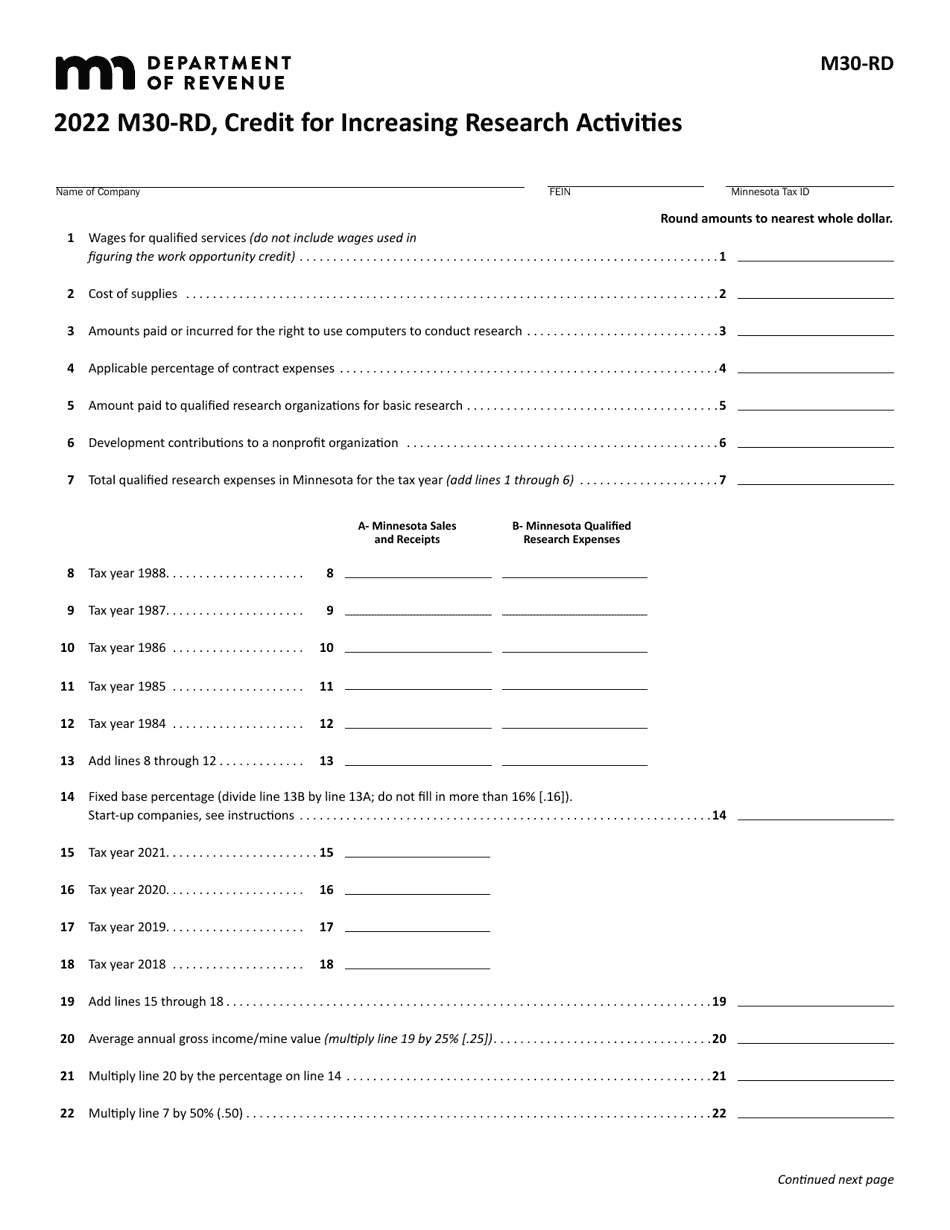

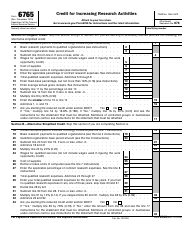

Form M30-RD Credit for Increasing Research Activities - Minnesota

What Is Form M30-RD?

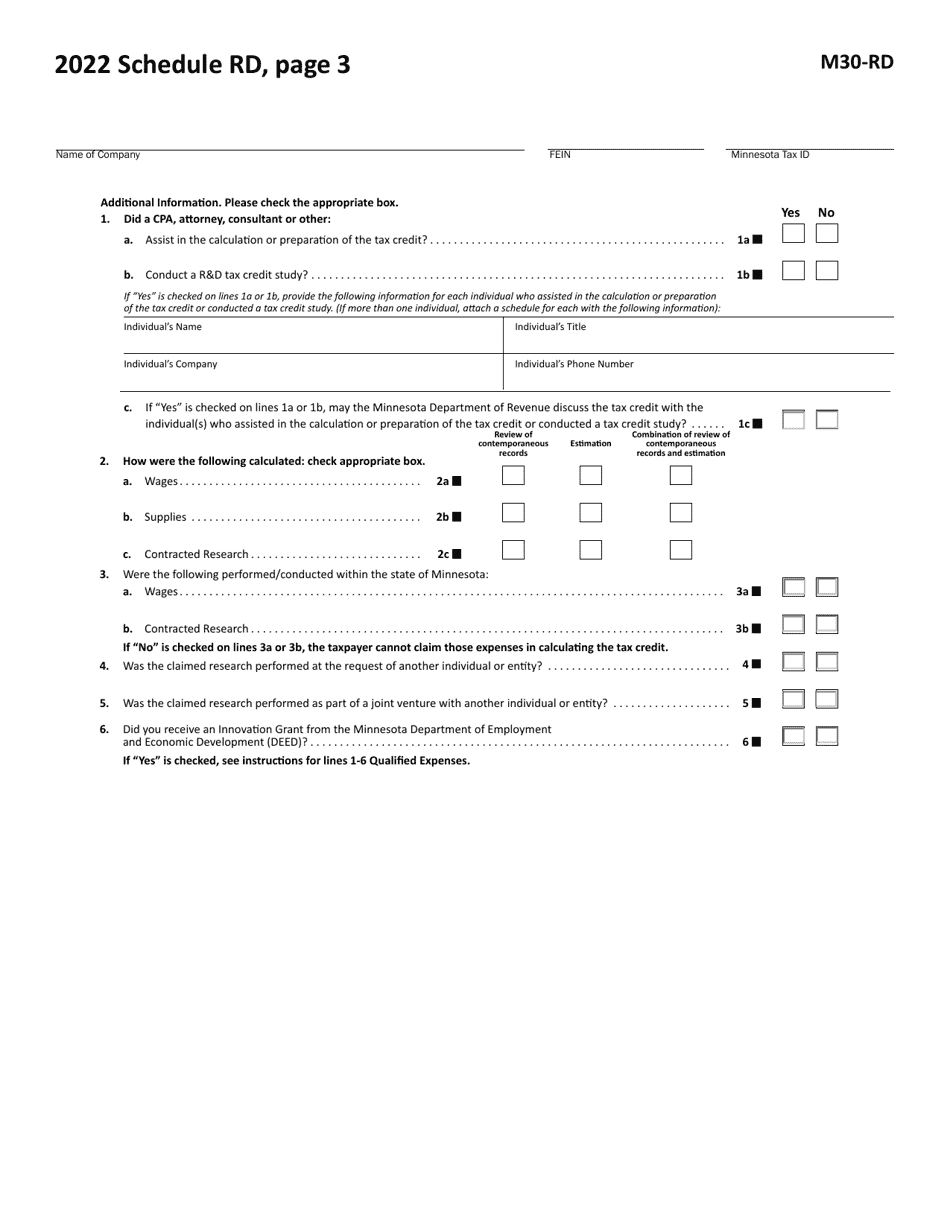

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the M30-RD form?

A: The M30-RD form is the Credit for Increasing Research Activities form in Minnesota.

Q: What is the purpose of the M30-RD form?

A: The purpose of the M30-RD form is to claim the credit for increasing research activities in Minnesota.

Q: Who is eligible to use the M30-RD form?

A: Businesses and individuals engaged in qualified research activities in Minnesota may be eligible to use the M30-RD form.

Q: What are qualified research activities?

A: Qualified research activities are activities that meet certain criteria defined by the IRS, such as the development or improvement of a product or process.

Q: What can the M30-RD credit be used for?

A: The M30-RD credit can be used to reduce a taxpayer's Minnesota tax liability or claimed as a refund.

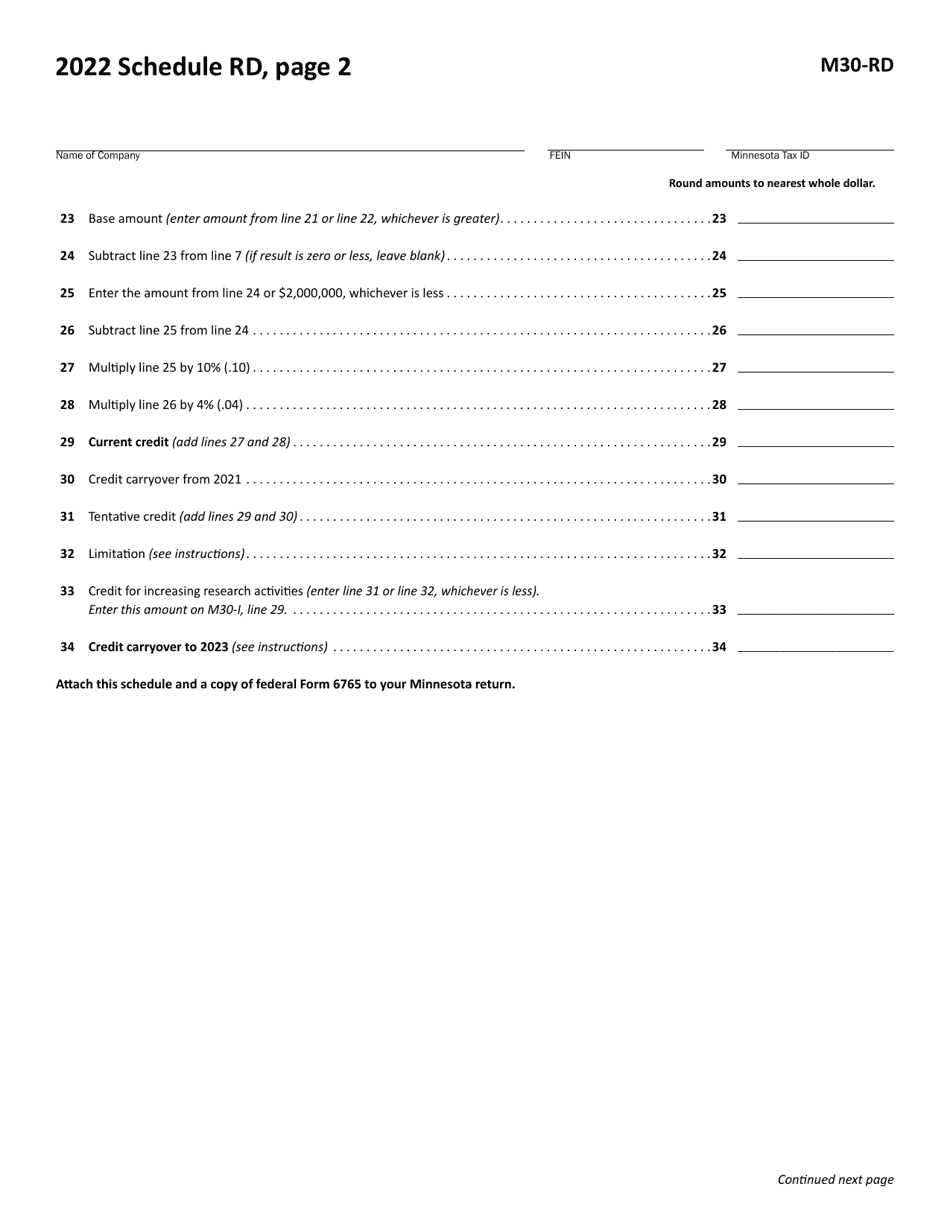

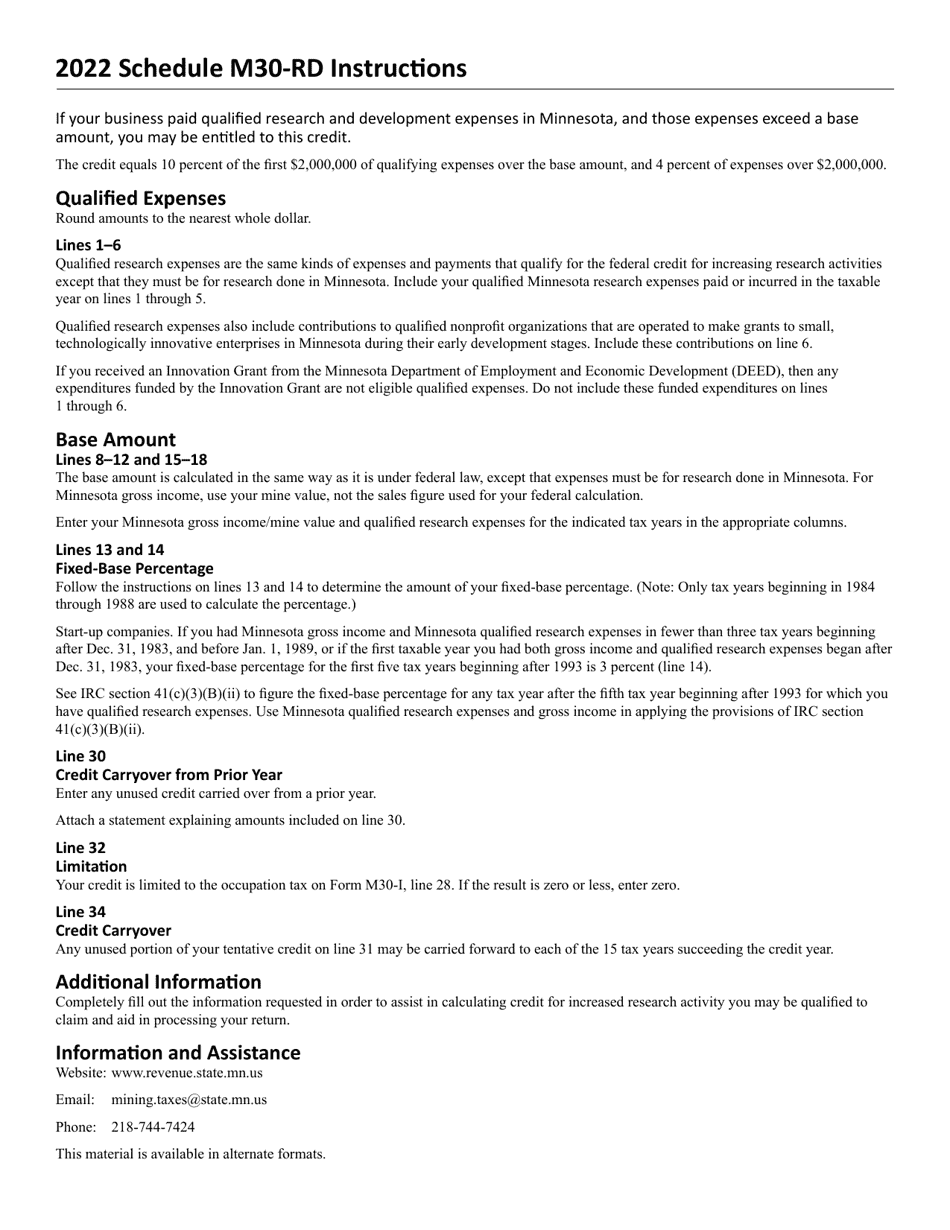

Q: How is the M30-RD credit calculated?

A: The M30-RD credit is calculated based on the qualified research expenses incurred by the taxpayer in Minnesota.

Q: Are there any limitations or restrictions on the M30-RD credit?

A: Yes, there are limitations and restrictions on the M30-RD credit, including limitations based on the size of the business and the amount of qualified research expenses.

Q: Are there any deadlines for filing the M30-RD form?

A: Yes, the M30-RD form must be filed on or before the due date of the taxpayer's Minnesota tax return for the taxable year in which the qualified research activities were performed.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M30-RD by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.