This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule M1HOME

for the current year.

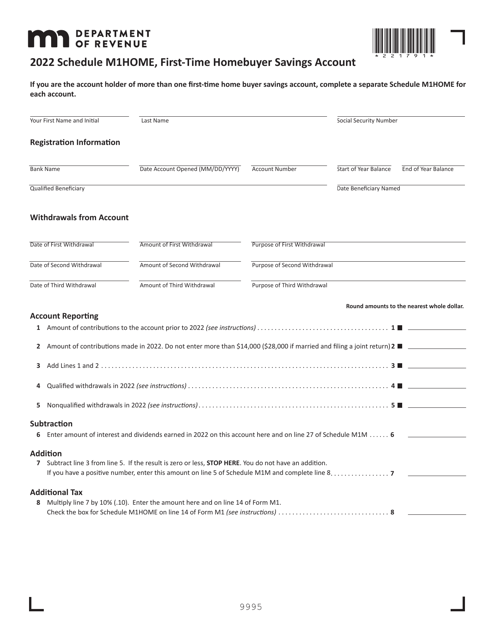

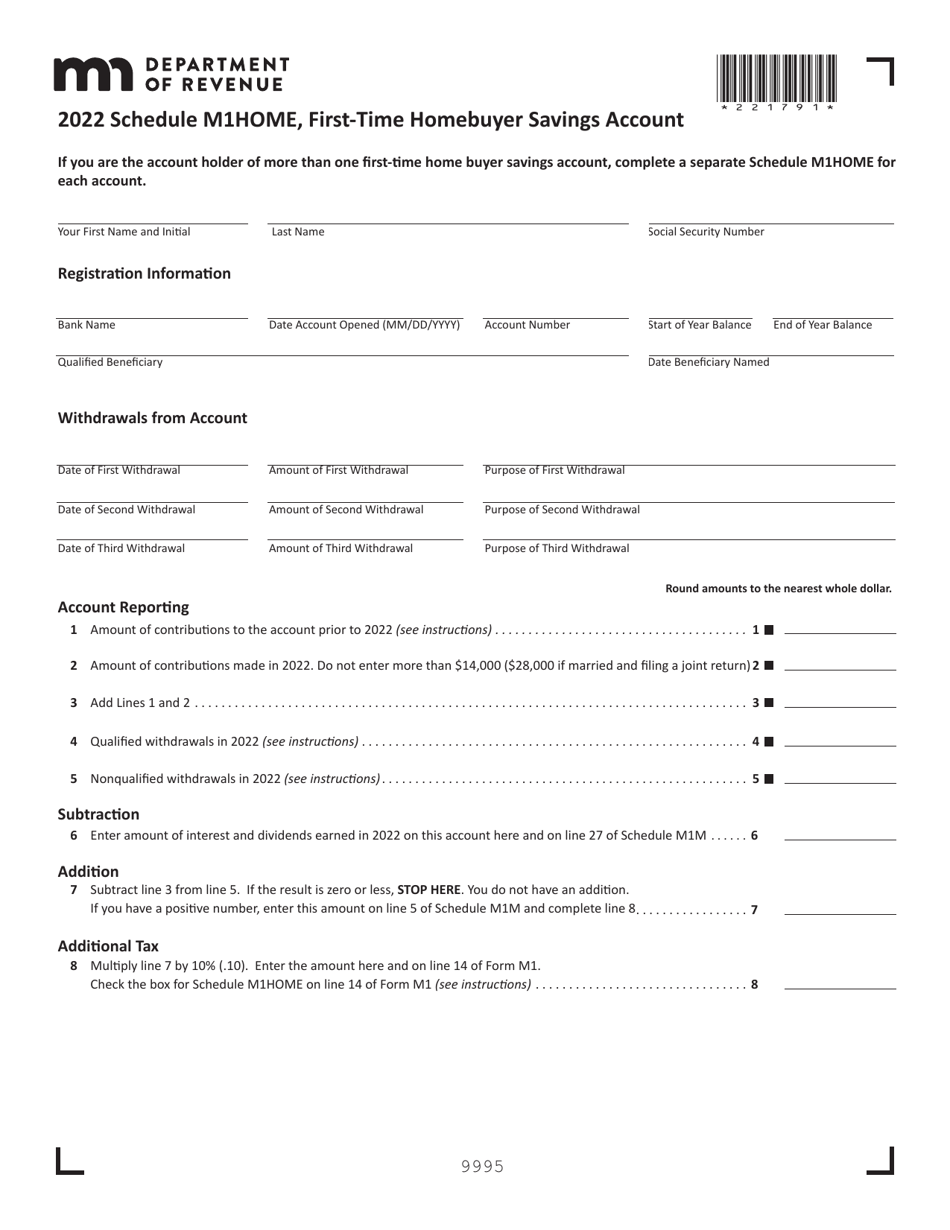

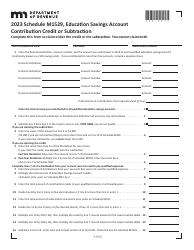

Schedule M1HOME First-Time Homebuyer Savings Account - Minnesota

What Is Schedule M1HOME?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

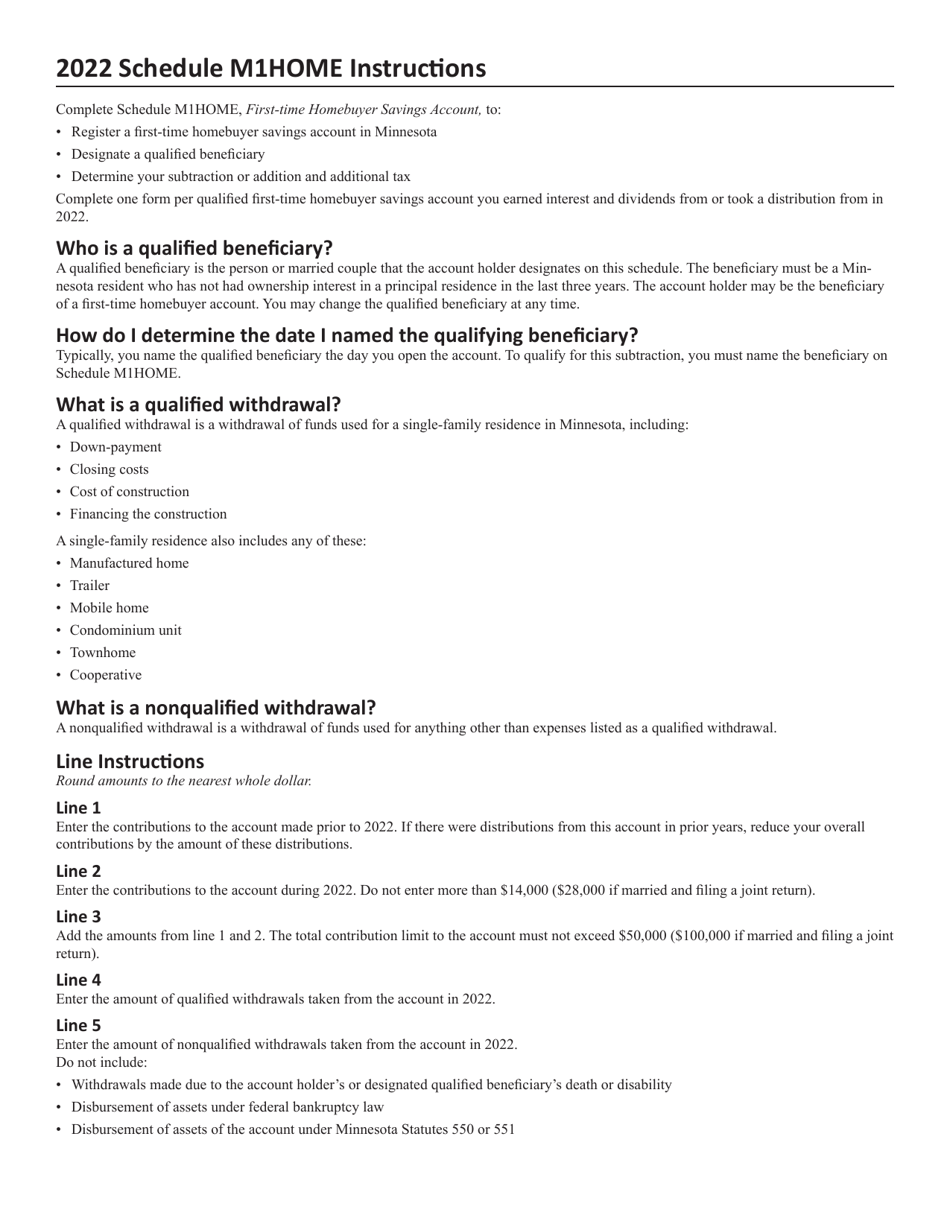

Q: What is Schedule M1HOME?

A: Schedule M1HOME is a form used in Minnesota for reporting First-Time Homebuyer Savings Account information.

Q: What is a First-Time Homebuyer Savings Account?

A: A First-Time Homebuyer Savings Account is a special savings account in Minnesota that allows individuals to save money towards the purchase of their first home.

Q: Who can open a First-Time Homebuyer Savings Account?

A: Any individual who is a resident of Minnesota and has never owned a home may open a First-Time Homebuyer Savings Account.

Q: What are the benefits of a First-Time Homebuyer Savings Account?

A: The contributions made to a First-Time Homebuyer Savings Account are tax-deductible, and any earnings on the account are tax-free.

Q: How much can be contributed to a First-Time Homebuyer Savings Account?

A: The annual contribution limit for a First-Time Homebuyer Savings Account in Minnesota is $14,000 for married couples filing jointly, and $7,000 for individuals and all other filing statuses.

Q: What can the money in a First-Time Homebuyer Savings Account be used for?

A: The money in a First-Time Homebuyer Savings Account can be used for any expenses related to the purchase or construction of a qualified first home, including down payments, closing costs, and fees.

Q: Are there any penalties for withdrawing money from a First-Time Homebuyer Savings Account?

A: If the money is not used for a qualified first home purchase, any withdrawals from a First-Time Homebuyer Savings Account are subject to income tax and a 10% penalty.

Q: How do I report my First-Time Homebuyer Savings Account on my tax return?

A: You should use Schedule M1HOME to report your First-Time Homebuyer Savings Account on your Minnesota tax return.

Q: Is the First-Time Homebuyer Savings Account program available in any other states?

A: No, the First-Time Homebuyer Savings Account program is currently unique to Minnesota.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M1HOME by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.