This version of the form is not currently in use and is provided for reference only. Download this version of

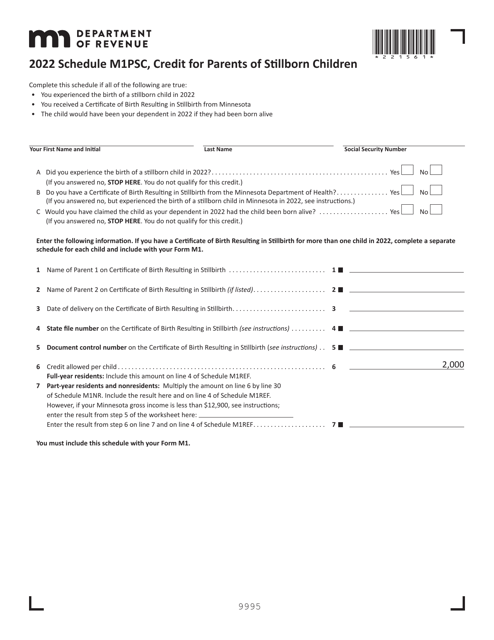

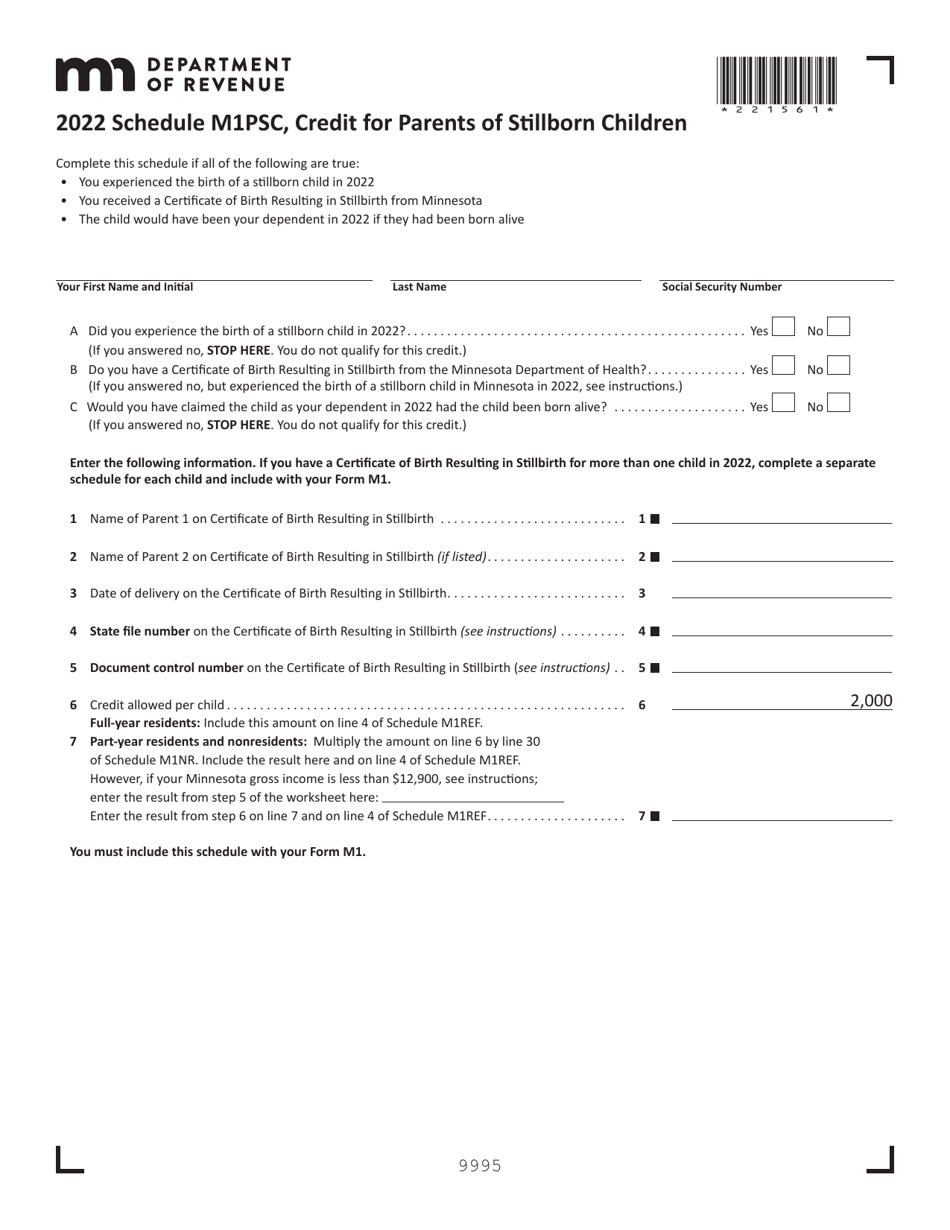

Schedule M1PSC

for the current year.

Schedule M1PSC Credit for Parents of Stillborn Children - Minnesota

What Is Schedule M1PSC?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

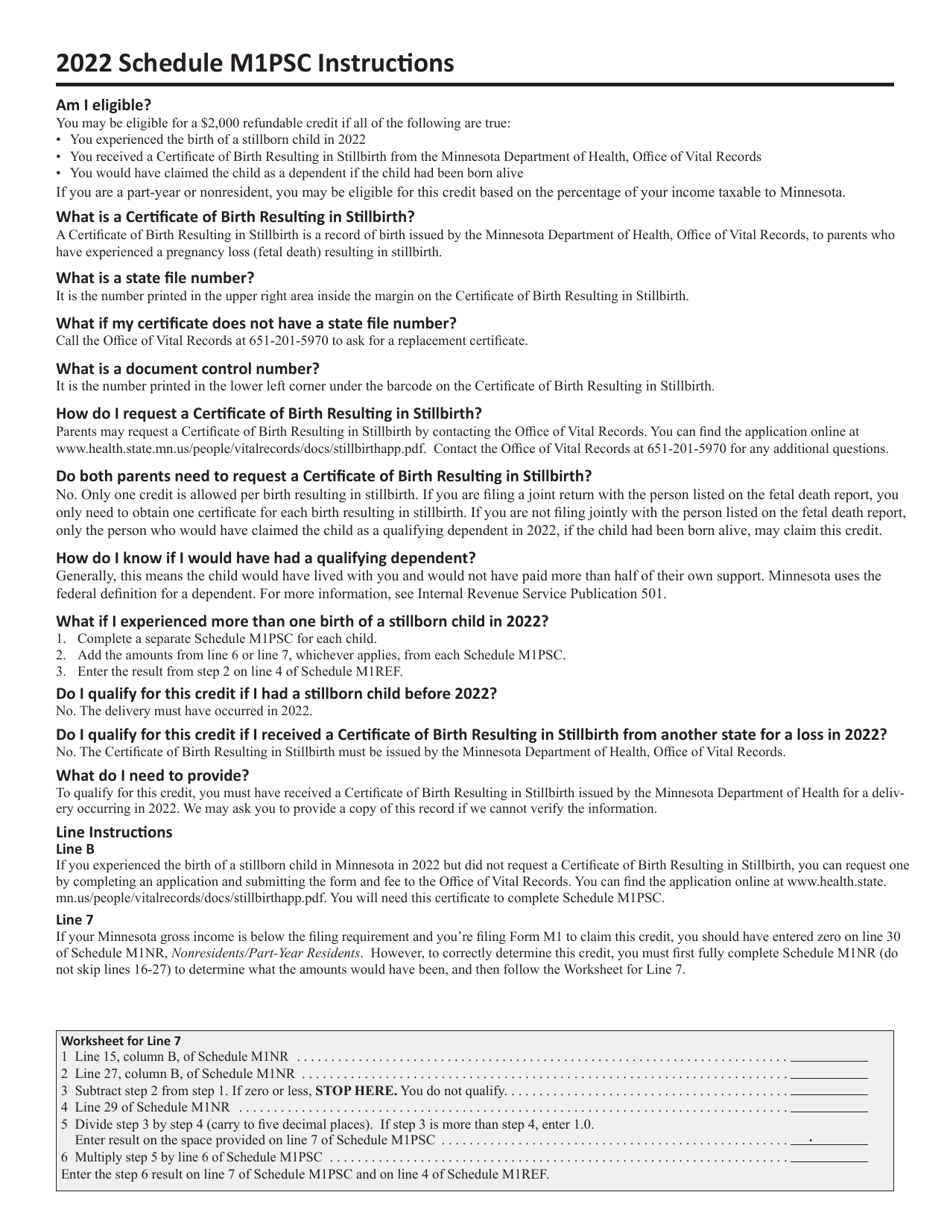

Q: What is the Schedule M1PSC Credit?

A: The Schedule M1PSC Credit is a tax credit available to parents of stillborn children in Minnesota.

Q: Who is eligible for the Schedule M1PSC Credit?

A: Parents who experienced a stillbirth in Minnesota are eligible for the Schedule M1PSC Credit.

Q: How much is the Schedule M1PSC Credit?

A: The Schedule M1PSC Credit is $2,000 per stillborn child.

Q: What documents are required to claim the Schedule M1PSC Credit?

A: To claim the credit, you will need to provide a copy of the fetal death certificate and any other documentation required by the Minnesota Department of Revenue.

Q: How do I claim the Schedule M1PSC Credit?

A: You can claim the Schedule M1PSC Credit by filling out Schedule M1PSC and attaching it to your Minnesota income tax return.

Q: Can the Schedule M1PSC Credit be carried forward or transferred?

A: No, the Schedule M1PSC Credit cannot be carried forward to future years or transferred to another taxpayer.

Q: Is the Schedule M1PSC Credit refundable?

A: Yes, the Schedule M1PSC Credit is refundable, which means it can reduce your tax liability and provide a refund if the credit exceeds your tax liability.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M1PSC by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.