This version of the form is not currently in use and is provided for reference only. Download this version of

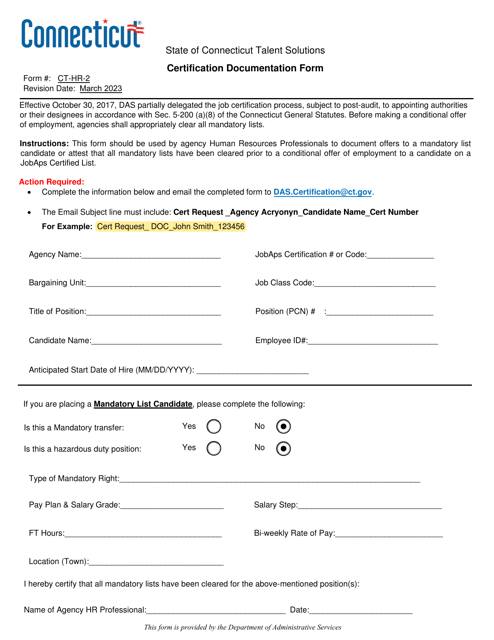

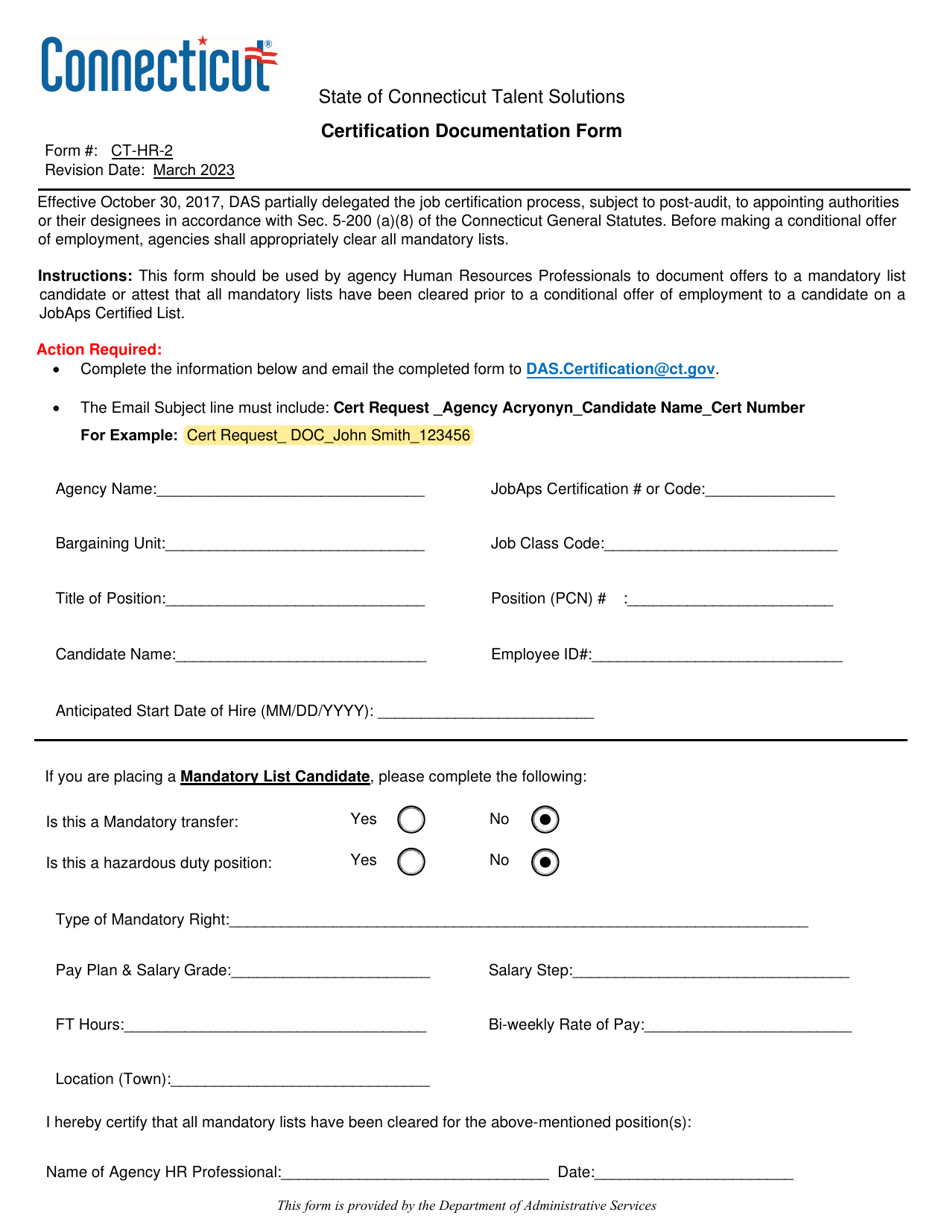

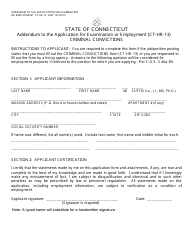

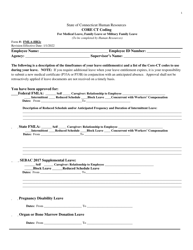

Form CT-HR-2

for the current year.

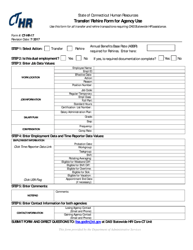

Form CT-HR-2 Certification Documentation Form - Connecticut

What Is Form CT-HR-2?

This is a legal form that was released by the Connecticut Department of Administrative Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

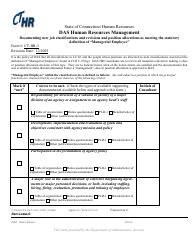

Q: What is Form CT-HR-2?

A: Form CT-HR-2 is a certification documentation form used in Connecticut.

Q: What is the purpose of Form CT-HR-2?

A: The purpose of Form CT-HR-2 is to certify that the information provided on the form is true and accurate.

Q: Who needs to fill out Form CT-HR-2?

A: Employers in Connecticut may be required to fill out Form CT-HR-2.

Q: When is Form CT-HR-2 used?

A: Form CT-HR-2 is typically used when an employer is seeking certification for certain tax credits or incentives.

Q: Is there a fee to file Form CT-HR-2?

A: No, there is no fee to file Form CT-HR-2.

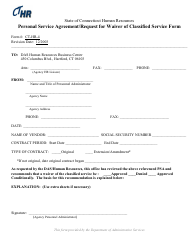

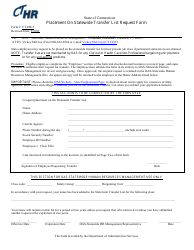

Q: What information do I need to provide on Form CT-HR-2?

A: You will need to provide information about your business, including your employer identification number (EIN) and details about the tax credits or incentives you are seeking certification for.

Q: Are there any penalties for providing false information on Form CT-HR-2?

A: Yes, providing false information on Form CT-HR-2 can result in penalties, including fines and criminal charges.

Q: Can I save a copy of Form CT-HR-2 for my records?

A: Yes, it is recommended to save a copy of Form CT-HR-2 for your records.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Connecticut Department of Administrative Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-HR-2 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Administrative Services.