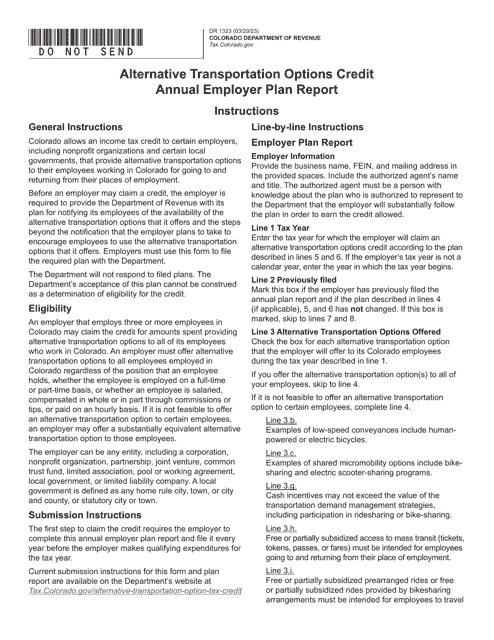

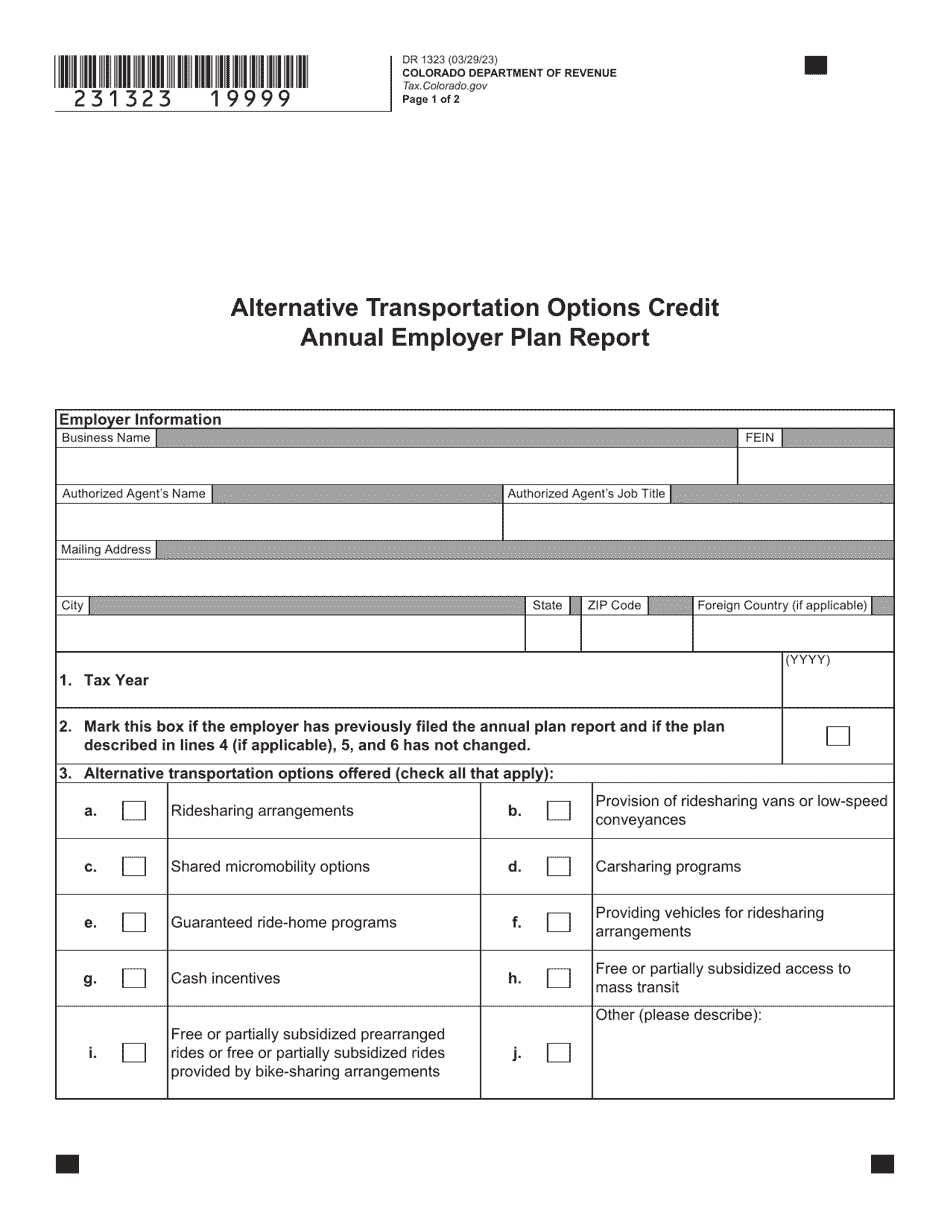

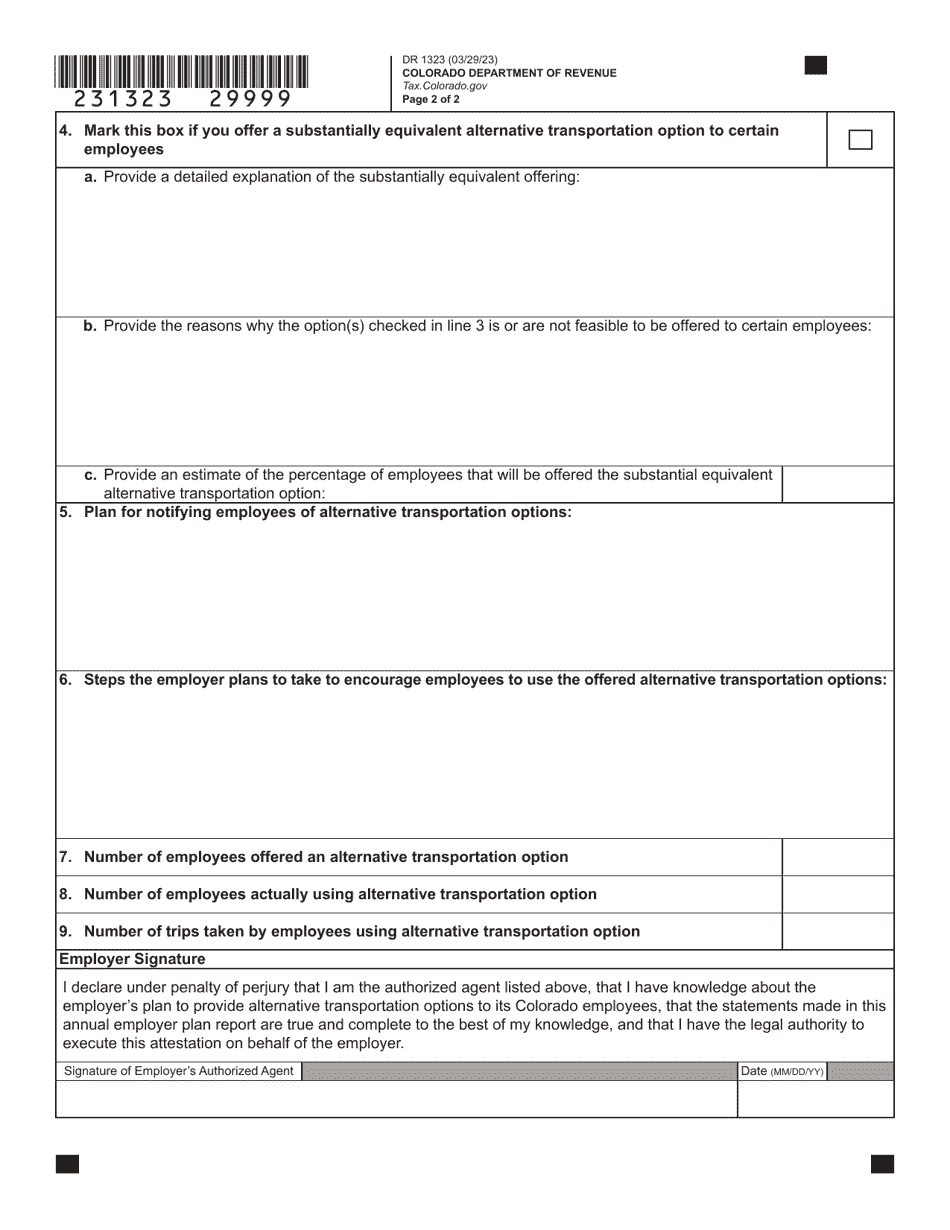

Form DR1323 Alternative Transportation Options Credit Annual Employer Plan Report - Colorado

What Is Form DR1323?

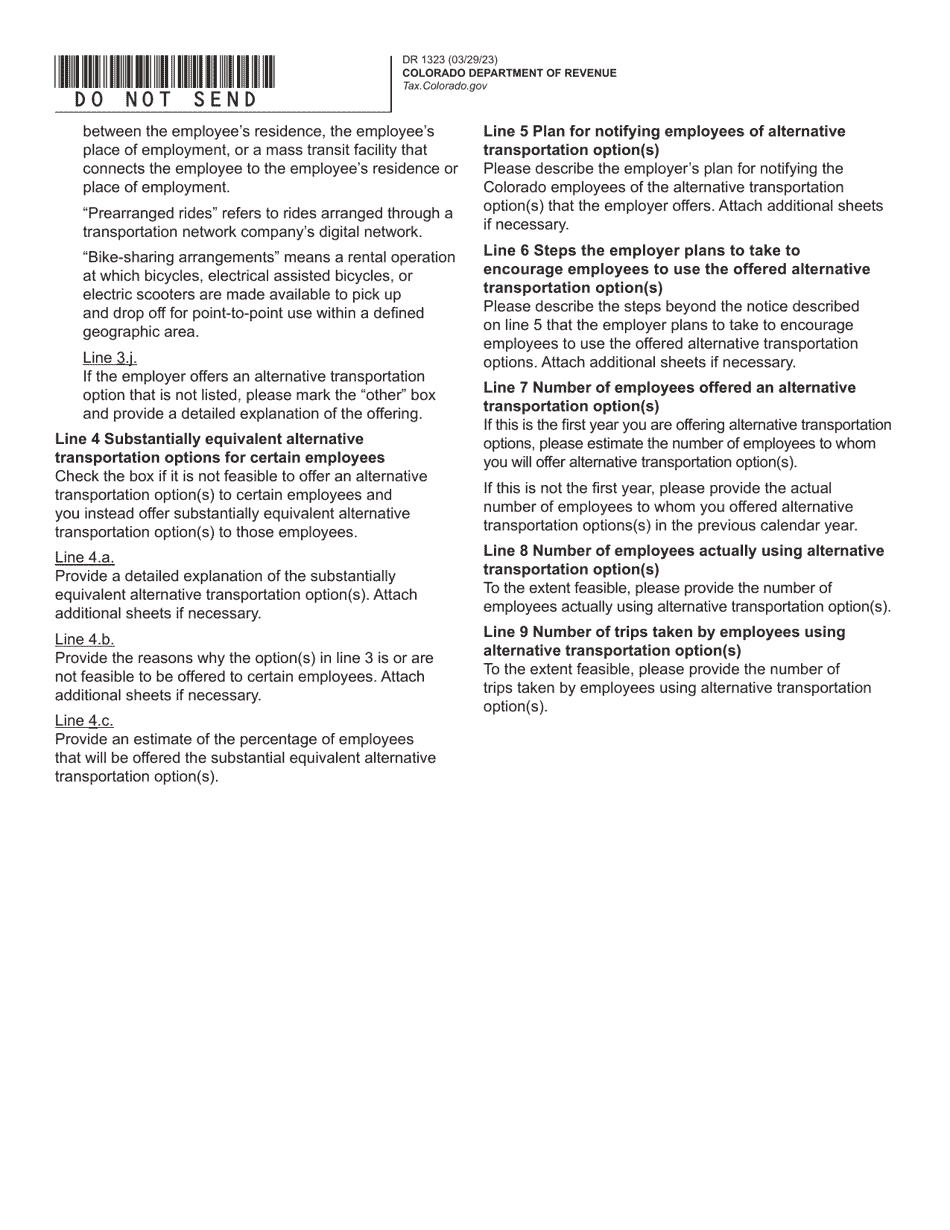

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DR1323?

A: Form DR1323 is the Annual Employer Plan Report for Alternative Transportation Options Credit in Colorado.

Q: What is the Alternative Transportation Options Credit?

A: The Alternative Transportation Options Credit is a tax credit available to employers in Colorado who provide alternative transportation options for their employees.

Q: Who is required to file the Form DR1323?

A: Employers in Colorado who provide alternative transportation options and claim the Alternative Transportation Options Credit are required to file the Form DR1323.

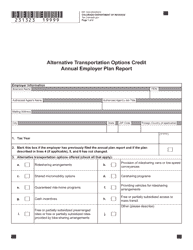

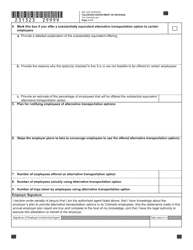

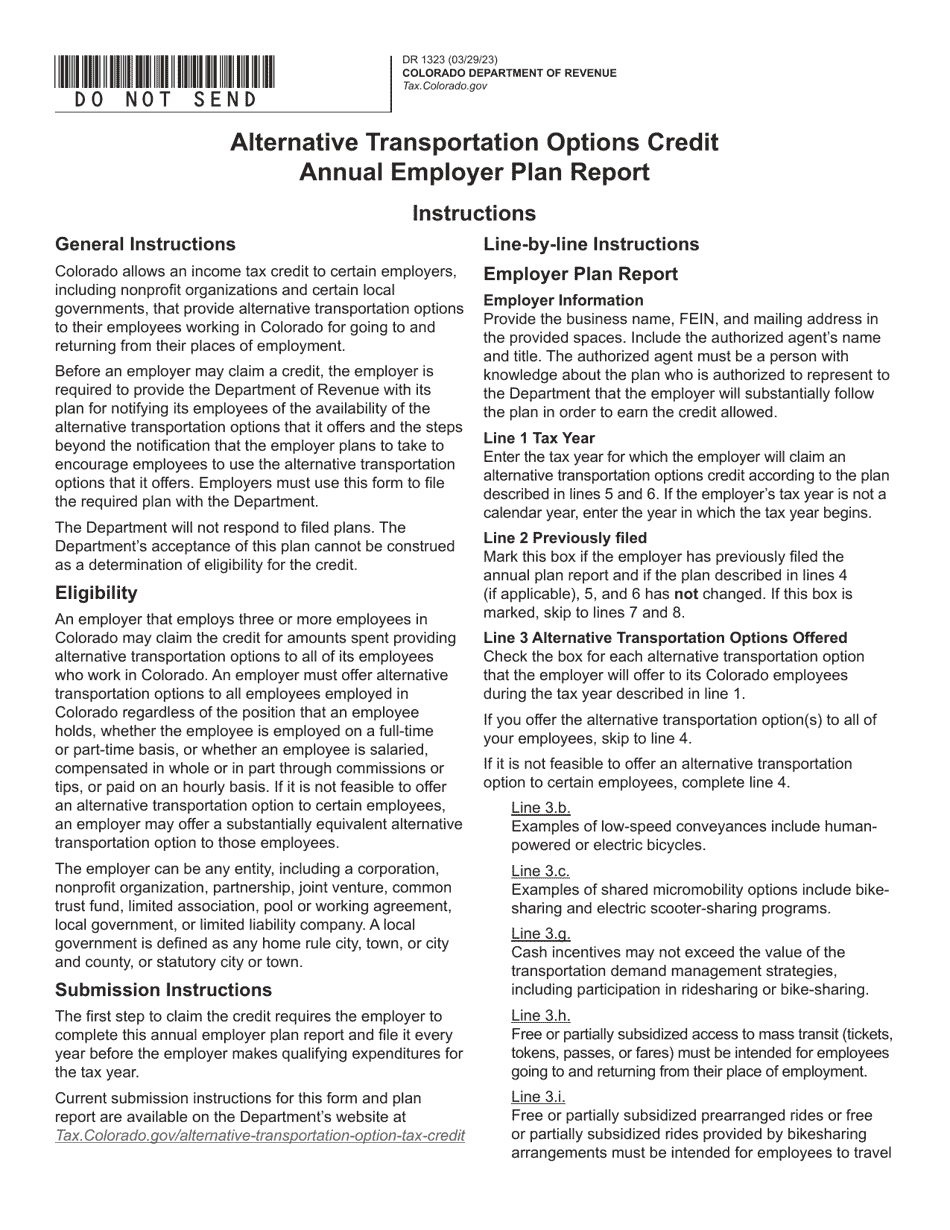

Q: What information is required on the Form DR1323?

A: The Form DR1323 requires employers to provide information about their alternative transportation plan, including the number of employees enrolled, the type of transportation options provided, and the expenses incurred.

Q: When is the deadline to file the Form DR1323?

A: The Form DR1323 must be filed annually by January 31st.

Q: Is there a penalty for late filing of the Form DR1323?

A: Yes, there is a penalty for late filing of the Form DR1323. The penalty is $10 per day, up to a maximum of $500.

Q: Can the Alternative Transportation Options Credit be carried forward?

A: Yes, any unused Alternative Transportation Options Credit can be carried forward for up to five years.

Q: Are there any restrictions on the types of alternative transportation options that qualify for the credit?

A: Yes, not all alternative transportation options qualify for the credit. The options must meet certain criteria specified by the Colorado Department of Revenue.

Q: Can self-employed individuals claim the Alternative Transportation Options Credit?

A: No, the Alternative Transportation Options Credit is only available to employers in Colorado.

Form Details:

- Released on March 29, 2023;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR1323 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.