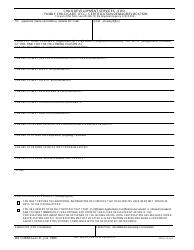

This version of the form is not currently in use and is provided for reference only. Download this version of

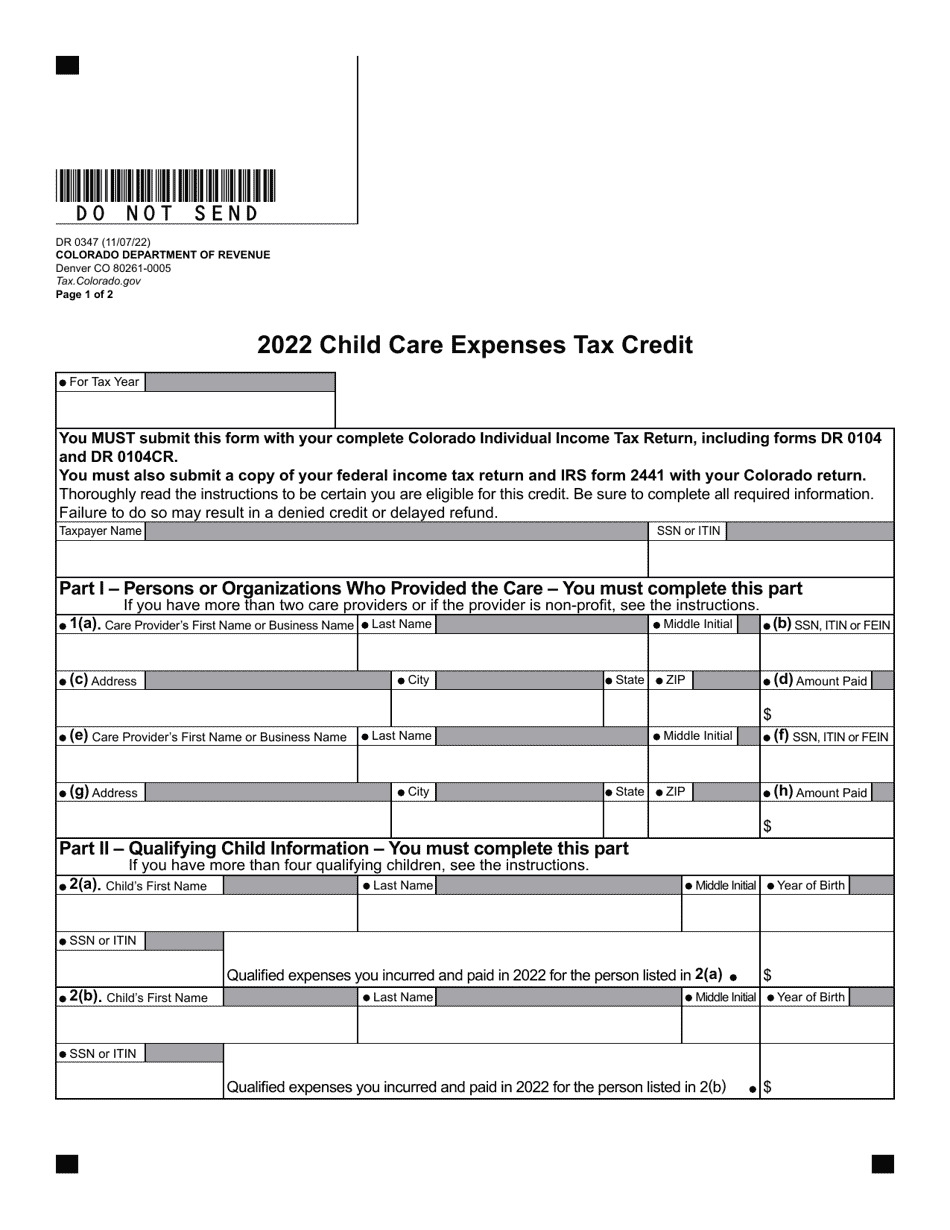

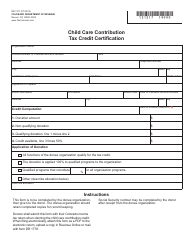

Form DR0347

for the current year.

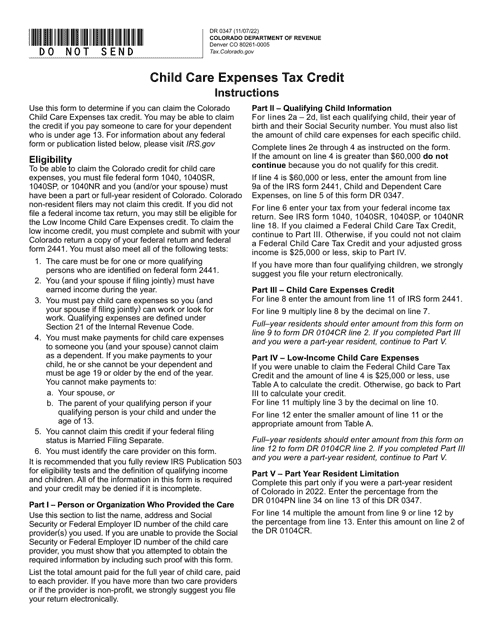

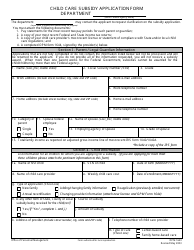

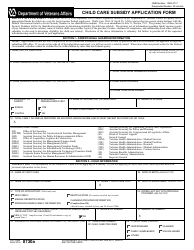

Form DR0347 Child Care Expenses Tax Credit - Colorado

What Is Form DR0347?

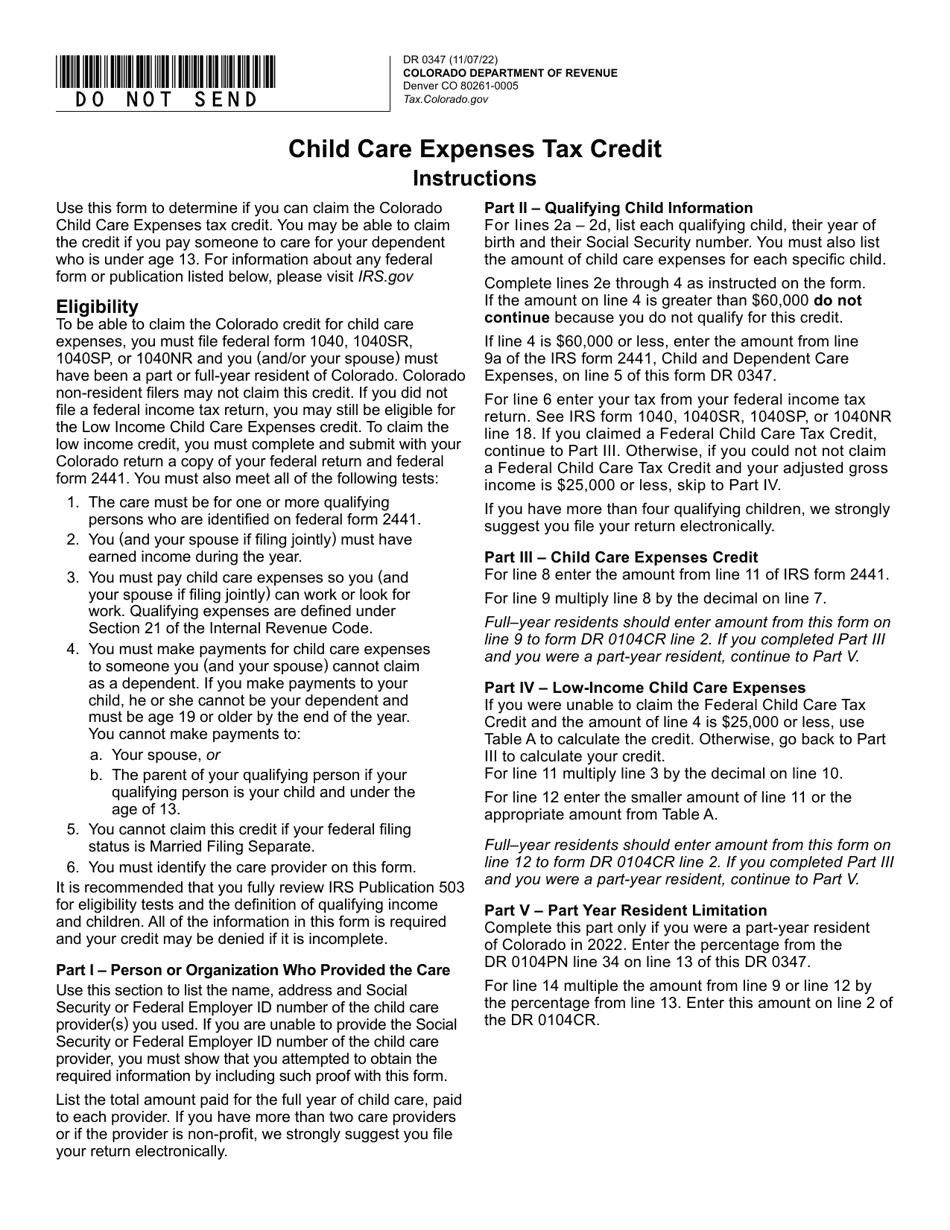

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

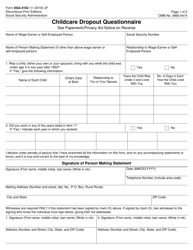

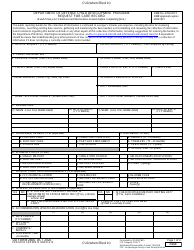

Q: What is Form DR0347?

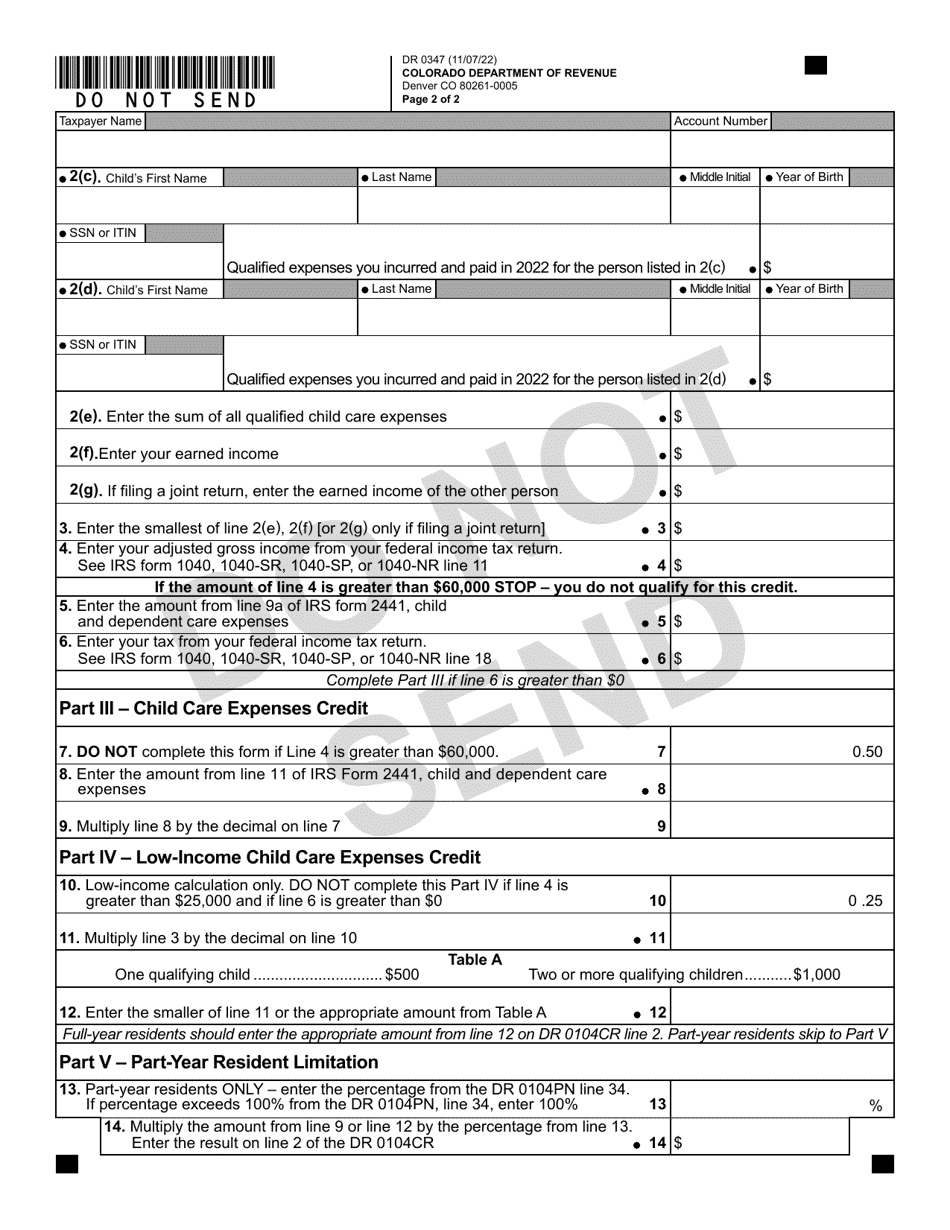

A: Form DR0347 is a tax form used to claim the Child Care Expenses Tax Credit in Colorado.

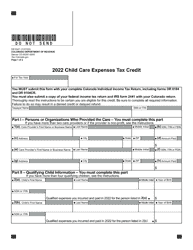

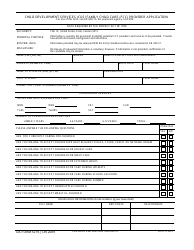

Q: What is the Child Care Expenses Tax Credit?

A: The Child Care Expenses Tax Credit is a tax credit that allows Colorado taxpayers to claim a portion of their child care expenses as a credit on their state income tax return.

Q: Who is eligible to claim the Child Care Expenses Tax Credit?

A: Colorado taxpayers who paid for child care expenses for children under the age of 13 may be eligible to claim the credit.

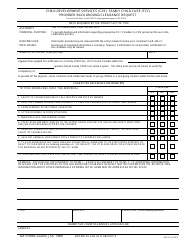

Q: What type of child care expenses can be included?

A: Qualifying child care expenses include payments made to licensed child care providers or babysitters, as well as fees paid to a nursery school, preschool, or daycare center.

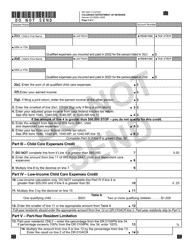

Q: How much is the Child Care Expenses Tax Credit?

A: The credit is based on a percentage of the federal child care expenses credit, which can range from 20% to 75% depending on the taxpayer's income.

Q: How do I apply for the Child Care Expenses Tax Credit?

A: To claim the credit, you must complete and file Form DR0347 with your Colorado state income tax return.

Q: Are there any limitations or restrictions for claiming the credit?

A: Yes, there are some limitations and restrictions. For example, the credit is limited to $500 per child and the total credit cannot exceed the taxpayer's Colorado income tax liability.

Q: Is there a deadline for claiming the credit?

A: Yes, the deadline to claim the Child Care Expenses Tax Credit is the same as the deadline to file your Colorado state income tax return, which is typically April 15th.

Q: Is the Child Care Expenses Tax Credit refundable?

A: No, the credit is non-refundable, which means it can only reduce the amount of state income tax you owe, but it will not result in a refund if you have no tax liability.

Form Details:

- Released on November 7, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR0347 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.