This version of the form is not currently in use and is provided for reference only. Download this version of

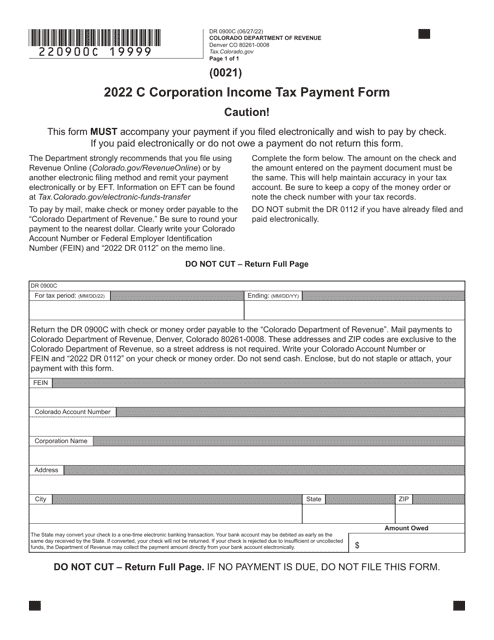

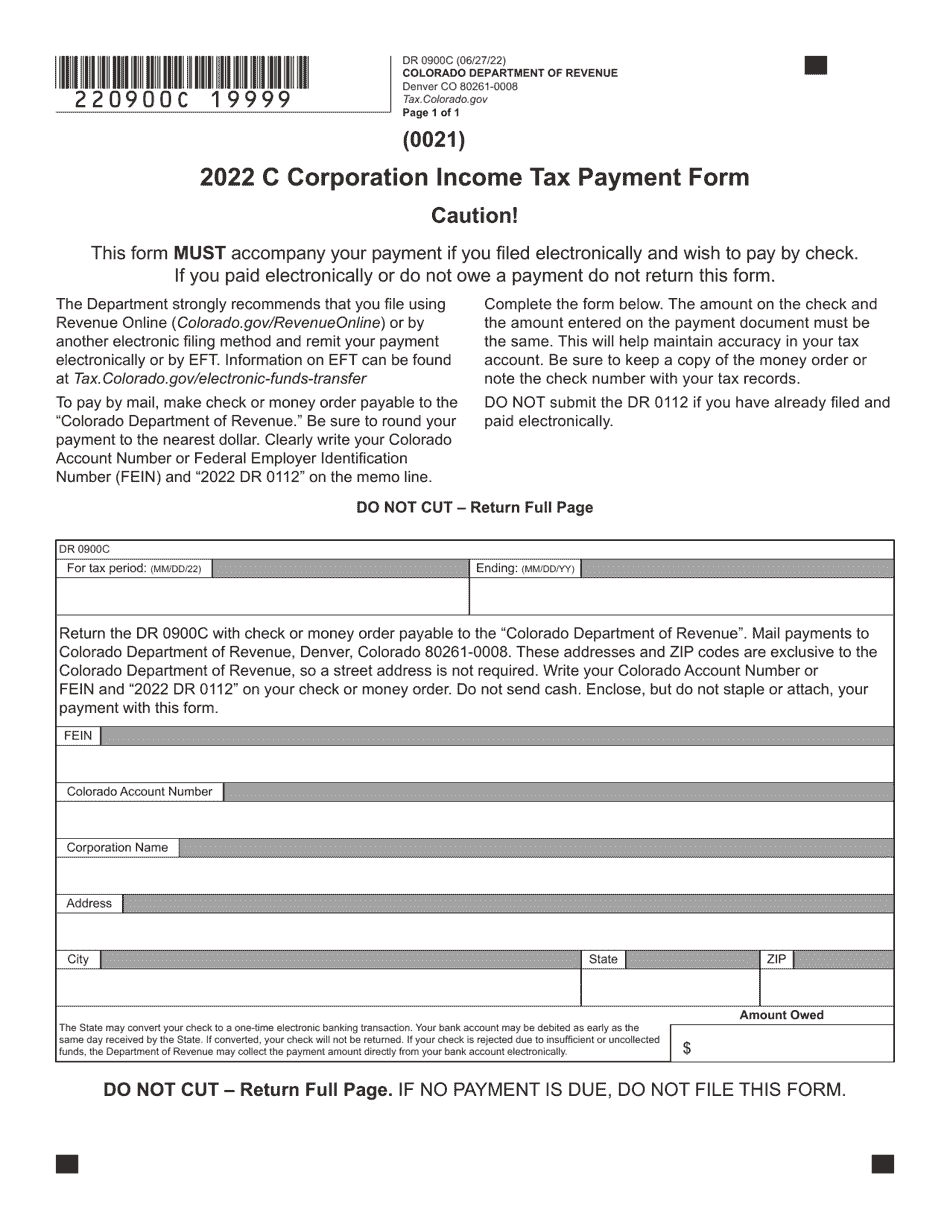

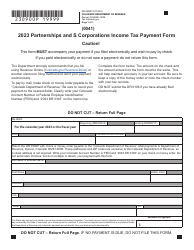

Form DR0900C

for the current year.

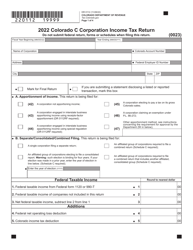

Form DR0900C C Corporation Income Tax Payment Form - Colorado

What Is Form DR0900C?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0900C?

A: Form DR0900C is the C Corporation Income Tax Payment Form for the state of Colorado.

Q: Who needs to file Form DR0900C?

A: C Corporations in Colorado who owe income tax need to file Form DR0900C.

Q: What is the purpose of Form DR0900C?

A: The purpose of Form DR0900C is to report and pay income tax owed by C Corporations in Colorado.

Q: When is Form DR0900C due?

A: Form DR0900C is due on the 15th day of the 4th month following the end of the corporation's tax year.

Q: How do I pay the income tax reported on Form DR0900C?

A: You can pay the income tax reported on Form DR0900C electronically or by mailing a check or money order to the Colorado Department of Revenue.

Q: Are there any penalties for late payment or non-payment of income tax?

A: Yes, there are penalties for late payment or non-payment of income tax in Colorado. It is important to file and pay on time to avoid penalties and interest.

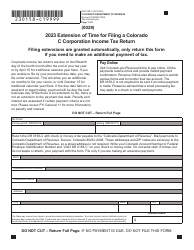

Q: Can I request an extension to file Form DR0900C?

A: Yes, you can request an extension to file Form DR0900C by filing Form DR0158C, Application for Extension of Time for Filing Colorado C Corporation Returns.

Form Details:

- Released on June 27, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0900C by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.