This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0350

for the current year.

Form DR0350 First-Time Home Buyer Savings Account Interest Deduction - Colorado

What Is Form DR0350?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

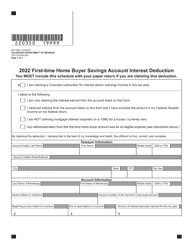

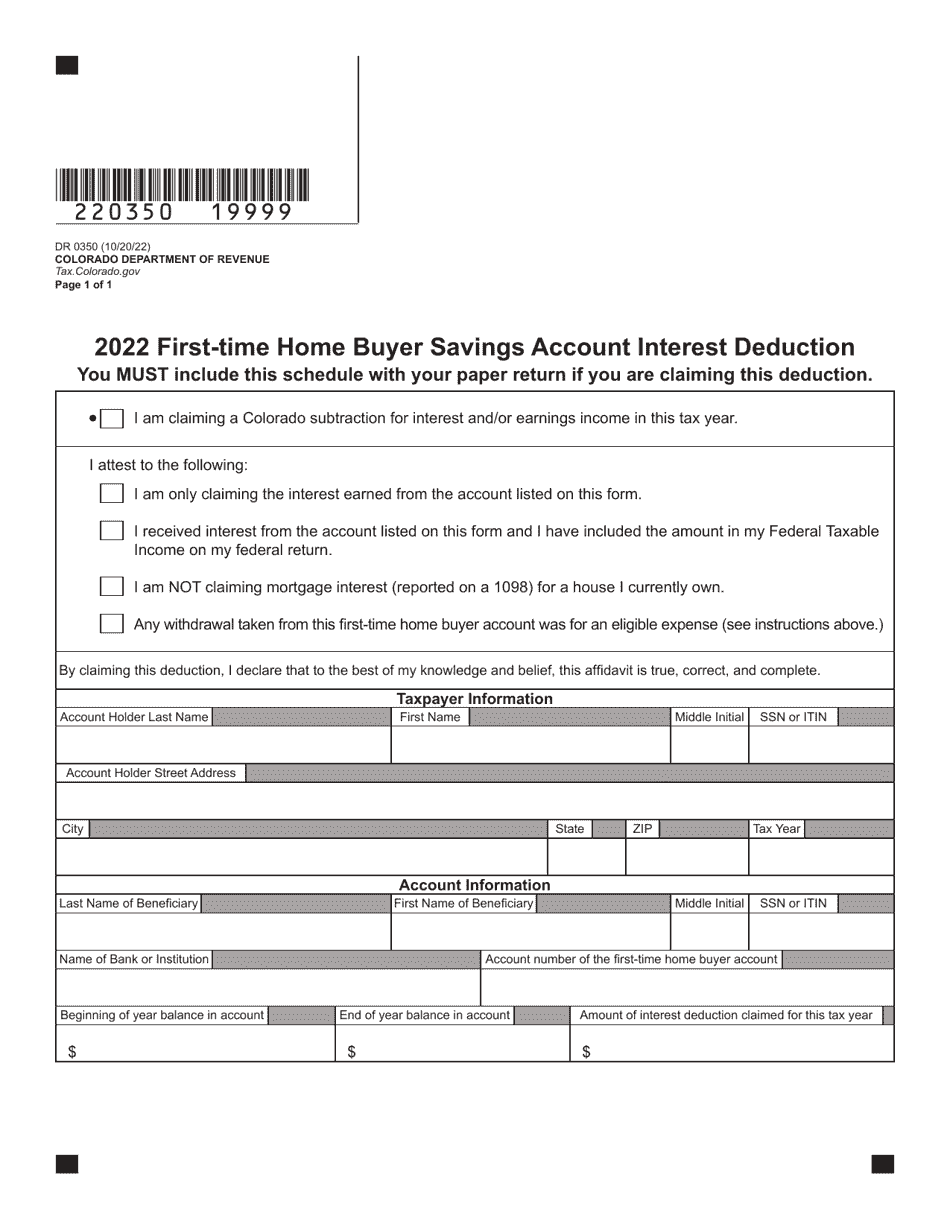

Q: What is Form DR0350?

A: Form DR0350 is a tax form used in Colorado for claiming the First-Time Home Buyer Savings Account Interest Deduction.

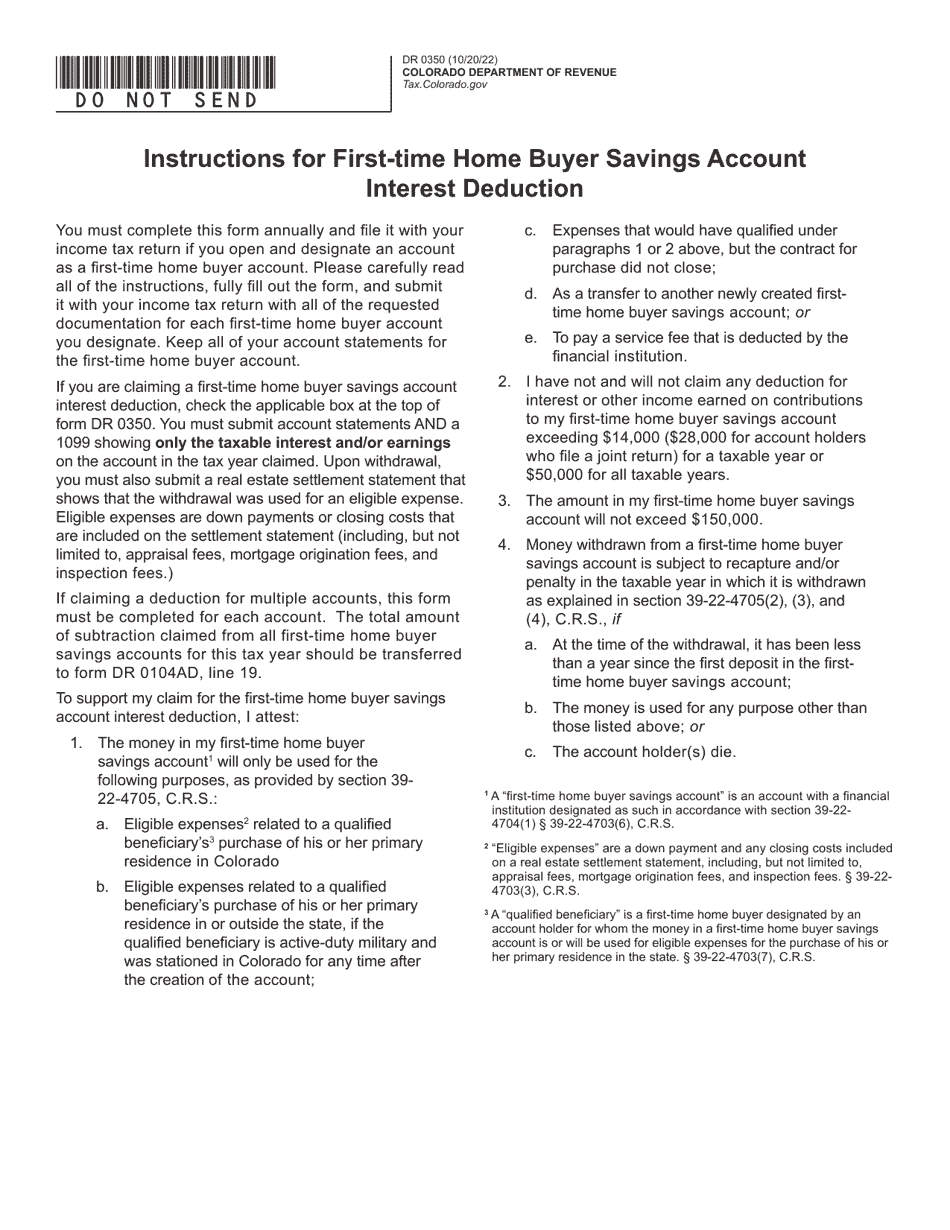

Q: What is the First-Time Home Buyer Savings Account Interest Deduction?

A: The First-Time Home Buyer Savings Account Interest Deduction allows eligible taxpayers in Colorado to deduct the interest earned on money saved in a first-time home buyer savings account.

Q: Who is eligible for the First-Time Home Buyer Savings Account Interest Deduction?

A: Individuals who have established and contributed to a first-time home buyer savings account in Colorado are potentially eligible for the deduction.

Q: How do I claim the First-Time Home Buyer Savings Account Interest Deduction?

A: To claim the deduction, taxpayers must complete and file Form DR0350 with their Colorado state income tax return.

Q: Are there any limitations or requirements for the First-Time Home Buyer Savings Account Interest Deduction?

A: Yes, there are specific limitations and requirements for the deduction, such as a maximum deduction amount and a minimum account balance.

Q: Is the First-Time Home Buyer Savings Account Interest Deduction available in other states?

A: No, the deduction is specific to Colorado and is not available in other states.

Form Details:

- Released on October 20, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0350 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.