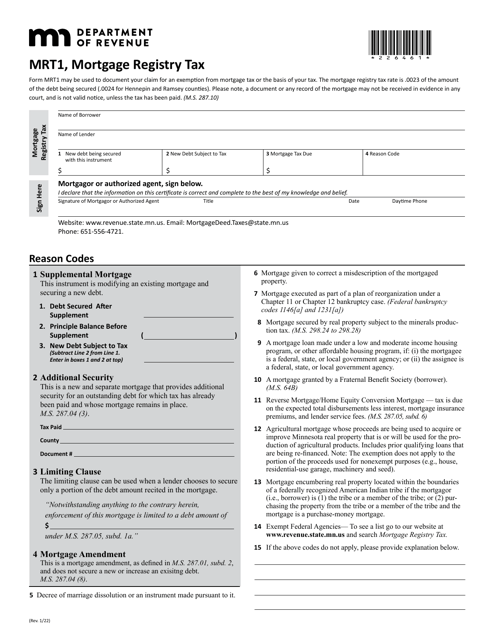

Form MRT1 Mortgage Registry Tax - Minnesota

What Is Form MRT1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MRT1 Mortgage Registry Tax?

A: MRT1 Mortgage Registry Tax is a tax levied on the recording of certain mortgage documents in Minnesota.

Q: Who is responsible for paying MRT1 Mortgage Registry Tax?

A: The borrower or the buyer is typically responsible for paying MRT1 Mortgage Registry Tax.

Q: How is MRT1 Mortgage Registry Tax calculated?

A: MRT1 Mortgage Registry Tax is calculated based on the principal amount of the mortgage being recorded.

Q: What is the current rate of MRT1 Mortgage Registry Tax in Minnesota?

A: The current rate of MRT1 Mortgage Registry Tax in Minnesota is 0.23% of the principal amount of the mortgage.

Q: Are there any exemptions or deductions available for MRT1 Mortgage Registry Tax?

A: No, there are no exemptions or deductions available for MRT1 Mortgage Registry Tax.

Q: What happens if MRT1 Mortgage Registry Tax is not paid?

A: If MRT1 Mortgage Registry Tax is not paid, the mortgage may not be eligible for recording, which could cause issues with the validity of the mortgage.

Q: Can MRT1 Mortgage Registry Tax be included in the mortgage amount?

A: No, MRT1 Mortgage Registry Tax cannot be included in the mortgage amount. It must be paid separately.

Q: Is MRT1 Mortgage Registry Tax deductible for income tax purposes?

A: No, MRT1 Mortgage Registry Tax is not deductible for income tax purposes.

Q: Is MRT1 Mortgage Registry Tax refundable?

A: No, MRT1 Mortgage Registry Tax is not refundable once paid.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MRT1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.