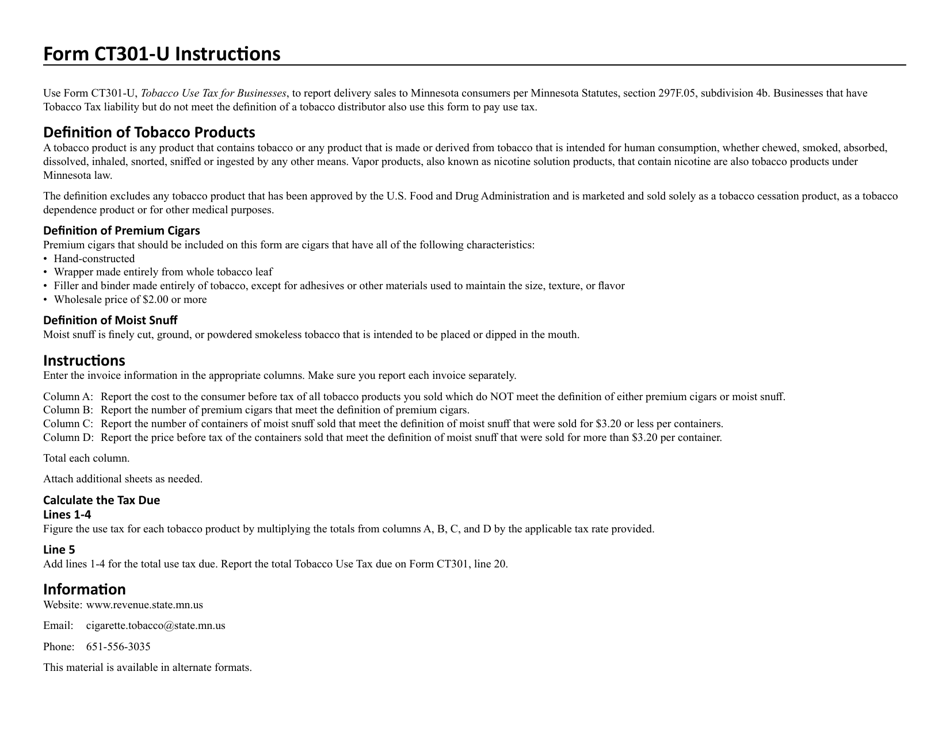

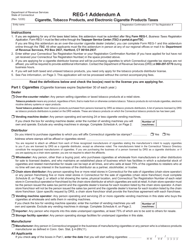

Form CT301-U Tobacco Use Tax for Businesses - Connecticut

What Is Form CT301-U?

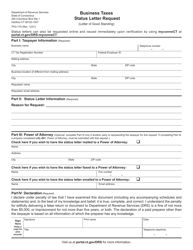

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

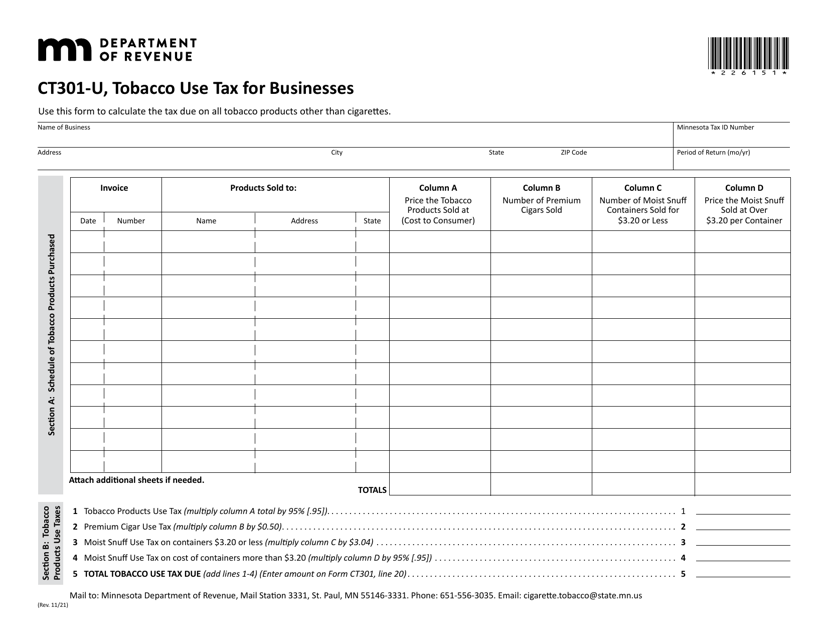

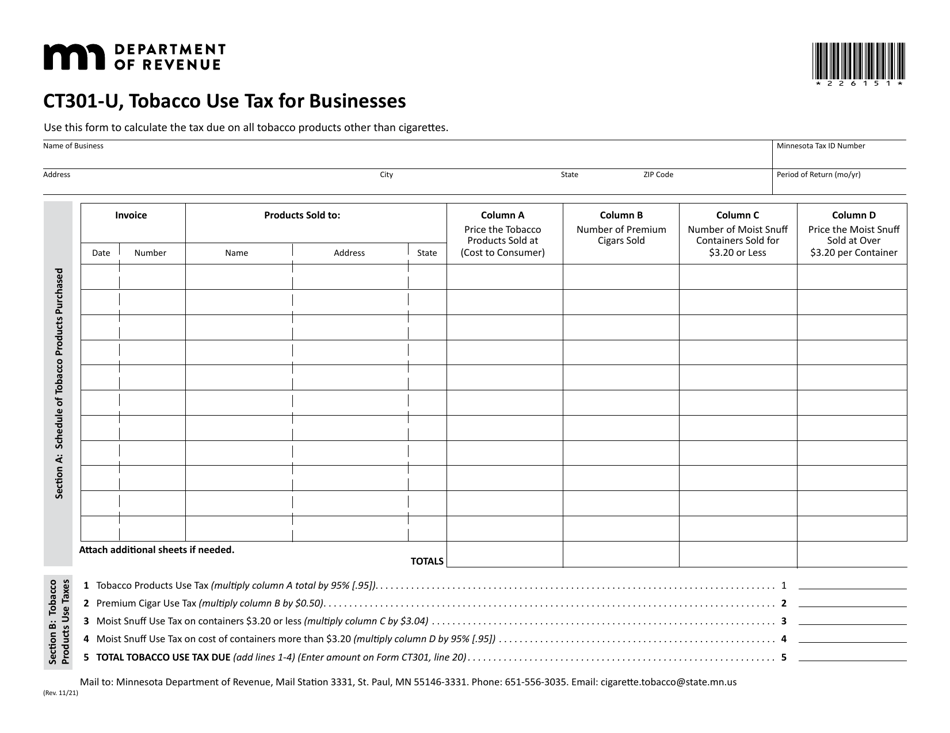

Q: What is Form CT301-U?

A: Form CT301-U is a document used for reporting and paying tobacco use tax for businesses in Connecticut.

Q: Who needs to file Form CT301-U?

A: Businesses in Connecticut that sell or distribute tobacco products need to file Form CT301-U.

Q: What is tobacco use tax?

A: Tobacco use tax is a tax imposed on the sale or distribution of tobacco products.

Q: How often is Form CT301-U filed?

A: Form CT301-U is filed on a monthly basis.

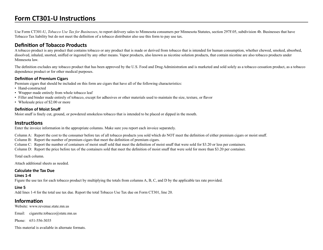

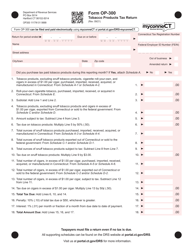

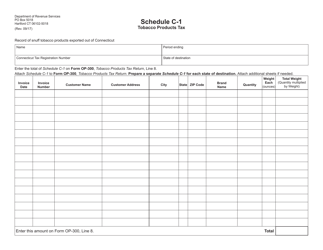

Q: What information is required on Form CT301-U?

A: Form CT301-U requires businesses to provide information about the quantity and value of tobacco products sold.

Q: When is Form CT301-U due?

A: Form CT301-U is due on the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form CT301-U?

A: Yes, there are penalties for late filing of Form CT301-U, including interest charges on outstanding tax owed.

Q: What happens if I don't file Form CT301-U?

A: Failure to file Form CT301-U or pay the tobacco use tax can result in penalties, interest charges, and other enforcement actions by the Connecticut Department of Revenue Services.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT301-U by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.