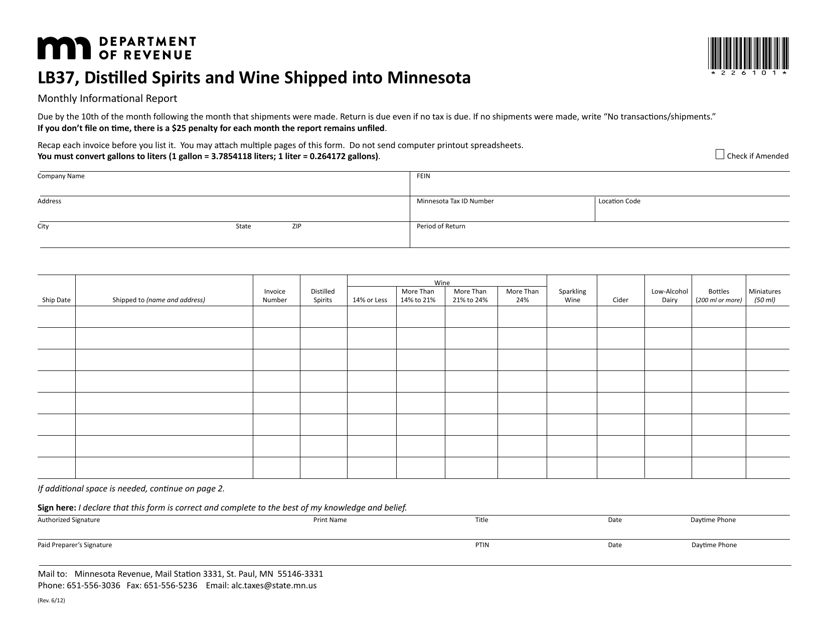

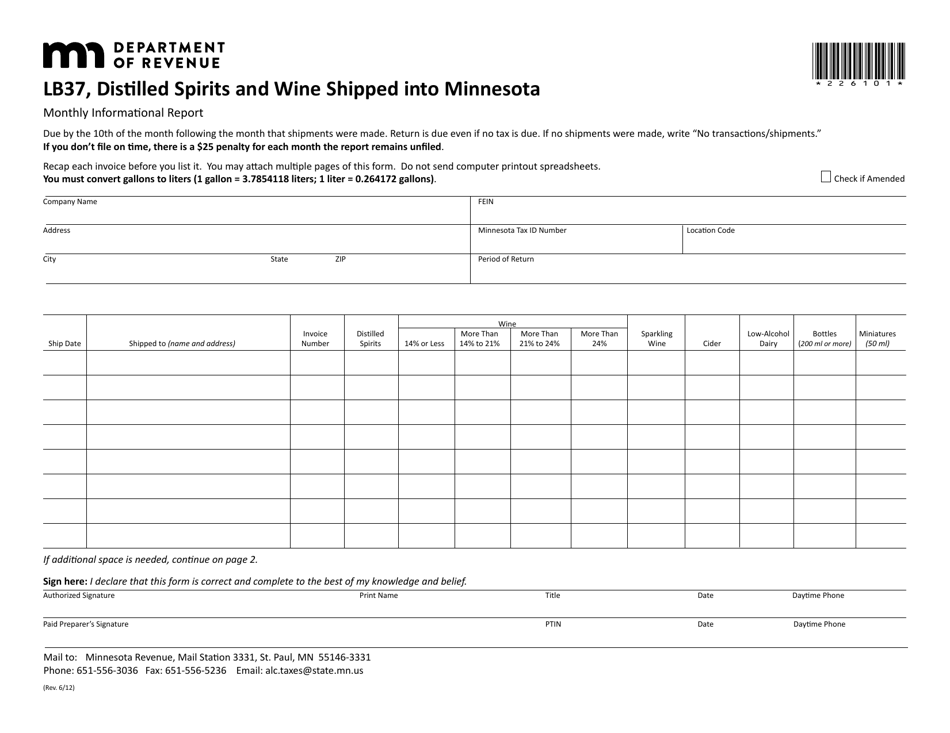

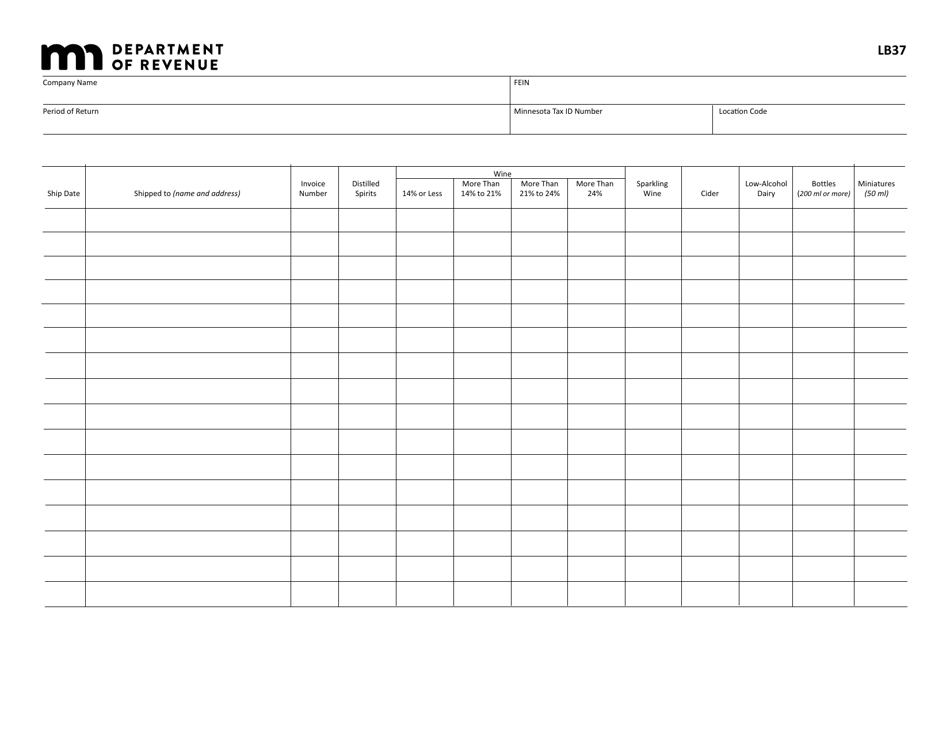

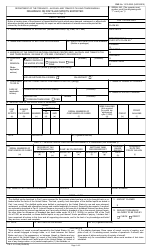

Form LB37 Distilled Spirits and Wine Shipped Into Minnesota - Minnesota

What Is Form LB37?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LB37?

A: Form LB37 is a form used for reporting the shipment of distilled spirits and wine into Minnesota.

Q: Who is required to file Form LB37?

A: Any entity or individual who ships distilled spirits and wine into Minnesota is required to file Form LB37.

Q: What is the purpose of Form LB37?

A: The purpose of Form LB37 is to track and monitor the shipment of distilled spirits and wine into Minnesota for regulatory purposes.

Q: Are there any specific requirements for completing Form LB37?

A: Yes, there are specific requirements for completing Form LB37, including providing information about the shipper, consignee, and shipment details.

Q: Is there a deadline for filing Form LB37?

A: Yes, Form LB37 must be filed on a monthly basis by the 18th day of the following month.

Q: What happens if I fail to file Form LB37?

A: Failure to file Form LB37 or inaccurately completing the form may result in penalties or other enforcement actions by the Minnesota Department of Revenue.

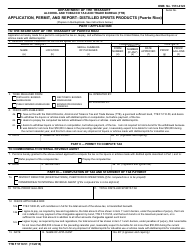

Q: Can I file Form LB37 electronically?

A: Yes, the Minnesota Department of Revenue allows for electronic filing of Form LB37 through their e-Services system.

Q: Is there a fee for filing Form LB37?

A: There is no fee for filing Form LB37.

Q: What should I do if I have additional questions about Form LB37?

A: If you have additional questions about Form LB37, you should contact the Minnesota Department of Revenue for assistance.

Form Details:

- Released on June 1, 2012;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LB37 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.