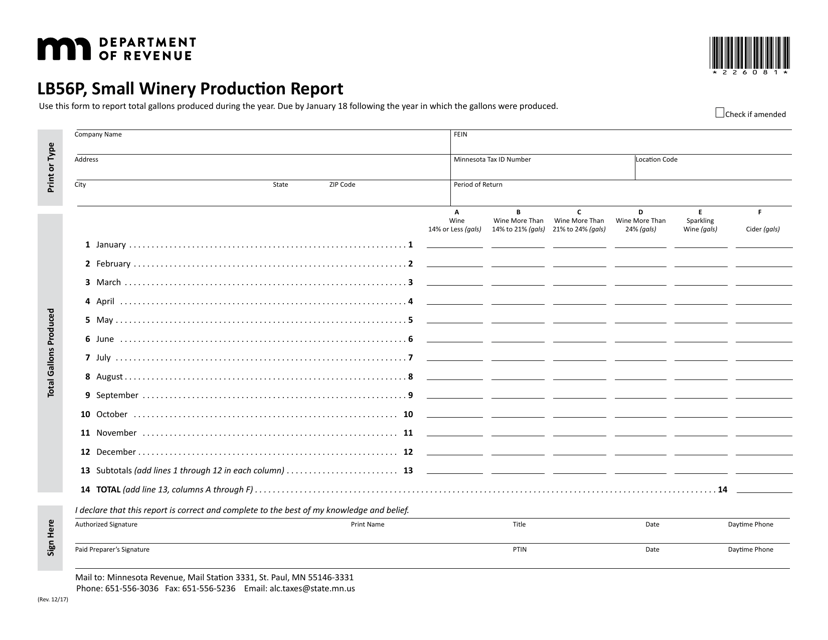

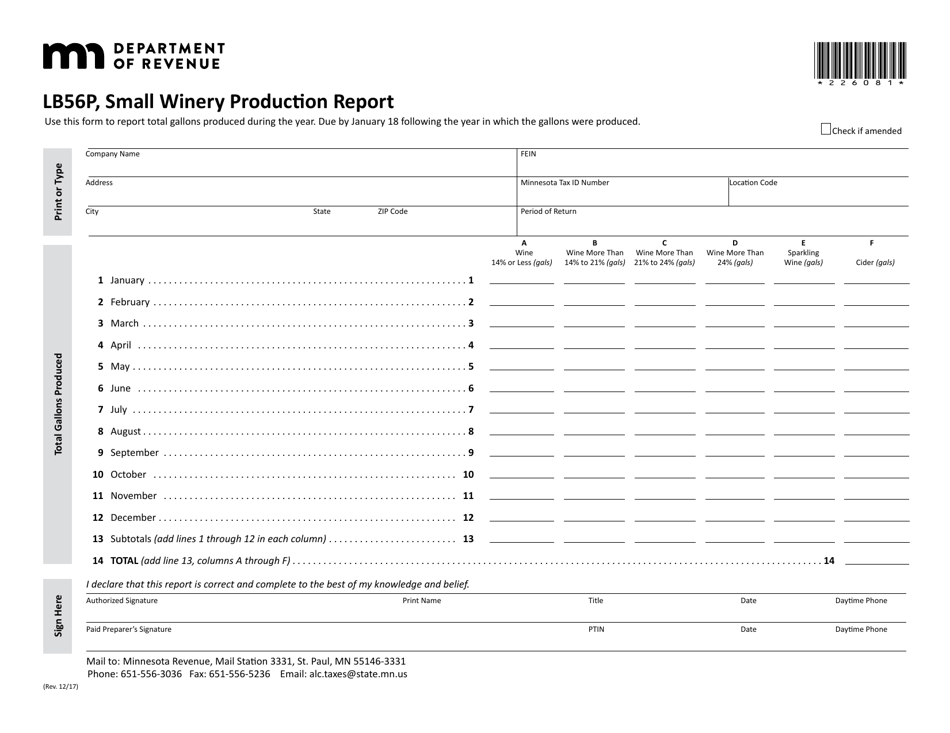

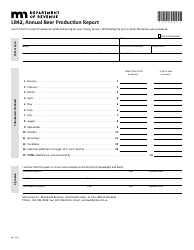

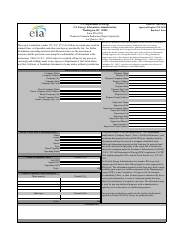

Form LB56P Small Winery Production Report - Minnesota

What Is Form LB56P?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form LB56P Small Winery Production Report?

A: The Form LB56P Small Winery Production Report is a specific form used by small wineries in Minnesota to report their wine production.

Q: Who needs to complete the Form LB56P Small Winery Production Report?

A: Small wineries in Minnesota are required to complete the Form LB56P Small Winery Production Report.

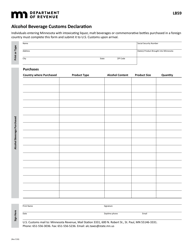

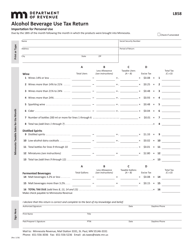

Q: What information is requested on the Form LB56P Small Winery Production Report?

A: The Form LB56P Small Winery Production Report requests information regarding the amount of wine produced, sold, stored, and removed from storage during a specific reporting period.

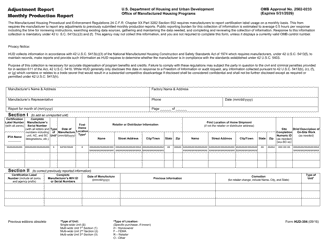

Q: How often should the Form LB56P Small Winery Production Report be completed?

A: The Form LB56P Small Winery Production Report should be completed monthly by small wineries in Minnesota.

Q: Are there any deadlines for submitting the Form LB56P Small Winery Production Report?

A: Yes, the Form LB56P Small Winery Production Report must be submitted to the Minnesota Department of Revenue by the 15th day of the month following the reporting period.

Q: What are the consequences of not filing the Form LB56P Small Winery Production Report?

A: Failure to file the Form LB56P Small Winery Production Report can result in penalties and fines imposed by the Minnesota Department of Revenue.

Q: Is there a fee for submitting the Form LB56P Small Winery Production Report?

A: No, there is no fee for submitting the Form LB56P Small Winery Production Report.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LB56P by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.