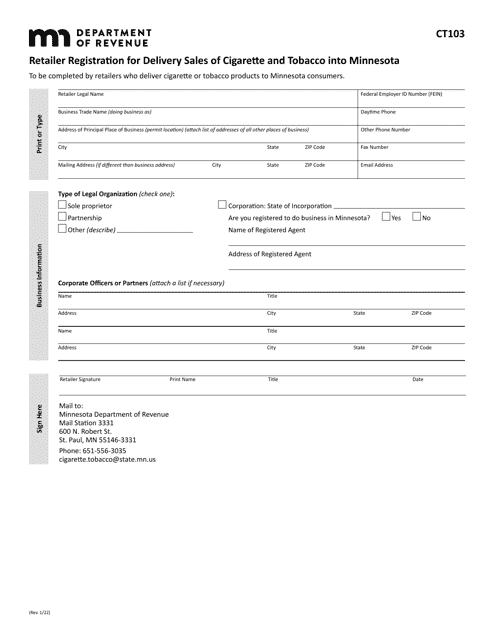

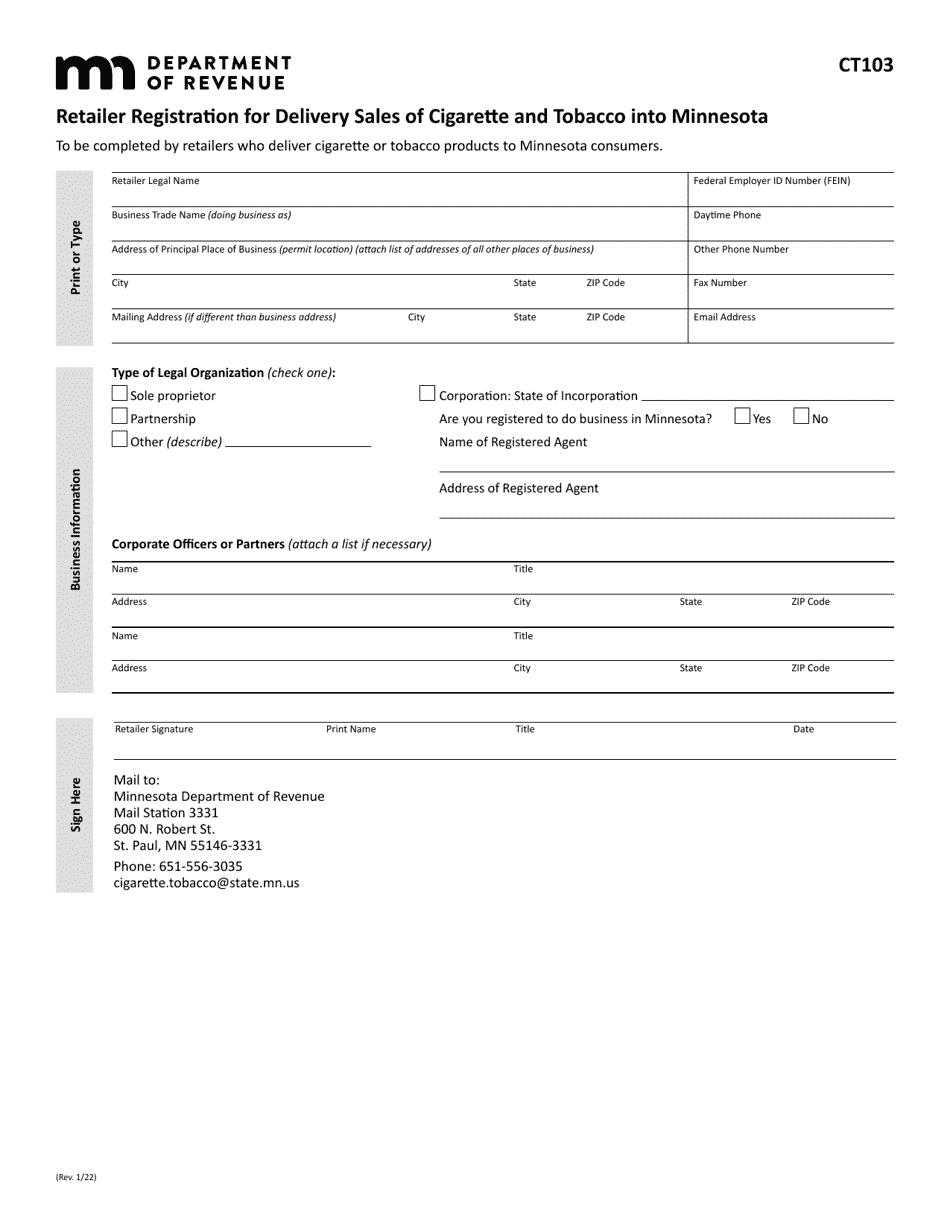

Form CT103 Retailer Registration for Delivery Sales of Cigarette and Tobacco Into Minnesota - Minnesota

What Is Form CT103?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT103?

A: Form CT103 is a registration form for retailers who wish to make delivery sales of cigarettes and tobacco into Minnesota.

Q: Who needs to file Form CT103?

A: Retailers who want to sell cigarettes and tobacco products through delivery sales in Minnesota need to file Form CT103.

Q: What is the purpose of Form CT103?

A: The purpose of Form CT103 is to register retailers and track delivery sales of cigarettes and tobacco in Minnesota.

Q: Are there any fees associated with filing Form CT103?

A: Yes, there is an annual $500 registration fee for filing Form CT103.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT103 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.