This version of the form is not currently in use and is provided for reference only. Download this version of

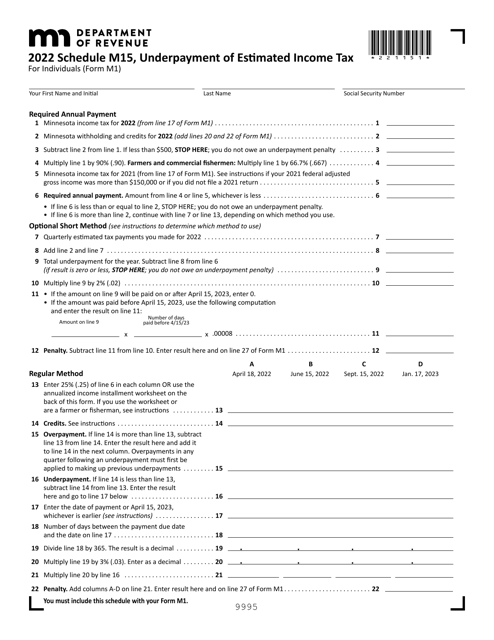

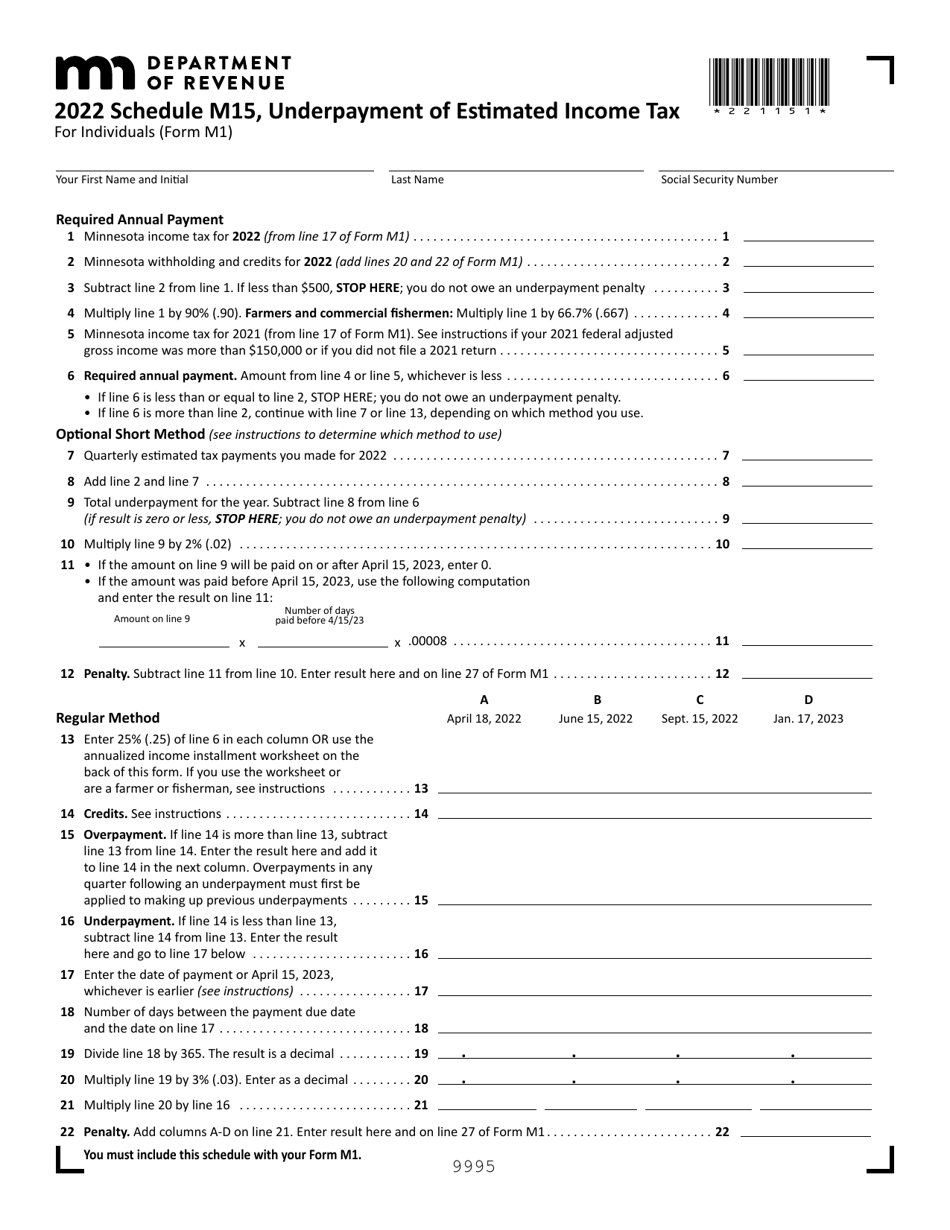

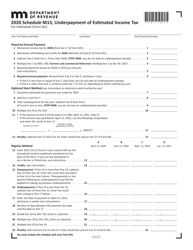

Schedule M15

for the current year.

Schedule M15 Underpayment of Estimated Income Tax - Minnesota

What Is Schedule M15?

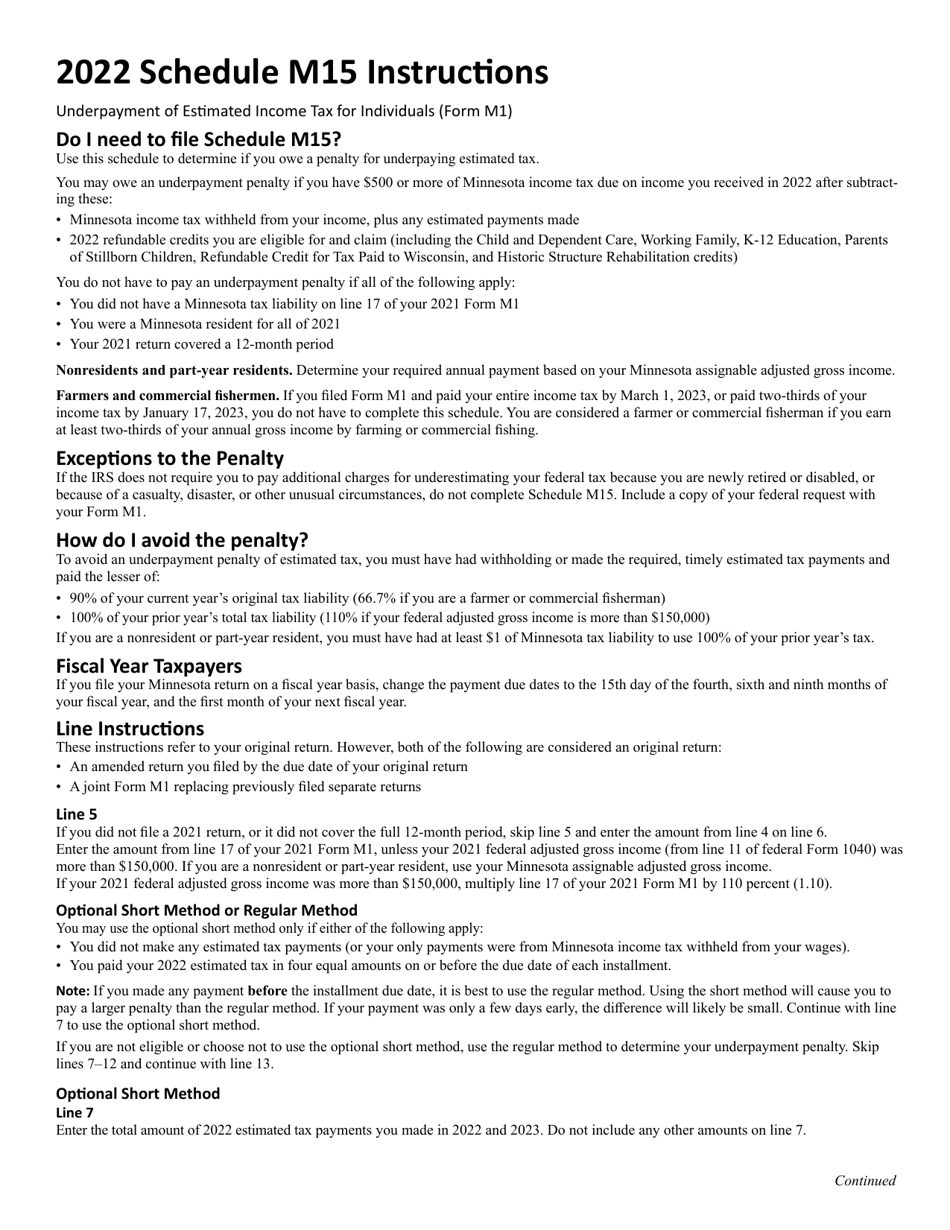

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M15?

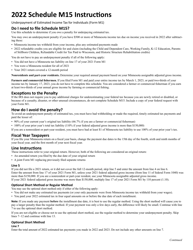

A: Schedule M15 is a form used to calculate and pay any underpayment of estimated income tax owed to the state of Minnesota.

Q: Who needs to file Schedule M15?

A: Individuals and businesses that owe underpayment of estimated income tax to Minnesota are required to file Schedule M15.

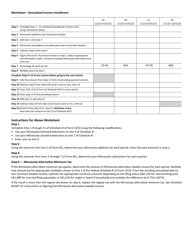

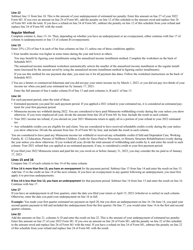

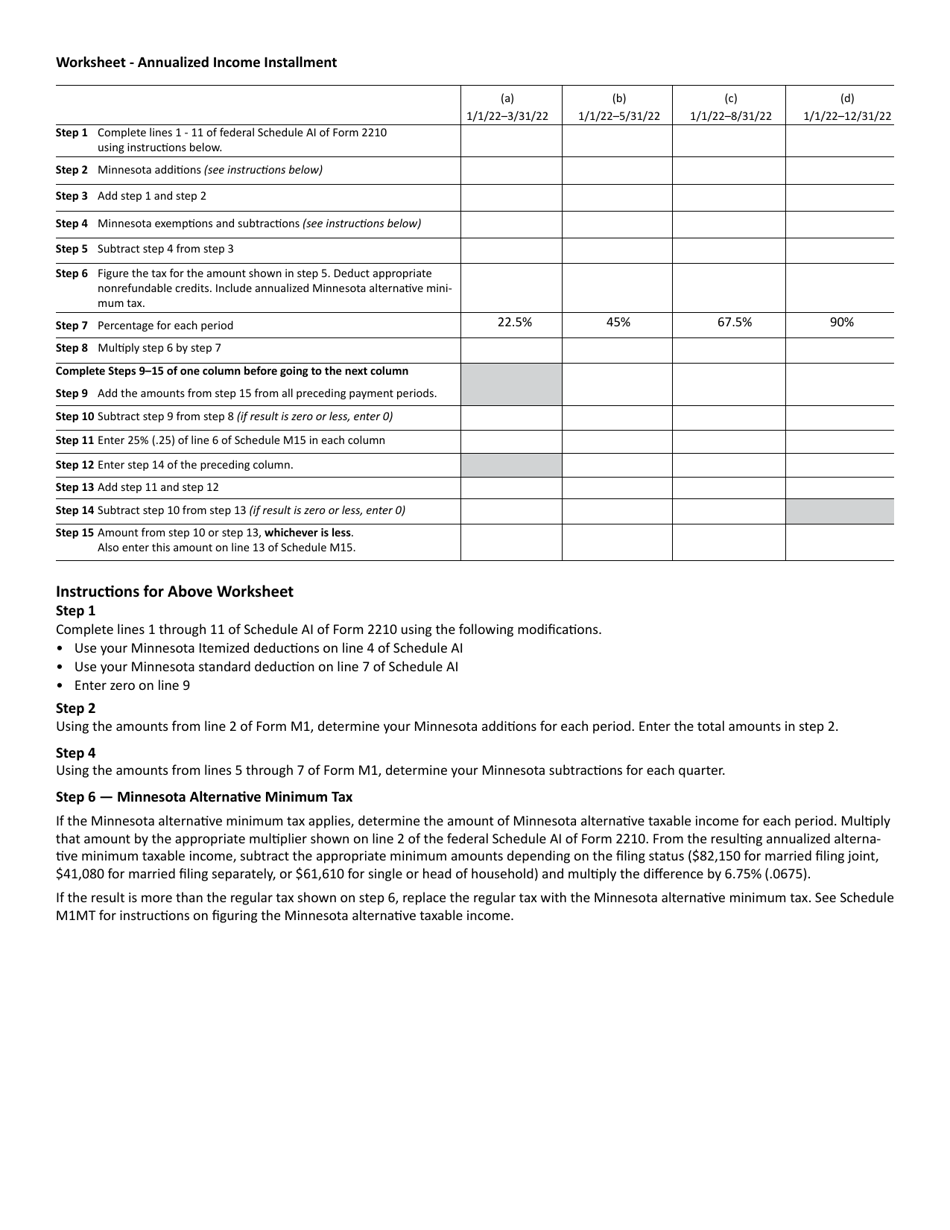

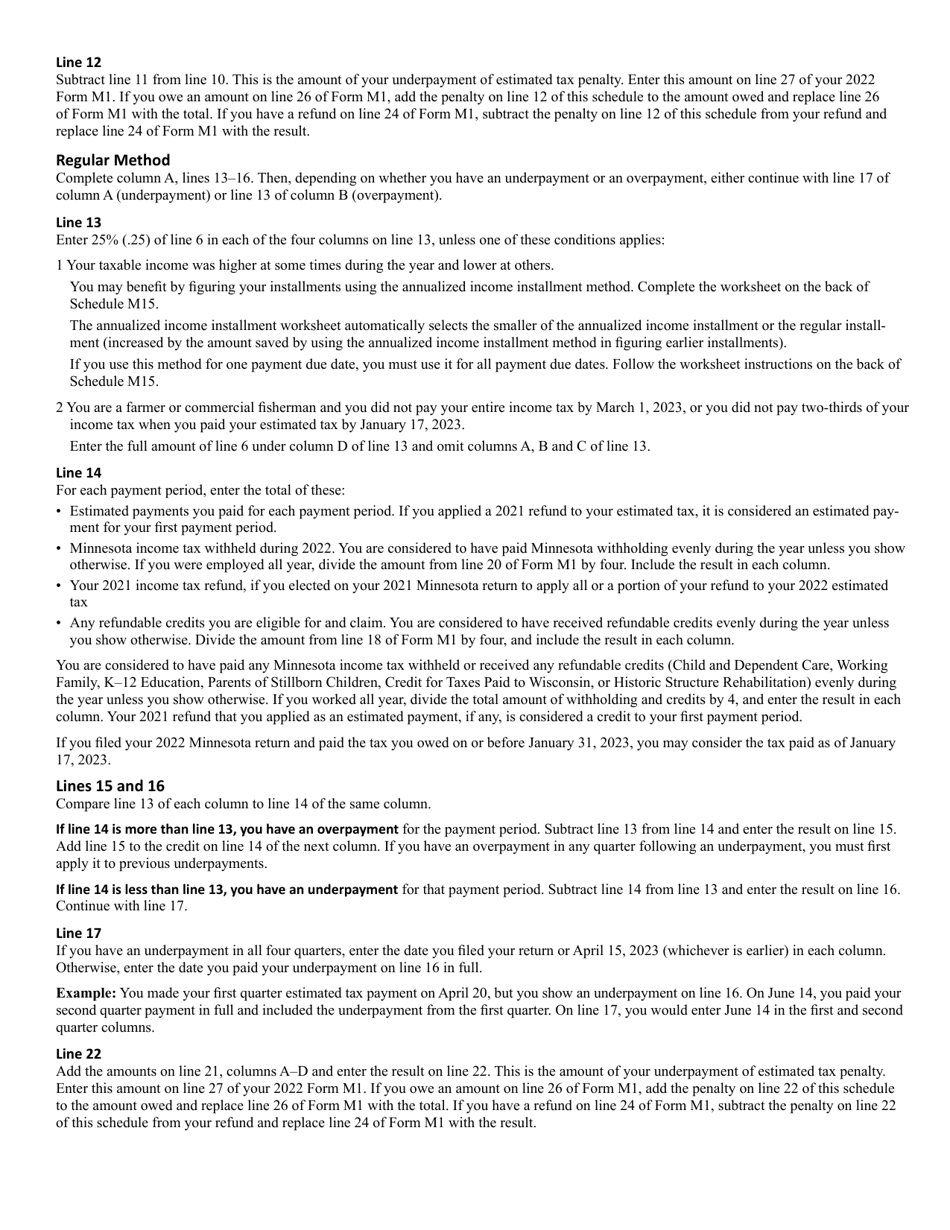

Q: How do I calculate the underpayment of estimated income tax?

A: To calculate the underpayment of estimated income tax, you will need to complete Schedule M15 using the information from your federal tax return and Minnesota tax forms.

Q: When is Schedule M15 due?

A: Schedule M15 is typically due on April 15th of the following year, along with your Minnesota state tax return.

Q: What happens if I don't file Schedule M15?

A: If you owe underpayment of estimated income tax to Minnesota and fail to file Schedule M15, you may be subject to penalties and interest.

Q: Is Schedule M15 the same as my federal tax return?

A: No, Schedule M15 is a separate form specific to the state of Minnesota. It is used to calculate and pay underpayment of estimated income tax owed to the state.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M15 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.